Tag Archive: reverse repo

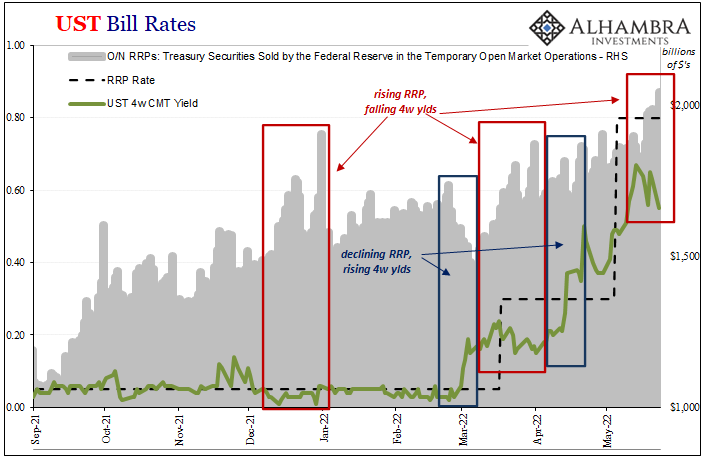

RRP (use) Hits $2T, SOFR Like T-bills Below RRP (rate), What Is (really) Going On?

You might not know it, but front-end T-bill yields are not the only market spaces which are making a mockery of the Federal Reserve’s “floor.” There are others, including the same money number the same Fed demanded the world (or whatever banks in its jurisdiction it could threaten) ditch LIBOR over.

Read More »

Read More »

So Much Fragile *Cannot* Be Random Deflationary Coincidences

At first glance, or first exposure to this, there doesn’t seem to be any reason why all these so many pieces could be related. Outwardly, from the mainstream perspective, anyway, you’d think them random, and even if somehow correlated they’re supposed to be in the opposite way from what’s happened.

Read More »

Read More »

Bill Issuance Has Absolutely Surged, So Why *Haven’t* Yields, Reflation, And Other Good Things?

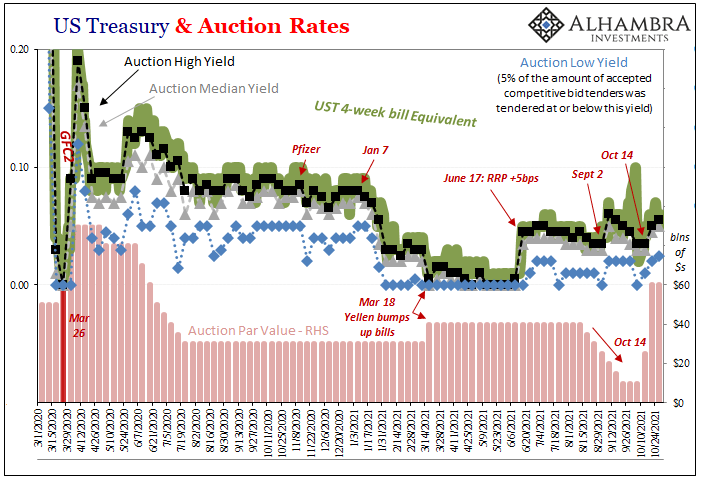

Treasury Secretary Janet Yellen hasn’t just been busy hawking cash management bills, her department has also been filling back up with the usual stuff, too. Regular T-bills. Going back to October 14, at the same time the CMB’s have been revived, so, too, have the 4-week and 13-week (3-month). Not the 8-week, though.

Read More »

Read More »

Golden Collateral Checking

Searching for clues or even small collateral indications, you can’t leave out the gold market. We’ve been on the lookout for scarcity primarily via the T-bill market, and that’s a good place to start, yet looking back to last March the relationship between bills and bullion was uniquely strong. It’s therefore a persuasive pattern if or when it turns up again.

Read More »

Read More »

Lower Yields And (fewer) Bills

Back on February 23, Federal Reserve Chairman Jay Powell stopped by (in a virtual, Zoom sense) the Senate Banking Committee to testify as required by law. In the Q&A portion, he was asked the following by Montana’s Senator Steve Daines.

Read More »

Read More »

RRP No Collateral Coincidences As Bills Quirk, Too

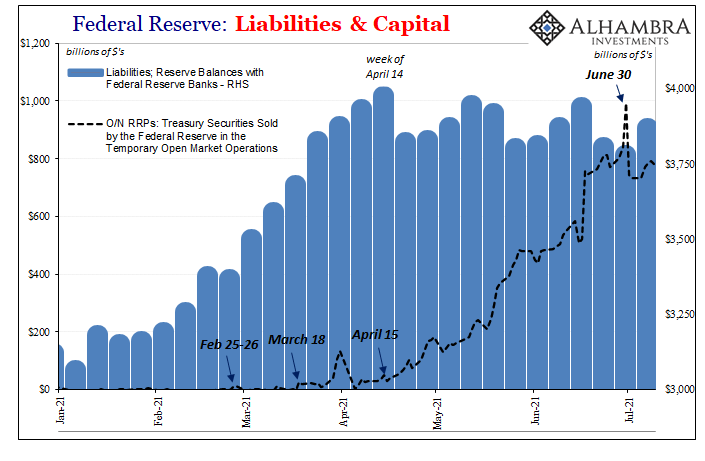

So much going on this week in the bond market, it actually overshadowed the ridiculous noise coming from the Fed’s reverse repo. Some maybe too many want to make a huge deal out of this RRP if only because the numbers associated with it have gotten so big.

Read More »

Read More »

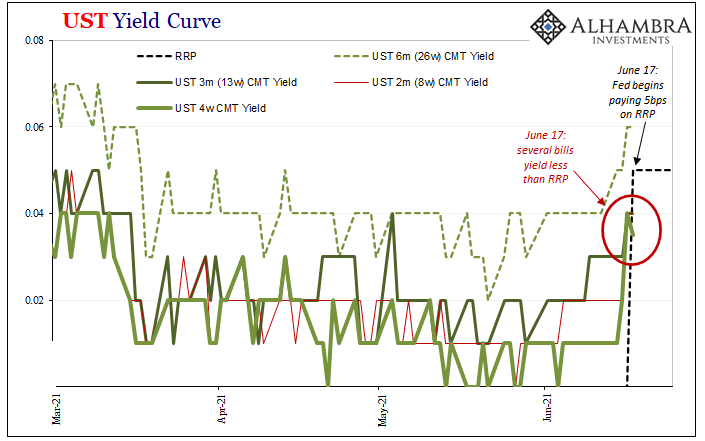

The FOMC Accidentally Exposes Itself (Reverse Repo-style)

Initially, the dots got all the attention. Though these things are beyond hopeless, the media needs them to write up its account of a more fruitful monetary policy outcome because markets continue to discount that entirely.

Read More »

Read More »

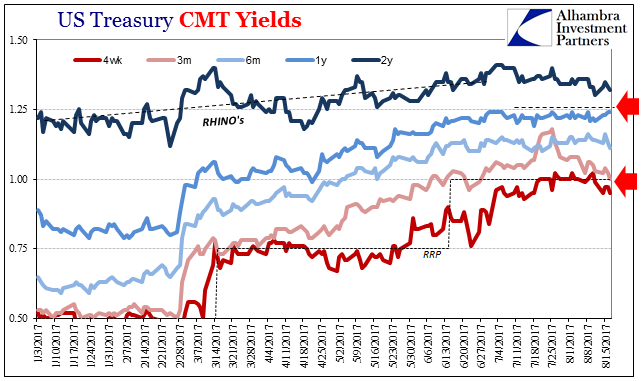

United States: The Fed Tries To Tighten By Rates, But The System Instead Tightens By Repo

The Fed voted for the first federal funds increase in almost a decade on December 15, 2015. It was the official end of ZIRP, and though taking so many additional years to happen, to many it marked the start of recovery. The yield on the 2-year Treasury Note was 98 bps that day.

Read More »

Read More »

SNB Bills, Chinese Repos and Reverse Repos

A repo provides liquidity to banks while the reserve repos aims to reduce liquidity and reduce inflation. In 2011, the SNB used SNB bills and reverse repos to reduce inflationary pressure. SNB bills are short-term bonds that pay a certain interest.

Read More »

Read More »