Tag Archive: S&P 500

“Buying The Dip” – Here’s A Technical Way To Do It

Recently, I did an interview about "buying the dip" in the market, which generated many comments. Most were, "You're stupid; the market is going to crash," but one comment deserved a more thorough discussion. "When buying the dip, how do you know when to do it, or not?" That is the right question. Of course, you will never know … Continue...

Read More »

Read More »

Does Consumer Spending Drive Earnings Growth?

It would seem evident that most investors would understand that consumer spending drives economic growth, ultimately creating corporate earnings growth. Yet, despite this somewhat tautological statement, Wall Street appears to ignore this simple reality when forecasting forward earnings. As discussed recently, S&P Global's current estimates show earnings are growing far above the long-term exponential growth …

Read More »

Read More »

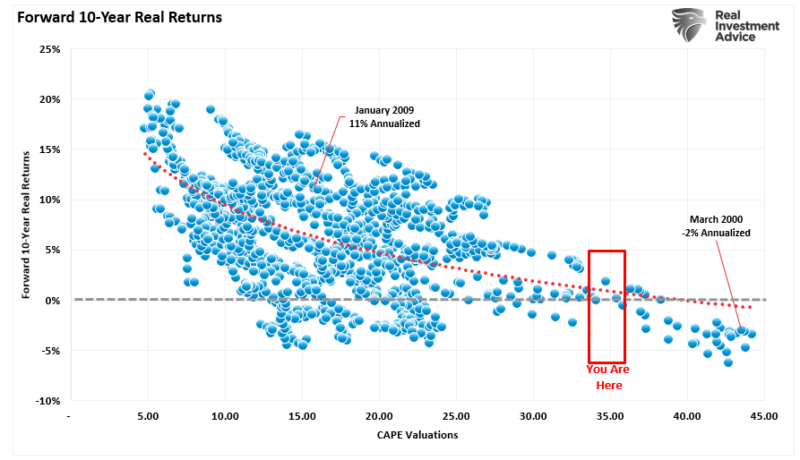

Buying Stocks Is Always Hard

Buying stocks is always hard. Particularly during corrections. Or, near market peaks. Or, when stocks are falling. And when they are rising. Oh, buying stocks is also tricky when valuations are high. And when they are low. You get the point. There is never the right time when it comes to buying stocks. I recently … Continue reading »

Read More »

Read More »

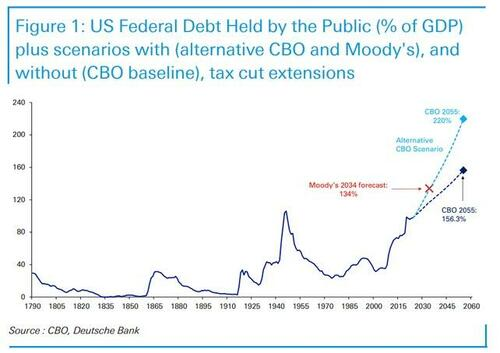

Ray Dalio Is Predicting A Financial Crisis…Again.

Ray Dalio, the former head of Bridgewater Associates, is back in the media, trying to stay relevant by claiming the "deficit has become critical." " “It’s like ... I’m a doctor, and I’m looking at the patient, and I’ve said, you’re having this accumulation, and I can tell you that this is very, very serious, and …

Read More »

Read More »

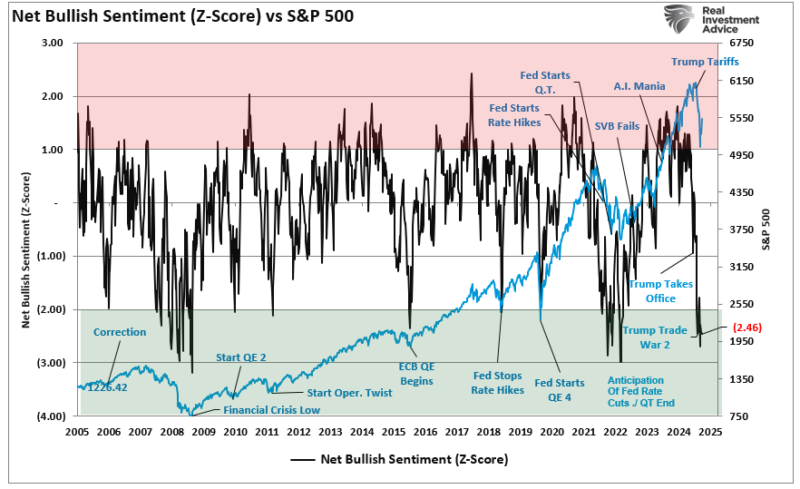

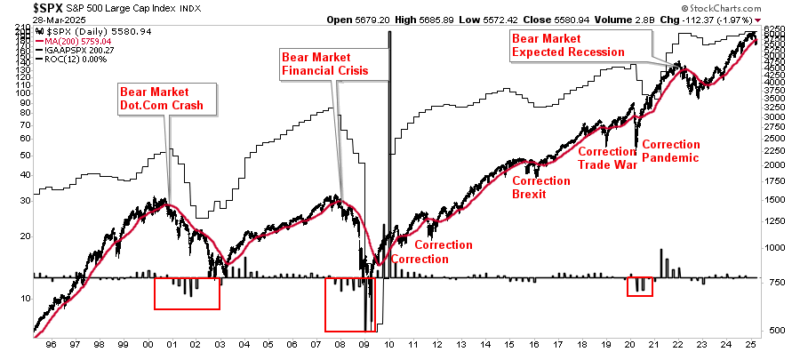

The Stealth Bear Market

Is this a "stealth" bear market? Of course, you may be asking yourself what I mean by that. Historically, bear markets have tended to be pretty evident, as highlighted in the chart below. These bear markets are often more protracted affairs that lead to investors developing profoundly negative sentiment towards markets. This article will use …

Read More »

Read More »

The Anchoring Problem And How To Solve It

Market perspective is essential in avoiding investing mistakes. With the media constantly pushing a “Markets In Turmoil” narrative, it’s no wonder that investor sentiment recently reached some of the lowest levels since the financial crisis. The following chart is the z-score of the retail and professional investor sentiment composite index of bullish sentiment. Notably, we …

Read More »

Read More »

Moody’s Debt Downgrade – Does It Matter?

This morning, markets are reacting to Moody's rating downgrade of U.S. debt. For those promoting egregious amounts of "bear porn," this is nirvana for fear-mongering headlines that gain clicks and views. However, as investors, we need to step back and examine the history of previous debt downgrades and their outcomes for both the stock and …

Read More »

Read More »

Corporate Stock Buybacks – Do They Affect Markets?

Fisher Investments recently wrote an interesting article asking whether corporate stock buybacks affect markets. Here is their conclusion: "Yes and no? Stocks move on supply and demand. Stock buybacks, where a company buys and takes shares off the market, theoretically reduce supply.

Read More »

Read More »

A Bear Market Rally? Or, Just A Correction?

Assessing a bear market rally proves challenging when you experience it firsthand. It is only in hindsight that the complete picture reveals itself to investors. Of course, after a bear market rally, investors tend to review their investments and speculate on what they should have done differently.

Read More »

Read More »

Employment Data Confirms Economy Is Slowing

While coming in much stronger than expected, the latest employment data confirmed what we already suspected: the economy is slowing. The reason the employment data is so important is that without employment growth, the economy stalls. It takes, on average, […] The post Employment Data Confirms Economy Is Slowing appeared first on RIA.

Read More »

Read More »

“Resistance Is Futile” – For Both Bulls And Bears

"Resistance is futile" was a sentence that struck fear in the hearts of Trekkie fans during "Star Trek: The Next Generation," specifically in both of the "Best Of Worlds" and "First Contact" episodes. In those episodes, the "Starship Enterprise" crew encountered a species called the "Borg." The Borg's primary purpose was to achieve "perfection" by assimilating other beings …

Read More »

Read More »

The Awards You Never Get When Investing

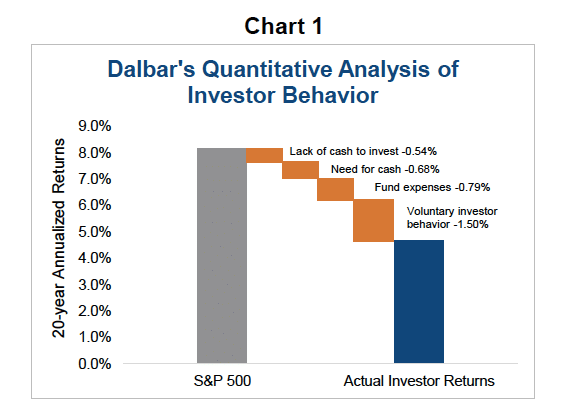

In investing, success is often judged by numbers—returns on investment, percentage gains, and the ability to outperform benchmarks like the S&P 500. However, some investors frequently pursue a peculiar set of "awards" without realizing the pitfalls they embody. These unspoken goals, while tempting, rarely lead to sustainable investment success. If there were awards for some of these …

Read More »

Read More »

Correction Continues – The Value Of Risk Management

Despite the recent rally, the correction continues. While wanting to "buy the dip" is tempting, there has been enough technical damage to warrant remaining cautious in the near term. As we have discussed, managing risk requires discipline and the emotional ability to navigate more volatile markets until a more straightforward path for risk-taking emerges. The …

Read More »

Read More »

Speculator Or Investor? 10-Rules From Legendary Investors

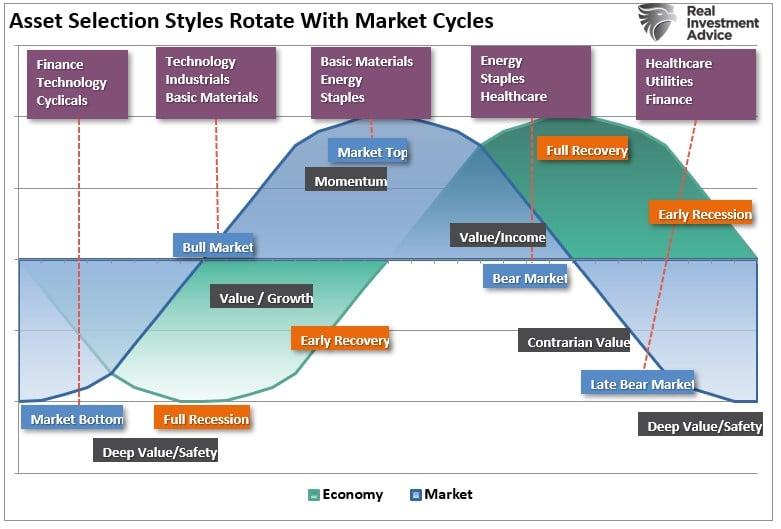

Are you a "speculator" or an "investor"? This is an essential question that every individual deploying capital into the financial markets must answer. The reason is that how you answer that question determines how you should behave during market cycles.

Read More »

Read More »

The Death Cross And Market Bottoms

In financial markets, few technical patterns generate as much attention and anxiety as the death cross. This ominous-sounding term refers to a crossover on a price chart when a short-term moving average, most commonly the 50-day moving average (50-DMA), drops below a long-term moving average, usually the 200-day moving average (200-DMA). The "death cross" is a fantastic …

Read More »

Read More »

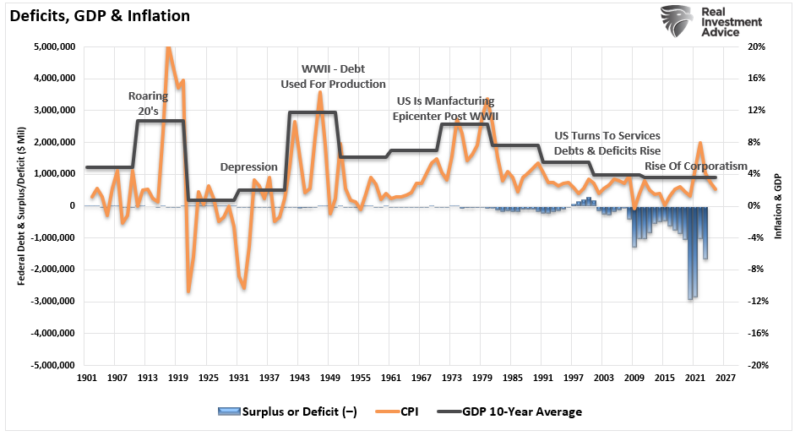

Inflation Risk Is Subsiding Rapidly

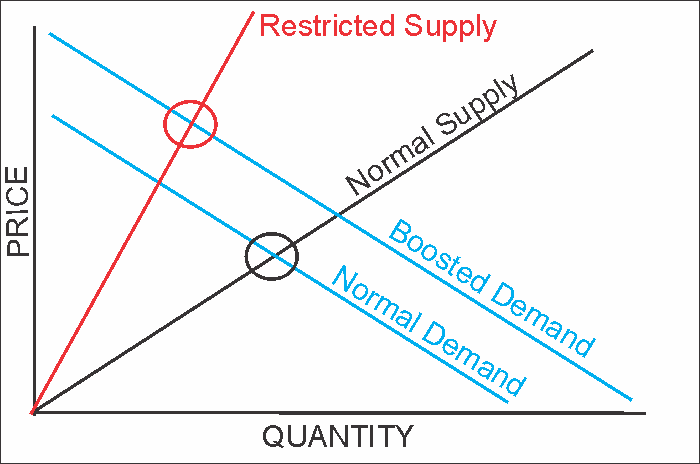

Inflation risk has been a significant topic of discussion in the mainstream media for the last few years. Such is unsurprising given that inflation spiked following the pandemic in 2020 as consumer spending (demand) was shot into overdrive from stimulus payments and production (supply) was shuttered. To understand why that occurred, we need to revisit …

Read More »

Read More »

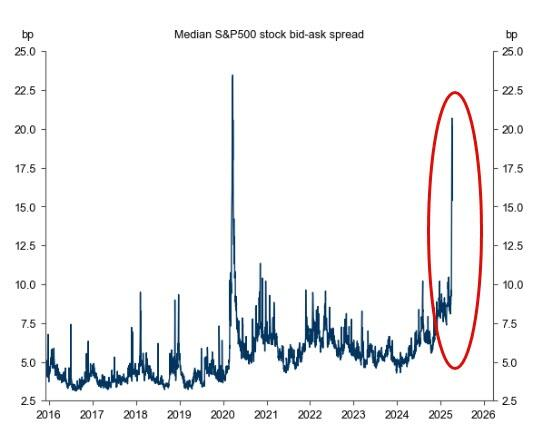

Yield Spreads Suggest The Risk Isn’t Over Yet

In November last year, I discussed the importance of yield spreads, historically the market's "early warning system." To wit:" "Yield spreads are critical to understanding market sentiment and predicting potential stock market downturns. A credit spread refers to the difference in yield between two bonds of similar maturity but different credit quality. This comparison often …

Read More »

Read More »

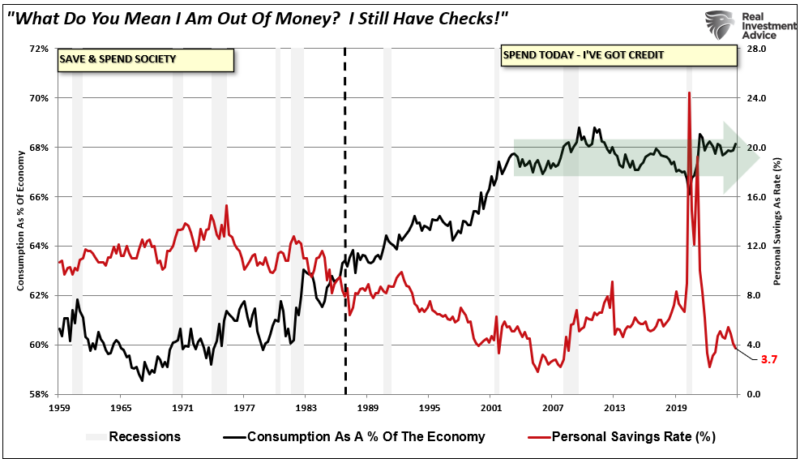

The Consumer Is Tapping Out

The recent implementation of tariffs has the media buzzing about increased recession odds as the consumer faces potentially higher costs. While recent economic reports, like the latest employment report, still show robust growth, those data points run with a lag that hasn't yet caught up with reality. As we have discussed, the American consumer is …

Read More »

Read More »

The Market Crash – Hope In The Fear

Last week, we noted that "nothing good happens below the 200-DMA," and the tariff-induced market crash this past week confirmed that statement. However, we also noted that over the last 30 years, previous failures at the 200-DMA have also often been buying opportunities. That is unless some "event" of magnitude creates a massive shift in analysts' estimates. …

Read More »

Read More »

The Stock Market Warning Of A Recession?

A Wall Street axiom states that the stock markets lead the economy by about six months. While not a perfect predictor, the stock market reacts to investor expectations about future corporate earnings, economic activity, interest rates, and inflation. When sentiment shifts due to anticipated weakness in any of these areas, equity prices often decline, reflecting …

Read More »

Read More »