Tag Archive: Uncategorized

“We are expecting a new wave and we’re prepared for it.”

Interview with Robert Hartmann, Co-Owner ProAurum, Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens.

Read More »

Read More »

Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot. As the week commences, a few markets such as Sri Lanka and Philippines are extending their lockdown periods while others such as Nigeria and Kenya continue to experience USD liquidity issues. Please see comments below.

Read More »

Read More »

Restricted Market Trading Comments

With many markets still under lockdown and some going out on Easter holidays this week, we continue to see amended trading hours. The most notable change has been in India with a reduction in trading hours, while in Nigeria we saw a small amount of liquidity being released by the Central Bank of Nigeria (CBN). Below are our updates for the week.

Read More »

Read More »

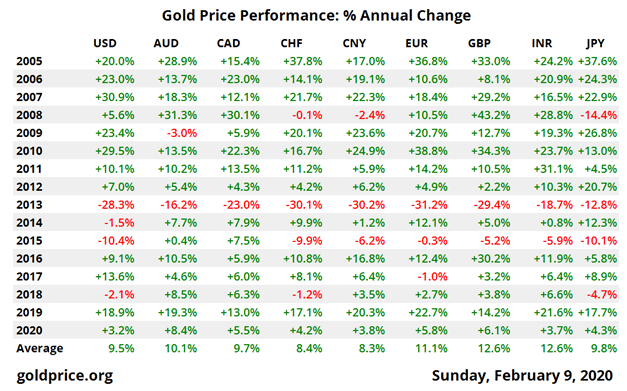

Is gold still a safe haven?

There have been moments in recent months when many gold owners, myself included, have asked themselves whether gold might have lost its safe haven status, at least in the western world. Was it enough for two generations, who grew up in a paper money system, to forget the history and the 5000-year-old status of gold as real money?

Read More »

Read More »

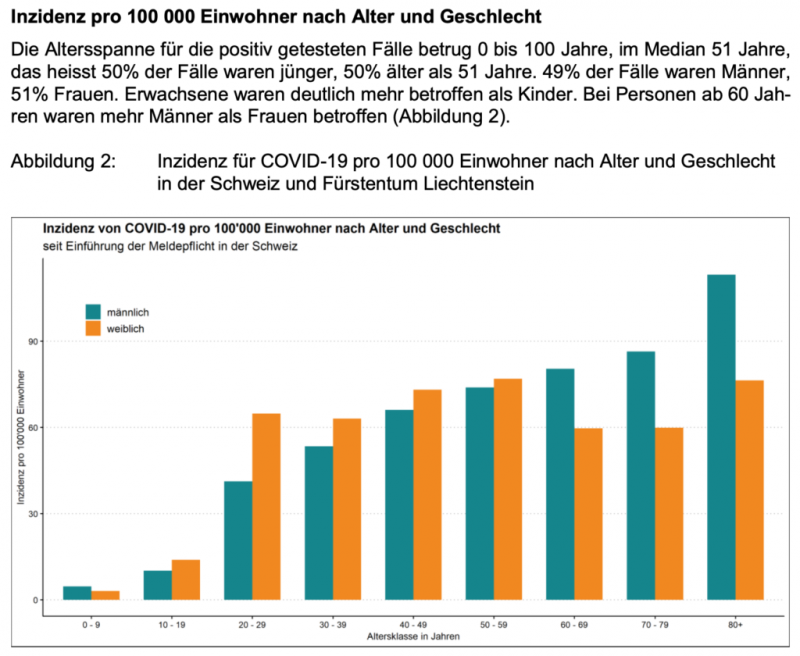

COVID-19 – Auslegeordnung

In den vergangenen Tagen habe ich mich immer wieder gefragt, “wo besteht eigentlich das Problem?” Zu oft habe ich das Gefühl, dass viele Experten, Medien und Politiker mit den Zahlen ein Durcheinander haben und so mehr zur Verwirrung als zur Klärung beitragen. Deshalb hier der Versuch einer strukturierten Aufschlüsselung.

Read More »

Read More »

A crisis is a terrible thing to waste – Part I

“You never want a serious crisis to go to waste. And what I mean by that, it’s an opportunity to do things you think you could not do before.” -Rahm Emanuel, Barack Obama’s Chief of Staff from 2009 to 2010. Only a couple of weeks ago, if anyone told you that your entire country would be basically shutting down, that events and public gatherings would be outlawed, that you’d be looking at empty shelves in your local supermarket and that the global...

Read More »

Read More »

Modern Monetary Theory is an old Marxist Idea

Modern Monetary Theory, or “MMT”, has been getting a lot of attention lately, often celebrated as a revolutionary breakthrough. However, there is absolutely nothing new about it. The very basis of the theory, the idea that governments can finance their expenditures themselves and therefore deficits don’t matter, actually goes back to the Polish Marxist economist, Michael Kalecki (1899 – 1970).

Read More »

Read More »

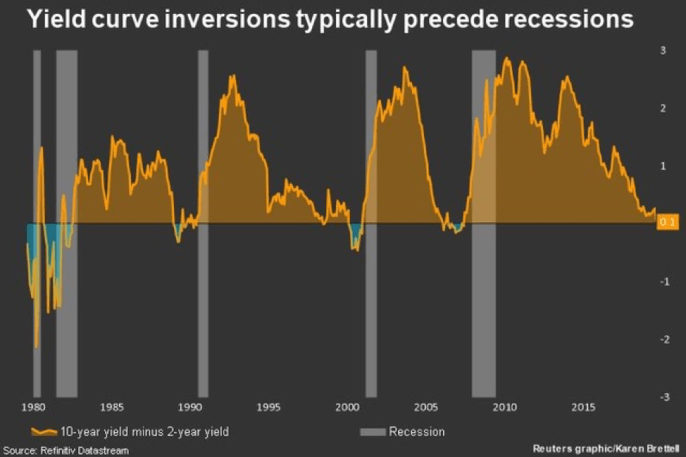

Gold is the 7th sense of financial markets

Claudio Grass (CG): Looking at the interest rate policy of the last years, it would seem that central banks are backed into a corner. They cannot hike borrowing costs without risking a domino effect, as both government and corporate debt have reached record highs, encouraged by the central banks’ own NIRP and ZIRP policies. In your view, is there a “safe” way out of this vicious circle?

Read More »

Read More »

Gold is the 7th sense of financial markets

As we embark on this new decade, there are plenty of good reasons to be optimistic about gold’s prospects. The global economy and the financial system are already stretched to a breaking point and demand for precious metals is heating up. This, of course, is plain for all to see, even as mainstream investors and analysts still refuse to face facts and prefer to focus on naïve hopes of an eternal expansion.

Read More »

Read More »

Dollar Mixed as Some Risk Appetite Returns

The dollar continues to climb; one of side-effects of the virus has been a swelling of the amount of negative yielding debt globally. The US primary season got off to a rocky start for the Democrats. During the North American session, December factory orders will be reported; the US economy remains strong.

Read More »

Read More »

Dollar Firm Ahead of BOE Decision

The World Health Organization called an emergency meeting today; the dollar continues to climb. The FOMC meeting was a non-event; US advance Q4 GDP will be reported. Risk-off sentiment has derailed curve steepening trades. Implied rates still suggest that today’s BOE meeting is a coin toss.

Read More »

Read More »

Das Internet – die dezentrale (R)Evolution

Menschen werden durch unterschiedliche Motive angetrieben. Die einen sehen das höchste Glück in der Ansammlung von materiellen Werten, und andere sind von geistigen Werten angetrieben. Eine Idee kann genauso wie eine Rolex Glücksgefühle und Ansporn auslösen. Mich persönliche treiben Ideen an.

Read More »

Read More »

What lies ahead for gold in 2020

Over the last few months, gold’s performance has been remarkable. Many market observers and mainstream analysts have pointed to various geopolitical developments in their efforts to explain away the bullishness as a reaction to whatever happens to be in the headlines at the time.

Read More »

Read More »

Investing in crypto the sound way!

I have long been fascinated by the far-reaching consequences and the great potential of the wave of new technologies and ideas that emerged with the crypto revolution. While most of us first came into contact with these concepts in 2017, this tectonic shift that is only just beginning has been in the making for nearly a decade. Now, we begin to see the basic ideas and tools take shape and give rise to endless exciting possibilities that can affect...

Read More »

Read More »

The owl has landed: Lagarde’s new vision for the ECB

On December 12, Christine Lagarde introduced her goals and vision in her first rate-setting meeting as the new President of the ECB. On the actual policy front, there were no surprises. She remained committed to the path set by her predecessor, Mario Draghi, and kept the current monetary stimulus unchanged.

Read More »

Read More »

The ECB’s “mea culpa”

Economists, conservative investors and market observers have been issuing stern warnings for years regarding the severe impact of the current monetary policy direction. In a recent statement, ECB Vice President Luis de Guindos warned of potential side effects and risks to the economy resulting directly from the central bank’s policies.

Read More »

Read More »

A turning point in the bond market?

We’ve recently seen a lot of coverage and even more “expert analyses” on the state of the bond market, to the extent that the average investor, or the average citizen for that matter, is likely to be overwhelmed and very confused about what it all means. Experts from the institutional side and defenders of the current monetary direction argue that it is all the result of policy choices, that’s it’s all under control and that we really shouldn’t...

Read More »

Read More »

Developed market equities update: a fairly reassuring reporting season

There is an ongoing tug-of-war between trade tensions and fundamentals Due to renewed trade tensions, the S&P 500 corrected by 6.0% and the Stoxx Europe 600 by 5.8% from the late July peak to the 5 August low. Because the pullback was clustered around just a few days, its intensity was reminiscent of the worst market days of past major crises.

Read More »

Read More »

Gold is the secret knowledge of the financial universe

Every seasoned gold investor and every student of monetary history has likely stumbled upon various theories about institutional manipulation of the gold market. While it is true that rarely is there smoke without fire, it is still important to approach this matter rationally and form opinions based on sound evidence and solid research.

Read More »

Read More »