Tag Archive: UBS

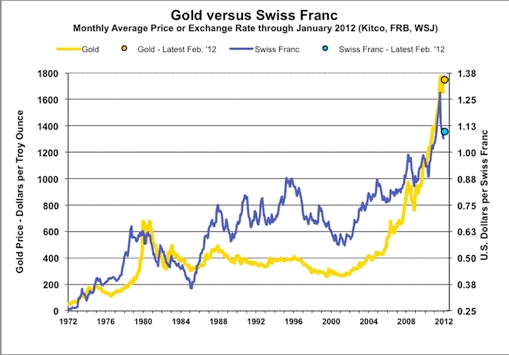

Gold, CHF, Brent Arbitrage Trading after Negative CS, UBS Interest Rates

Credit Suisse and UBS will charge negative interests for cash clearing clients above a threshold. Last year such news was worth 250 bps, on December 3 only 28 bips. One remembers August 26, 2011, when UBS only spoke of negative interests and consequently EUR/CHF rose from 1.1420 to 1.1688. At the time FX traders …

Read More »

Read More »

UBS Wealthy Clients and Hedge Funds Move into Shorts EUR/CHF

UBS wealthy clients and hedge funds are moving into shorts of EUR/CHF. The pressure on the SNB might become challenging. See more on Euromoney.

Read More »

Read More »

Net Speculative Positions, FX Outlook, Global Stock Markets, Week September 10

Submitted by Mark Chandler, from marctomarkets.com Key policy makers are preparing new efforts to address the deterioration of financial and economic conditions. This is seen reducing tail risks, which allowed the rally in risk assets to be extended, and undermined the dollar. China is providing new fiscal support. The ECB announced its new Outright Market …

Read More »

Read More »

What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?

On Friday there was a big movement in the EUR/CHF. First it went up to 1.2154, fell later down to 1.2080 in the main American trading and rose again to 1.21 in the low-volume trading time. We repeat our entry from Friday, because we continuously updated the post after new developments, e.g. after the … Continue reading »

Read More »

Read More »

Net Speculative Positions, Technical Outlook, Global Markets Ahead of Eventful Week September 3rd

Submitted by Mark Chandler, from marctomarkets.com The week ahead kicks off what we expect to be a period of intense event risk. The combination of positioning, judging from the futures market and anecdotal reports, and the low implied volatility in currencies and equity markets warn of heightened risk in the period ahead. The week begins …

Read More »

Read More »

FX Technical Outlook, Net Speculative Positions, Global Markets, week August 27

Submitted by Mark Chandler, from marctomarkets.com There are two main drivers behind the price action in the foreign exchange market and they will likely persist in the days ahead. First, there continues to be position adjustment ahead of the what promises to be eventful few weeks. Second, the release of the minutes from the August 1 …

Read More »

Read More »

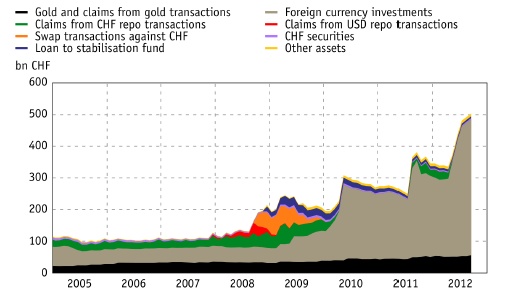

EUR/CHF, A History of Interventions: What markets say, July 2012

More Chatter About The EUR/CHF Peg The FT reports that Switzerland is ‘new China’ in currencies Chatter that the SNB was buying 3 billion francs worth of euros per day. “The picture is one of a central bank that’s not coping with how much money is coming in,” said Kit Juckes, foreign currency analyst at Société … Continue reading »

Read More »

Read More »

The End of Swiss and Japanese Deflation

At a time of speculations about global deflation, we show an interesting and very different aspect. Our CPI and wage data comparison among different developed countries, shows that Switzerland and Japan will see both inflation, whereas other countries like Australia will see disinflation.

Read More »

Read More »

EUR/CHF, A History of Interventions: What markets say, June 2012

SNB In A Bind With Euro Holdings Today’s reserve data showed skyrocketing reserves at the Swiss National Bank as they defend the EUR/CHF floor. Reserves were at 365B francs at the end of Q2 compared to 245B at the end of March, with all the growth coming in the final two months of the quarter … Continue reading »

Read More »

Read More »

The win of the pro-bailout parties in the Greek elections was no win for the SNB

The win for the pro-bailout parties in the Greek elections was no win for the Swiss National Bank (SNB), even if the fear of an immediate bank-run and extreme money flows into Switzerland are avoided. Also the fact that QE3 is not coming in the next weeks did not help the SNB.

Read More »

Read More »

Former SNB chief economist: Capital controls are just empty words

A former SNB chief economist says that capital controls are impossible, just empty words. In case of a Euro break-up the Swissie must rise together with USD, GBP and JPY An article, surprisingly from the usually left-wing Tagesanzeiger, more or less closely translated with some additional remarks.

Read More »

Read More »

SNB meeting on March 15th, 2012: Pure Speculation that SNB raises floor, How to Trade it ?

Between November 2011 and January 2012 mostly left-wing politicians and trade unions wanted the EUR/CHF floor to be risen to 1.30 or 1.40 and uttered their wishes regularly in the Swiss newspapers, triggering many FX traders to speculate on this hike. Recently these demands have become more silent even if some UBS analysts still see the floor to …

Read More »

Read More »

Written in February 2012: Will the EUR/CHF never rise over 1.22 or 1.23 again?

Our analysis from February 2012 shows astonishing accurateness: It predicted that the euro would not rise against CHF and that the commodity currencies were overvalued and subject to correction.

Basic foreign exchange theory, the SNB price stability mandate and strong fundamentals for Switzerland and bad ones for the peripheral countries of the euro zone speak for the thesis that the EUR/CHF exchange rate might never go over the level of around...

Read More »

Read More »

EUR/CHF, A History, Market Betting on Floor Hike: February 2012

EUR/CHF Busy Doing Jack; Jordan Gobbing Off Later EUR/CHF sits at 1.2048, some 7 pips easier from when I started out. Barrier option interest sits at 1.2025 and ofcourse 1.2000. SNB interim head honcho Jordan speaks later this evening (18:30 GMT) in Zurich. Might be giving instructions on how to make his favourite alpine muesli … Continue reading...

Read More »

Read More »

EUR/CHF, Market betting on Floor Hike, December 2011

Four Trades For 2012: #2 Sell The Swiss Franc I bought EUR/CHF shortly after the 1.20 peg was introduced and have held it ever since. My only regret has not been trading the range more aggressively. At this point everyone has an opinion of the SNB so I won’t try to convince the bears. Personally, … Continue reading »

Read More »

Read More »