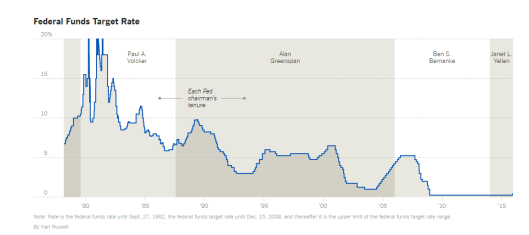

The Volcker Myth is simple because there isn’t math for it just voodoo economics (to borrow George HW Bush’s phrase). In theory, the FOMC finally realized after more than a decade of currency devastation and its economic, financial, and social consequences, hey, inflation and money.

Read More »

Tag Archive: Paul Volcker

The Death of a Business Cycle

How do business cycles end? In the US, conventional wisdom is that they are murdered by the Federal Reserve. It is too slow to raise rates and then goes too quickly. This view is espoused by numerous well-respected economists and policymakers. President Trump's criticism of the Federal Reserve is anchored by such views.

Read More »

Read More »

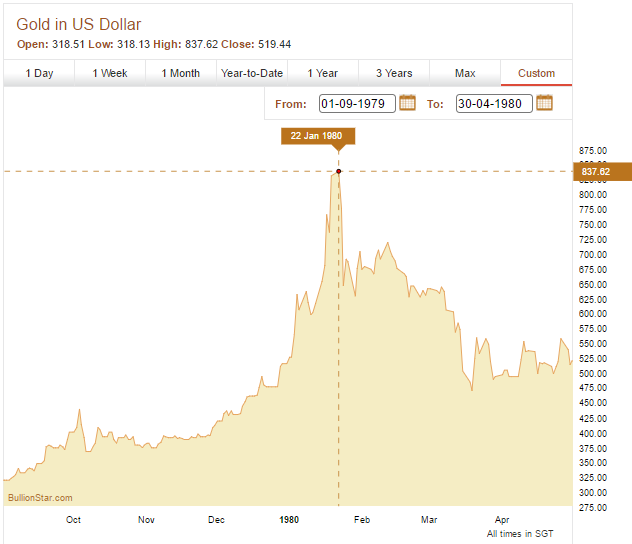

New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil

This is Part 2 of a two-part series. The series focuses on collusive discussions and meetings that took place between the world’s most powerful central bankers in late 1979 and 1980 in an attempt to launch a central bank Gold Pool cartel to manipulate and control the free market price of gold. The meetings centered around the Bank for International Settlements (BIS) in Basle, Switzerland.

Read More »

Read More »

New Gold Pool at the BIS Basle, Switzerland: Part 1

“In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.”

Read More »

Read More »

‘Last Economist Standing’ John Taylor Urges “Less Weird Policy” At Jackson Hole

I attended the first monetary-policy conference there in 1982, and I may be the only person to attend both the 1st and the 35th. I know the Tetons will still be there, but virtually everything else will be different. As the Wall Street Journal front page headline screamed out on Monday, central bank Stimulus Efforts Get Weirder. I’m looking forward to it.

Read More »

Read More »