Blog Archive

Baden Württemberg Sensation: AfD immer stärker!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Why the Rich NEVER Gamble During Earnings Season – Andy Tanner, Del Denney

🎯 Ready to take control of your financial future? Visit https://bit.ly/3JsRdmj for access to FREE investing tools, including Andy’s “Power of 6” ebook.

Earnings season is here — and for most investors, that means chaos. Stocks soar, crash, and social media is full of hype and hot takes. But here’s the truth: the rich don’t gamble during earnings season… they prepare for it.

In this episode of Rich Dad StockCast, host Del Denney sits down with...

Read More »

Read More »

Vorsicht! Deshalb verlierst Du Geld mit Aktien

Zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

5-13-25 Is Tariff-driven Volatility Over?

Tariffs rattled markets. Then… silence. Are we in the clear—or is another shock coming? Lance Roberts and Jonathan Penn tackle the question: Is Tariff Volatility Over? The reversal of tariffs is only a 90-day reprieve; markets are very over bought, and after Monday's rally are due for some pullback (sooner or later); be patient and bide your time before jumping into the fray. Lance and Jonathan discuss why contrarian investing is smart. Preview of...

Read More »

Read More »

Eilmeldung: CDU ist völlig am Ende!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Kommer ETF: Wie kann man den US-Anteil im Portfolio reduzieren? 🦅 #usa

Kommer ETF: Wie kann man den US-Anteil im Portfolio reduzieren? 🦅 #usa

🎥 Zu viel USA im Portfolio: Jetzt neu gewichten?:

-cisBd8?si=LGJExlCQaQWc2btj

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔...

Read More »

Read More »

Knall: Deutschland erschüttert von Dobrindt Skandal!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

USDJPY Technical Analysis – The greenback is back

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:13 Technical Analysis with Optimal Entries.

2:25 Upcoming Catalysts...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #447

Klicke hier, um Dich direkt gemeinsam mit Oli durchs Trading unabhängig zu machen 👉 https://oliverklemmtrading.com/apply-now-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=2

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM AUF FACEBOOK (Bisher 6000+ Mitglieder): ►Jetzt Beitreten...

Read More »

Read More »

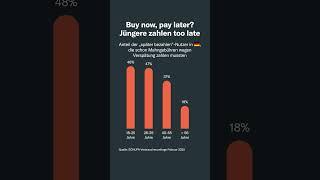

Buy now, pay later? Jüngere zahlen too late

Eine SCHUFA-Verbraucherumfrage von Februar 2025 zeigt, dass 36% der Menschen in 🇩🇪, die die "Pay Now, Buy Later"-Funktion nutzen, in den letzten Monaten eine Zahlungsfrist verpasst haben und deshalb eine Mahngebühr bezahlen mussten. Vor allem die jüngeren Generationen tendieren dazu, Zahlungsfristen zu verpassen.

fun Fact: Diese Umfrage kam auch zu dem Ergebnis, dass Männer (42%) öfter in Zahlungsverzug kommen als Frauen (30%)....

Read More »

Read More »

Die Ursprünge von Armut und Reichtum in Argentinien

Zitelmanns neuer Roman "2075" über die Entwicklung einer totalitären Diktatur: www.schoenheit-2075.de

Kurse, Bücher und Filme von Dr. Dr. Rainer Zitelmann finden Sie hier: https://linktube.com/zitelmann

Der Podcast von Dr. Dr. Rainer Zitelmann: Erfolg, Reichtumsforschung und Finanzen

iTunes: https://podcasts.apple.com/us/podcast/dr-dr-rainer-zitelmann-erfolg-reichtumsforschung-und/id1629889731

Spotify:...

Read More »

Read More »

Anti-AfD Demos scheitern krachend!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

HISTÓRICO ACUERDO COMERCIAL ENTRE EE.UU. Y CHINA

Fracasa la narrativa antiEEUU: acuerdos históricos con China y Reino Unido desmontan el relato mediático. Esto lo cambia todo.

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te...

Read More »

Read More »

Things are Changing, Let me Explain

We are at a critical time, and I hope my teachings are able to help make the world a better place. In order to understand where we are at in history, you have to understand the mechanics of the debt cycles. To lean more, read my new book, How Countries Go Broke: The Big Cycle, available for pre-order at the link here: https://bit.ly/3F5OFvN

#raydalio #principles #politics #economics

Read More »

Read More »

How many times in your life have you had a great boss?

Learn how to be a better manager from top CEOs and experts who’ve studied them on the “Boss Class” podcast. The series returns with tips from some of the world’s best-known companies. To listen you’ll need to be a subscriber. Search Economist Podcasts+ for our best offer

Listen to Boss Class: https://econ.st/4iZVYmO

Read More »

Read More »

Meine neuen Kursziele: Bitcoin, Gold und US-Aktien!

► Finfluencer-Award » Jetzt für „BuyTheDip“ abstimmen → https://www.finfluencer.digital/awards/de/vote

► Jetzt die „BuyTheDip“-App downloaden » App Store (Apple) → https://www.buy-the-dip.de/apple oder Google Play Store → https://www.buy-the-dip.de/android

► Hier kannst Du meinen Kanal abonnieren → https://www.youtube.com/erichsengeld?sub_confirmation=1

Im wahrscheinlich kompaktesten Video des Jahres, nenne ich Euch meine Minimum-Kursziele für den...

Read More »

Read More »

Eil: TRUMP mit Schock-Warnung an Von der Leyen!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »