Tag Archive: Thoughts

“Fundamentals and technical analysis are two sides of the same coin”

Interview with Laurent Halmos

For most die-hard physical gold investors and students of history like myself and most of my readers and clients, technical analysis is often seen as a bit of a taboo, or at best something irrelevant to our worldview and investment approach. Nevertheless, to paraphrase the old saying about politics, just because you are not interested in the charts doesn’t mean that the charts are not interested in you.

I met...

Read More »

Read More »

2022 is the end of big tech and the beginning of the 11 years commodity cycle from 2023 – 2033

Don’t miss my latest talk with my “political incorrect” friend Jeremy on TNT Radio – about the World Economic Muppet-Show called WEF and much more

Click on the below link, to listen to the show.

https://tntradiolive.podbean.com/e/claudio-grass-on-jerm-warfare-with-jeremy-nell-24-january-2023/

This work is licensed under a Creative Commons Attribution 4.0 International License. Therefore please feel free to share and you can subscribe for...

Read More »

Read More »

The death of the middle class is the death of civil society

The middle class in the West has been shrinking for years, but after the covid crisis and especially after the inflation explosion, whatever was left of it is now basically under threat of extinction. This has immense sociopolitical implications.

Read More »

Read More »

“Markets and civil society are win-win institutions, government and politics are zero-sum.”

Division, friction and polarization have been on the rise in the West for at least a decade, but the escalation we saw during the “covid years” was especially worrying. Over the last year, this “worry” has become a truly pressing concern, even a real emergency one might argue, as inflationary pressures and an actual war were added to the mix of political and social tensions.

Read More »

Read More »

A grateful goodbye to 2022, a hopeful hello to 2023

Even though what we saw during the height of the pandemic was shocking enough for most people, what we saw during 2022 was arguably even more astonishing. During the lockdowns and quarantines and the forced business shutdowns, the sheer number of all the rights and freedoms that were coercively “suspended”, as though that’s a thing one can do with true liberty, left so many fellow citizens in disbelief. However, what many people found even more...

Read More »

Read More »

Gold is money – everything else is credit!

What physical precious metals investors can expect 2023 and beyond

Throughout the better part of 2022 there has been one question that has consistently, and predictably, popped up in conversations with my friends, clients and readers. Those who know me and are familiar with my ideas are well aware of my position on precious metals and the multiple roles they serve, so I can’t blame them for them for being curious whether I still “stick to my...

Read More »

Read More »

“It begins”: The rise of the digital dollar

In mid-November, while the whole world was focused on the Ukraine crisis, the US midterms or whatever other “big story” the media decided was more important, a truly momentous shift took place in the global financial system. It might seem like a small step on the surface, but it has the potential to bring about a real and possibly irreversible sea change in the way we use money; or better said, the way it uses us.

As Reuters reported on the...

Read More »

Read More »

The way forward:

A practical roadmap to reclaiming individual and financial sovereignty – Part II of II

Essential ingredients

There have always been people with a passion for liberty. Since the earliest historical records, we can find questioners, dissenters, “trouble makers”, contrarians and all kinds of free and inquisitive minds. In this day and age, however, technology has played a decisive role in the influence they can have. Sure, the “bad guys” might...

Read More »

Read More »

The way forward:

A practical roadmap to reclaiming individual and financial sovereignty – Part I of II

Those who are familiar with my ideas and my writings undoubtedly know that one the issues I’m most passionate about is individual freedom, on all levels. I believe that free-thinking people know what’s best of them and they need no “guardians”, no “nannies” and certainly no bailiffs and enforcers, to limit or to dictate their choices “for their own good”. As...

Read More »

Read More »

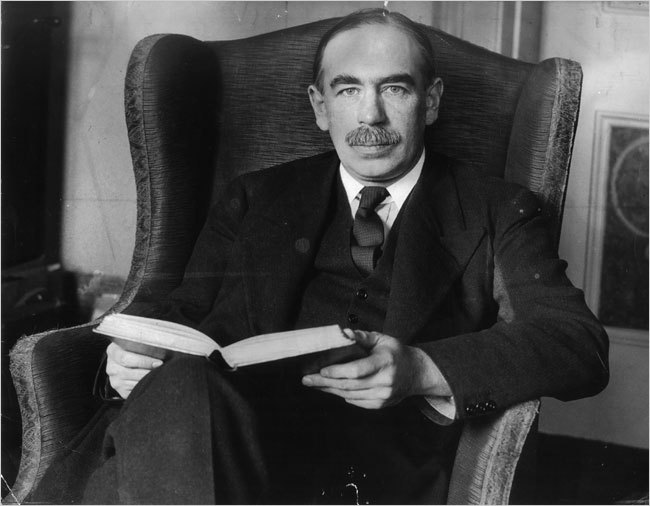

“Keynes is the winner of the day, not Milton Friedman”

To many of us, no matter how well versed in history, in political affairs or in socioeconomic issues, the present conditions in the West, and especially in Europe, can sometimes seem like the plot of a bad movie. It is often said that history doesn’t repeat itself, but it does rhyme, and what we’re seeing today is a great example of that.

Read More »

Read More »

Claudio Grass – The Movement Is Spreading World Wide, The Great Awakening, The [DS] Has Failed

Claudio begins his discussion with the pandemic, the people are waking up and they are now seeing that the criminals lied to them. The war is a show and as the economy implodes on itself the people understand that its not Putin fault, it is the criminal politicians that are causing the problem. Claudio says that more and more people are waking up.

Read More »

Read More »

The importance of being modest

It can be argued that the world has reach the sorry state it’s in today largely because academics, politicians and “distinguished experts” or “recognized authorities” did not have the humility to admit their own mistakes, or to at least recognize the limits of their knowledge. Of course, this is far from a new affliction in our societies and political systems. Hubris was one among the most terrible sins that the ancient Greeks warned against and...

Read More »

Read More »

“The British people are politically homeless – Part II”

Interview with Godfrey Bloom: Part II of II (click on this link for Part I)

Claudio Grass (CG): With everything that’s been going on, it could be argued that very few of Liz Truss’s predecessors had worse luck in their first month in office. The Queen’s death dominated international mainstream media for weeks and it reignited a lot of old debates about Britain’s past and about the monarchy itself. What is your own view on the monarchy? Is it...

Read More »

Read More »

“The British people are politically homeless – Part I”

Interview with Godfrey Bloom: Part I of II

A lot has been said and written about Britain’s political and economic woes since Brexit, and even more so over the last two years. Overwhelmingly, mainstream media coverage has been negative and many of the nation’s problems have been blamed on Brexit itself. The role of the lockdowns, the forced business closures and especially of the extreme fiscal and monetary interventions during the Covid...

Read More »

Read More »

Fernando del Pino Calvo-Sotelo: The decline of Reason in the West

By Claudio Grass, Hünenberg, Switzerland

It will come as no surprise to friends and regular readers that I hold but a handful of contemporary intellects in high esteem, given the present Zeitgeist, the current state of state education and the level of public discourse. It will be even less surprising that Fernando del Pino Calvo-Sotelo is one of them. He is a free and independent thinker, whose original, unshackled and unadulterated ideas I have...

Read More »

Read More »

Philosophy and (Un)Common Sense

Interview with Jakub Bożydar Wiśniewski

In today’s world, dominated as it is by the ephemeral, the superficial and the inconsequential, it can be hard for a rational, dispassionate observer to make sense of what is going on – politically, socially, economically and philosophically.

It is that last aspect that gets the least “oxygen” in mainstream media, in public education and in pretty much all debates and disagreements we grapple with as a...

Read More »

Read More »

Conversation with Sean from SGT

Precious metals analyst and expert Claudio Grass returns to SGT Report to discuss the World Economic Forum and the New World Order.

Click on the below link – the content is too much for YouTube and therefore we have to protect on rumble to avoid the “spin-doctors” from the “Ministry of Truth”.

Enjoy and stay free

Claudio Grass, Hünenberg See, Switzerland...

Read More »

Read More »

Eat or heat

As the citizens of the Eurozone and the UK are increasingly struggling to make ends meet due to record levels of inflation, and as the winter draws closer, a serious cost of living crisis is set to spiral out of control. Skyrocketing energy costs, combined with galloping prices for food and other essential goods and services are bound to erase whatever was left of the “middle class”.

Read More »

Read More »

Greetings from Switzerland

I’m back from Geneva where, among other things, I briefly visited the headquarter of the World Economic Forum (WEF) to express my appreciation for this organization. Check out my picture :-). In addition I enjoyed a conversation with Jose El Niño – you will find the podcast under the below link.

Claudio Grass, Switzerland

If you want to listen, please click on the following link to the podcast:...

Read More »

Read More »