Tag Archive: newsletter

Understanding Taxable vs. Non-Taxable Benefits: Key Insights from a Financial Advisor

? Understanding the tax implications of benefits can be tricky! Remember, it all depends on how it's paid for. Stay informed! ? #taxes #benefits

Watch the entire show here: https://cstu.io/fd173c

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Don’t mention the war: Russia’s internal tensions

There is no simplistic split of sentiment about Vladimir Putin’s war in Ukraine. But what most Russians want is a return to normal that now seems impossible (https://www.economist.com/briefing/2024/11/28/the-war-in-ukraine-is-straining-russias-economy-and-society?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners). Our The...

Read More »

Read More »

New York: Alice Weidel trifft Elon Musk! (Wildes Gerücht)

Wildes Gerücht über Alice Weidel und Elon Musk!

Meine Depot-Empfehlung:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

Bildrechte:

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT *

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR *...

Read More »

Read More »

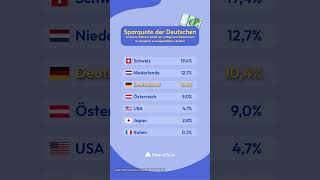

Sparquote der Deutschen ?? #sparquote

Sparquote der Deutschen ?? #sparquote

? Quelle: VGR für Deutschland, ansonsten OECD, Stand 2024

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff...

Read More »

Read More »

Wir verlosen Finanztip Merch!

Du träumst schon die ganze Zeit von unserem Finanztip-Hoodie? Dann bist Du hier richtig, wir verlosen pünktlich zu Weihnachten ein Merch-Paket. Was Du dafür tun musst, das erfährst Du hier.

#finanztip

Das Gewinnspiel läuft bis 08.01.2025, 23:59 Uhr. Jede natürliche Person über 18 Jahren mit Wohnsitz in der Bundesrepublik Deutschland kann am Gewinnspiel teilnehmen. Das Gewinnspiel steht in keiner Verbindung mit Instagram, Meta, TikTok oder...

Read More »

Read More »

Bitcoin, Ether & Co: Die Gewinner und Verlierer der Kryptowährungen 2024

Am Kryptomarkt bewegten sich einige Werte im vergangenen Jahr stark. Das sind die Gewinner und Verlierer. So bewegten sich die einzelnen Kryptowährungen in 2024: Das RankingDas folgende Ranking stellt die Top/Flop-Werte ausgewählter Kryptowährungen in 2024 dar. Zugrunde gelegt wurden die Kurswerte zum US-Dollar zwischen dem 01.01.2024 und dem 31.12.2024. Stand ist der 31.12.2024.

Read More »

Read More »

Rechtsanwalt zerlegt Habeck und Faeser komplett!

Rechtsanwalt Steinhoefel hat einen tollen Artikel geschrieben:

Die Gedanken sind frei und Meinungen auch!

Meine Depot-Empfehlung:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

Bildrechte:

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT *

?JETZT auch als...

Read More »

Read More »

Warum leidet unsere Autoindustrie? | E-Auto Desaster | Aktienkurse

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Kaum ein Tag vergeht, in dem nicht eine neue #Hiobsbotschaft aus der heimischen Autoindustrie eintrifft. Es geht um Absatzrückgänge, #Firmenpleiten und/oder #Arbeitsplatzabbau. Ist das E-Auto schuld? Ja und nein. Ja, weil es hohe #Kosten verursacht aber...

Read More »

Read More »

Nuclear Waste Could Power the Future – Here’s Why – Mike Mauceli, Ron Stein

What if I told you we’re sitting on an untapped energy source that could power the world for generations? In this episode of the Energy Show with REI Energy, Mike Mauceli sits down with energy expert Ron Stein to discuss a surprising truth – 97% of nuclear fuel labeled as “waste” can actually still generate power. That’s right – we’re throwing away fuel that could provide infinite electricity with the right technology.

Ron breaks down how fast...

Read More »

Read More »

New Year’s Resolutions

On New Year’s Eve, my family members and I go around the table and reflect on our past year’s resolutions. How do you make your New Year’s resolution? How do you stay accountable?

#principles #raydalio #mentor

Read More »

Read More »

Verluste beim Hebeln? Das musst du wissen!

? Hebelprodukte versprechen hohe Gewinne, aber wie sieht die Realität aus? In Zeiten von Krisen und Marktabstürzen kann der Einsatz von Hebeln gefährliche Folgen haben?

Read More »

Read More »

Pasos para comprar una propiedad y tener Libertad Financiera: Andrea González

? https://realmentor.net/rd ? ENTRA AQUÍ ¡Descubre Cómo Alcanzar La LIBERTAD FINANCIERA y Crear INGRESOS PASIVOS Usando El Sistema Que Me Convirtió En Millonario!

=================================

? ¿El dinero fortalece tu familia o crea conflictos?

En este video, Andrea y su padre comparten cómo lograron transformar sus vidas familiares y financieras al construir un legado basado en la educación financiera y los valores compartidos. Para ellos, la...

Read More »

Read More »

Bitcoin: 146 Millionen Prozent Plus – zu viel?

▬ Kontakt ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Vereinbare jetzt Dein kostenloses Beratungsgespräch??:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen???:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck?:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern?:

► https://go.investorenausbildung.de/3xJn7ow

▬ Über Mich ▬▬▬▬▬▬▬▬▬▬▬▬

Florian Günther ist der Kopf hinter Investorenausbildung.de. Er ist...

Read More »

Read More »

Wikipedia: Gründer mit Schockbotschaft für Nutzer!

Der Mitgründer von Wikipedia schlägt Alarm!

Meine Depot-Empfehlung:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

Bildrechte:

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT *

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR *...

Read More »

Read More »

90% Verlust durch Krisen?

? Würdest du dein ganzes Portfolio hebeln oder bleibst du lieber sicher? Teile deine Meinung in den Kommentaren!

Read More »

Read More »

What Rich People Do, That YOU Don’t

In this video we dive deep into the concepts of respecting property, learning from mistakes, and the invaluable lessons that come with responsibility. My friend Josh shares a powerful story about how he learned the hard way what it means to truly value what you have. It’s not just about material things—it’s about mindset.

We discuss:

Why respecting property is a sign of wealth in your mind, not just your wallet.

How mistakes, no matter how big or...

Read More »

Read More »

5 ungewöhnliche Prognosen für 2025

Im heutigen Video werfe ich einen Blick in die Glaskugel und teile mit dir meine fünf Prognosen für das Jahr 2025.

JETZT zum Webinar anmelden:

https://www.jensrabe.de/WebinarJan25

Vereinbare jetzt dein kostenfreies Beratungsgespräch:

https://jensrabe.de/Q4Termin24

Aktien kann Jeder - jetzt testen:

https://jensrabe.de/YTAKJ

Schau auf meinem Instagram-Account vorbei:

@jensrabe_official

https://www.instagram.com/jensrabe_official

ALLE Bücher von...

Read More »

Read More »