With a backdrop of concern about US protectionism and a possible abandonment of the 23-year old strong dollar policy, and among the weakest sentiment toward the dollar in at least a decade, the ECB takes center stage. What a turn of events for Mr. Draghi, the President of the European Central Bank.

Read More »

Tag Archive: Spain Unemployment Rate

Unemployment rate measures the percentage of the total work force that is unemployed and actively seeking employment during the reported month.

FX Daily, October 26: Draghi’s Day

It is all about the ECB meeting today. The market was hoping for more details last month, but Draghi pointed to today. The broad issue is well known. While growth has been strong, price pressures are still not, according to the ECB, on a durable path toward its "close but lower than 2%" target. The ECB judges that substantial additional stimulus is needed.

Read More »

Read More »

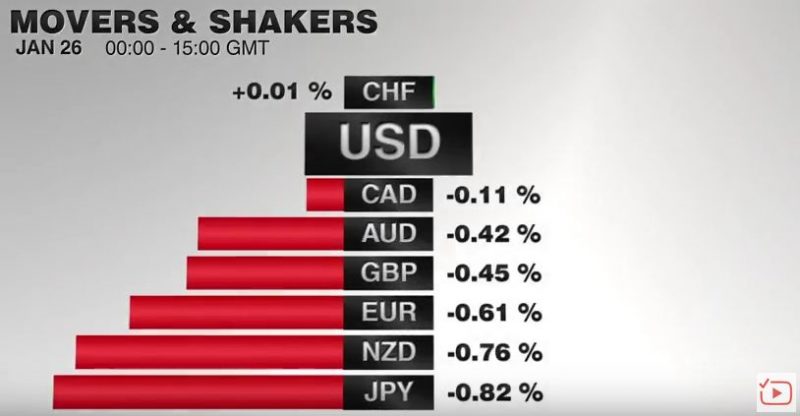

FX Daily, July 27: Dollar Remains on the Defensive

The US dollar is narrowly mixed after selling off following the FOMC statement. Sometimes the narrative explains the price action, and sometimes the price action explains the narrative. This seems to be the case of the latter. The dollar and interest rates fell, and so the Fed was dovish.

Read More »

Read More »

FX Daily, April 27: Several Developments ahead of the ECB meeting

The ECB meeting and the press conference that follows it is the main event. However, it has had to compete with the Bank of Japan and Riksbank meetings, as well as the further reflection of the tax reform proposals by the Trump Administration yesterday.

Read More »

Read More »

FX Daily, January 26: EUR/CHF collapses to 1.670

The US dollar is mostly firmer against the major currencies but is confined to narrow ranges, and well-worn ranges at that, but the focus has shifted to the strong advance in equities. Yesterday, the Dow Jones Industrials finally rose through the psychologically-important 20k level, and the S&P 500 gapped higher to new record levels.

Read More »

Read More »

FX Daily, July 28: Dollar Pulls Back Further Post-FOMC

After reversing lower yesterday after the FOMC statement, the US dollar has continued to move lower against the major currencies, save sterling. While the market is not fully confident of a rate cut by the Reserve Bank of Australia, indicative pricing in the derivative markets suggest a UK rate cut has been fully discounted (and a new asset purchase plan may also be announced).

Read More »

Read More »

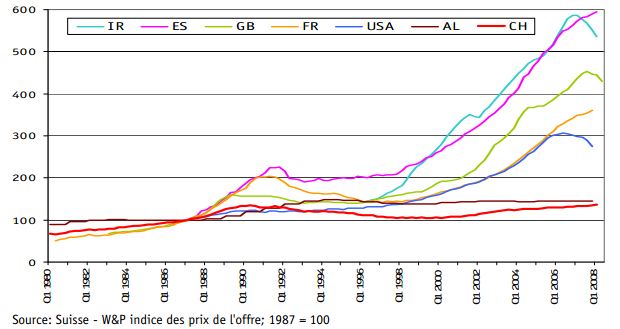

Why the Euro Crisis may last another 15 years

Abstract In the following article we will explain which types of crisis occur in the euro area and will argue that this crisis will last at least another fifteen years. (1) Competitiveness crisis: Before the euro introduction peripheral countries regularly saw their currency depreciate against the German Mark and helped them to increase their competitiveness. …

Read More »

Read More »