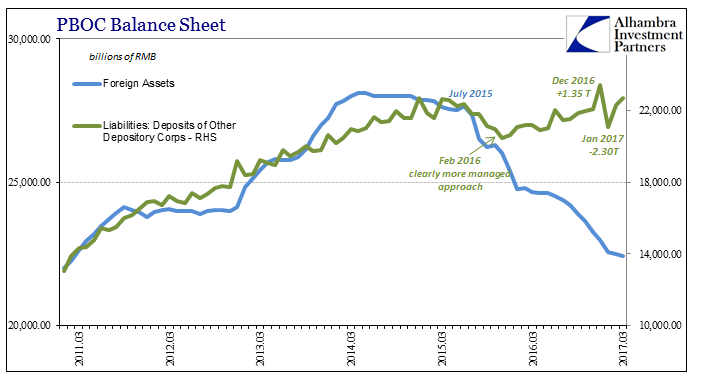

The mainstream narrative as it relates to Chinese money is “tightening.” Having survived the economic downturn last year, we are to believe that the PBOC is once again on bubble duty. They raised their reverse repo rates, considered to be their policy benchmarks, three times up to mid-March.

Read More »

Tag Archive: wholesale finance

To The Asian ‘Dollar’, And Then What?

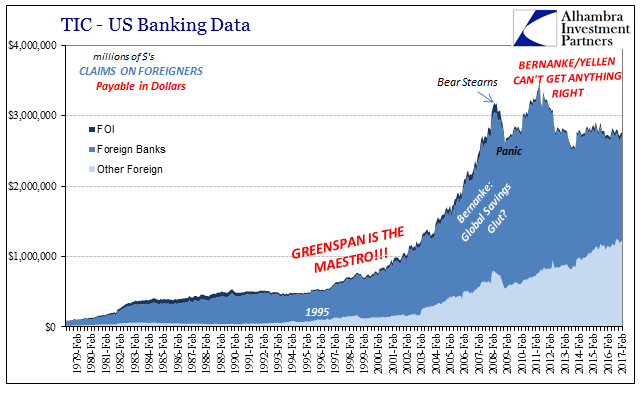

The Bretton Woods system was intentionally set up to funnel monetary convertibility through official channels. The primary characteristic of any true gold standard is that any person who wishes can change paper claims into hard money. It was as much true in any one country as between those bound by the same legal framework (property).

Read More »

Read More »

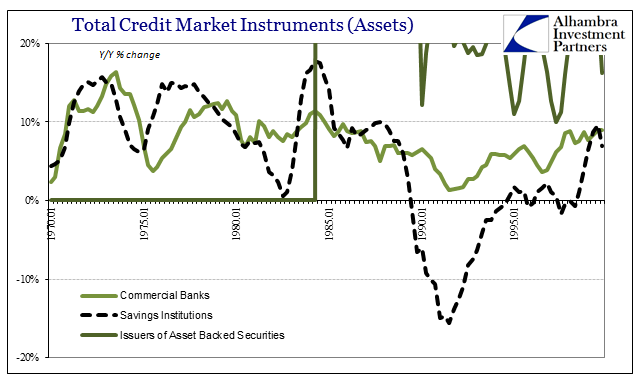

We Need To Define The ‘Shadows’, And All Parts of Them; or, ‘Rising Dollar’ Kills Another Recovery Narrative

JP Morgan’s CEO Jamie Dimon caused a stir yesterday with his 45-page annual letter to shareholders. The phrase that gained him so much widespread attention was, “there is something wrong with the US.” Dimon mentioned secular stagnation and correctly surmised it was the right idea if for the wrong reasons. He then gave his own which included a litany of globalist agenda items, including not enough access to mortgages.

Read More »

Read More »

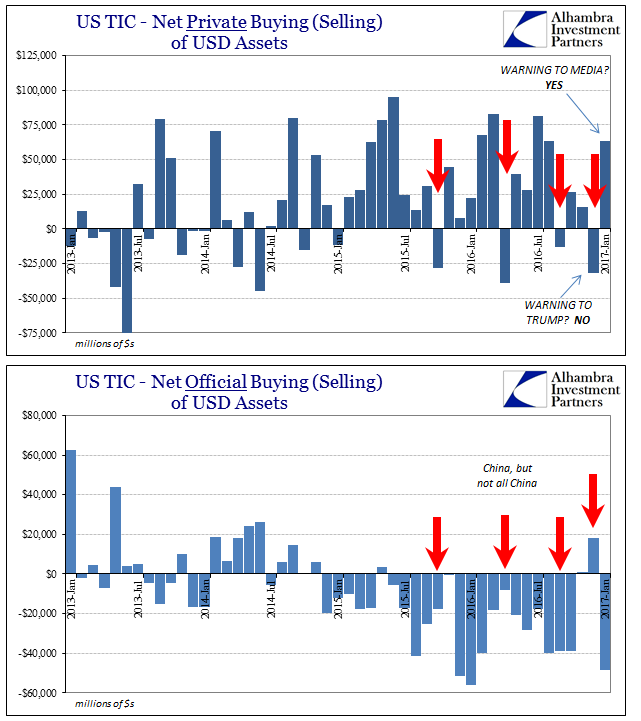

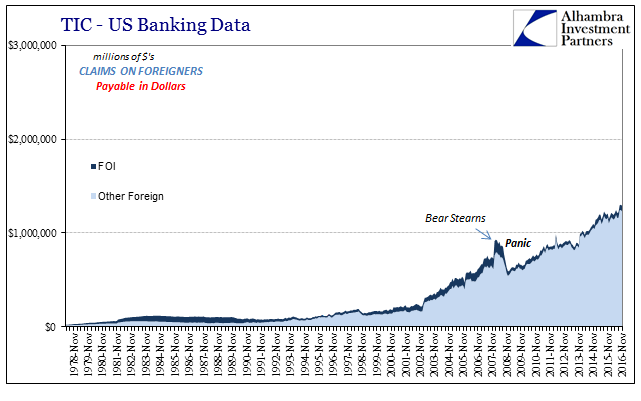

TIC Analysis of Selling

When the Treasury Department released its Treasury International Capital (TIC) data for December, what was a somewhat obscure report suddenly found mainstream attention. Private foreign investors had sold tens of billions in US securities primarily US Treasury bonds and notes which the media then made into some kind of warning to then-incoming President Trump. It was supposed to be a big deal, the kind of rebuke reserved for disreputable leaders of...

Read More »

Read More »

Do Record Eurodollar Balances Matter? Not Even Slightly

The BIS in its quarterly review published yesterday included a reference to the eurodollar market (thanks to M. Daya for pointing it out). The central bank to central banks, as the outfit is often called, is one of the few official institutions that have taken a more objective position with regard to the global money system. Of the very few who can identify eurodollars, or have even heard of them, the BIS while not fully on board is at least open...

Read More »

Read More »