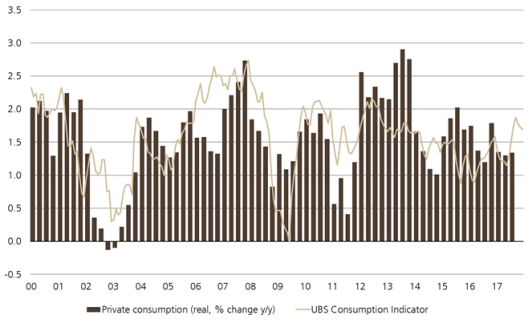

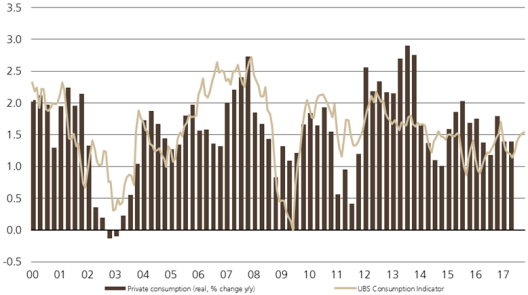

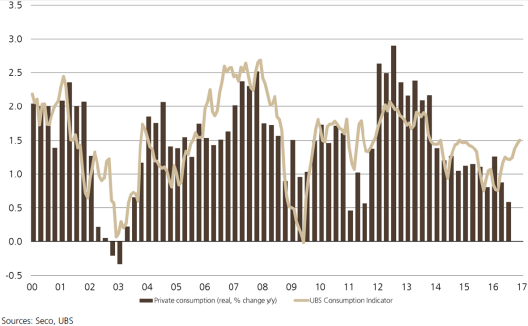

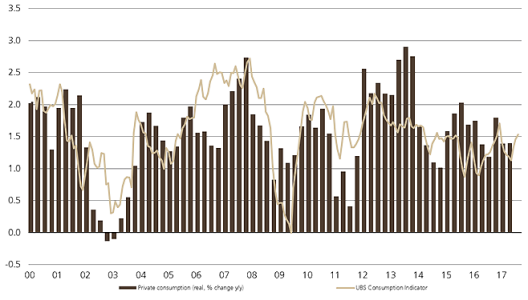

Tag Archive: Switzerland UBS Consumption Indicator

Switzerland UBS consumption indicator December: pleasing end to the year

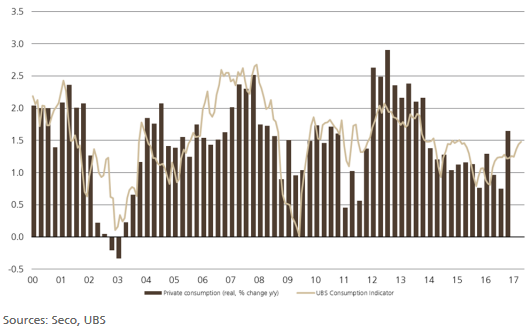

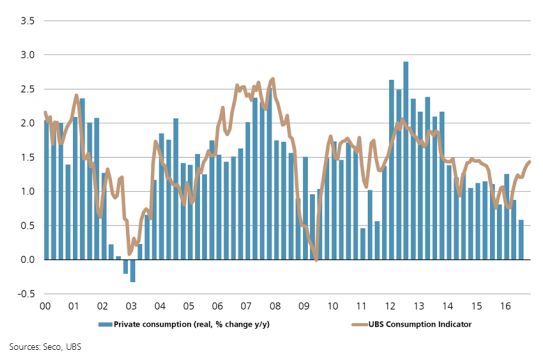

At 1.69 points, the consumption indicator lay well above the long-term average in December 2017, conveying an optimistic snapshot of Swiss private consumption. Weaker figures for new car registrations prevented an even higher value. The consumption indicator fell slightly in December 2017 to 1.69 points from 1.73. However, values had been revised upward in the past few months.

Read More »

Read More »

Switzerland UBS consumption indicator November: Solid private consumption in 2018

At 1.67 points, the UBS consumption indicator was above its long-term average in November, indicating solid consumption growth in 2018. Thanks to solid economic growth, private consumption will likely continue expanding despite rising inflation.

Read More »

Read More »

Switzerland UBS Consumption Indicator October: UBS consumption indicator trends sideways

The UBS consumption indicator was quoted at 1.54 points in October, suggesting that private consumption is growing at a solid pace in the fourth quarter. A weaker Swiss franc and a drop in unemployment provide support for it, but rising inflation and the accompanying stagnation of real wages are likely to cap any growth in it.

Read More »

Read More »

Switzerland UBS Consumption Indicator September: Higher expectations in the retail industry

The UBS consumption indicator rose to 1.56 points in September, signalling consumption growth slightly above the long-term average. The indicator was supported by significantly higher expectations in the retail industry, but UBS still projects consumer spending to grow 1.3 percent for the year overall.

Read More »

Read More »

Switzerland UBS Consumption Indicator August: A pleasant end to summer

The UBS consumption indicator increased to 1.53 points in August thanks to robust new car registrations and encouraging numbers of hotel stays by Swiss residents, indicating consumption growth slightly above the long-term average of 1.5%. However, the UBS economists still project 1.3% consumer spending growth for the year overall.

Read More »

Read More »

Switzerland UBS Consumption Indicator July: Weaker Swiss Franc Offers a Ray of Hope

UBS consumption indicator printed 1.38 in June, pointing to subdued growth in Swiss private consumption in recent months. Relatively weak growth in employment was much to blame for the lackluster number, however this was offset somewhat by robust new car registrations data and overnight hotel stays by Swiss nationals.

Read More »

Read More »

Switzerland UBS Consumption Indicator June: Subdued Growth

UBS consumption indicator printed 1.38 in June, pointing to subdued growth in Swiss private consumption in recent months. Relatively weak growth in employment was much to blame for the lackluster number, however this was offset somewhat by robust new car registrations data and overnight hotel stays by Swiss nationals.

Read More »

Read More »

Switzerland UBS Consumption Indicator May: Down slightly

The UBS consumption indicator registered 1.39 points in May, suggesting slightly below-average growth in private consumption. This matches the UBS CIO consumption growth forecast of 1.3% in 2017. The data published in June regarding new car registrations and hotel overnight stays by Swiss residents was robust and supported the consumption indicator.

Read More »

Read More »

Switzerland UBS Consumption Indicator April: Late Easter slows down car sales

The UBS consumption indicator stood at 1.48 points in April, indicating average private consumption growth. The improved mood in the retail sector supported the indicator, while a decline in new car registrations had a negative effect. The index of consumer sentiment measured by the State Secretariat for Economic Affairs also fell slightly.

Read More »

Read More »

Switzerland UBS Consumption Indicator March: Problem child in retail

The UBS consumption indicator registered at 1.50 points in March, indicating private consumption growth around the long-term average. Solid automotive demand drove this figure. Domestic tourism, on the other hand, took a breather after a strong start in 2017. Pessimism still prevails in retail.

Read More »

Read More »

Switzerland UBS Consumption Indicator February: Domestic tourism rising

The UBS consumption indicator rose to 1.50 points in February from 1.44, indicating solid private consumption in the first quarter. Domestic tourism bottomed out and then rose significantly in January. On the other hand, dour sentiment in the retail trade is hemming further gains by the consumption indicator.

Read More »

Read More »

Switzerland UBS Consumption Indicator January: Light and shade

The UBS consumption indicator rose from 1.38 to 1.43 points in January and continues to signal solid growth in private consumption. Swiss consumers view the economic and financial situation with considerably more optimism than in the last quarter. New car registrations and domestic tourism have, however, fallen compared with the previous January. Zurich, 1 March 2017 – Following a comprehensive data revision, the UBS consumption indicator climbed...

Read More »

Read More »

Switzerland UBS Consumption Indicator December: Automobile market with record year-end results

The UBS consumption indicator rose from 1.45 to 1.50 points in December. The positive trend of last fall continued and signalizes solid growth prospects for private consumption this year. New car registrations in the automobile sector, which are at an all-time high, are at the root of this positive outlook.

Read More »

Read More »

Switzerland UBS Consumption Indicator November: Subdued private consumption in 2017 despite solid November figures

The UBS Consumption Indicator climbed to 1.43 points in November from 1.39. Another strong month in domestic tourism and the positive trend on the automobile market made the rise possible. Initially a solid start is to be expected for 2017, but momentum is expected to subside.

Read More »

Read More »

Switzerland UBS Consumption Indicator October: Retailers are hoping for good Christmas business

In October, the UBS consumption indicator rose from 1.47 to 1.49 points. Positive developments in the automobile market and robust domestic tourism continue to support private consumption. However, the slump in the retail sector prevented a stronger rise of the indicator.

Read More »

Read More »

Switzerland UBS Consumption Indicator September: Confidence despite weakness in retail

The UBS consumption indicator rose from 1.53 to 1.59 points in September. The positive trend continues and points to further growth in private consumption for the fourth quarter. The driving forces are new vehicle registrations, which are at a record level, and the upsurge in domestic tourism in August.

Read More »

Read More »

Switzerland, UBS Consumption Indicator August

The UBS Consumption Indicator rose to 1.53 points in August from 1.45. This development was fueled by resurging tourism and above-average car sales for the month. However, the situation on the labor market casts a shadow on this rise.

Read More »

Read More »

Switzerland UBS Consumption Indicator July: Car buyers turn on cruise control

In July, the UBS consumption indicator rose to 1.32 points from 1.21. A slight downward adjustment of the June figure and above-average car sales generated the increase. However, the disappointing June figures for tourism and sluggish consumer sentiment slightly curbed this upward trend.

Read More »

Read More »

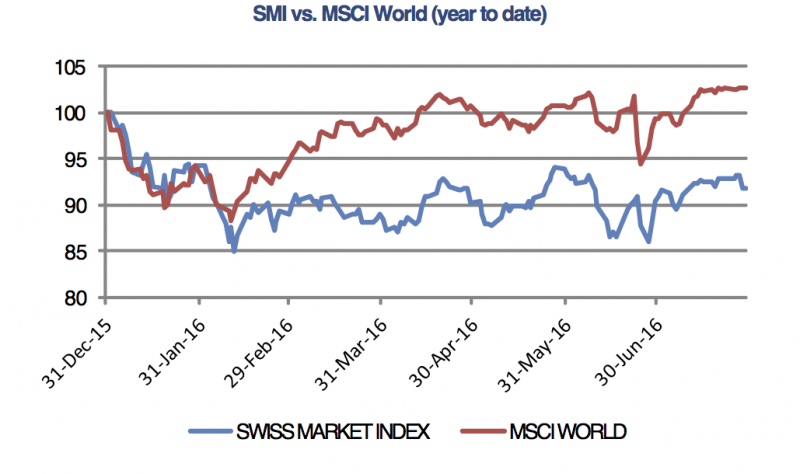

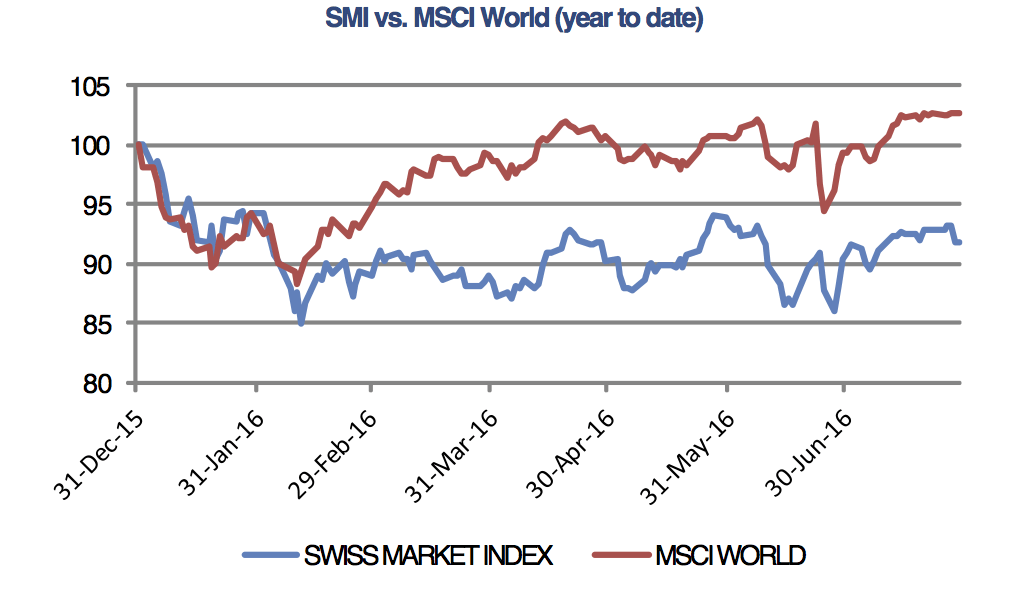

Swiss stock market rally loses momentum

The Swiss Market Index and global stock markets failed to extend last week’s rally after the Federal Reserve and Bank of Japan left rates unchanged and gave mixed messages about the global economic outlook.

Read More »

Read More »

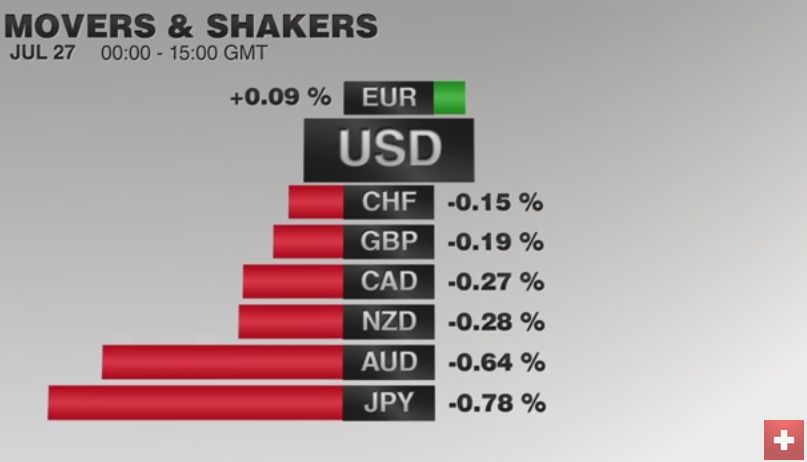

FX Daily, July 27: Yen Falls on Fiscal Stimulus, while Sterling and Aussie Can’t Sustain Upticks

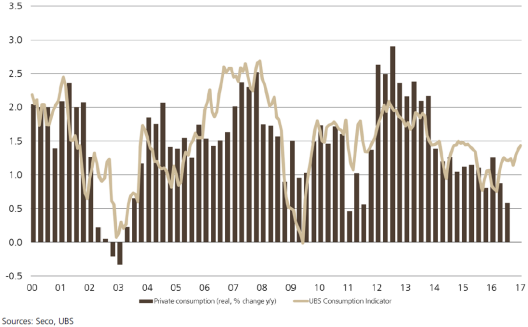

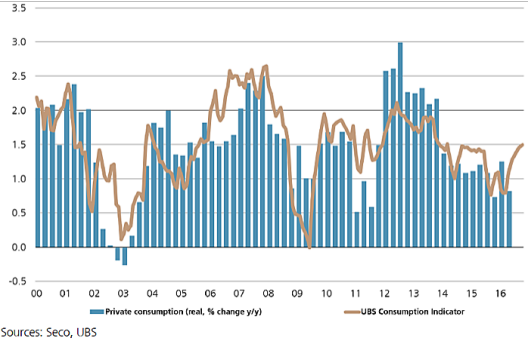

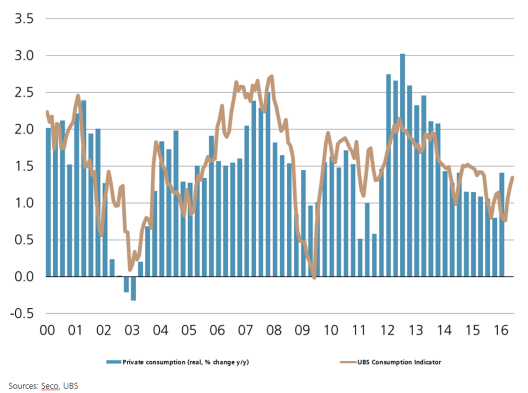

Swiss Franc: The Euro kept on climbing, after yesterday's rapid rise. The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

Read More »

Read More »