Tag Archive: S&P 500

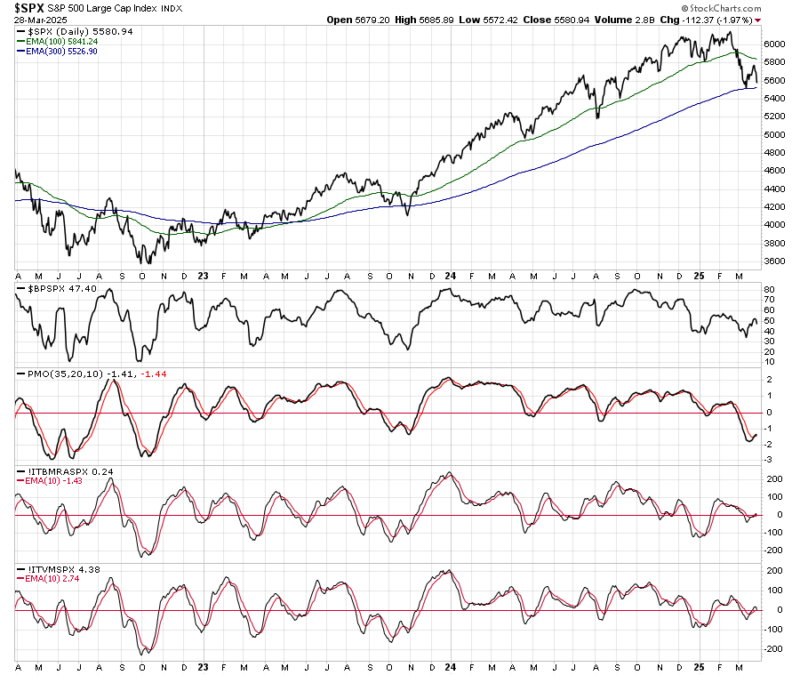

Failure At The 200-DMA

In last week's post, "Is the correction over?" we wrote about the potential for a rally back to the 200-DMA. However, the failure of that test increased short-term concerns. As we noted in that post, there were early indications of buyers returning to the market. To wit: "The chart below has four subpanels. The first … Continue reading...

Read More »

Read More »

Stagflation Panic: A Misdiagosed Media Spin

Following the latest Federal Reserve meeting, there was a massive surge in media headlines stating "stagflation." The media's stagflation panic is unsurprising as it elicits memories of the late 1970s during the Arab oil embargo. Of course, a "stagflation" is excellent fodder for clicks and views as it scares the “bejeebers” out of people. Over the last …

Read More »

Read More »

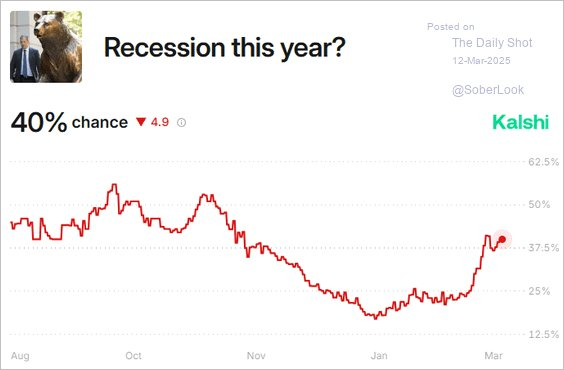

U.S. Recession Risks Not As High As The Media Suggests

U.S. recession risks have been a headline over the last few weeks as the markets sold off. "Goldman Sachs and Moody’s Analytics in recent days joined forecasters raising alarm about the increased likelihood of an economic downturn.

Read More »

Read More »

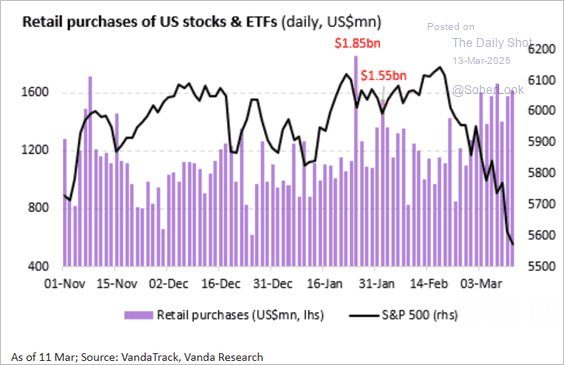

Retail Investor Buys The Dip Despite Bearish Sentiment

It has been an interesting correction. The average retail investor was "buying the dip" despite having an extremely bearish outlook. This is an interesting point because, as shown, the retail investor used to be considered a "contrarian indicator" as they were prone to be driven by emotional behaviors that led them to "buy high and sell low." …

Read More »

Read More »

Stupidity And The 5-Laws Not To Follow

Human stupidity is the one thing you can rely on in financial markets. I recently read a great piece by Joe Wiggins at Behavioral Investment, which discusses why "Investing is hard." The entire article is worth reading, but here are the five key reasons investors often fail at investing: These are great points, particularly now that …

Read More »

Read More »

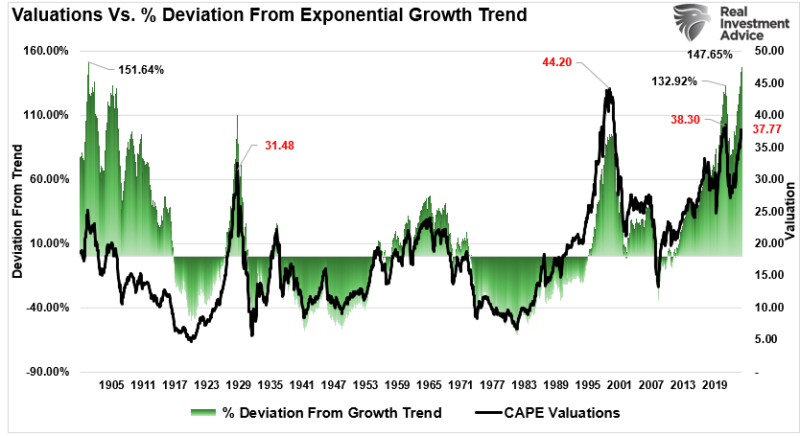

CAPE-5: A Different Measure Of Valuation

One of the most referenced valuation measures is Dr. Robert Shiller's Cyclically Adjusted Price-Earnings Ratio, known as CAPE. Valuations have always been, and remain, an essential variable in long-term investing returns. Or, as Warren Buffett once quipped: “Price Is What You Pay. Value Is What You Get.” One of the hallmarks of very late-stage bull …

Read More »

Read More »

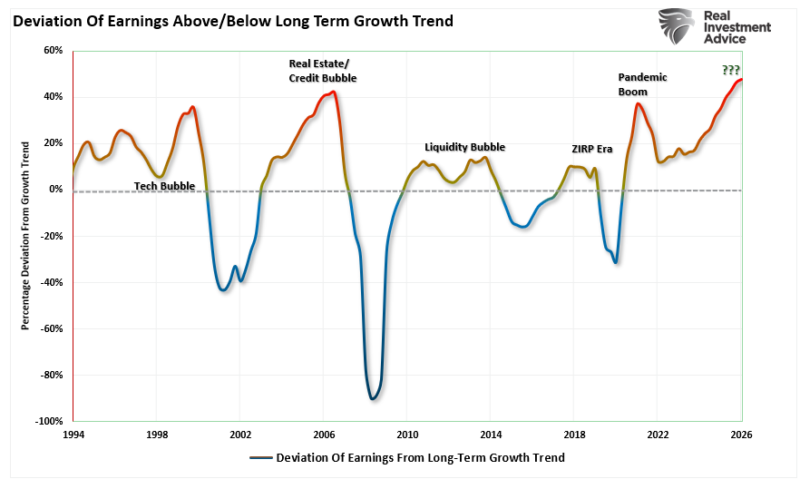

Estimates By Analysts Have Gone Parabolic

Just recently, S&P Global released its 2026 earnings estimates, which, for lack of a better word, have gone parabolic. Such should not be surprising given the ongoing exuberance on Wall Street. As noted last week, correlations between all asset classes, whether international or emerging markets, gold or bitcoin, have all gone to one. Unsurprisingly, rationalizations …

Read More »

Read More »

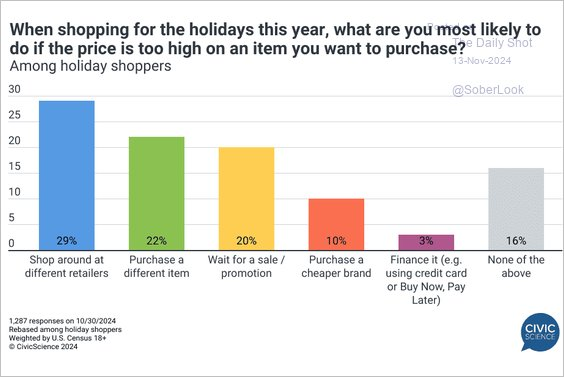

The Tariff Risk Isn’t In Inflation (Part II)

For Part 1 on "Tariff Risk" read: Tariff Impact Not As Bearish As Predicted. In "Trumpflation" we discussed why the tariff risk was not inflation. To wit: "Today, globalization and technology give consumers vast choices in the products they buy. While instituting a tariff on a set of products from China may indeed raise the …

Read More »

Read More »

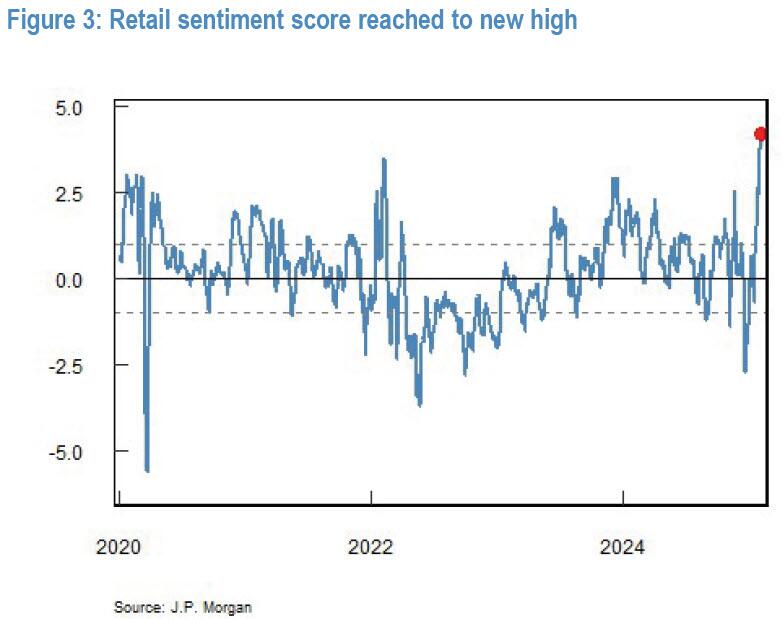

Retail Exuberance Sets Market Up For A Correction

Last week, we discussed the surge in retail exuberance in the market following the election of President Trump. "The market defies more negative news because retail investors continue to step in and "buy the dip." In our recent Bull Bear reports, we discussed the push by retail investors, but looking at retail sentiment is quite …

Read More »

Read More »

The Impact Of Tariffs Is Not As Bearish As Predicted

There are many media-driven narratives about the impact of tariffs on the economy and the markets. Most of them are incredibly bearish, predicting the absolute worst possible outcomes. For fun, I asked ChatGPT what the expected impact of Trump's tariffs will likely be. Here is the answer: "One of the immediate consequences of increased tariffs …

Read More »

Read More »

Bull Bear Report – Technical Update

I could not produce our weekly Bull Bear Report this past weekend as I presented at Michael Campbell's Moneytalks Conference in Vancouver. However, I wanted to use today's technical update to review some of the statistical analysis we produce each week in that commentary. Such is mainly the case given last Monday's "tariff" shock and …

Read More »

Read More »

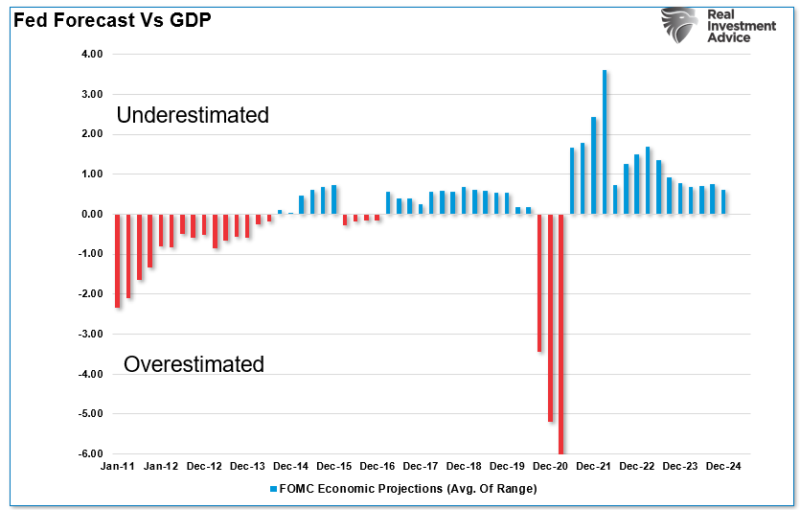

Forecasting Error Puts Fed On Wrong Side Again

The Federal Reserve's record of forecasting has frequently led it to respond too late to changes in economic and financial conditions. In the most recent FOMC meeting, the Federal Reserve changed its statement to support a pause in the current interest rate-cutting cycle. As noted by Forbes: "The policy-setting Federal Open Market Committee agreed unanimously …

Read More »

Read More »

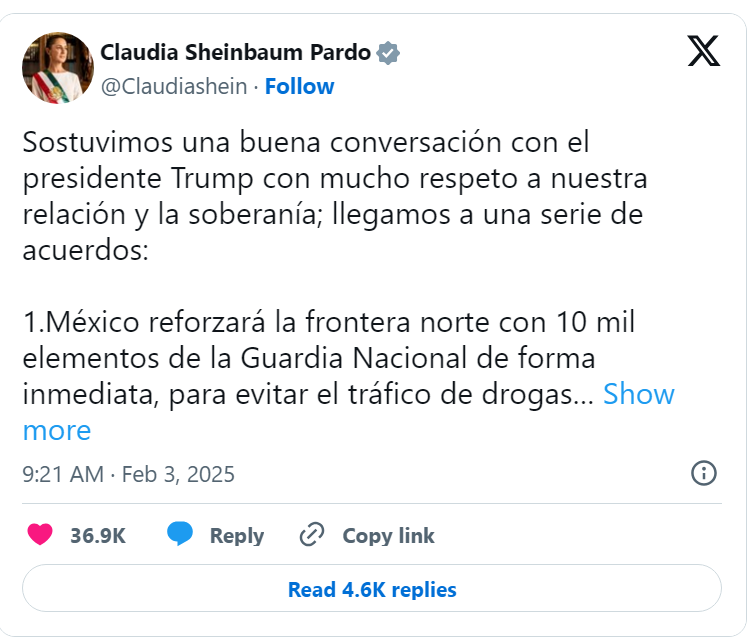

Tariffs Roil Markets

Over the weekend, President Trump announced tariffs of 25% on both Canada and Mexico, as well as a 10% tariff on China. Such was not unexpected, as contained in the Trump tariff Executive Order {SEE HERE}. Specifically, that order stated: "[Sec 2, SubSection (h)]: Sec. 2. (a) All articles that are products of Canada as defined …

Read More »

Read More »

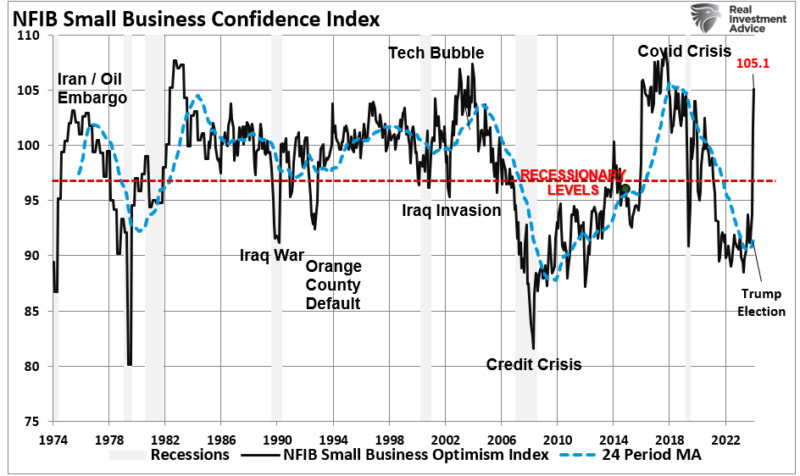

Bullish Exuberance Returns As Trump Takes Office

Bullish exuberance is returning to the markets and the economy in a big way following the Presidential election. Such is particularly the case with recent executive orders signed by Trump, which fulfill Trump's promises to "Make America Great Again." Given that short-term market dynamics are driven primarily by sentiment, as investors, we can not dismiss …

Read More »

Read More »

DeepSeek DeepSinks Bullish Exuberance

On Monday, markets were rocked by news that a Chinese Artificial Intelligence model, DeepSeek, performed better than expected at a lower development cost. As we noted in our Daily Market Commentary yesterday: "The 3% panic sell-off on the Tech-heavy Nasdaq-100 futures is focused on the view that China’s DeepSeek AI model rollouts show AI products …

Read More »

Read More »

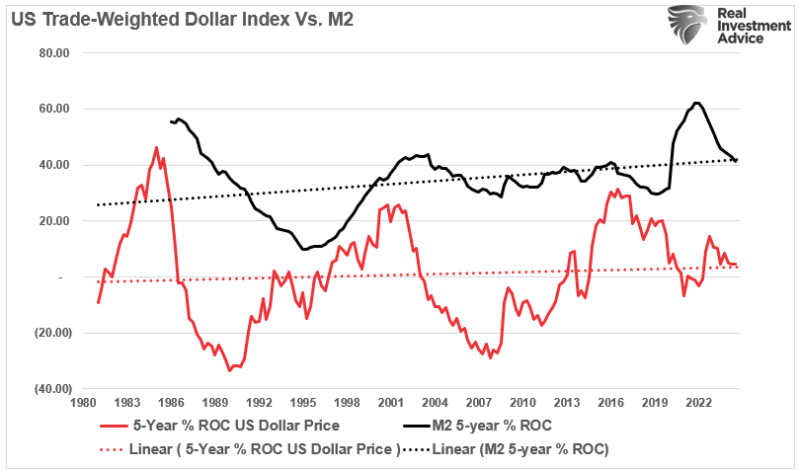

Do Money Supply, Deficit And QE Create Inflation?

I recently debated with Michael Pento, who made an interesting statement that increases in the money supply, the deficit, and a return to quantitative easing (QE) will lead to 1970s-style inflation. The recent experience of inflation in 2021 and 2022 would seem to justify such a view. However, is that historically the case, or was …

Read More »

Read More »

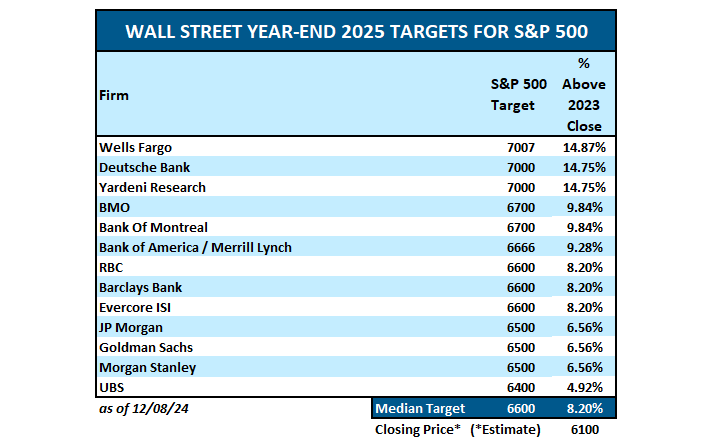

Are Return Expectations For 2025 Too High?

In a recent post, I discussed Wall Street's return estimates for 2025 for the S&P 500 index. To wit: "We have some early indications of Wall Street targets for the S&P 500 index, and, as is always the case, they are optimistic for the coming year. The median estimate is for the market to rise … Continue reading »

Read More »

Read More »

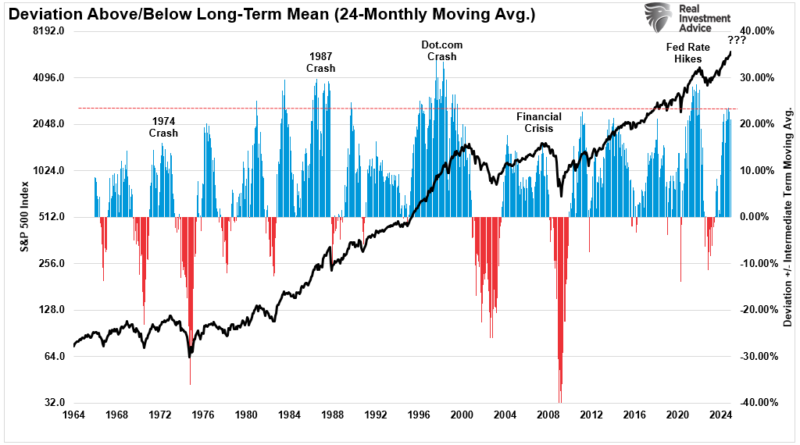

Gardening Guide To Better Portfolio Returns In 2025

As we head into 2025, investors are giddy over the market returns of the last two years. As shown, the annual returns, while elevated, have come with only average volatility along the way. However, while most analysts and investors expect 2025 to be another bullish year, there is always a risk of a more disappointing …

Read More »

Read More »

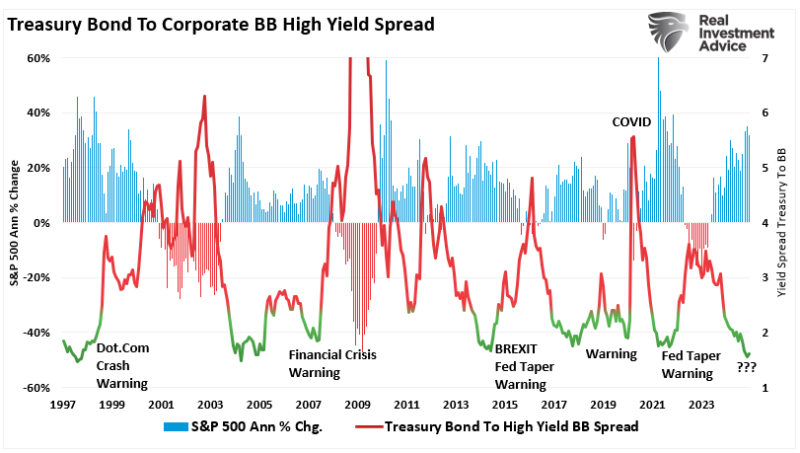

Tactically Bearish As Risks Increase

In last week's discussion with Thoughtful Money, I noted that we are becoming more "tactically bearish" as we progress into 2025. While we have remained primarily bullish in equity positioning over the last two years, several risks are now worth considering. However, it is critical to note that being "tactically bearish" does NOT mean we …

Read More »

Read More »

Investor Resolutions For 2025

I publish an updated version of my New Year “investor” resolutions yearly. The purpose of the process is to take an annual inventory of what I did and did not do over the last year to improve my portfolio management practices. As with all resolutions made at the beginning of a new year, it is not uncommon … Continue reading...

Read More »

Read More »