Tag Archive: newsletter

What comes down must go up again – DJE plus News Juli 2022 mit Mario Künzel (Marketing-Anzeige)

In dem monatlich stattfindendem DJE plus News reflektiert Mario Künzel, Referent Investmentstrategie, die Marktgeschehnisse der vergangenen vier Kalenderwochen und gibt Ihnen einen Ausblick auf die kommenden Wochen.

Das nächste DJE plusNews findet am 17. August 2022 statt.

Hier können Sie sich dazu anmelden: https://web.dje.de/djeplusnews

► Aktuelles: https://www.dje.de/unternehmen/aktuel...

► LinkedIn: https://www.linkedin.com/company/dje-......

Read More »

Read More »

Warnung! Diese Aktien fallen nochmal 50%

► Sichere Dir meine Tipps zu Gold, Aktien, ETFs - 100% gratis: http://lars-erichsen.de/

► NEU: Gewinne von bis zu +170%… Mein exklusives Lars-Erichsen-Depot: https://www.rendite-spezialisten.de/video/depot/

Jeder möchte an der Börse Gewinne erzielen. Es ist aber für die Rendite eines Depots mindestens ebenso wichtig, Verluste zu vermeiden und ich spreche über Verluste, die absolut vermeidbar wären. Deswegen ist das heute ein Warnvideo. Ganz...

Read More »

Read More »

Long Term Gold Price Prediction- Kevin Wadsworth

Long Term Gold Price Prediction- Kevin Wadsworth

Dave Russell welcomes #KevinWadsworth a meteorologist-turned-chart analyst of Northstarbadcharts.com. Kevin offers a lot of interesting insights and forecasts about market trends and the price of gold. He walks us through the possibilities for the #USDollar, precious metals, and the economy.

Our second episode of The M3 Report is now live:

Highlights from the episode:

Is there a connection...

Read More »

Read More »

Nik Bonitto: NFL draft experience, draft critics, & Visiting Denver Broncos facilities before draft

In segment three Nik Bonitto breaks down the draft process, his experience, blocking out the outside noise of his draft critics, and visiting the Denver Broncos before the draft.

FIYE SHOW INSTAGRAM:https://www.instagram.com/

Nik Bonitto Instagram:https://www.instagram.com/nik_hendrix/

Read More »

Read More »

Alle Karten auf den Tisch – mit Prof. Dr. Lars Feld und Prof. Dr. Hans-Werner Sinn

Das hat es nocht nicht gegeben: Die beiden Top-Ökonomen Lars P. Feld und Hans-Werner Sinn stellen sich gegenseitig Fragen, die sie selber nicht kennen. Das Gespräch dreht sich natürlich um Ökonomie - aber nicht nur. Wollten Sie schon immer einmal wissen, wieso Hans-Werner Sinn aus der SPD ausgetreten ist oder was Lars Feld und Frank Zappa gemeinsam haben? Bei diesem Tête-à-Tête kommen alle Karten auf den Tisch – keine Antwort ist keine...

Read More »

Read More »

This Is Why Investing In GOLD Is A Game Winner!

This Is Why Investing In GOLD Is A Game Winner! | Alasdair MacLeod Gold Price Forecast

#gold #goldprice #goldratetoday

Read More »

Read More »

Have We Reached the Bottom Yet? | 3:00 on Markets & Money

(7/20/22) We haven't seen investors THIS negative since 2008--does this suggest we're nearing a market bottom? This is not then: We're running the highest inflation rate in 40-years, the Fed is tightening its balance sheet AND hiking interest rates.

Read More »

Read More »

Meine Erfahrungen mit dem Trading und was ich daraus gelernt habe

Hast du dich auch schon einmal an Trading herangewagt? Dann ging es dir bestimmt ähnlich wie meinem Friseur Mehmet oder mir.

Read More »

Read More »

Calm before the Storm?

The biggest rally in the S&P 500 in three weeks helped lift global equities today. The MSCI Asia Pacific index rose for the third consecutive session, the longest streak this month. Europe’s Stoxx 600 is up for a fourth day and is at its best level since mid-June.

Read More »

Read More »

Could Millennials Sink the Mortgage Market?

(7/20/22) Mortgage eman is at a 22-year low; that's not the only reason house prices are falling; technical charts on't lie. The market is own less than 20% for the year; has FOMO become FOBO--the fear of missing the bottom?

Read More »

Read More »

EU dependent on Nord Stream 1 for gas, ‘Gazprom will fulfill obligations,’ says Putin | World News

Russia is expected to restart the gas supplies via the North Stream One pipeline on time. This, as per the EU was preparing for Russia to delay the gas supplies after the North Stream One pipeline was shut down for its annual maintenance on July 11.

Read More »

Read More »

Wie würdest du HEUTE neu starten? Live Q&A Teil 1

Wenn dir heute alles genommen wird, wie würdest du dann nochmal neu starten? Wieso es so wichtig ist dein aktives Einkommen stetig zu erhöhen und welche Chancen und Risiken du beachten solltest. Teilt Ihr diese Meinung und wie würdet Ihr neu starten? Schreibt es gerne in die Kommentare.

Read More »

Read More »

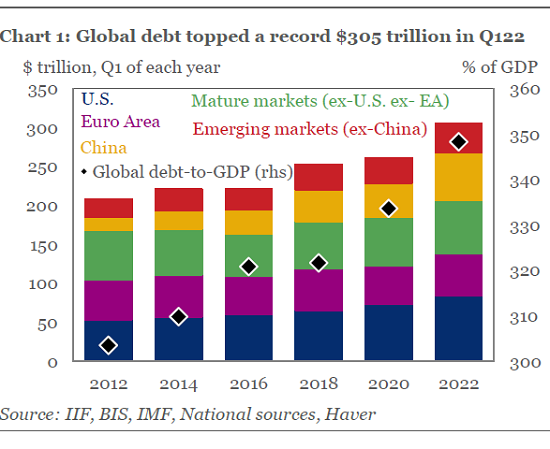

The Real Policy Error Is Expanding Debt and Calling It "Growth"

Waste is not growth, and neither are the unlimited expansion of debt and speculative bubbles. The financial punditry is whipping itself into a frenzy about a Federal Reserve "policy error," which is code for "if the music finally stops, we're doomed!"

Read More »

Read More »

Ask Bob: Is Maxing Out Your 401k A Good Investment Decision?

Since the beginning of 401(k) plans in 1978, people have considered it to be the quintessential retirement plan—you get to save money before taxes and in most cases, the company puts money into your account, too. What could be better than that? But now, 44 years later, it’s time to take a broader look at 401(k)s that considers taxes on 401(k) distributions.

Read More »

Read More »

No Need to Meet With Dictators

By now, most everyone knows about President Biden’s famous “fist bump” with Crown Prince Mohammed bin Salman, the Saudi dictator who has been accused of orchestrating the brutal murder of Washington Post columnist Jamal Khashoggi when he visited a Saudi consulate in Turkey.

Read More »

Read More »

Toleration Does Not Require Calling Evil Good

In the early morning of July 6th, an explosion damaged a monument in Georgia known as the Georgia Guidestones. Because of the damage, the rest of the monument was demolished for safety reasons. The stones were erected by anonymous donors in 1980 and list ten principles for humanity. At the time of writing, it seems that the explosion was the result of purposeful sabotage.

Read More »

Read More »

RENTNER MÜSSEN SICH WARM ANZIEHEN!

Wirtschaft aktuell: Was passiert jetzt? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst! Wie soll ich jetzt investieren?

Read More »

Read More »