Tag Archive: Yield Curve

Weekly Market Pulse: It’s An Uncertain World

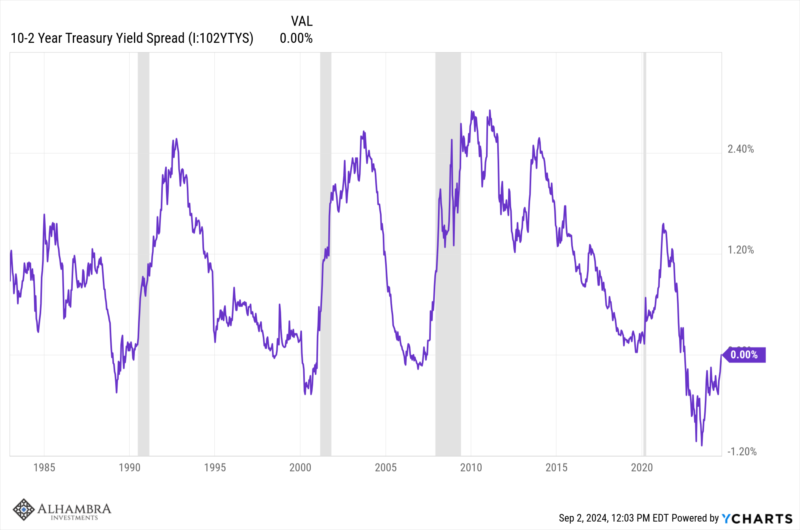

You’re going to hear a lot of talk about the yield curve soon and what it means for “the” yield curve to uninvert (which isn’t a real word but will get used a lot). The difference between the 10-year Treasury note yield and the 2-year Treasury note yield is about to turn positive, the 2-year note yield recently falling a bit more rapidly than the 10-year.

Read More »

Read More »

Pressure Returns to Bank Shares and seems to Help Propel Gold Higher

Overview: There are three themes today. First, the

sharp decline in US rates seen yesterday (-14 bp on the two-year yield) on the

back disappointing economic data seemed a bit exaggerated and the two-year

yield has bounced back to almost 3.90% from around 3.81%. This appears to be

helping the dollar consolidate today. Second, bank shares are coming under

renewed pressure. The US KBW bank index fell almost 2% yesterday after a 0.5%

decline on...

Read More »

Read More »

Weekly Market Pulse: Good News, Bad News

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday.

Read More »

Read More »

Weekly Market Pulse: Just A Little Volatility

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is.

Read More »

Read More »

Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish.

Read More »

Read More »

Weekly Market Pulse: A Most Unusual Economy

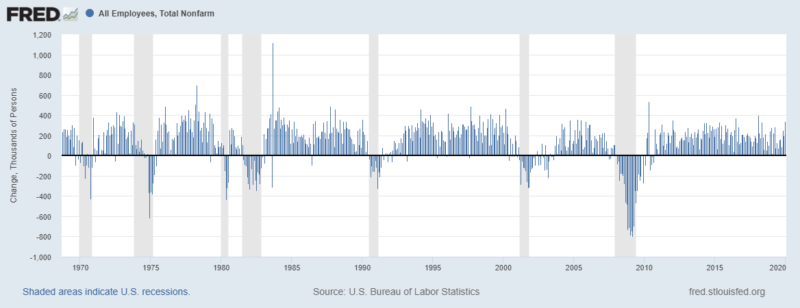

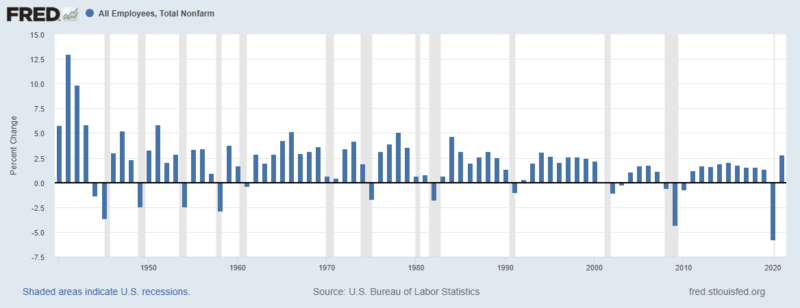

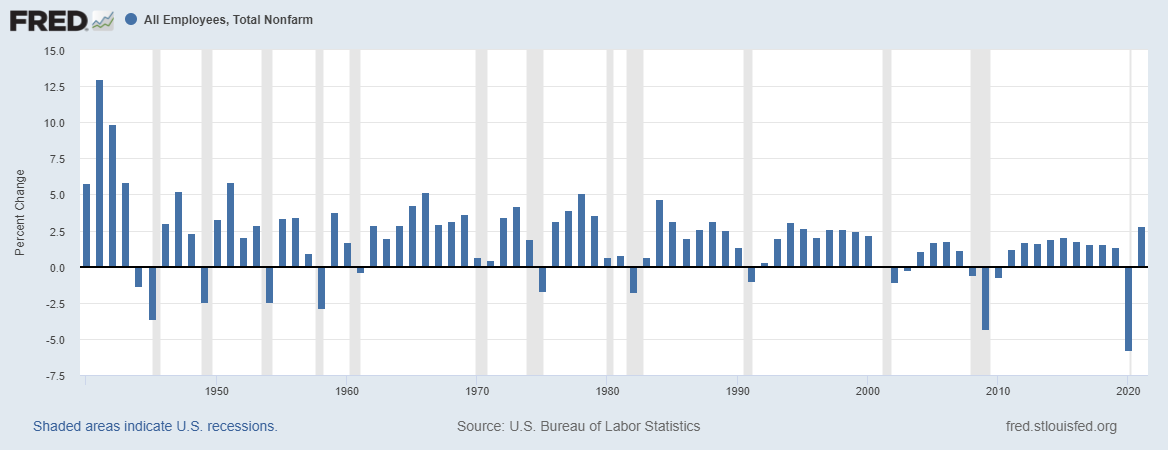

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy.

Read More »

Read More »

Weekly Market Pulse: Things That Need To Happen

Perspective is something that comes with age I think. Certainly, as I’ve gotten older, my perspective on things has changed considerably. As we age, we tend to see things from a longer-term view.

Read More »

Read More »

Update The Conflict of Interest Rate(s)

What changed? For over a month, the Treasury market had the Fed and its rate hiking figured out. Rising recession risks had been confirmed by almost every piece of incoming data, including, importantly, labor data.

Read More »

Read More »

Simple Economics and Money Math

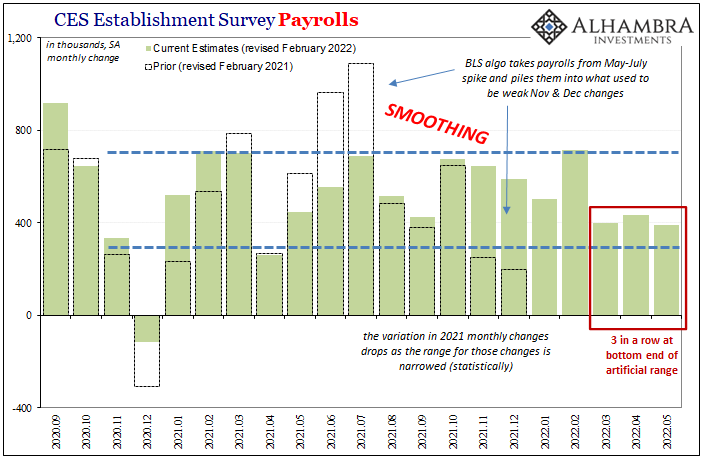

The BLS’s most recent labor market data is, well, troubling. Even the preferred if artificially-smooth Establishment Survey indicates that something has changed since around March. A slowdown at least, leaving more questions than answers (from President Phillips).

Read More »

Read More »

UST 2s & Euro$ Futures *Whites* Both Ask, Landmine At Last?

The 2-year Treasury right now is the key point, the spot on the yield curve which is influenced mostly by potential alternative rates including those offered by the Federal Reserve. Because of this, the market for the 2s is looking forward at what those alternate rates are likely to be, then pricing yields accordingly.

Read More »

Read More »

Peak Inflation (not what you think)

For once, I find myself in agreement with a mainstream article published over at Bloomberg. Notable Fed supporters without fail, this one maybe represents a change in tone. Perhaps the cheerleaders are feeling the heat and are seeking Jay Powell’s exit for him?

Read More »

Read More »

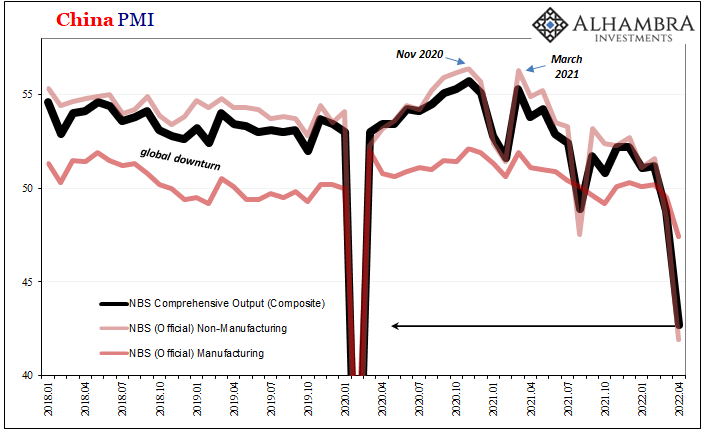

China Then Europe Then…

This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious.

Read More »

Read More »

Weekly Market Pulse: Welcome Back To The Old Normal

Stagflation. It’s a word that strikes fear in the hearts of investors, one that evokes memories – for some of us – of bell bottoms, disco, and Jimmy Carter’s American malaise. The combination of weak growth and high inflation is the worst of all worlds, one that required a transformational leader and a cigar-chomping central banker to defeat the last time it came around.

Read More »

Read More »

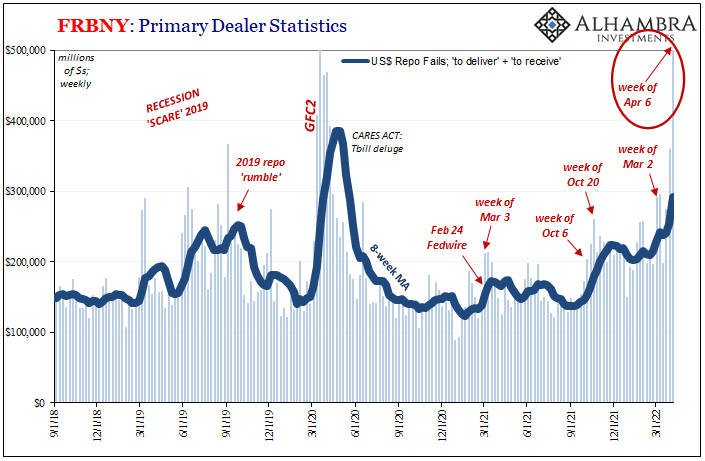

Yield Curve Inversion Was/Is Absolutely All About Collateral

If there was a compelling collateral case for bending the Treasury yield curve toward inversion beginning last October, what follows is the update for the twist itself. As collateral scarcity became shortage then a pretty substantial run, that was the very moment yield curve flattening became inverted.Just like October, you can actually see it all unfold.

Read More »

Read More »

You Know What They Say About The Light At The End Of The Tunnel

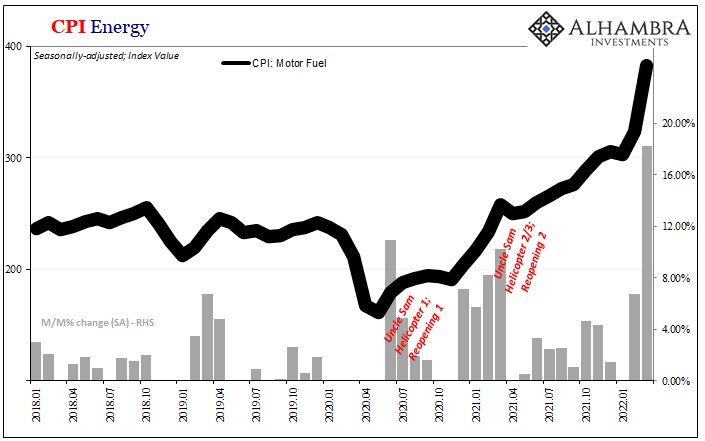

In any year when gasoline prices rise 18%, that’s not going to be good for anyone except maybe oil companies who extract its key ingredient from out of the ground (or don’t, as the case can be). Yet, annual rates of increase that size do happen.

Read More »

Read More »

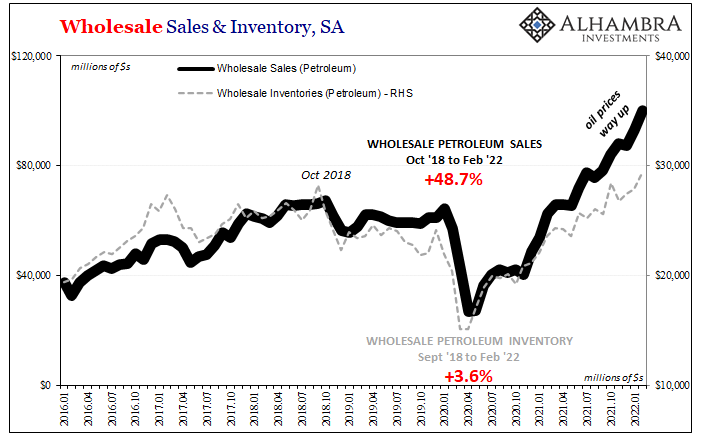

Concocting Inventory

The Census Bureau provided some updated inventory estimates about wholesalers, including its annual benchmark revisions. As to the latter, not a whole lot was changed, a small downward revision right around the peak (early 2021) of the supply shock which is consistent with the GDP estimates for when inventory levels were shrinking fast.

Read More »

Read More »

Weekly Market Pulse: What Now?

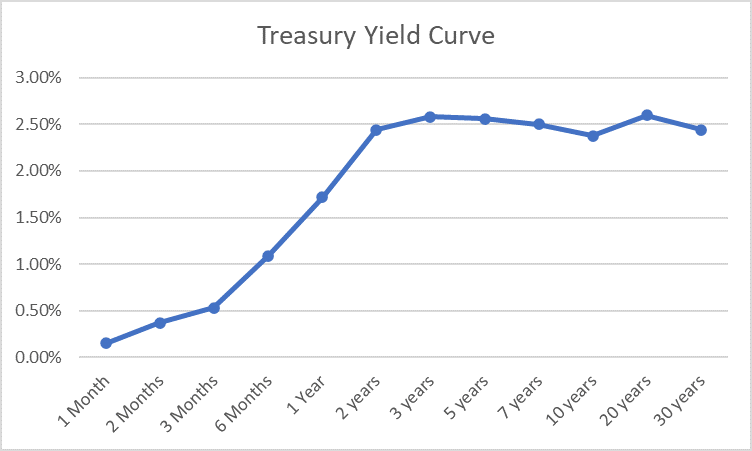

The yield curve inverted last week. Well, the part everyone watches, the 10 year/2 year Treasury yield spread, inverted, closing the week a solid 7 basis points in the negative. The difference between the 10 year and 2 year Treasury yields is not the yield curve though. The 10/2 spread is one point on the Treasury yield curve which is positively sloped from 1 month to 3 years, negatively sloped from 3 years to 10 years and positively sloped again...

Read More »

Read More »

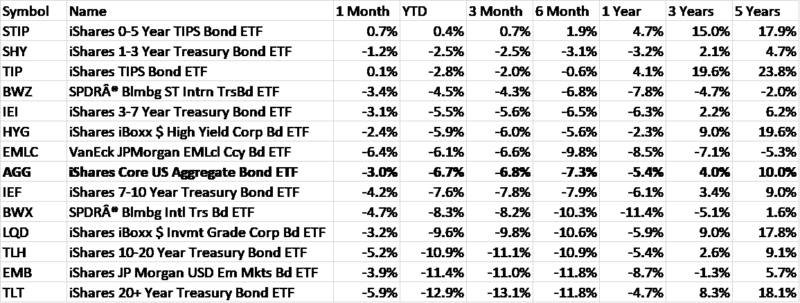

The Short, Sweet Income Case For Ugly Inversion(s), Too

A nod to just how backward and upside down the world is now. The economic data everyone is made to pay attention to, payrolls, that one is, in my view, irrelevant. As is the consumer price estimates from earlier this week, the PCE Deflator. That’s another one which receives vast amounts of interest even though it is already old news.

Read More »

Read More »

Weekly Market Pulse: The Cure For High Prices

There’s an old Wall Street maxim that the cure for high commodity prices is high commodity prices. As prices rise two things will generally limit the scope of the increase. Demand will wane as consumers just use less or find substitutes. Supply will also increase as the companies that extract these raw materials open new mines, grow more crops or drill new wells.

Read More »

Read More »

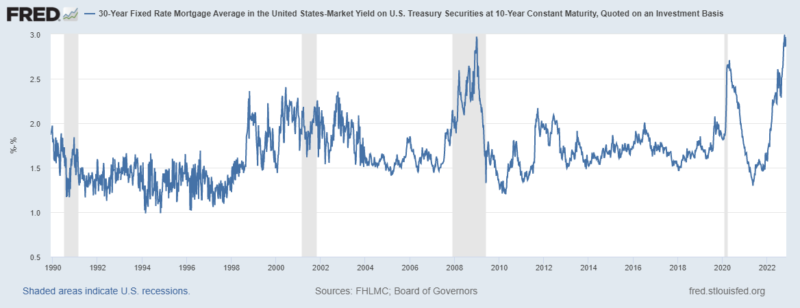

BOJ Steps-Up its Efforts, US 2-10 Curve steepens, and the Dollar Softens

Overview: A pullback in US yields yesterday and the Bank of Japan's stepped-up efforts to defend the Yield Curve Control policy helped extend the yen's recovery. This spurred profit-taking on Japanese stocks, where the Nikkei had rallied around 11% over the past two weeks.

Read More »

Read More »