Tag Archive: retirement income

Investor Dilemma: Pavlov Rings The Bell – Draft

Classical conditioning teaches us a valuable lesson regarding the current investor dilemma. Pavlov's research discovered a basic psychological rule: when a neutral stimulus is repeatedly paired with a reward‑stimulus, eventually it will trigger the same response even when the reward is absent. The famed experiment by Ivan Pavlov illustrated that dogs would salivate at the …

Read More »

Read More »

Retirees with guaranteed income spend more.

David Blanchett and Michael Finke penned a June 2024 research paper for the Retirement Income Institute that shared insight into why retirees with a guaranteed income spend more. They deem guaranteed retirement income a "license to spend."

Read More »

Read More »

Annuities Are Not Your Enemy.

Utter the word ANNUITY and watch facial expressions. They range from fear to disgust to confusion. But hear me out: Annuities are not your enemy. Billionaire money manager and financial pitchman Ken Fisher appears as a haunting senior version of Eddie Munster in television ads. He stares with deep eyes ablaze with intensity. The tight camera …

Read More »

Read More »

Understanding the Benefits and Risks of Annuities for Retirement Income

When planning for retirement, securing a reliable income stream is a top priority. Many retirees turn to annuities for retirement income as a way to guarantee financial stability. Guaranteed income strategies help retirees maintain cash flow throughout their lives, reducing the risk of outliving their savings. However, while annuities offer security and predictability, they also …

Read More »

Read More »

Retail Sales Data Suggests A Strong Consumer Or Does It

The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year.

Read More »

Read More »

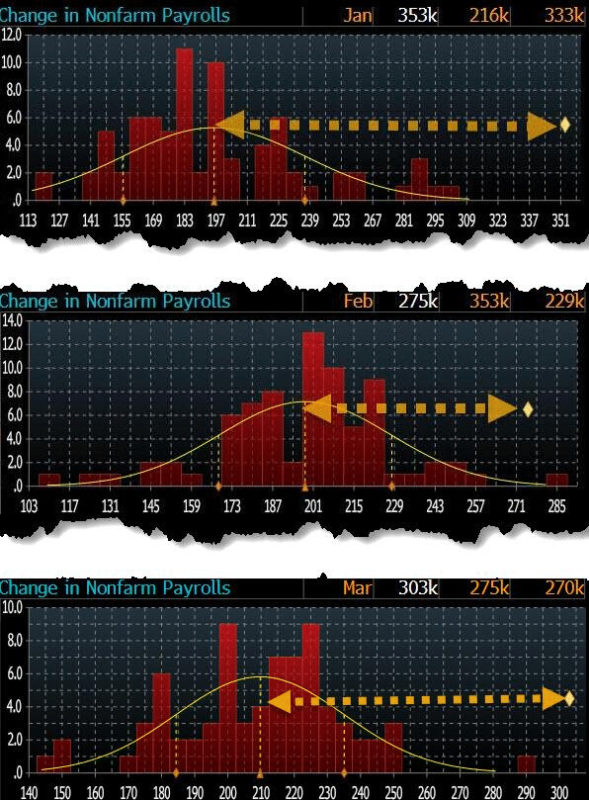

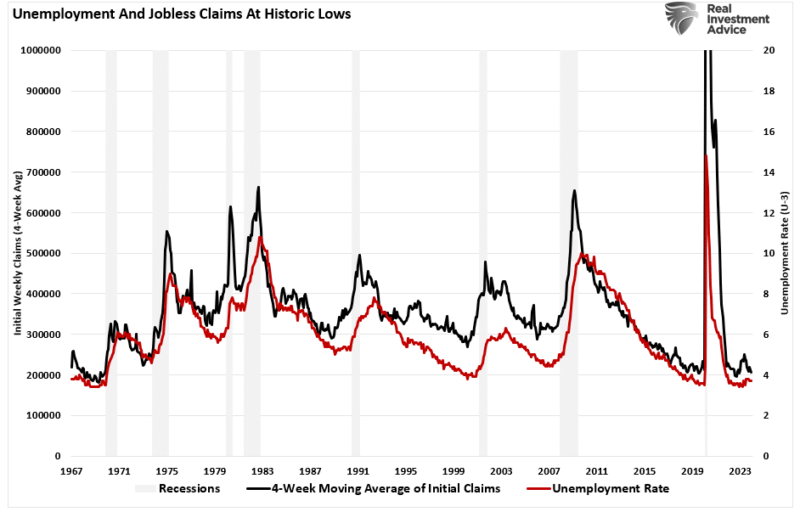

Immigration And Its Impact On Employment

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border.

Read More »

Read More »

Blackout Of Buybacks Threatens Bullish Run

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote.

Read More »

Read More »

Digital Currency And Gold As Speculative Warnings

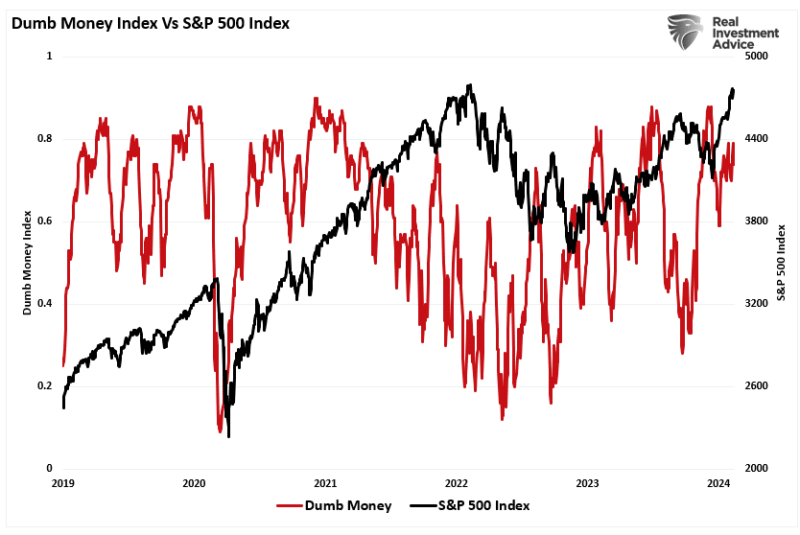

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites.

Read More »

Read More »

Presidential Elections And Market Corrections

Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two Presidential elections, where polarizing candidates trumped policies.

Read More »

Read More »

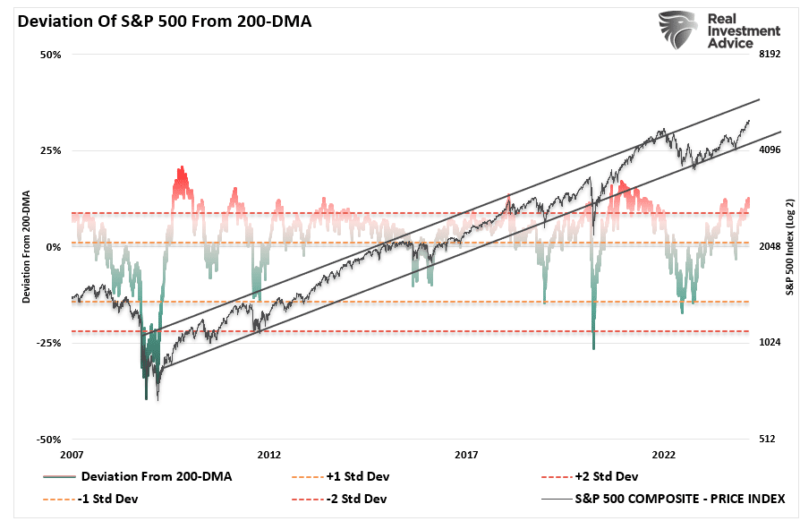

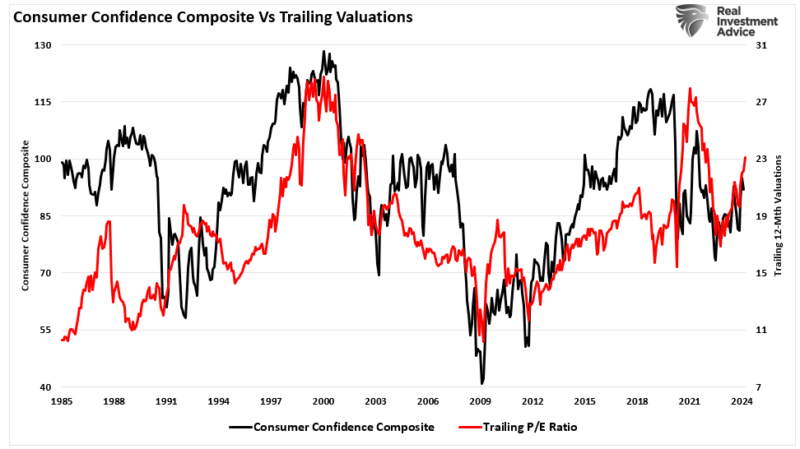

Valuation Metrics And Volatility Suggest Investor Caution

Valuation metrics have little to do with what the market will do over the next few days or months. However, they are essential to future outcomes and shouldn’t be dismissed during the surge in bullish sentiment. Just recently, Bank of America noted that the market is expensive based on 20 of the 25 valuation metrics they track.

Read More »

Read More »

Fed Chair Powell Just Said The Quiet Part Out Loud

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average...

Read More »

Read More »

2023 Retirement Plan Contribution Limits

Worried about saving enough for retirement? You can put away more next year. The IRS has just announced the new retirement plan contribution limits for 2023. The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan increases to $22,500, up from $20,500.

Read More »

Read More »

Medicare Part B Premiums Will Go Down in 2023

In a world where the price of everything is going up, Medicare recipients get a price cut beginning January 1, 2023. The Centers for Medicare and Medicaid Services (CMS) just announced that the monthly premium for Medicare Part B, which covers doctor visits, diagnostic tests, and other outpatient services, is decreasing $5.20 per month to $164.90.

Read More »

Read More »

Employees Want Paychecks for Life: Pros and Cons of Guaranteed Lifetime Income

Annuities and similar products may help address retirement readiness in an aging workforce. People are living longer, which means they may need their retirement savings to last decades. As a result, nearly half (48%) of participants are concerned about outliving their retirement savings.

Read More »

Read More »

How Could Inflation Impact Corporate Retirement Plans?

Increasing prices may put pressure on employers and delay workers from retiring. Inflation is the increase in the general price of goods and services, which can decrease the purchasing power of American workers. So how does this recent upward trend affect your workplace benefits, employees and retirement plan?

Read More »

Read More »

Be Sure to Read the Medicare Fine Print

Medicare. The government defines it as “The federal health insurance program for people 65 and older.” That seems simple enough. But there’s more to it than meets the eye because Medicare, like so many other things, has fine print that could end up costing you a lot of money if you don’t know about it.

Read More »

Read More »

How Working Longer Affects Your Social Security Benefits

Since 1935, Social Security has been synonymous with retirement. It was always intended to supplement retirement income, never be a person’s total retirement income. Unfortunately, according to the Center on Budget and Policy Priorities, about half of older Americans rely on Social Security for at least 50% of their income, and 25% of retirees rely on it for 90% of their income. That’s why more Americans are choosing to work longer.

Read More »

Read More »

Tips for Buying a Medicare Supplement Policy

The clock is ticking and it gets louder the closer you get to the magic age of 65. That’s when you sign up for Medicare. But there’s more than one way to receive Medicare coverage. There are Medicare Advantage plans, sometimes referred to as all-in-one plans, because they provide medical coverage and can also provide benefits for vision, dental, hearing, and prescriptions.

Read More »

Read More »

Another Historic Social Security Cost of Living Increase is on the Way

It’s almost time for the Social Security Administration to break out pencil and calculator to find out how much more it costs to live this year than it did last, and then decide how much of a raise Social Security beneficiaries will get in 2023. For 2022, the Social Security Cost of Living Adjustment (COLA) was 5.9%, the largest increase since 1982.

Read More »

Read More »

4 Social Security Changes to Expect in 2023

Looking into a crystal ball and prognosticating the future is always a risky endeavor, but when it comes to Social Security and the year 2023 there are 4 things that have a high probability of happening.

Read More »

Read More »