The great stock bull market is, perhaps, done. To most people, a bull market is good, and its end is bad. After all, a rising market signifies a healthy economy. Investors are making money. Share prices are connected to business productivity, aren’t they?

Read More »

Tag Archive: purchasing power

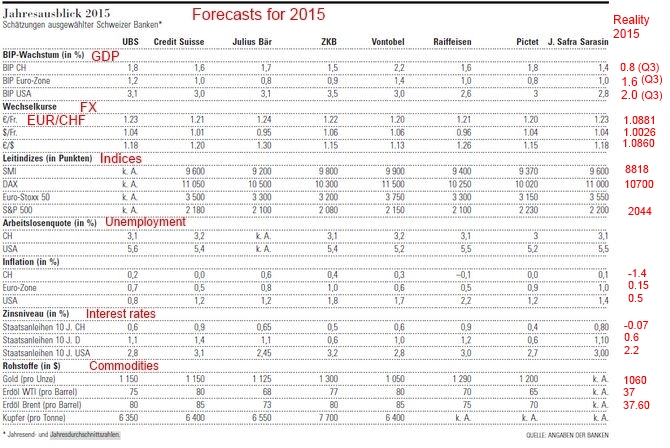

Economic Forecasts for 2015: Swiss Banks were too Optimistic

Our analysis of the forecasts of economic data for 2015 shows that the Swiss banks were too optimistic for most data. US growth, the oil price, inflation and interest rates are far lower than expected. The errors for stock indices were smaller.

Read More »

Read More »

Interest – Inflation = #REF

Economists say real interest = nominal interest - inflation. They paint a false and misleading picture.

Read More »

Read More »

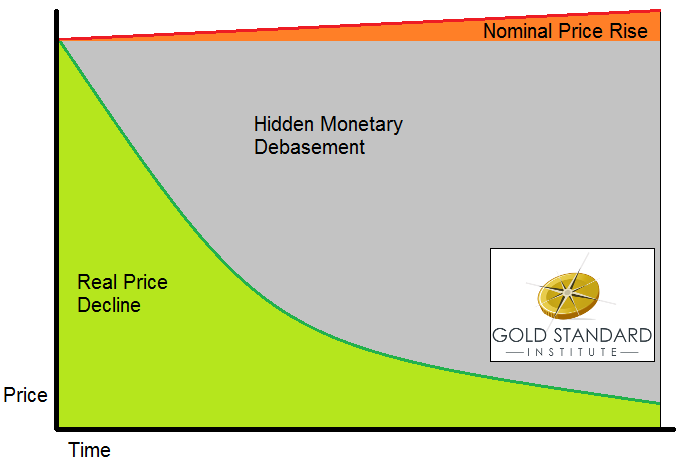

Yield Purchasing Power: Think Different About Purchasing Power

The dollar is always losing value. To measure the decline, people turn to the Consumer Price Index (CPI), or various alternative measures such as Shadow Stats or Billion Prices Project. They measure a basket of goods, and we can see how it changes every year.

However, companies are constantly cutting costs. If we see nominal—i.e. dollar—prices rising, it’s despite this relentless increase in efficiency.

At the same time, the interest rate is...

Read More »

Read More »

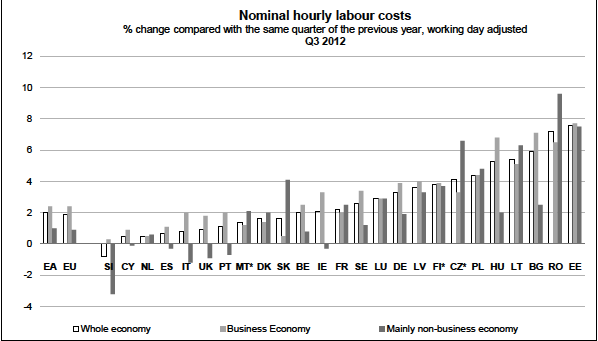

The Fairy Tale of Rising Competitiveness in the European Periphery

In our post we look on two questions concerning competitiveness for the European periphery: When will local production be cheaper than imported products? Do people have the money to buy these local products? It does not help reducing labor costs if local production costs still more than imported products. The second aspect is: even if …

Read More »

Read More »