Tag Archive: recession

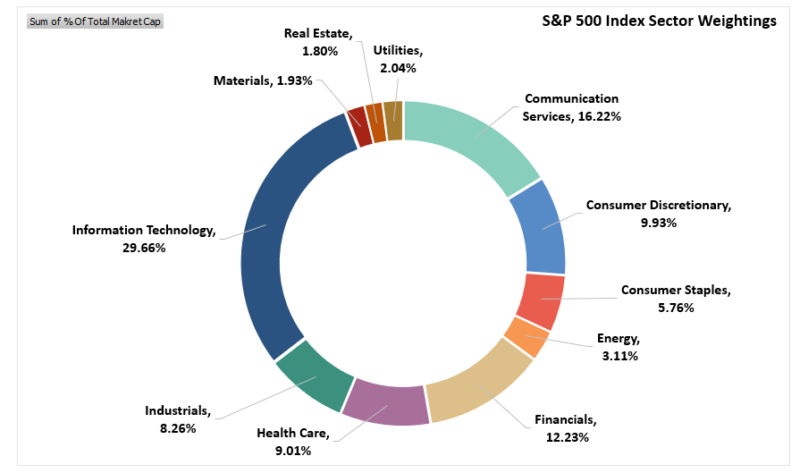

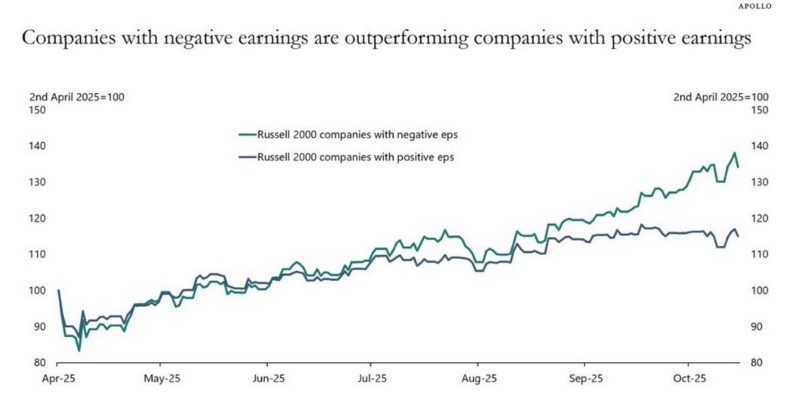

Market Sector Review: Extreme Market Bifurcation

Since the beginning of the year, we have discussed the "reflation trade" and its impact on specific market sectors. This past weekend's newsletter also showed some of these more extreme returns in various market sectors since the beginning of the year. To wit: "Despite what seemed like a rough week in the market, it really wasn’t as …

Read More »

Read More »

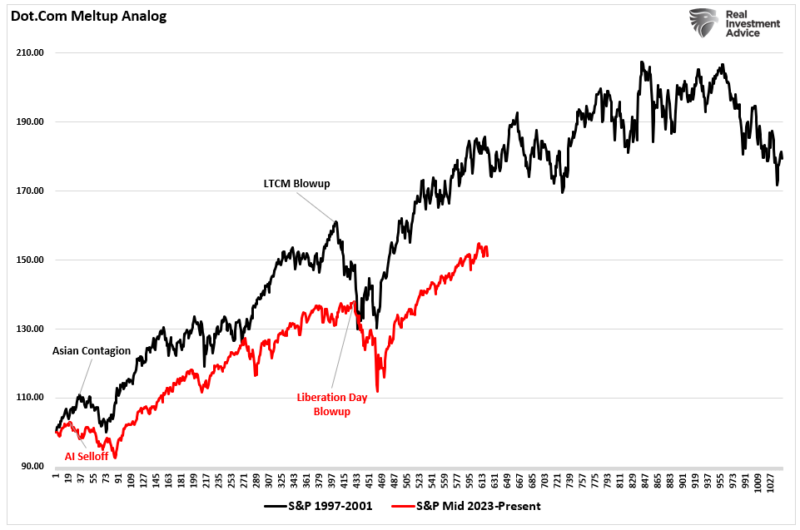

Speculative Narrative Unwinds

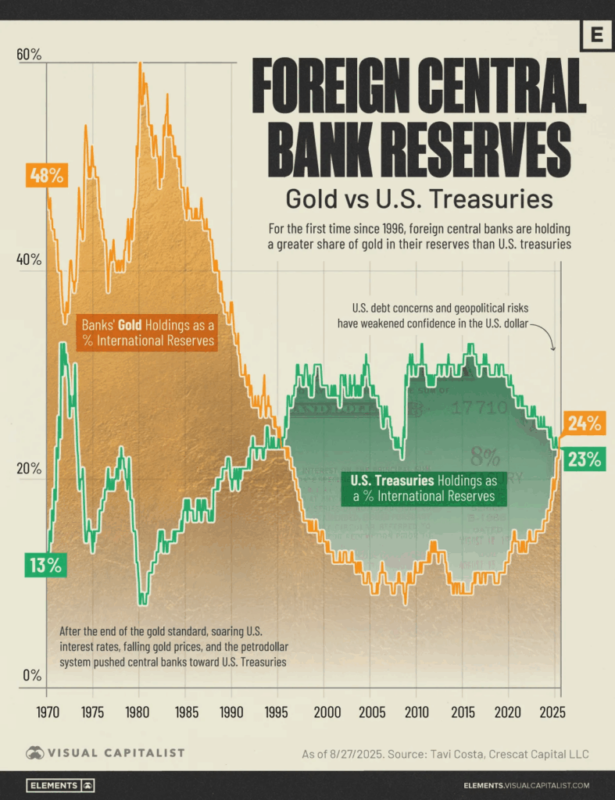

For nearly two years, markets were driven by the same speculative narrative that "this time is different.” Bitcoin, precious metals, and AI-linked equities rose not only because of robust fundamentals, but also because investors clung to powerful narratives about inflation, disruption, and monetary collapse. Those speculative narratives are not only seductive but also contribute to …

Read More »

Read More »

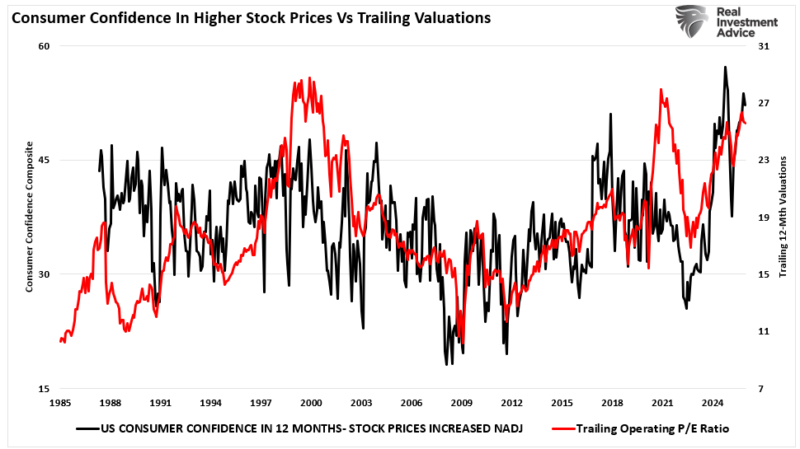

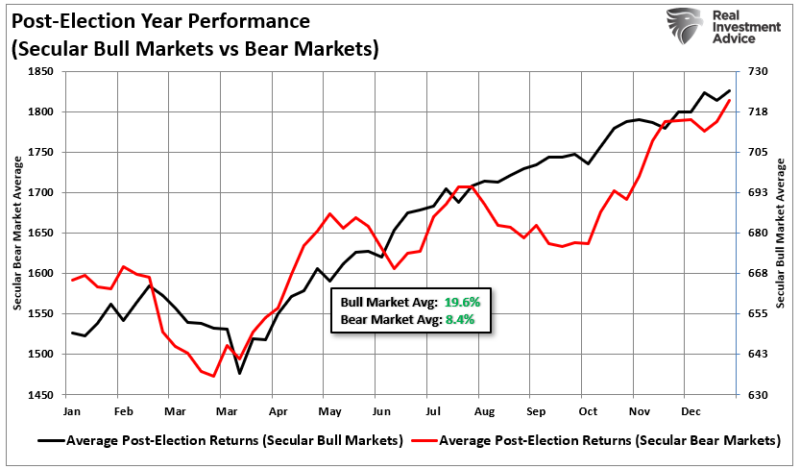

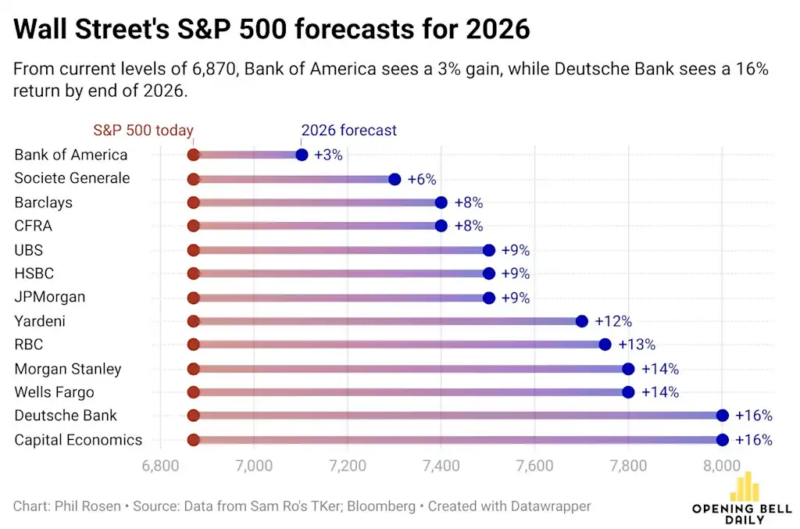

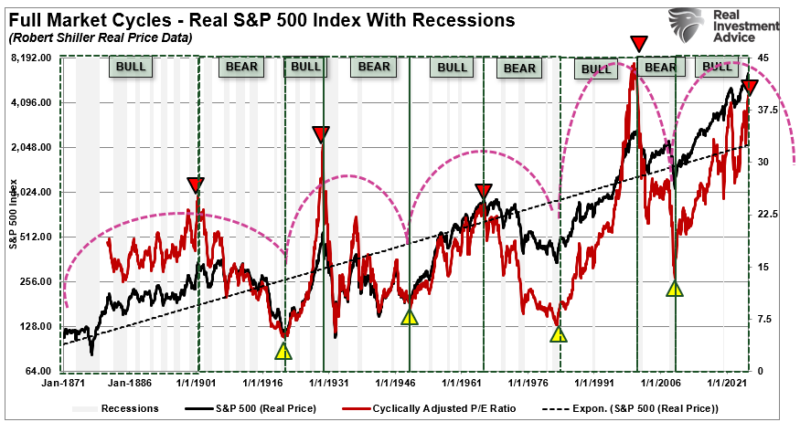

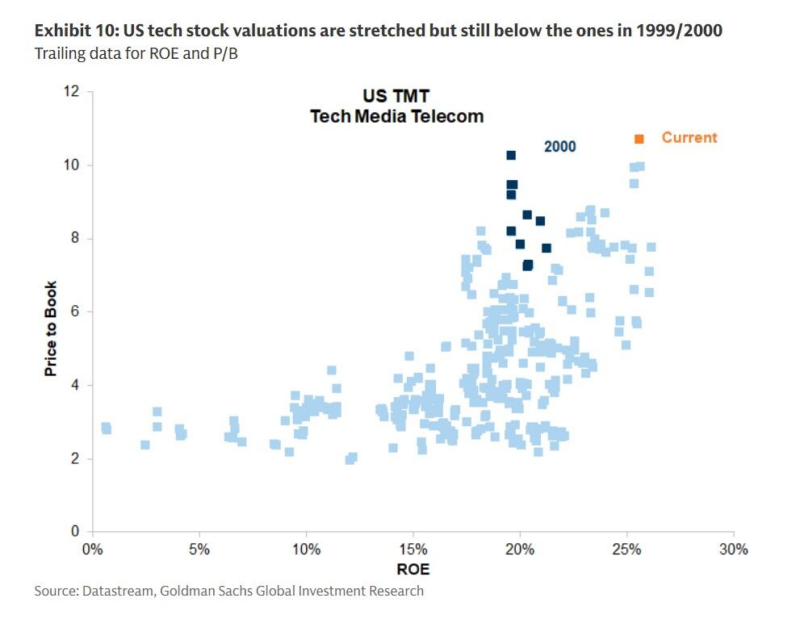

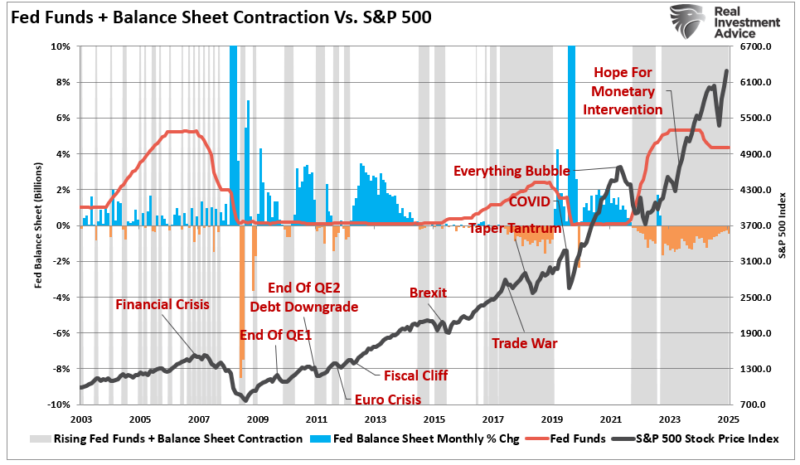

The Market Cycles Potentially Driving 2026 Returns

Market cycles are once again at the center of the investment narrative as we head into 2026. The optimism is familiar as earnings held up in 2025, the economy avoided recession, and big tech lifted the indexes. However, those victories are already reflected in the price. As we head into 2026, with valuations extended, the …

Read More »

Read More »

The South Park Market Of 2026

I have been a "South Park" fan for as long as I can remember, and while the show isn't a market guidebook, its brutal satire cuts through nonsense better than many Wall Street commentaries. Just like on the show, characters make absurd decisions and face absurd consequences, which is familiar to investors today. For example, … Continue...

Read More »

Read More »

2026 Earnings Outlook: Another Year Of Optimism

The Wall Street consensus forecast for 2026 earnings growth is strong by historical standards. Analysts are giddy and projecting another year of double-digit growth in S&P 500 earnings per share (EPS). FactSet’s most recent data showed an expected 2026 earnings growth rate for the S&P 500 of about 15 percent. That is well above the …

Read More »

Read More »

New Year’s Resolutions For 2026 – Investor Version

Every January, it happens like clockwork: you drive by gym parking lots that look like a Taylor Swift concert. Go to the store, and the salad aisles are ransacked like there’s a lettuce shortage, and half of your coworkers suddenly start quoting Warren Buffett while buying stock in companies they can’t spell. You got it, …

Read More »

Read More »

Bull Market Genius Is A Dangerous Thing

During extended upward-trending markets that reward risk-takers and punish caution, everyone is a "bull market genius." That dynamic flips investor psychology and, over time, creates a false sense of control. As the market continues to climb, risk appears to vanish, and investors believe that nothing can go wrong, leading them to take on increasing levels …

Read More »

Read More »

The DPI Link To Margin Debt

A recent article by Simon White, via Bloomberg, discussed the rising cost of margin debt for investors. While his analysis below compares the cost of debt to GDP, we will also consider a more critical comparison to disposable personal income (DPI). Here is Simon's point. "Yet, where history does raise a red flag is if … Continue reading...

Read More »

Read More »

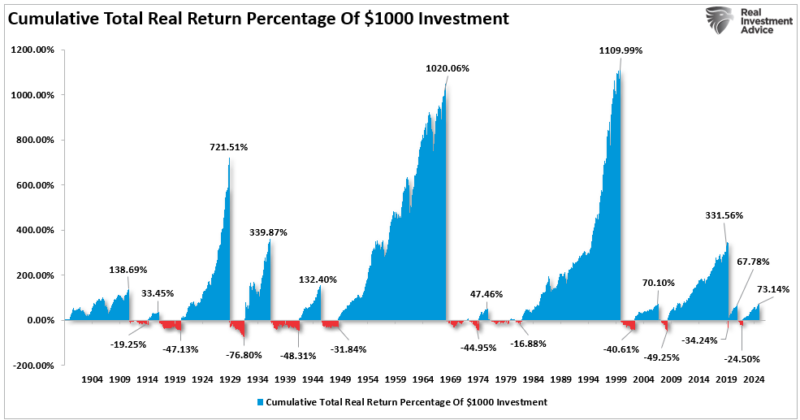

A Bear Market Is A Good Thing.

One of my favorite writers for the WSJ is Spencer Jakab, who recently penned an article explaining why a bear market is not necessarily a bad thing. He starts with a quote from "The Godfather." "“These things gotta happen every five years or so, ten years. Helps to get rid of the bad blood…been ten … Continue reading »

Read More »

Read More »

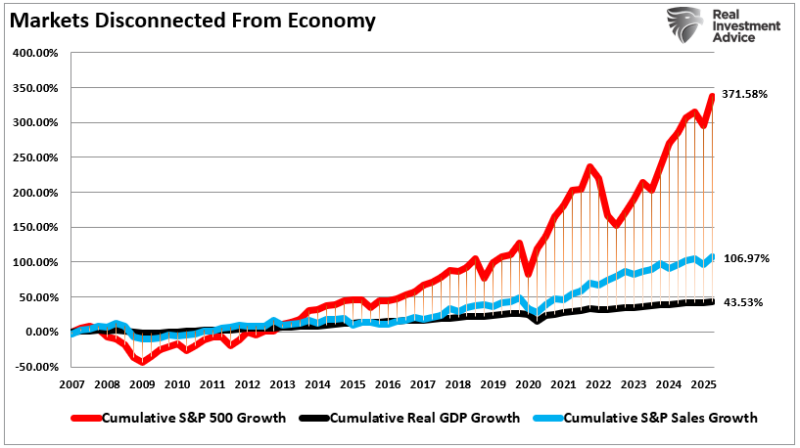

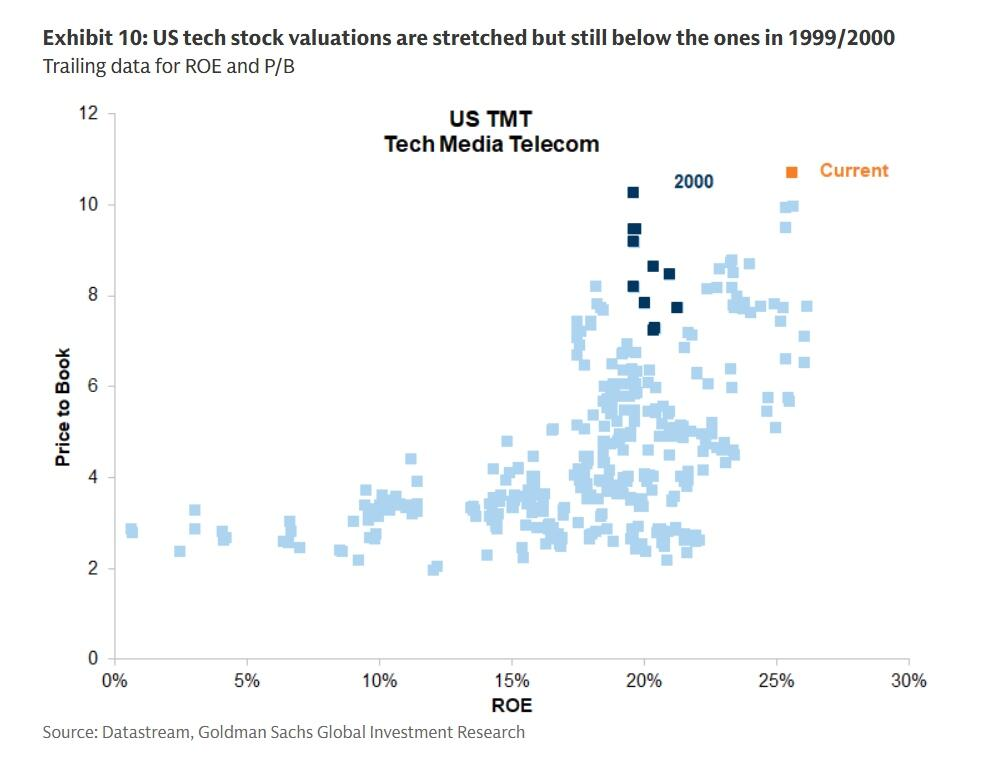

Market Bubbles: A Rational Guide To An Irrational Market

We’re hearing it everywhere: AI is in a bubble. The surge in capital, the parabolic stock charts, and the bold claims from CEOs all have a familiar rhythm. Nvidia’s valuation has soared, along with AI-related startups raising billions with little to no revenue. Investment in data centers, chips, and infrastructure is happening at a scale …

Read More »

Read More »

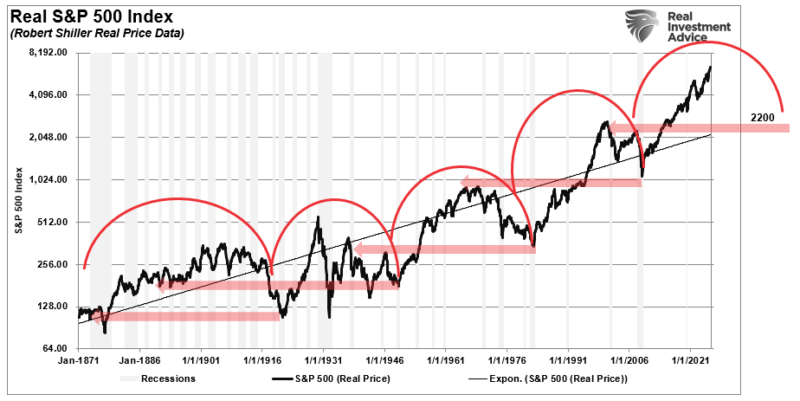

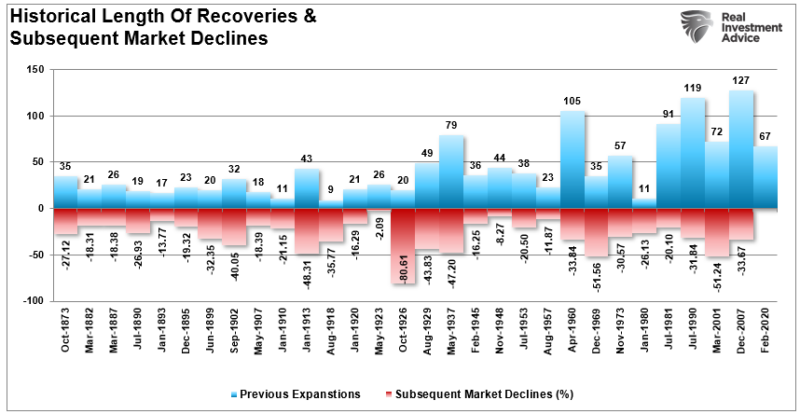

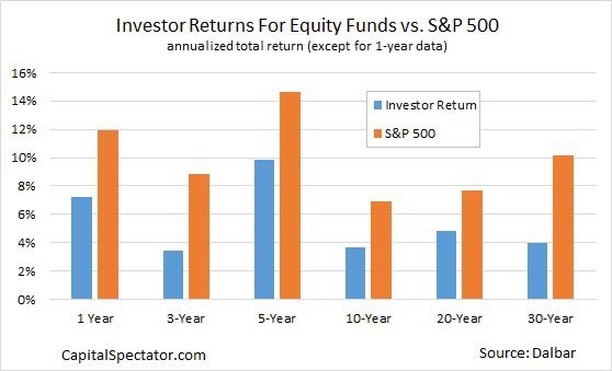

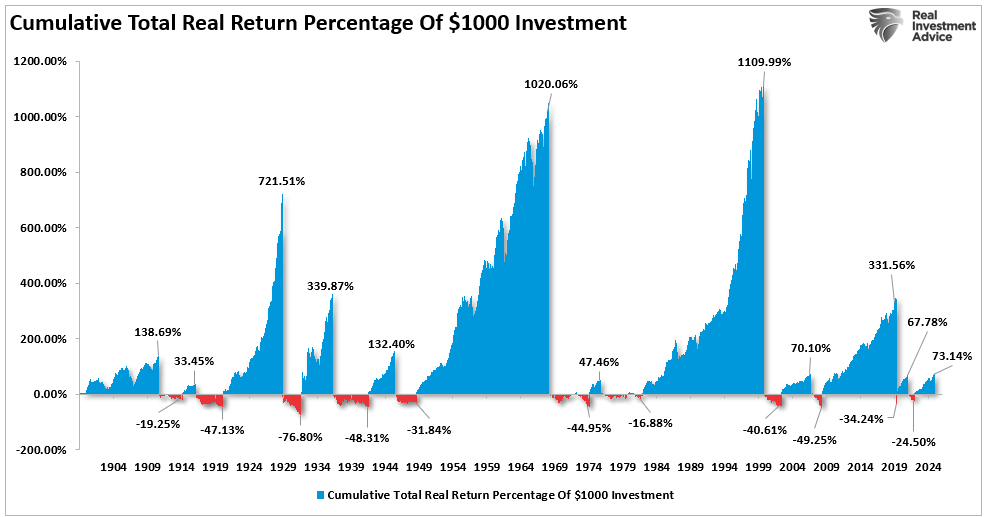

Full Market Cycles: Half Bull and Half Bear

Last week, we discussed the importance of "math" as it relates to valuations and noted the importance of understanding "full market cycles." To wit: "The math on forward return expectations, given current valuation levels, does not hold up. The assumption that valuations can fall without the price of the markets being negatively impacted is also grossly flawed. …

Read More »

Read More »

Forward Return And The Importance Of Math

During strongly trending bull markets, investors often overlook the importance of math in predicting forward returns. Such is easy to do when the market just seemingly continues to rise without regard to fundamentals. The current environment is also heavily influenced by the impact of "passive indexing," which has distorted market dynamics as well. However, none …

Read More »

Read More »

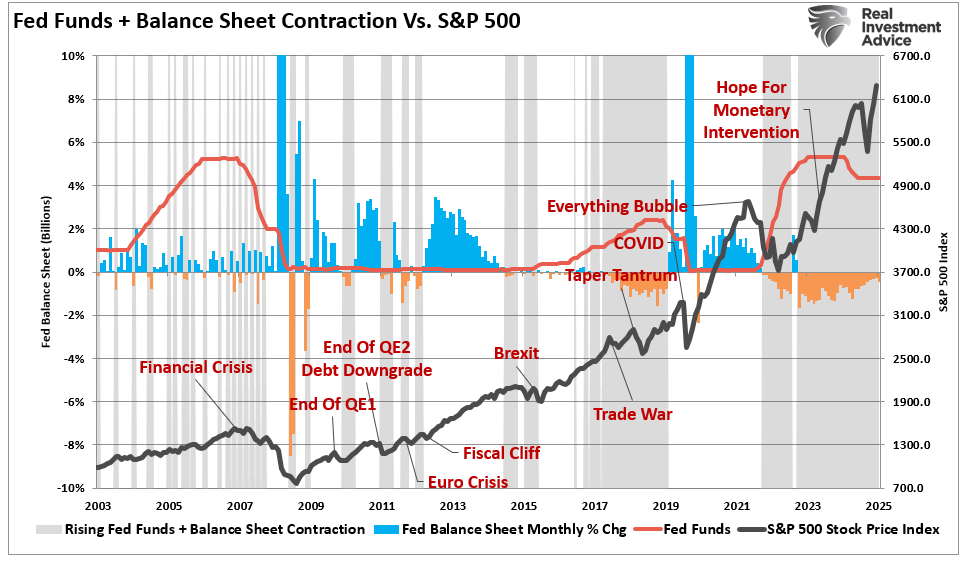

Investor Dilemma: Pavlov Rings The Bell – Draft

Classical conditioning teaches us a valuable lesson regarding the current investor dilemma. Pavlov's research discovered a basic psychological rule: when a neutral stimulus is repeatedly paired with a reward‑stimulus, eventually it will trigger the same response even when the reward is absent. The famed experiment by Ivan Pavlov illustrated that dogs would salivate at the …

Read More »

Read More »

Gold Myths Luring Investors Into Risk

In case you haven't heard, precious metals, particularly gold, have risen sharply this year. Of course, whenever any asset class experiences a more speculative melt-up, investors are quick to rationalize why "this time is different." In stocks, it is about "artificial intelligence" and "data centers." The cryptocurrency community believes all fiat currencies will fail and …

Read More »

Read More »

The Most Dangerous Era In History

We live in what Brett Arends claimed as "The Dumbest Stock Market In History," but I believe it is potentially the most dangerous era. That phrase is not hyperbole as it reflects structural distortion, extreme valuations, and an investor base intoxicated by momentum and narrative. The MarketWatch piece puts it bluntly: “At one level, there …

Read More »

Read More »

Speculative Bull Runs And The Value Of A Bearish Tilt

The recent market crack certainly woke up the more complacent bullish investors. Of course, the complacency was warranted, given the recent market surge, conversations about “TINA” (There Is No Alternative), and how “this time is different.” But that is what a speculative bull run looks and feels like. However, deep inside, you know there are …

Read More »

Read More »

The Psychology Of Investing In A Zero-Risk Illusion

Every market cycle eventually changes investor psychology to believe risk has been conquered. The storylines may change, from “this time it’s different” to “the Fed has our back,” but the psychology does not. When markets rise steadily and volatility remains low, investors confuse stability with safety. That’s precisely the illusion forming in markets today. The …

Read More »

Read More »

ChatGPT Gives Financial Advice On Volatile Markets

Following Friday's selloff amid the resurgence of tariff threats on China, I asked ChatGPT a simple question: " How to Stay Calm In The Stock Market?" That simple question generated an engaging and humorous take on financial advice for navigating volatile markets. In this week's post, I thought it would be helpful to review ChatGPT's advice …

Read More »

Read More »

Bear Market Losses – A Dangerous Illusion

When bear market losses occur, headlines talk in percentages: “The market dropped 20 %.” Investors nod. A 20 % decline sounds manageable, historical, and expected. As Ben Carlson recently penned: "Bear markets have some symmetry to them, at least in the short-term. In the long term, bull markets versus bear markets are asymmetric. Things are not balanced. Look at …

Read More »

Read More »

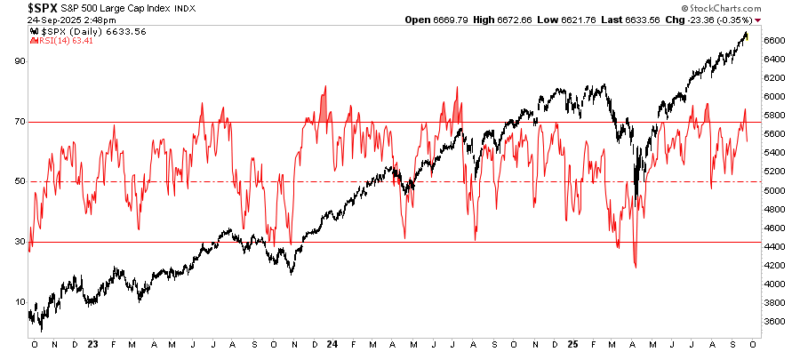

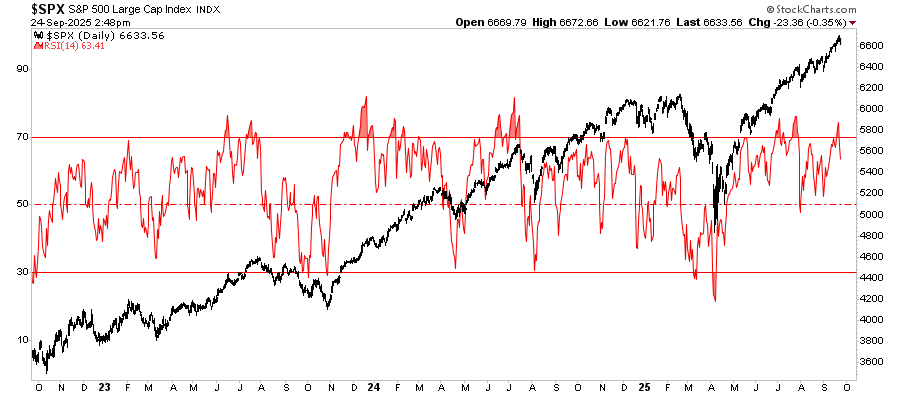

RSI (Relative Strength Index): Timing The Next Correction

In the world of technical analysis, there is one reliable indicator for measuring market risk. The relative strength index (RSI) measures overextension (in either direction). Developed by J. Welles Wilder in 1978, the RSI is a momentum oscillator. As such, it measures the velocity and magnitude of price changes, plotting those on a scale from 0 …

Read More »

Read More »