Tag Archive: Wholesale Inventories

Trying To Project The Goods Trade Cycle

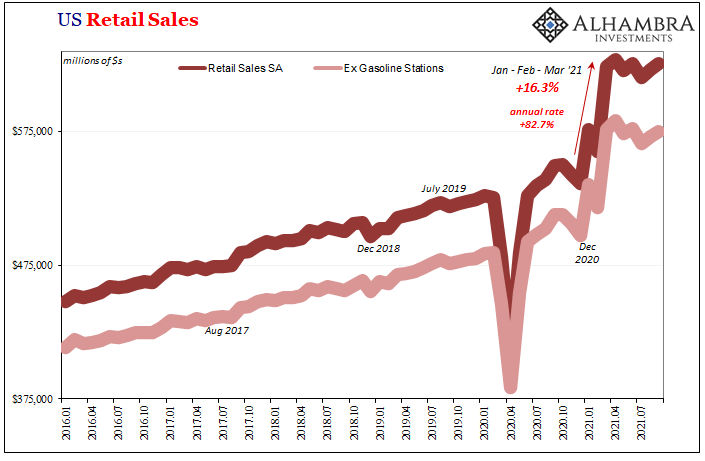

One quick note on yesterday’s retail sales estimates in the US for the month of November 2021. The increase for them was less than had been expected, but these were hardly awful by any rational measure.

Read More »

Read More »

Revisiting The Last Overhang

One reason why I still believe the US most likely would have entered a recession at some point in 2020 even without COVID wasn’t just the yield curve inversion that popped up several months before then. In August of 2019, the small part of the Treasury curve most people pay attention to (2s10s) did send out that dreaded signal, suggesting already to expect contraction in the intermediate term ahead of then.

Read More »

Read More »

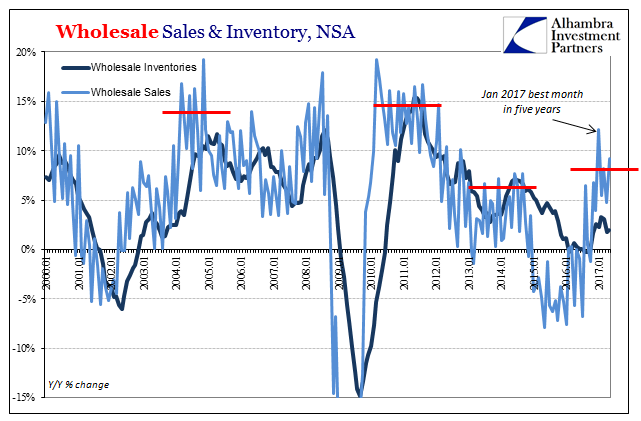

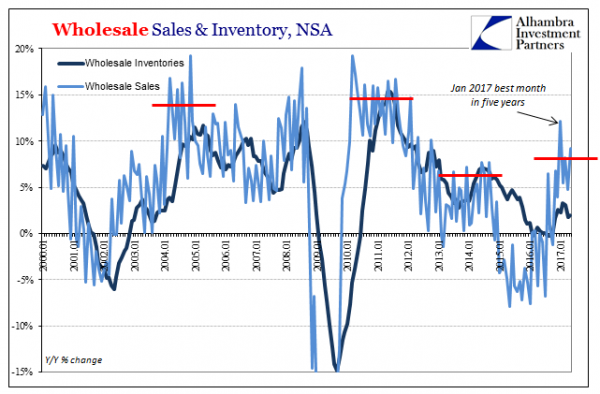

Wholesale: No Acceleration, No Liquidation

In the same way as durable goods orders and US imports, wholesale sales in May 2017 were up somewhat unadjusted but down for the third straight month according the seasonally-adjusted series. As with those other two, the difference is one of timing. In other words, combining the two sets, seasonal and not, we are left to interpret a possible recent slowing in activity.

Read More »

Read More »

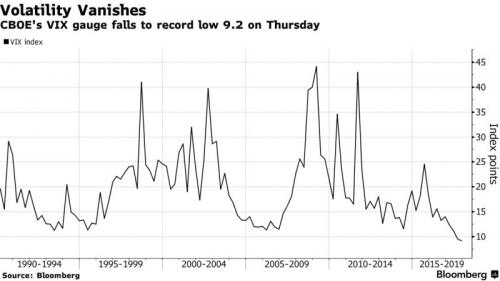

FX Daily, July 12: Currencies Stabilize, but Yen Strengthens

The US dollar and sterling have stabilized after being sold off yesterday. The yen, which had begun recovering from a four-month low, is the strongest of the major currencies today, gaining around 0.5% against the dollar (@~JPY113.40).

Read More »

Read More »

Bi-Weekly Economic Review

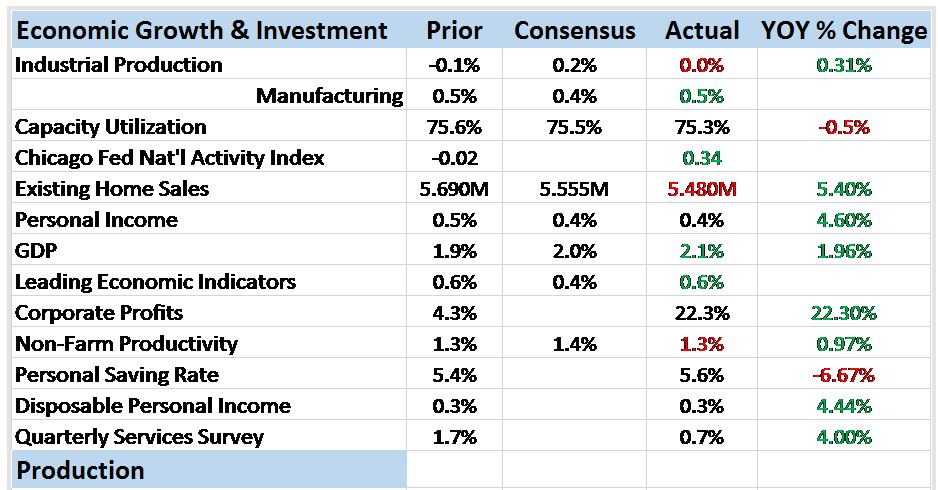

It is hard not to notice that the chart above has a lot less red in it than it has in some time. That is true of the month to month data as well as the year over year changes. There has been a widely reported gap between so called soft data – surveys and polls – and the hard data – actual economic activity reports. Bulls say the gap is there because the soft data always leads the hard data.

Read More »

Read More »