Tag Archive: recession

Trump Presidency – Quick Thoughts On Market Impact

The prospect of a Trump presidency has led to much debate and speculation about how markets might react. Depending on what policies are eventually passed, there are potential risks and opportunities in both the stock and bond markets. While the market surged immediately following the election, many potential future headwinds may impact returns from economic growth, monetary and fiscal policy, and geopolitical events.

Here are some quick...

Read More »

Read More »

Election Day! Plan For Volatility

With Election Day finally here, markets are bracing for potential volatility. History shows that the stock market can react unpredictably to election outcomes, especially when the results are unclear or contested. In past elections, sudden policy shifts, political uncertainty, or contentious outcomes caused heightened volatility—making it essential to prepare your portfolio now to weather whatever …

Read More »

Read More »

Election Day! Plan For Volatility

With Election Day finally here, markets are bracing for potential volatility. History shows that the stock market can react unpredictably to election outcomes, especially when the results are unclear or contested. In past elections, sudden policy shifts, political uncertainty, or contentious outcomes caused heightened volatility—making it essential to prepare your portfolio now to weather whatever the day brings.

The S&P 500 has averaged a...

Read More »

Read More »

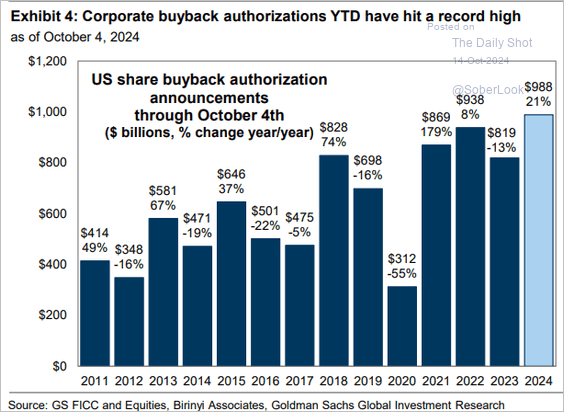

Corporate Buybacks: A Wolf In Sheep’s Clothing

Corporate buybacks have become a hot topic, drawing criticism from regulators and policymakers. In recent years, Washington, D.C., has considered proposals to tax or limit them. Historically, buybacks were banned as a form of market manipulation, but in 1982, the SEC legalized open-market repurchases through Rule 10b-18. Although intended to offer companies flexibility in managing …

Read More »

Read More »

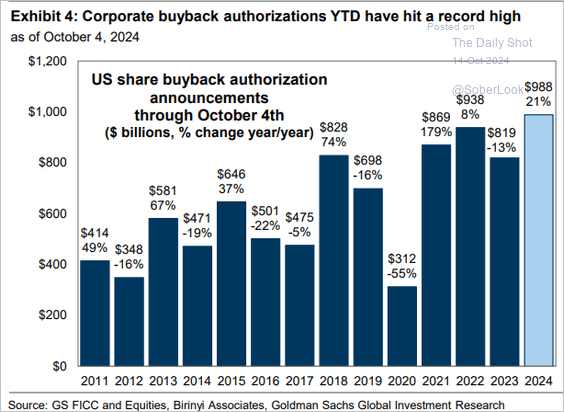

Corporate Buybacks: A Wolf In Sheep’s Clothing

Corporate buybacks have become a hot topic, drawing criticism from regulators and policymakers. In recent years, Washington, D.C., has considered proposals to tax or limit them. Historically, buybacks were banned as a form of market manipulation, but in 1982, the SEC legalized open-market repurchases through Rule 10b-18. Although intended to offer companies flexibility in managing capital, buybacks have evolved into tools often serving executive...

Read More »

Read More »

Key Market Indicators for November 2024

Key market indicators for November 2024 present a complex but opportunity-filled environment for traders and investors. Following the first phase of Federal Reserve rate cuts and growing global uncertainties, the technical landscape suggests several notable shifts. Let’s explore the key market indicators to watch.

Note: If you are unfamiliar with basic technical analysis, this video is a short tutorial.

Seasonality and Breakout...

Read More »

Read More »

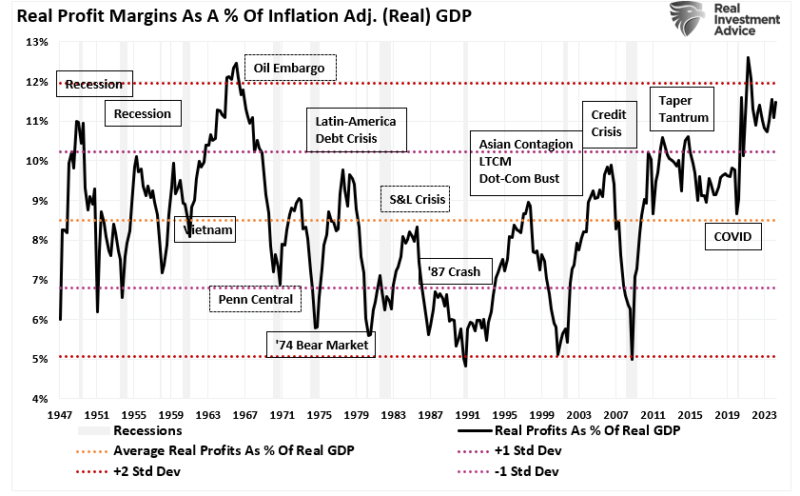

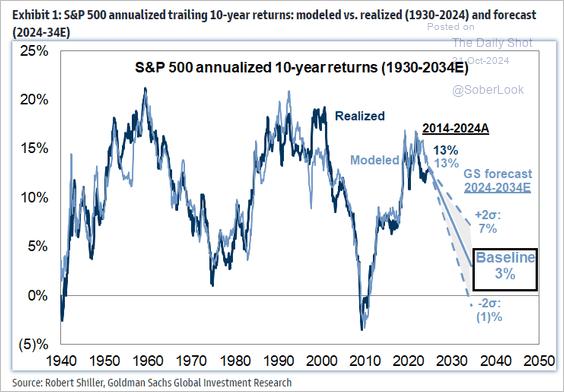

Lower Forward Returns Are A High Probability Event

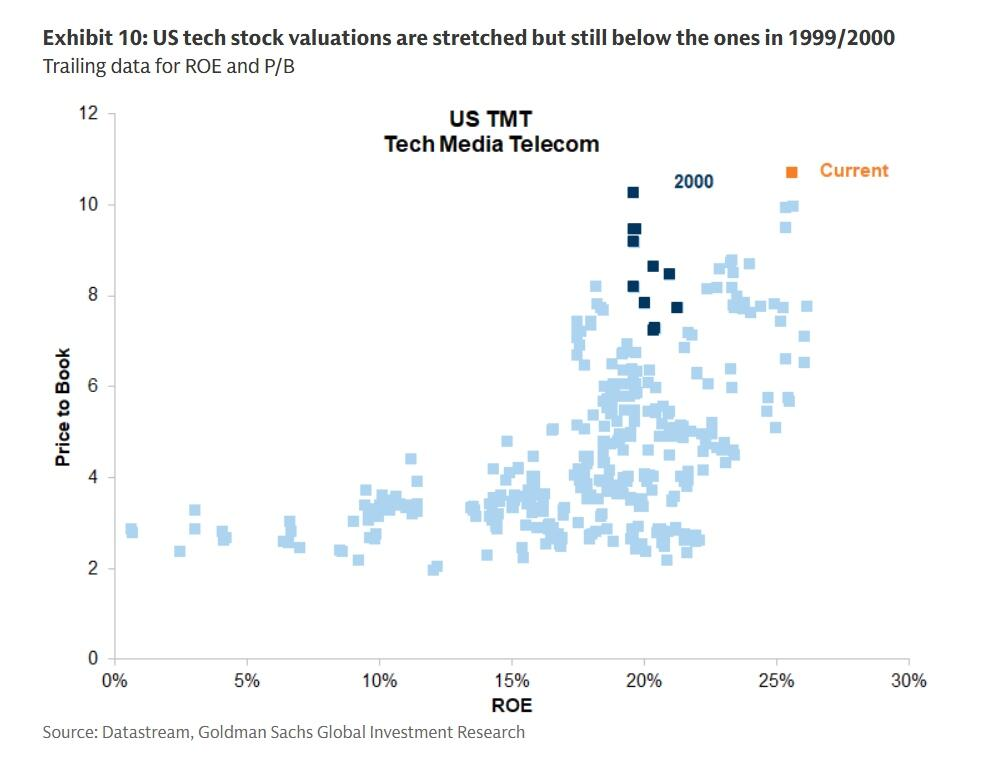

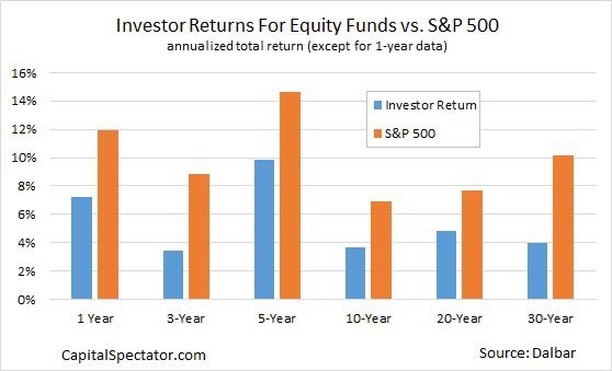

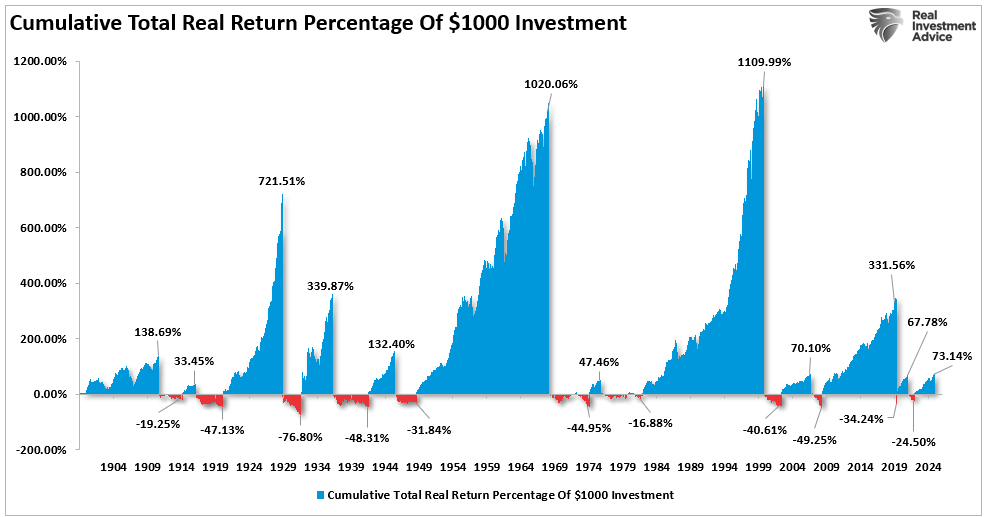

I was emailed several times about a recent Morningstar article about J.P. Morgan’s warning of lower forward returns over the next decade. That was followed up by numerous emails about Goldman Sachs’ recent warnings of 3% annualized returns over the next decade.

While we have previously covered many of these article’s points, a comprehensive analysis is needed. Let’s start with the overall conclusion from JP Morgan’s article:

“The...

Read More »

Read More »

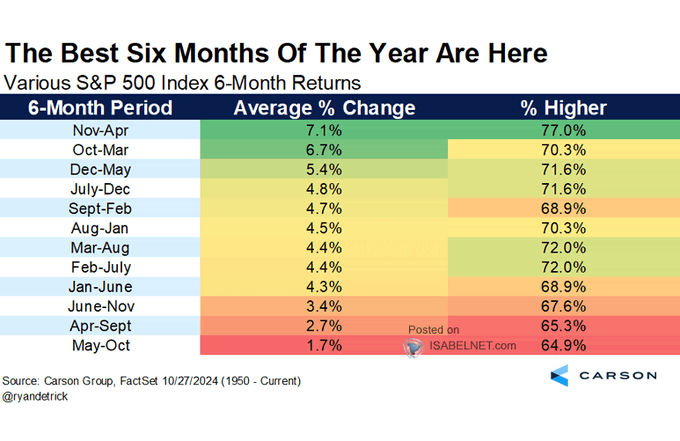

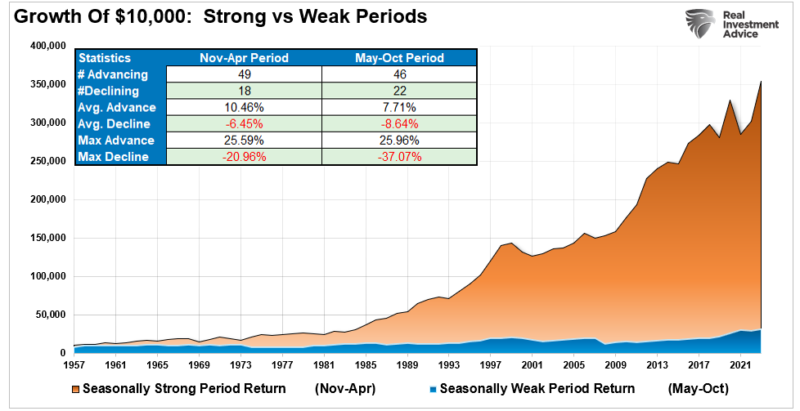

Seasonality: Buy Signal And Investing Outcomes

Seasonality has long influenced stock market trends, offering insights into predictable cycles of strength and weakness throughout the year. Yale Hirsch, the creator of the Stock Trader’s Almanac, is one of the most well-known contributors to studying these patterns. His research has highlighted that certain periods of the year consistently present better opportunities for investors to generate returns, while other times warrant caution.

The...

Read More »

Read More »

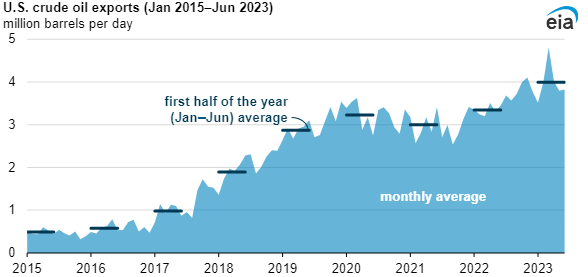

Bastiat And The “Broken Window”

In times of disaster and destruction, a common narrative often emerges that rebuilding efforts will lead to economic growth. The idea that repairing damage and replacing destroyed goods creates jobs that spur consumption and stimulate economic activity is tempting. However, as French economist Frédéric Bastiat explained in his famous “Broken Window Theory,” this reasoning is fundamentally flawed. Rather than generating net economic benefits,...

Read More »

Read More »

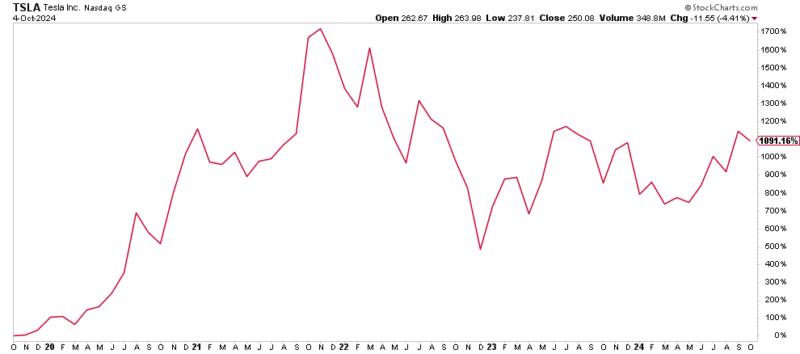

Greed And How To Lose 100% Of Your Money

In the movies, greed is a trait often exhibited by the rich and powerful as a means to an end. Of particular note is the famous quote from Michael Douglas in the 1987 movie classic “Wall Street:”

“The point is, ladies and gentlemen, that greed, for lack of a better word, is good.

Read More »

Read More »

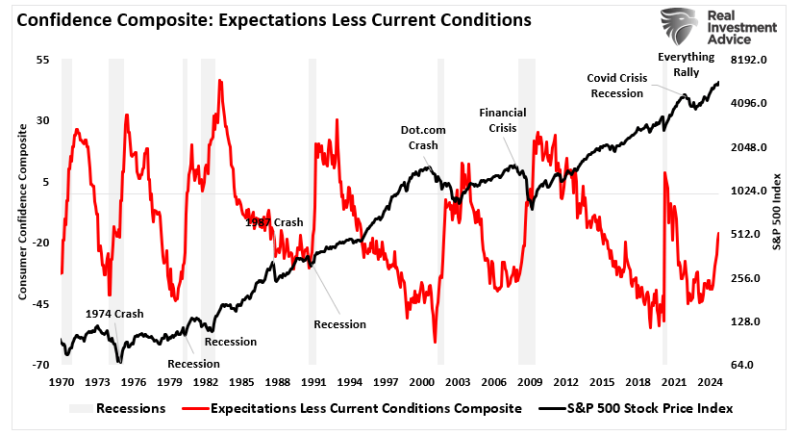

GDP Report Continues To Defy Recession Forecasts

The Bureau of Economic Analysis (BEA) recently released its second-quarter GDP report for 2024, showcasing a 2.96% growth rate. This number has sparked discussions among investors and analysts, particularly those predicting an imminent recession. There are certainly many supportive data points that have historically predicted recessionary downturns. The reversal of the yield curve inversion, the 6-month rate of change in the leading economic index,...

Read More »

Read More »

How Howard Marks Thinks About Risk…And You Should Too

When most people hear the word “risk,” they think about wild market swings, scary headlines, and losing money overnight, but Howard Marks, Co-Chairman and Co-Founder of Oaktree Capital Management, takes a different approach. In his new video series How to Think About Risk, Marks digs deep into what risk is and how investors should handle it. Spoiler alert: It’s not just about volatility.

The CFA Institute recently summarized the video stream,...

Read More »

Read More »

Election Outcome Presents Opportunity For Investors

As the November 2024 election draws near, the election outcome will profoundly affect the financial markets. Whether Donald Trump or Kamala Harris wins the presidency, each administration will bring distinct policies creating investment opportunities and potential risks for investors.

Read More »

Read More »

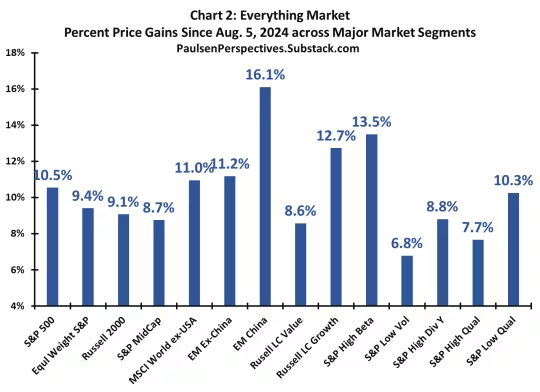

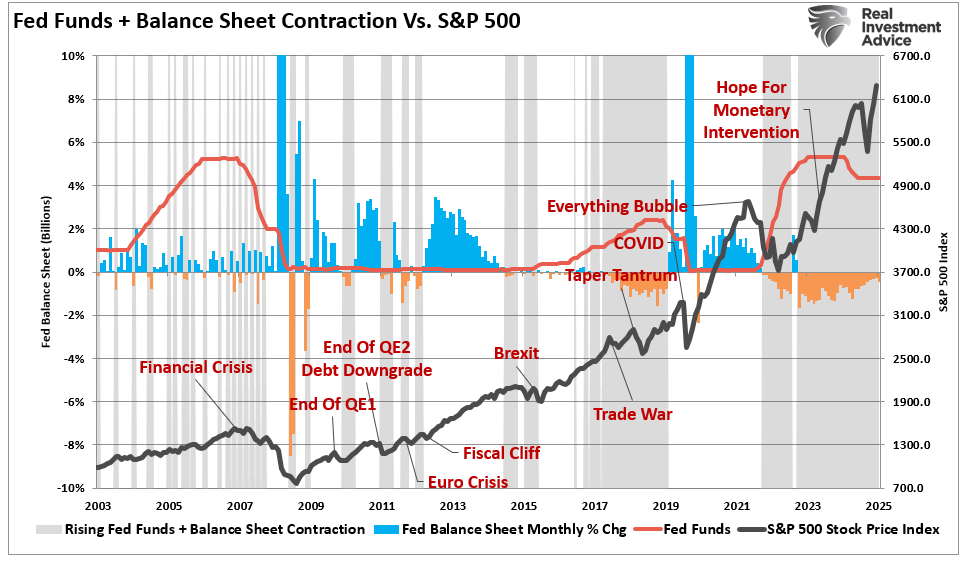

The “Everything Market” Could Last A While Longer

We are currently in the “everything market.” It doesn’t matter what you have probably invested in; it is currently increasing in value. However, it isn’t likely for the reasons you think. A recent Marketwatch interview with the always bullish Jim Paulson got his reasoning for the rally.

“It is this cocktail of ‘full support’ at the front end of a bull market which commonly has created an ‘Everything Market’ during the early part of a new bull....

Read More »

Read More »

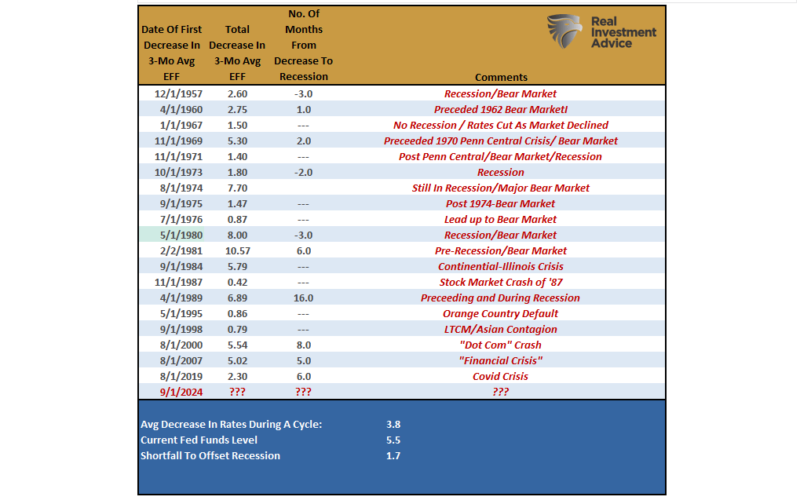

50 Basis Point Rate Cut – A Review And Outlook

Last week, the Federal Reserve made a significant move by cutting its overnight lending rate by 50 basis points. This marks the first rate cut since 2020, signaling the Fed is aggressively supporting the economy amid a backdrop of softening economic data. For investors, understanding how similar rate cuts have historically impacted markets and which sectors tend to benefit is key to navigating the months ahead.

In this post, we will explore the...

Read More »

Read More »

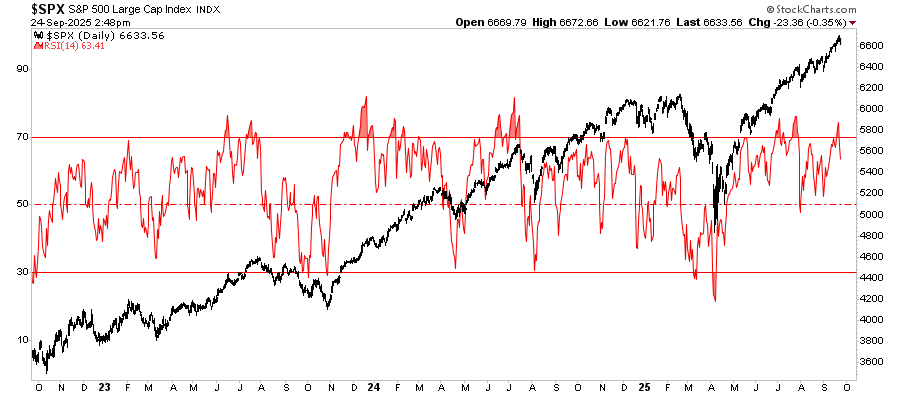

S&P 500 – A Bullish And Bearish Analysis

The S&P 500 index is a critical benchmark for the U.S. equity market, and its performance often dictates investor sentiment and decision-making. Between November 1, 2022, and September 6, 2024, the S&P 500 experienced a significant rally but not without volatility. Currently, investors have very mixed views about where markets are heading next as concerns of a recession linger or what changes to monetary policy will cause.

However, as...

Read More »

Read More »

Technological Advances Make Things Better – Or Does It?

It certainly seems that technological advances make our lives better. Instead of writing a letter, stamping it, and mailing it (which was vastly more personal), we now send emails. Rather than driving to a local retailer or manufacturer, we order it online. Of course, we mustn’t dismiss the rise of social media, which connects us to everyone and everything more than ever.

Economists and experts have long argued that technological advances drive...

Read More »

Read More »

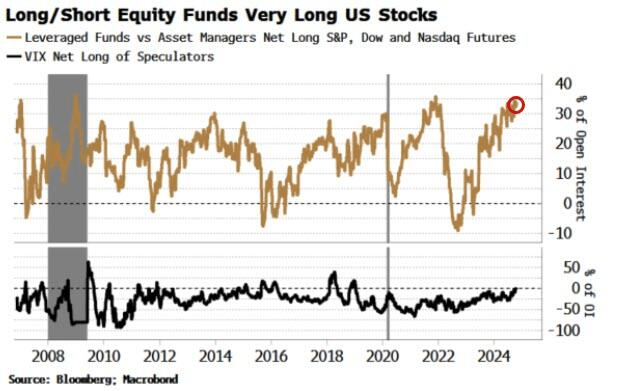

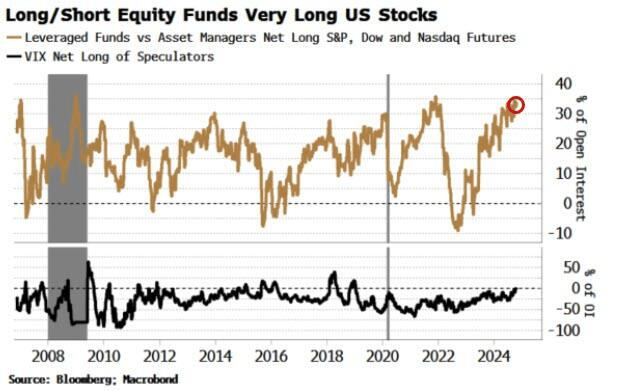

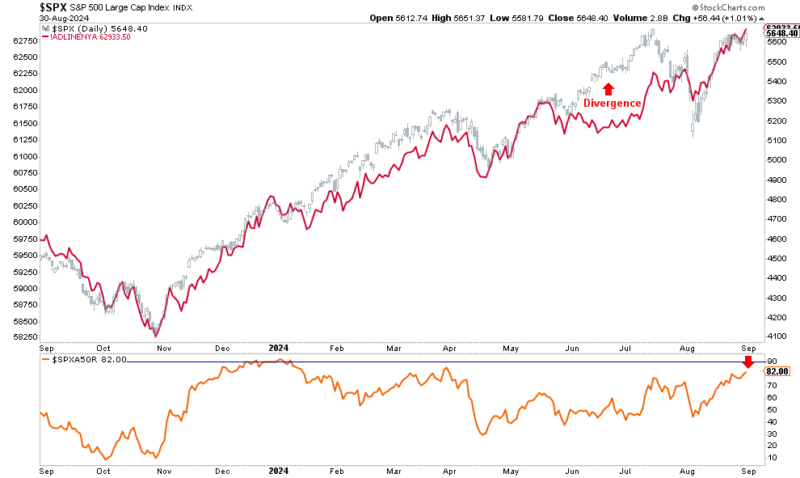

Risks Facing Bullish Investors As September Begins

Since the end of the “Yen Carry Trade” correction in August, bullish positioning has returned with a vengeance, yet two key risks face investors as September begins. While bullish positioning and optimism are ingredients for a rising market, there is more to this story.

Read More »

Read More »

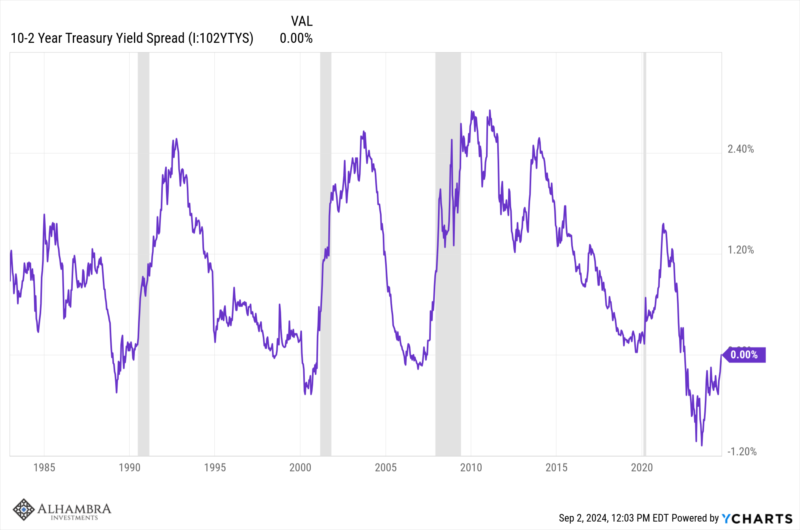

Weekly Market Pulse: It’s An Uncertain World

You’re going to hear a lot of talk about the yield curve soon and what it means for “the” yield curve to uninvert (which isn’t a real word but will get used a lot). The difference between the 10-year Treasury note yield and the 2-year Treasury note yield is about to turn positive, the 2-year note yield recently falling a bit more rapidly than the 10-year.

Read More »

Read More »

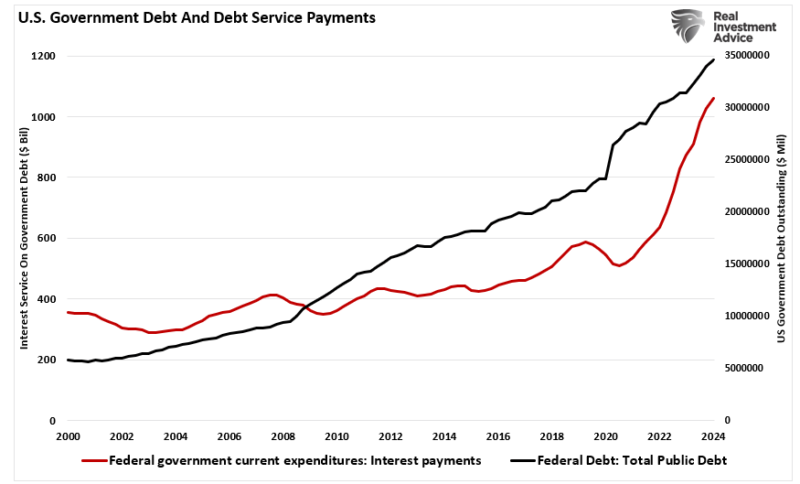

Japanese Style Policies And The Future Of America

In a recent discussion with Adam Taggart via Thoughtful Money, we quickly touched on the similarities between the U.S. and Japanese monetary policies around the 11-minute mark. However, that discussion warrants a deeper dive. As we will review, Japan has much to tell us about the future of the U.S. economically.

Let’s start with the deficit. Much angst exists over the rise in interest rates. The concern is whether the government can continue to...

Read More »

Read More »