Tag Archive: Russia

The Dollar Jumps and the Euro Slips under $1.03

Overview: The dollar is soaring today, and the euro is trading at new 22-year lows having traded below $1.03. Even a 50 bp hike by the Reserve Bank of Australia has failed to prevent a sharp drop in the Australian dollar.

Read More »

Read More »

Weekly Market Pulse: Things That Need To Happen

Perspective is something that comes with age I think. Certainly, as I’ve gotten older, my perspective on things has changed considerably. As we age, we tend to see things from a longer-term view.

Read More »

Read More »

Spanish Inflation Shocks

Overview: The sharp sell-off in US equities yesterday, led by tech, is weighing on today’s activity. Most of the large Asia Pacific markets excluding Japan and India lost more than 1% today.

Read More »

Read More »

Consolidation in FX Featured

Overview: The strong equity market rally seen at the end of last week is carrying into today’s activity. Most of the large markets in Asia Pacific rose by at least 1%.

Read More »

Read More »

Risk Appetites Improve Ahead of the Weekend

Overview: Equities are higher and bonds lower as the week's activity winds down. Asia Pacific markets rallied, paced by more than 2% gains in Hong Kong and South Korea.

Read More »

Read More »

Update The Conflict of Interest Rate(s)

What changed? For over a month, the Treasury market had the Fed and its rate hiking figured out. Rising recession risks had been confirmed by almost every piece of incoming data, including, importantly, labor data.

Read More »

Read More »

Yen Blues

Benchmark 10-year bonds yields in the US and Europe are at new highs for the year. The US yield is approaching 2.90%, while European rates are mostly 5-8 bp higher. The 10-year UK Gilt yield is up nine basis points to push near 1.98%. The higher yields are seeing the yen's losing streak extend, and the greenback has jumped 1% to around JPY128.45 The dollar is trading lower against the other major currencies but the Swiss franc.

Read More »

Read More »

Greenback Starts New Week on Firm Note

Overview: With many financial centers, especially in Europe, closed for the long holiday weekend, risk-appetites remain in check. Most Asia Pacific markets fell, and poor earnings from Infosys and Tata Consultancy, saw India pace the decline with a 2% drop. US futures are also trading with a heavier bias.

Read More »

Read More »

Good Friday

Overview: Most centers are closed for the holidays today. The Asia Pacific equity markets were open and moved lower following the losses on Wall Street yesterday. The weakness of the yen failed to underpin Japanese shares.

Read More »

Read More »

Russia’s “gold peg”: Lessons for Western investors

It is undeniable that the ongoing crisis in Ukraine has polarized Western societies to an extent unseen in decades in any other foreign conflict. For over a month, we have been bombarded unceasingly by all mainstream media sources with reports and stories about Russia’s invasion and this conflict has already created deep social rifts in many other nations, and EU members in particular.

Read More »

Read More »

RBA Drops “patience” to Send the Aussie Higher

Overview: The Reserve Bank of Australia hinted that it was getting closer to a rate hike. The Australian dollar was bid to its best level since the middle of last year. Australian stocks advanced in a mixed regional session while China and Hong Kong markets were closed for the local holiday. BOJ Kuroda called the yen's recent moves "rapid." The yen is sidelined today as the dollar weakens against other major currencies, led by the...

Read More »

Read More »

BOJ Steps-Up its Efforts, US 2-10 Curve steepens, and the Dollar Softens

Overview: A pullback in US yields yesterday and the Bank of Japan's stepped-up efforts to defend the Yield Curve Control policy helped extend the yen's recovery. This spurred profit-taking on Japanese stocks, where the Nikkei had rallied around 11% over the past two weeks.

Read More »

Read More »

Calmer Markets: Hope Springs Eternal

Overview: Interest rates continue to rise, but equities are looking through it today and the dollar is drawing less succor. Asia Pacific equities were mostly higher. With half of Shanghai in lockdown, Chinese equities were unable to join the regional advance. Europe's Stoxx 600, led by energy and consumer discretionary sectors, is rising for the third consecutive sessions. US futures have a small upward bias.

Read More »

Read More »

Yields Jump, Greenback Bid

Overview: Yields are surging. Canada and Australia's two-year yields have jumped 20 bp, with

the US yield up 10 bp to 2.37% ahead of the $50 bln sale later today. The US 10-year yield has risen a more modest three basis points to 2.50%, flattening the 2-10-year yields curve. The 5–30-year curve has inverted for the first time since 2016.

Read More »

Read More »

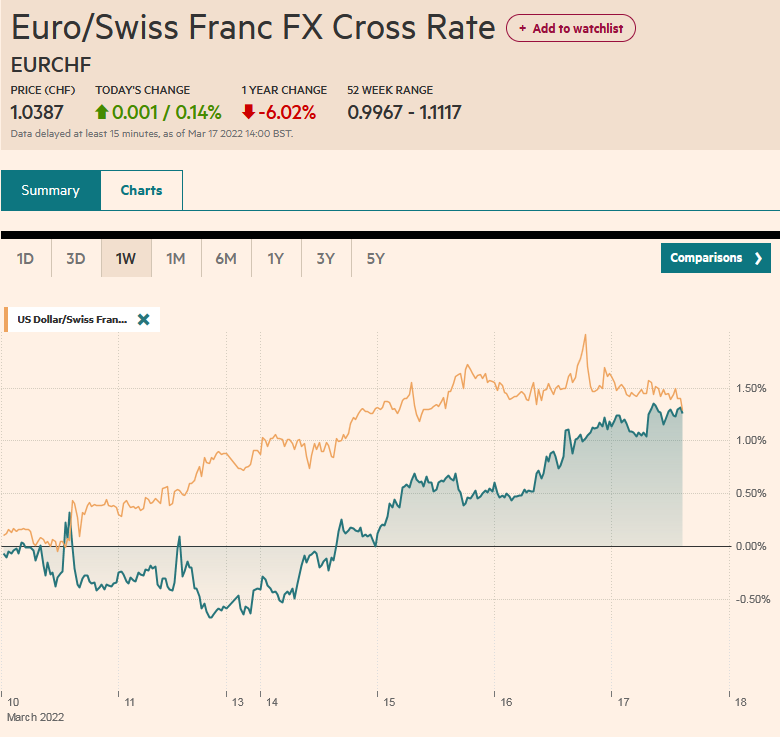

FX Daily, March 17: Investors are Skeptical that the Fed can Achieve a Soft-Landing. Can the BOE do Better?

Overview: The markets continue to digest the implications of yesterday's Fed move and Beijing's signals of more economic supportive efforts as the Bank of England's move awaited. The US 5–10-year curve is straddling inversion and the 2-10 curve has flattened as the Fed moves from one horn of the dilemma (behind the inflation curve) to the other horn (recession fears). Asia Pacific equities extended yesterday's surge. The Hang Seng led the...

Read More »

Read More »

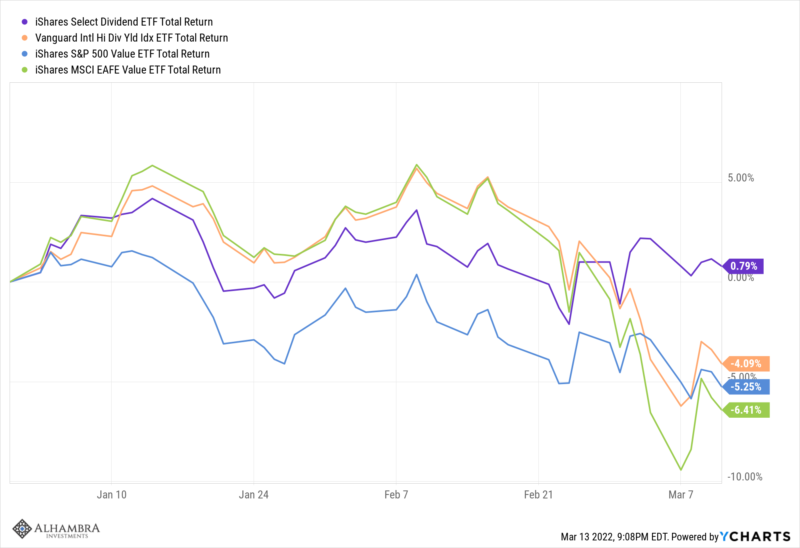

Weekly Market Pulse: Is This A Bear Market?

I don’t know the answer to the question posed in the title. No one does because the future is not predictable. I don’t know what will happen in Ukraine. I don’t know how much what has already happened there – and what might – matters to the US and global economy. I don’t know if the Fed is making a mistake by (likely) hiking interest rates by an entire 1/4 of 1% this week.

Read More »

Read More »

China and Hong Kong Stocks Plummet, Yields Soar

Overview: While the World Health Organization debates about downgrading Covid from a pandemic, the rise China and Hong Kong cases is striking. A lockdown in Shenzhen and restrictions in Shanghai, coupled with a record fine by PBOC officials on Tencent drove local stocks sharply lower. China's CSI 300 fell 3% and a measure of Chinese stocks that trade in HK plunged more than 7%.

Read More »

Read More »

Is The Ruble Backed By Gold Now?

2022-04-16

by Stephen Flood

2022-04-16

Read More »