Overview: The foreign exchange market is quiet to

start the new week. As the North American session is about to begin, the dollar

is mostly +/- 0.10% against most of the G10 currencies. The Swedish krona is

the notable exception, rising about 0.25% against the US dollar amid good

demand for its bonds today. Emerging market currencies are mostly lower. The

Taiwanese dollar is the strongest in the complex so far today, rising about

0.30% against the...

Read More »

Tag Archive: SWIFT

Capital and Commodity Markets Strain

Overview: The capital and commodity markets are becoming less orderly. The scramble for dollars is pressuring the cross-currency basis swaps. Volatility is racing higher in bond and stock markets. The industrial metals and other supplies, and foodstuffs that Russia and Ukraine are important providers have skyrocketed. Large Asia Pacific equity markets, including Japan, Hong Kong, China, and Taiwan fell by 1%-2%, while South Korea, Australia,...

Read More »

Read More »

SWIFT Isn’t The ‘Nuclear Option’ For Russia, Because Russia can sell the dollars elsewhere and NOT via Swift

As everyone “knows”, the US dollar is the world’s reserve currency which can only leave the US government in control of it. Participation is both required and at the pleasure of American authorities. If you don’t accept their terms, you risk the death penalty: exile from the privilege of the US dollar’s essential business.From what little most people know about that essential business, it seems like it has something to do with that thing called...

Read More »

Read More »

De-dollarization By Default Is Not What You Might Think

Last month, a group of central bank governors from across the South Pacific region gathered in Australia to move forward the idea of a KYC utility. If you haven’t heard of KYC, or know your customer, it is a growing legal requirement that is being, and has been, imposed on banks all over the world. Spurred by anti-money laundering efforts undertaken first by the European Union, more and more governments are forcing global banks to take part.

Read More »

Read More »

Cashless Society – Is The War On Cash Set To Benefit Gold?

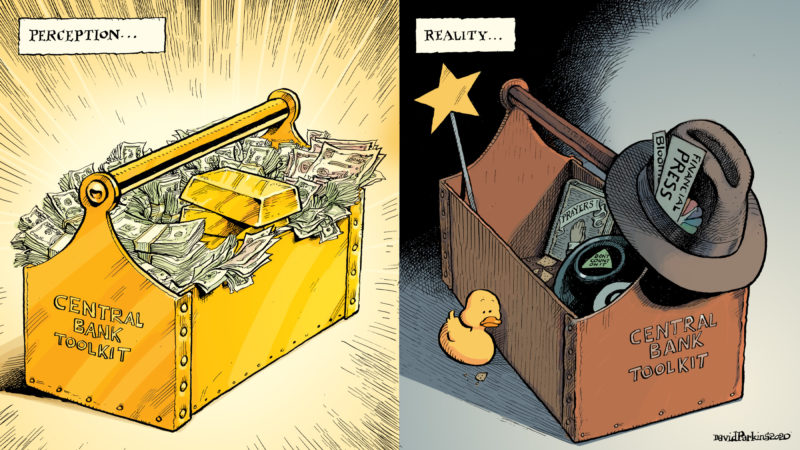

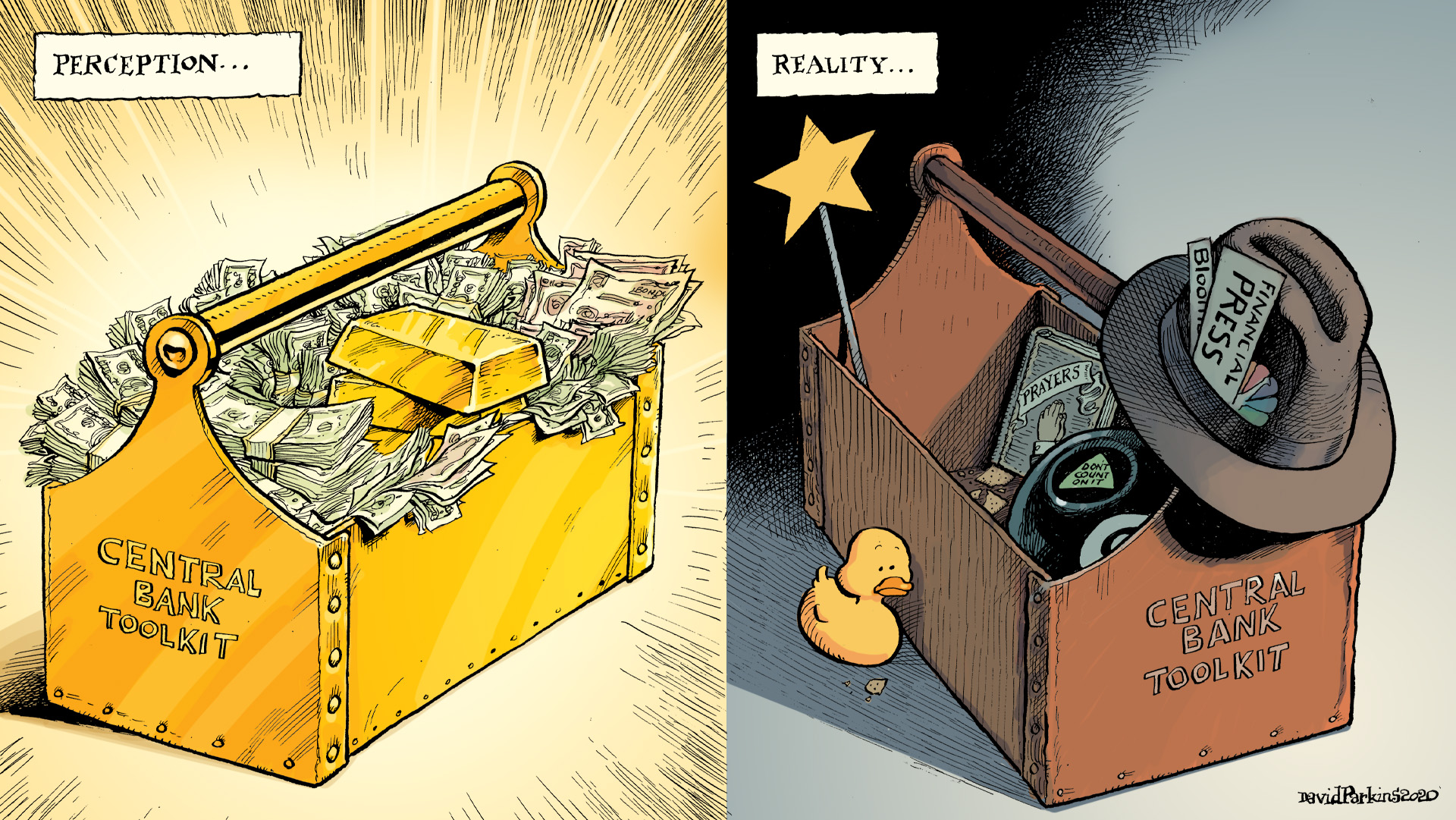

Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society.

Read More »

Read More »

IIF Chief Warns “Brexit Bigger Threat To Global Economy Than Lehman”

As Brexit appears to gathering pace among British voters, Bloomberg Briefs interviews Hung Tan, executive managing director at the Institute of International Finance in Washington, DC., to understand the global impact of a decision by Britain to leav...

Read More »

Read More »