Tag Archive: value stocks

Weekly Market Pulse: No Free Lunches

Moody’s Ratings downgrades United States ratings to Aa1 from Aaa; changes outlook to stable New York, May 16, 2025 — Moody’s Ratings (Moody’s) has downgraded the Government of United States of America’s (US) long-term issuer and senior unsecured ratings to Aa1 from Aaa and changed the outlook to stable from negative.

Read More »

Read More »

Weekly Market Pulse: Peak America?

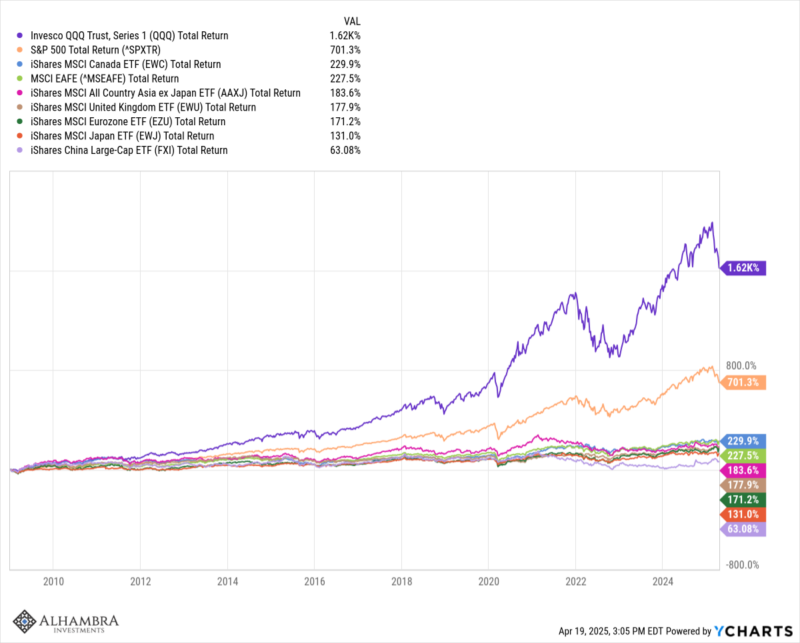

The US economy has been the envy of the world for a long time, especially after the 2008 financial crisis and the COVID pandemic. Our economy has grown faster than just about any other in the developed world thanks in large part to the extraordinary performance of our technology sector. Our markets for debt and equity are the largest and most liquid on the planet. The US economy represents roughly 25% of global GDP but our stocks make up over 50%...

Read More »

Read More »

Weekly Market Pulse: Tune Out The Noise

Okay, I confess. It was my fault. I decided to take a couple of days off. I took my eye off the ball and the stock market fell a quick 2% while I was relaxing, eating too much, and seeing some great art in the Holy City, Charleston, SC. I promise it won’t happen again, at least until my wife tells me where we’re going next.

It is a running joke within Alhambra that every time I go away for a few days the market takes a hit. Of course, that isn’t...

Read More »

Read More »

Weekly Market Pulse: It’s An Uncertain World

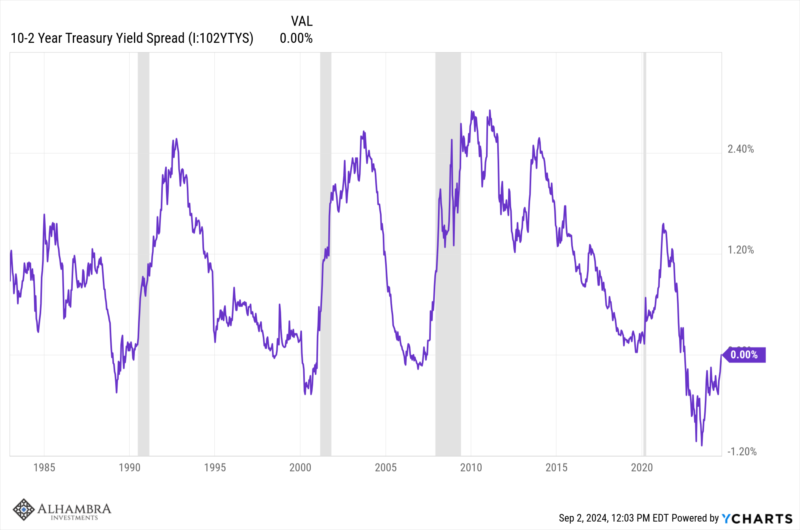

You’re going to hear a lot of talk about the yield curve soon and what it means for “the” yield curve to uninvert (which isn’t a real word but will get used a lot). The difference between the 10-year Treasury note yield and the 2-year Treasury note yield is about to turn positive, the 2-year note yield recently falling a bit more rapidly than the 10-year.

Read More »

Read More »

Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air.

Read More »

Read More »

Weekly Market Pulse: Happy Days Are Here Again!

Your cares and troubles are gone

There’ll be no more from now on!

Happy days are here again!

The skies above are clear again

Let us sing a song of cheer again

Happy days are here again!

Lyrics: Jack Yellen, Music: Milton Ager

That’s certainly how it’s felt since the turn of the new year with the NASDAQ up nearly 15%, European stocks continuing to recover, emerging markets anticipating a Chinese recovery and a solid January for the S&P...

Read More »

Read More »

Weekly Market Pulse: The Consensus Will Be Wrong

What’s your outlook for this year? I’ve heard that question repeatedly over the last month and if you’re reading this hoping I’ll let you have a peak at my crystal ball, you’re going to be disappointed. Because I don’t have a crystal ball and neither, I hasten to add, does anyone else in this business.

Read More »

Read More »

Weekly Market Pulse: Currency Illusion

When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately,...

Read More »

Read More »

Weekly Market Pulse: Peak Pessimism?

Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year.

Read More »

Read More »

Weekly Market Pulse: No News Is…

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy.

Read More »

Read More »

Weekly Market Pulse: The More Things Change…

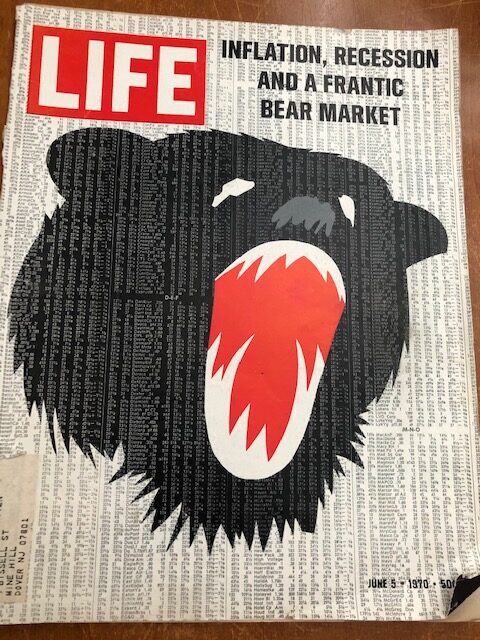

I stopped in a local antique shop over the weekend. The owner is retiring and trying to clear out as much as she can before they close the doors so I paid a mere $3 for the Life magazine above. I think it might be worth many multiples of that price for investors who think our situation today is somehow uniquely bad. The cover headline could just as easily be describing today as 1970.

Read More »

Read More »

Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong.

Read More »

Read More »

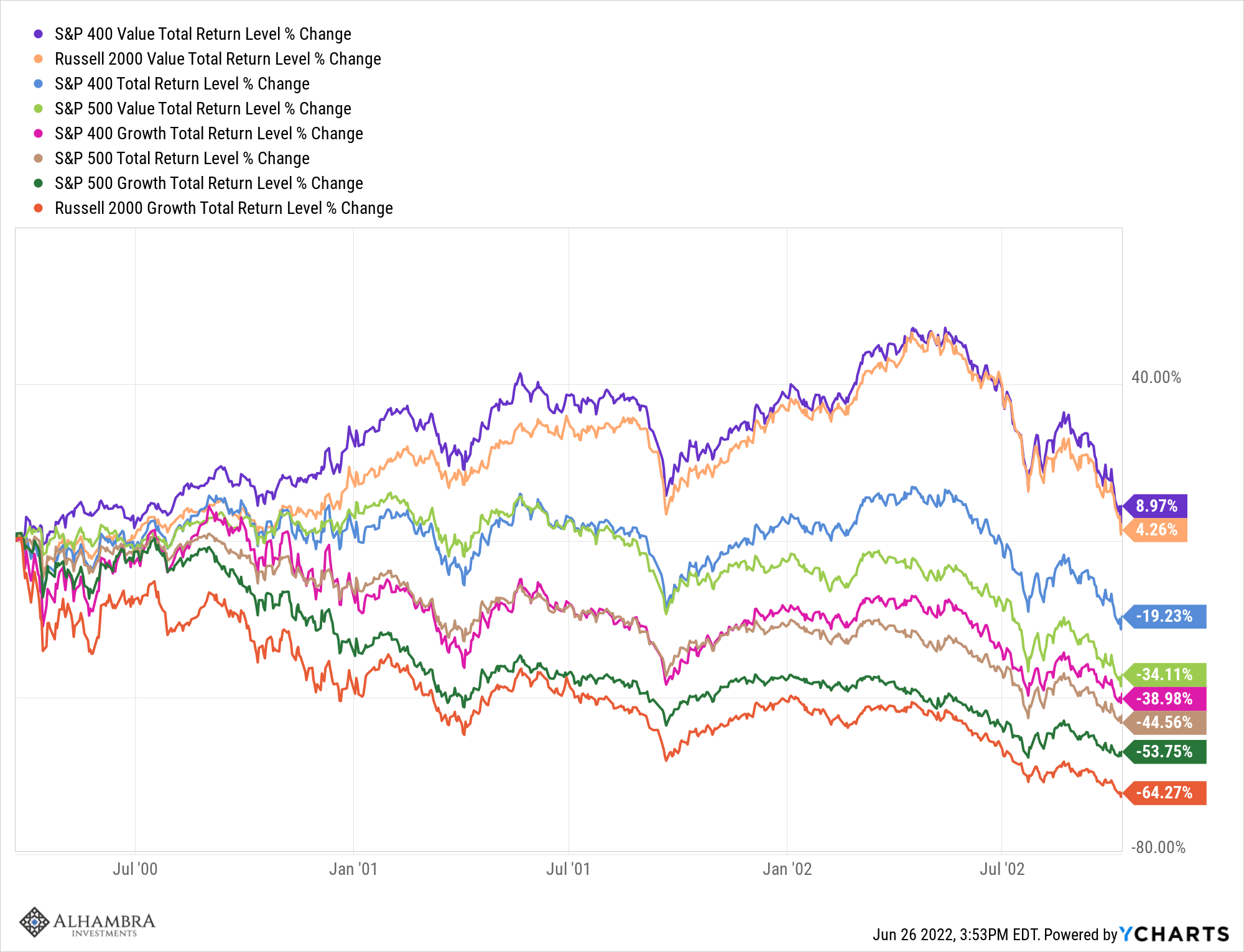

Weekly Market Pulse: Expand Your Horizons

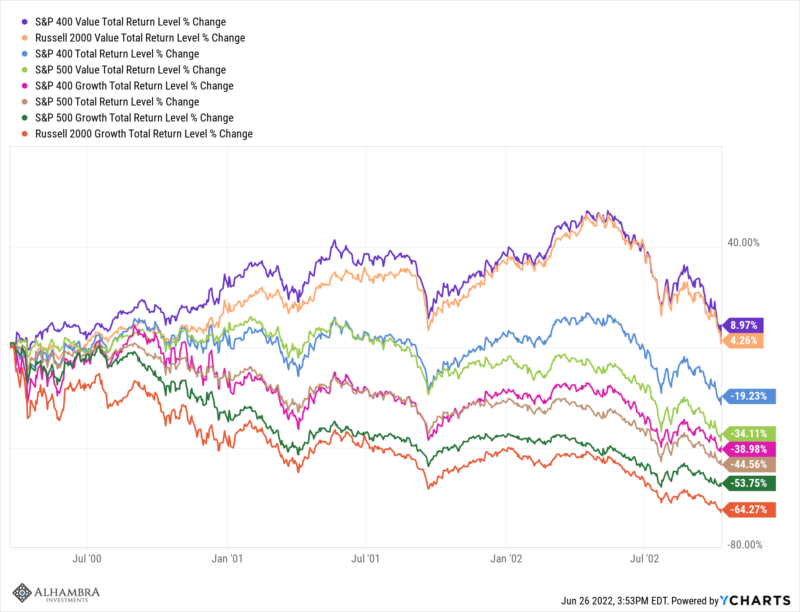

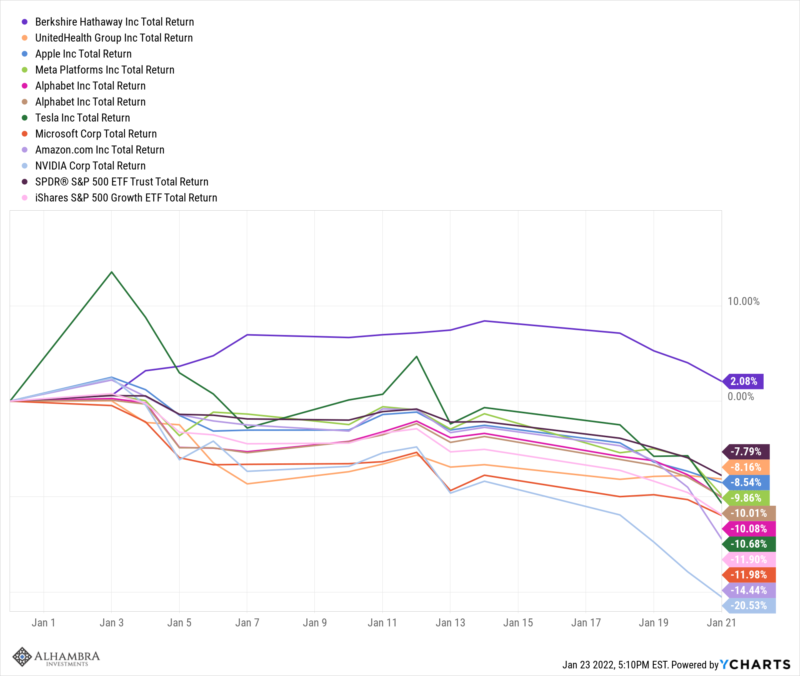

Late last year I wrote a weekly update that focused on the speculative nature of the markets. In that article, I focused on the S&P 500 because I wanted to make a point, namely that owning the S&P 500 did not absolve investment advisers of their fiduciary duty.

Read More »

Read More »

Weekly Market Pulse: Is The Bear Market Over?

Stocks had a rip snorter of a rally last week and a lot of people are pondering the question in the title over this long weekend. The S&P 500 was down 20.9% from intraday high (4818.62, January 4th) to intraday low (3810.32, May 20th). From that intraday low the market has risen 9.1% in just six trading days.

Read More »

Read More »

Weekly Market Pulse: TANSTAAFL

TANSTAAFL is an acronym for “There ain’t no such thing as a free lunch”. It has been around a long time – Rudyard Kipling used it in an essay in 1891 – but it was popularized by Robert Heinlein’s 1966 book, “The Moon is a Harsh Mistress”.

Read More »

Read More »

Weekly Market Pulse: Welcome Back To The Old Normal

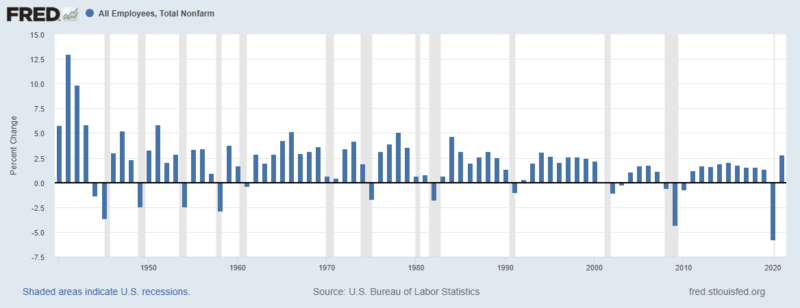

Stagflation. It’s a word that strikes fear in the hearts of investors, one that evokes memories – for some of us – of bell bottoms, disco, and Jimmy Carter’s American malaise. The combination of weak growth and high inflation is the worst of all worlds, one that required a transformational leader and a cigar-chomping central banker to defeat the last time it came around.

Read More »

Read More »

Weekly Market Pulse: The Cure For High Prices

There’s an old Wall Street maxim that the cure for high commodity prices is high commodity prices. As prices rise two things will generally limit the scope of the increase. Demand will wane as consumers just use less or find substitutes. Supply will also increase as the companies that extract these raw materials open new mines, grow more crops or drill new wells.

Read More »

Read More »

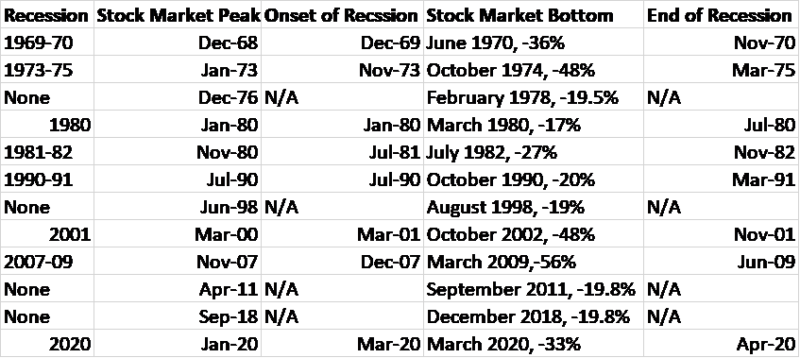

Weekly Market Pulse: Is This A Bear Market?

I don’t know the answer to the question posed in the title. No one does because the future is not predictable. I don’t know what will happen in Ukraine. I don’t know how much what has already happened there – and what might – matters to the US and global economy. I don’t know if the Fed is making a mistake by (likely) hiking interest rates by an entire 1/4 of 1% this week.

Read More »

Read More »

Weekly Market Pulse: Oil Shock

Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week.

Read More »

Read More »

Weekly Market Pulse: Fear Makes A Comeback

Fear tends to manifest itself much more quickly than greed, so volatile markets tend to be on the downside. In up markets, volatility tends to gradually decline.

Read More »

Read More »