Blog Archive

Tino Chrupalla zerlegt Strack-Zimmermanns falsches Spiel!

Tino Chrupalla zerlegt das falsche Spiel von Strack-Zimmermann!

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

BIldrechte: By Olaf Kosinsky - Own work, CC BY-SA 3.0 de, https://commons.wikimedia.org/w/index.php?curid=79559705

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als...

Read More »

Read More »

¿Puede Trump GANAR Las Elecciones de USA?

#trump #eleccionesusa #mercados #economía

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Antikapitalismus – Die todbringende Religion vieler Intellektueller

Kanal von: https://www.youtube.com/@misesde

Seminare, Bücher und Filme von Dr. Dr. Rainer Zitelmann finden Sie hier: https://linktube.com/zitelmann

Der Podcast von Dr. Dr. Rainer Zitelmann: Erfolg, Reichtumsforschung und Finanzen

iTunes: https://podcasts.apple.com/us/podcast/dr-dr-rainer-zitelmann-erfolg-reichtumsforschung-und/id1629889731

Spotify: https://open.spotify.com/show/1E6YAqN5q0qzSzvVooVT9E?si=9cffa670bc224fa5

Podcast.de:...

Read More »

Read More »

Wo bleibt die Rezession? Achtung!

► Höre Dir meine Podcast-Folge „Finfluenzer-Verbot? Was das für mich bedeutet...“ an! Hier findest Du sie → https://lars-erichsen.de/podcast

Die Rezession, sie sollte eigentlich schon da sein! Ich werde in diesem Video in rund 10 Minuten sagen, ob sie noch kommt oder nicht. Und die Beantwortung dieser Frage ist sehr wichtig, denn eines ist klar, in den aktuellen Notierungen der Aktien ist eine Rezession nicht mehr eingepreist. Kommt sie also noch,...

Read More »

Read More »

Das soll keiner erfahren! AfD & Russland Wahl – Ernst Wolff im Gespräch mit Krissy Rieger

Raus aus dem System? Aber wie? Trage dich zu unserem kostenlosen Report ein: https://www.rieger-consulting.com/riegersreport

Mehr zu Krissy Rieger:

Finanzkanal ►► / @chrisrieger91

Zweitkanal ►► / @krissy.rieger2

Instagram ►► https://www.instagram.com/krissy.rieg...

Twitter ►► https://twitter.com/krissyrieger?lang=de

Telegram ►► https://t.me/KrissyRieger

____________________

? Alle Termine und die Links zu meiner Vortragsreihe finden Sie...

Read More »

Read More »

The Secrets to Becoming a Millionaire with Real Estate – Robert Kiyosaki, Ken McElroy

In this episode of the Rich Dad Radio Show, Robert Kiyosaki, alongside real estate mogul Ken McElroy, dives deep into the world of real estate investment, offering unparalleled insights that could potentially alter your financial future. With over 25 years of friendship and millions in earnings together, Robert and Ken share their journey to becoming titans in the real estate sector, all while paying minimal taxes.

They share personal investment...

Read More »

Read More »

5 gefährliche Geld-Fehler in Deinen 60ern, die Du vermeiden solltest

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_MT0QAVrLXf0

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_MT0QAVrLXf0

Trade Republic* ► https://www.finanztip.de/link/traderepublic-depot-yt/yt_MT0QAVrLXf0

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_MT0QAVrLXf0

Justtrade

Traders Place* ►...

Read More »

Read More »

NZDUSD trades to new 2024 lows today and maintains a bearish bias. What shift the bias?

A technical look at the NZDUSD as we head toward the US Fed decision at 2 PM ET. What levels are in play? What would shift the bias back to the upside? What key targets loom on more downside momentum today?

Read More »

Read More »

Joe Biden’s Ponzi Scheme

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

You've almost certainly heard of Bernie Madoff's Ponzi scheme. He was sentenced to 150 years in prison for running it. Well, as Mike Maharrey explains in this episode of the Money Metals' Midweek Memo, Joe Biden is overseeing an even bigger Ponzi scheme - the national debt.

In this episode of the Money Metals' Midweek Memo, Mike puts the national debt into perspective,...

Read More »

Read More »

AUDUSD traders stall the rise today against a key MA and keep the sellers in control

The technical roadmap for the AUDUSD ahead of the Fed rate decision is explained in full.

Read More »

Read More »

¿Las políticas de Milei son coherentes con sus discursos?

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

USDCAD bounces higher today but finds sellers near swing area resistance. What next?

It is Fed Day. What technical levels are in play for the USDCAD through the FOMC rate decision

Read More »

Read More »

Heftig: Klinik VERKLAGT Lauterbach!

Lauterbach sieht sich nun einer immer größeren Klagewelle gegenüber. Denn die Krankenhäuser und Kliniken sind chronisch unterfinanziert!

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

BIldrechte: By © Raimond Spekking / CC BY-SA 4.0 (via Wikimedia Commons), CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=110143011

? Tracke deine Dividenden mit dieser App...

Read More »

Read More »

USDCHF extends above key retracement target. Trades at highest since November 14

The price of the USDCHF moves above its 61.8% retracement at 0.88957.. What is driving the pair technically.

Read More »

Read More »

Is Your Ex Worth More Dead than Alive?

It's Fed Day: Danny Ratliff provides a preview in Lance's absence; mortgage rates are pricing-out most buyers. Is your ex- worth more dead than alive? Taking a look at SS survivors' benefits: There are some caveats. How to incorporate inflation hedging into your portfolio. Making buying choices to better manage inflation in household budgets. Why some are accessing 401-k funds (and what about those who do not have one?) Understanding target date...

Read More »

Read More »

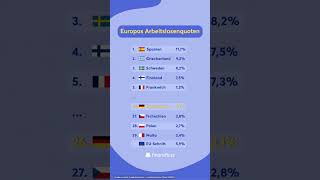

Ausgewählte Arbeitslosenquoten Europas #arbeit

Ausgewählte Arbeitslosenquoten Europas ? #arbeit

?Quelle: eurostat, Arbeitslosendaten - monatliche Daten, Stand 12/2023

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen...

Read More »

Read More »