Tag Archive: newsletter

The Coming Silver Price Will Shock You!! – Alasdair Macleod | Silver Price Prediction

The Coming Silver Price Will Shock You!! - Alasdair Macleod | Silver Price Prediction

Alasdair MacLeod shares what's happening with the current financial market.

#AlasdairMacLeod #silver #gold #theincomefinance

--------------

⬇ Inspired By: ⬇

Financial Crisis Is Already Here, Don’t Let the Market Exuberance Fool You Warns Lynette Zang

-tnozmGa4

Fed’s Credibility is Destroyed, Why Cash, Gold and Silver Will Be Best Lifeline | Outlook 2022

Silver...

Read More »

Read More »

Trotz Millionendepot bodenständig leben (Reaktion)

Originalvideo:

Depot eröffnen & loslegen:

⭐ Flatex (in Österreich keine Depotgebühr): *https://www.minimalfrugal.com/flatex.at

⭐DADAT (Dividendendepot für Österreicher/Innen): *https://minimalfrugal.com/dadatdepot

► Trade Republic: (um 1€ Aktien kaufen): *https://www.minimalfrugal.com/traderepublic

► Smartbroker: *https://www.minimalfrugal.com/smartbroker

► Comdirect: *http://www.minimalfrugal.com/comdirect

► Onvista:...

Read More »

Read More »

Alasdair Macleod: Has Basel III Impacted Gold & Silver

▶︎1000x – Enter your Email ▶︎ https://bit.ly/3bmwpQb

▶︎ Subscribe to this YouTube channel ▶︎ https://bit.ly/CompactSilverNews_subscribe

▶︎ Join the official 1000x Telegram channel! Join us on the road to 1000x: https://t.me/official1000x

Alasdair has been a celebrated stockbroker and Member of the London Stock Exchange for over four decades. His experience encompasses equity and bond markets, fund management, corporate finance and investment...

Read More »

Read More »

SILVER Price To Repeat The Nickel Situation | Am PUTTING My Money There – Alasdair Macleod

SILVER Price To Repeat The Nickel Situation | Am PUTTING My Money There - Alasdair Macleod

⬇ Inspired By: ⬇

_9SyDw

#silverstacking #Silverbullion

--------

? Checkout These Similar Videos?:

-------

? Don't Forget To Subscribe For More: shorturl.at/twPQ2

Read More »

Read More »

Trading Wochenanalyse für KW 33/2022 mit Marcus Klebe – DAX – DOW – EUR/USD – Gold #Chartanalyse

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

In dieser Analyse blickt Marcus Klebe auf die vergangene Handelswoche im DAX, Dow, EUR/USD und Gold und bespricht wichtige charttechnische Bereiche und mögliche Bewegungen für die kommenden Handelstage.

#BigPicture #Chartanalyse #MarcusKlebe

HIER geht es zur Webinarserie: TRADEN MIT KLEINEM KONTO IN 2022...

Read More »

Read More »

Von der Negativ-Diagnose zum Multiunternehmer // Interview mit Claus-Stefan Duffner

Im heutigen Interview erzählt uns Claus-Stefan Duffner von seiner Geschichte, wie er es in wenigen Monaten von einer negativen Diagnose zum Multiunternehmer geschafft hat.

Hier bekommt ihr die erste Lektion von Claus-Stefan Duffner’s Coaching “Der Digitalcode” gratis:

(Wie Du Dir in 4 Wochen ein zusätzliches Einkommen aufbaust...)

►https://go.investorenausbildung.de/3AniQd0

Mehr von Claus-Stefan Duffner:

Zur Website:...

Read More »

Read More »

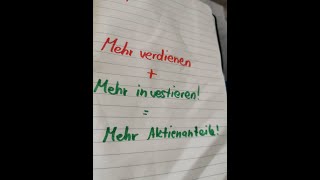

Jeder Anleger unter 50 kann ganz entspannt bleiben!

Wenn jetzt doch noch ein CRASH stattfindet und wir nur in einer kurzfristigen Bärenmarkt-Rally sind, so what? Selbst wenn es 10-15 JAHRE dauert, Verluste wieder aufzuholen, so kann man sich auf das Geld verdienen konzentrieren und Aktienanteile nach und nach günstig aufkaufen. Jeder Anleger, der noch weit weg von seiner Entsparphase ist, kann einem Crash also ganz entspannt entgegenschauen!

? bis zu 2 Gratisaktien bei Depotempfehlung für ETFs...

Read More »

Read More »

Is the Dollar’s Month-Long Pullback Over?

The bullish dollar narrative was fairly straightforward. Yes, the US main challengers, China and Russia, have been hobbled in different ways by self-inflicted injuries. Still, the driver of the dollar was the expected aggressive tightening by the Federal Reserve.

Read More »

Read More »

Major Financial System Collapse! Buy GOLD & SILVER To Save Your Money! | Alasdair Macleod Forecast

Major Financial System Collapse! Buy GOLD & SILVER To Save Your Money! | Alasdair Macleod Forecast

#gold #silverstacking #silverprice

➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖

FAIR-USE COPYRIGHT DISCLAIMER

Copyright Disclaimer Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, commenting, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright...

Read More »

Read More »

Max Otte: Mit diesen Aktien können Sie endlich ruhig schlafen

Jetzt unser Anleger-Magazin Smart Investor kostenlos testen! https://bit.ly/3Qqnhck

Ob es noch zum Crash kommt oder nicht: Gewisse Basisinvestments sollte jeder Anleger im Depot haben. Welche Aktien Fondsmanager Max Otte auch in stürmischen Zeiten ruhig schlafen lassen, verrät er im Interview.

Die Tech-Giganten Amazon und Microsoft gehören zu jenen Aktien, die bei vielen Anlegern als Langzeitinvestments beliebt sind. Auch Max Otte, Fondsmanager...

Read More »

Read More »

Warum wir wie Ray Dalio auch unsere Short Positionen deutlich erhöhen – Was uns 2023 erwartet

Investiert in EUCH:

LONG & SHORT BÖRSENBRIEF: ▶︎ https://www.homm-longshort.com *

Coming soon...

https://florian-homm.com/

- Einzigartiges AI-Projekt für volatile Märkte

- Kooperation mit einem europäischen FinTech

- Investmentvehikel ab Q1/2023 für ausgewählte Anleger verfügbar

Auf der Website eintragen und up to date bleiben:

https://florian-homm.com/

Schaut euch auch den Vortrag dazu an: _VG5No

Warum steigt der Markt?

Wie investiere ich...

Read More »

Read More »

Als Schüler & Teenager Vermögen aufbauen: So geht’s!

Als Schüler/Teenager Vermögen aufbauen!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=517&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://link.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=517&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

ℹ️ Weitere Infos zum...

Read More »

Read More »

ACHTUNG: Das sagt Dir keiner über ETFs!

ETFs gelten als die günstigsten und einsteigerfreundlichsten Anlageinstrumente. Jedoch sollte man vor einem langfristigen Einstieg einiges beachten. Welche Risiken ETFs momentan bergen, erläutere ich dir in diesem Video.

0:00 Allgemeinwissen

2:45 Wie viel verdient BlackRock

5:19 Thema Indizes und Sektoren

9:48 Das Tech- Problem

13:05 Augenöffner

19:51 Erschreckendes Beispiel

23:00 Das bedeutet es für dich

Vereinbare jetzt Dein kostenfreies...

Read More »

Read More »

Ich VERGLEICHE für euch 3 DIVIDENDEN-Strategien !

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Ich VERGLEICHE für euch 3 DIVIDENDEN-Strategien !

Welche ist die beste Dividendenstrategie? Dividenden Wachstum, Dividenden Aristokraten oder High-Yield? Dazu heute ein Vergleich, wie ich darüber denke und welche Strategie ich bevorzuge. Welche dieser Strategien ist euer Favorit und verfolgt Ihr? Schreibt es gerne in die...

Read More »

Read More »

Solar power plant to be built on Lake Lei dam

A large alpine solar power plant is to be installed on the dam wall of Lake Lei near Ferrera in southeastern Switzerland. The 1,800 square-metre plant is being built by the Zurich Electricity Company. Located at an altitude of 1,930 metres, the plant will comprise more than 1,000 solar units with a total output of 350 kilowatts, equivalent to the consumption of 160 households.

Read More »

Read More »

US Secretary of State Antony Blinken lands in Africa two weeks after Russian FM Lavrov’s visit

US top diplomat Antony Blinken is in Africa to woo the nations, which have largely steered clear of backing Washington against Moscow in the Ukraine war.

Read More »

Read More »

Tips for Buying a Medicare Supplement Policy

The clock is ticking and it gets louder the closer you get to the magic age of 65. That’s when you sign up for Medicare. But there’s more than one way to receive Medicare coverage. There are Medicare Advantage plans, sometimes referred to as all-in-one plans, because they provide medical coverage and can also provide benefits for vision, dental, hearing, and prescriptions.

Read More »

Read More »

Germany Can Save Itself, and Possibly the World, by Abandoning Four Failed Policies

The following is a plea to Germany—the war is over and has been for three-quarters of a century. It's time to stop prostrating yourself for the supposed "good" of Europe. It's time to take complete control of your domestic and foreign policy, without interference from haughty, busybody world elites, and do what is best for yourself. You will be pleasantly surprised that what is good for yourself is also good for your neighbors and the...

Read More »

Read More »

Africa Needs Conventional Fuels, Not Windmills and Solar Panels

The energy and climate goals that Western governments, the United Nations, and other organizations are pushing on Africa constitute a crippling blow to its economies. As the least developed region, Africa should unequivocally prioritize economic development. One would think that amid energy poverty in Africa, Western governments and “development” institutions would prioritize energy security for African countries over energy transition.

Read More »

Read More »