Tag Archive: newsletter

Dr. Markus Krall wütend – IRRE!!! Dieser GEHEIME Plan LÄUFT…und das ist das ZIEL! Hör DIR das an!

Videoinhalte: Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland , Geld Deutschland , Kapital Deutschland, Aktien Deutschland , Börse Deutschland , Immobilien Deutschland , Politik Deutschland , Medien Deutschland , Gold, Goldmünzen, Silber, Edelmetalle, Bitcoin, Kryptowährung, Währungskrise,

Read More »

Read More »

Vivid Money Depot & Girokonto im Test: ab 1 Cent Aktien kaufen? Unsere Erfahrungen

Fürs Geld ausgeben bezahlt werden? 🙃 https://www.talerbox.com/cashback-crashkurs

Vivid Money im Test: Unsere Erfahrung mit dem Cashback Girokonto + Broker

📈 Mehr zu Vivid Money inkl. 20€ Aktienprämie ► https://www.talerbox.com/out/vivid-money/ *

⛑Erste Hilfe Set zum Vermögensaufbau ► https://talerbox.com/go/erste-hilfe-set/ *

👕 Talerbox Merch ► https://shop.spreadshirt.de/talerbox-shop/ *

ℹ️ Vivid Money Erfahrungen:

Vivid Money hat seinen Broker...

Read More »

Read More »

Switzerland’s low-income earners hit far harder despite lower Covid-19 infection rates

The economic impact of the Covid-19 pandemic has hit low-income households far harder than those on high incomes, according to a study published by the KOF Swiss Economic Institute at ETH Zurich.

Read More »

Read More »

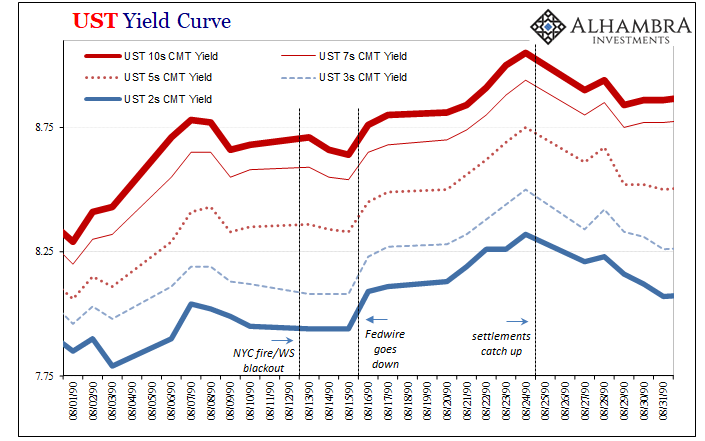

Three Things About Today’s UST Sell-off, Beginning With Fedwire

Three relatively quick observations surrounding today’s UST selloff.1. The intensity. Reflation is the underlying short run basis, but there is ample reason to suspect quite a bit more than that alone given the unexpected interruption in Fedwire yesterday.

Read More »

Read More »

Dr. Markus Krall warnt – SIE tun es JETZT!!! DU musst AUFWACHEN und dich VORBEREITEN…ZEIT LÄUFT AB

Videoinhalte: Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland , Geld Deutschland , Kapital Deutschland, Aktien Deutschland , Börse Deutschland , Immobilien Deutschland , Politik Deutschland , Medien Deutschland , Gold, Goldmünzen, Silber, Edelmetalle, Bitcoin, Kryptowährung, Währungskrise, Währungsreform, Finanzcommunity, Finanzpolitik, Finanzmarkt, Banken

Read More »

Read More »

3 Grundsätze zu GELD die dein LEBEN verändern!

3 Grundsätze zu GELD die dein LEBEN verändern! Heute möchte ich euch 3 wichtige Punkte zum Thema Geld an die Hand geben. 3 Punkte die ich glaube essentiell wichtig sind im Leben und die euer Leben verändern können wenn ihr Sie kennt. Was meint Ihr dazu, teilt Ihr diese Grundsätze mit mir?

Read More »

Read More »

Prof. Thorsten Polleit redet klartext – APOKALYPTISCHE AUSMAßE!!! Der große LOCKDOWN-SCHOCK…

Videoinhalte: Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland , Geld Deutschland , Kapital Deutschland, Aktien Deutschland , Börse Deutschland , Immobilien Deutschland , Politik Deutschland , Medien Deutschland , Gold, Goldmünzen, Silber, Edelmetalle, Bitcoin, Kryptowährung, Währungskrise, Währungsreform, Finanzcommunity, Finanzpolitik, Finanzmarkt, Banken, Finanzcrash, Eurocrash, Bankencrash, Geldanlage,...

Read More »

Read More »

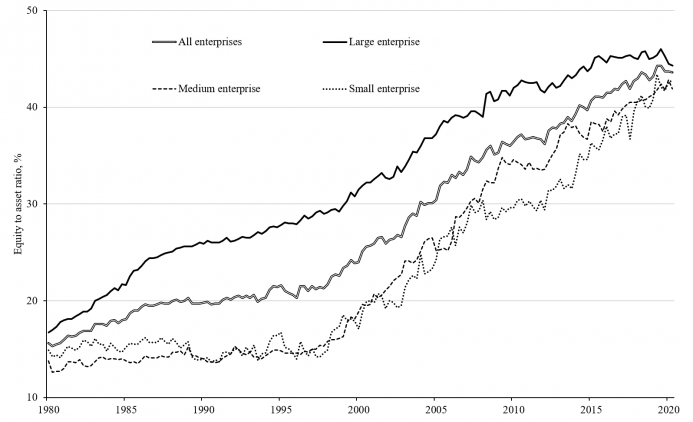

Japan’s Well-Fed Zombie Corporations

The corona crisis has intensified the discussion about the zombification of the economy; enterprises have become more dependent on government bailouts, loans, subsidies, short-time working benefits, and loans from central banks. Governments around the world claim the measures to be only temporary.

Read More »

Read More »

The PRO Act Is Not Just a Union Handout—It’s an Assault on the Freedom of Association Itself

On February 4, 2021, Democrats in the House and Senate introduced the Protecting the Right to Organize (PRO) Act. Like many names in Washington, this one is an Orwellian misnomer that does the exact opposite of what it claims to be doing. If passed, the bill, which is basically a union wish list, would radically transform the nature of the labor market in the US with numerous sweeping and heavy-handed changes.

Read More »

Read More »

Employment in Switzerland fell in 4th quarter 2020 for the third consecutive time

In the 4th quarter 2020, the total employment (number of jobs) fell by 0.4% in comparison with the same quarter a year earlier (+0.1% with previous quarter). Among women, the decrease was 0.6%, while employment among men fell by 0.3%. In full-time equivalents, employment in the same period declined also by 0.4%.

Read More »

Read More »

Former Swiss central banker throws in towel to lead OECD

Former Swiss National Bank (SNB) chairman, Philipp Hildebrand, has pulled out of the race to become the next secretary-general of the Organisation for Economic Co-operation and Development (OECD).

Read More »

Read More »

Tiny House? Eigenheim? Größere Wohnung? Investieren in Immobilien? Meine Pläne!

? ✘ ÜBER MICH: Hey! Ich bin die Valentina, 22 Jahre alt und komme aus Österreich. Vor ein paar Monaten bin ich auf den Begriff Frugalismus gestoßen und seitdem sehr begeistert von diesem Thema. Meine Sparquote beträgt über 50% und mein Ziel ist es, mit 35 Jahren finanziell frei bzw. unabhängig zu sein. Auf diesem Kanal möchte ich dich mit auf meinem Weg nehmen und ich freue mich sehr, wenn du dabei bist :) Auf meinem Kanal dreht sich alles um die...

Read More »

Read More »

Die Artikel auf Mises Deutschland – Februar 2021

„Der archimedische Punkt bei Anthony de Jasay ist die Freiheitsvermutung.“ Interview mit Burkhard Sievert, 1, Februar 2021 Ich bin über die Bücher von Roland Baader auf Anthony de Jasay aufmerksam geworden, der ihn als einen herausragenden freiheitlichen Philosophen hervorhob. Um es mit Gerhard Radnitzky zu sagen: „Im intellektuellen Bereich haben nur sehr wenige mehr für die Sache der Freiheit getan als Anthony de Jasay.“

Read More »

Read More »

V-Tuber oder virtual YouTuber und die Bedeutung für unsere Zukunft

#VTuber veröffentlichen ihre YouTube-Videos mit einem Avatar anstatt sich selbst dem Publikum zu zeigen. Virtuelle Welten kennen wir spätestens seit dem Hype um Second Life im Jahr 2003.

Read More »

Read More »

Bulls, Bears, and Beyond: In Depth with James Grant

James Grant is editor of Grant’s Interest Rate Observer, which he founded in 1983. He is the author of nine books, including Money of the Mind, The Trouble with Prosperity, John Adams: Party of One, The Forgotten Depression, and more recently Bagehot: The Life and Times of the Greatest Victorian.

Read More »

Read More »

Diese Sache kommt auf uns zu! Bereiten Sie sich vor!

Markus Krall (* 10. Oktober 1962) ist ein deutscher Volkswirt, Unternehmensberater und Autor. Seit September 2019 ist Krall Mitglied und Sprecher der Geschäftsführung der Degussa Goldhandel GmbH. Er steht der Österreichischen Schule nahe. Rezipiert wurde er als „Crash-Prophet“ mit umstrittenen gesellschaftlichen Forderungen, beispielsweise der Einschränkung bzw.

Read More »

Read More »

Deutschland bricht gerade zusammen Extreme Folgen kommen, hier die Fakten

Thorsten Polleit (* 4. Dezember 1967) ist ein deutscher Ökonom. Er ist Chefökonom der Degussa Sonne/Mond Goldhandel, Partner der Polleit & Riechert Investment Management LLP, Präsident und Gründer der deutschen Abteilung des libertären Ludwig von Mises Institute und Honorarprofessor an der Universität Bayreuth. Er tritt für eine marktwirtschaftliche Gesellschafts- und Wirtschaftsordnung ohne solche Störungen ein.

Read More »

Read More »

Monatsupdate Max Otte Multiple Opportunities Fund (MOMO)

Der mit Abstand beste Performer war die Aktie unserer Versandapotheke Zur Rose. Die Gesamtrendite lag bei über 40% allein im Januar. Hintergrund war insbesondere die Publikation erster Eckdaten für das abgelaufene Schlussquartal sowie das Gesamtjahr 2020.

Read More »

Read More »

FX Daily, February 26: Fed Hike Ideas Give the Beleaguered Greenback Support

A poor seven-year note auction and ideas that the first Fed hike can come as early as the end of next year spurred a steep sell-off in bonds and equities. Technical factors like the triggering of stops losses, large selling in the futures market, which some also link to hedging of mortgage exposure (convexity hedging), also play a role.

Read More »

Read More »

How High is Too High for Rising Government Bond Yields?

2021-02-27

by Stephen Flood

2021-02-27

Read More »