Tag Archive: newsletter

Be Prepared: Something Big Is Happening In Silver – Alasdair Macleod | Gold Silver Price [PART 2]

Be Prepared: Something Big Is Happening In Silver - Alasdair Macleod | Gold Silver Price

#silverprice #silverstacking #fed #financedaily #silverprice #silversqueeze

________________

Video content: Mike Larson, silver, Restart, reset, the big reset, banks USA, savings banks USA, economy USA, finance USA, money USA, capital USA, stocks USA, stock exchange USA, real estate USA, politics USA, media USA, gold, gold coins, silver, precious...

Read More »

Read More »

Crypto-Mining-Farmen im Iran beschlagnahmt

Im Iran wurde in den letzten Tagen Equipment der Mining-Farmen beschlagnahmt. Offiziell heißt es, dass die iranische Regierung damit Blackouts verhindern wolle, die durch Strommangel verursacht werden.

Read More »

Read More »

Als DEUTSCHER ?? in die SCHWEIZ ?? Auswandern? | Thomas Kovacs Podcast Clips

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Als DEUTSCHER ?? in die SCHWEIZ ?? Auswandern? | Thomas Kovacs Podcast Clips

Link zum Podcast:

?? Der BLOG zum YouTube-Kanal ►► http://sparkojote.ch

#Thomas #Sparkojote #Finanzrudel

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★ Herzensprojekte von Thomas dem Sparkojoten ★

Mittlerweile betreibe ich einige Projekte und es macht mir...

Read More »

Read More »

History Of Money and Evolution Suggests a Crash is Coming

History Of Money and Evolution Suggests a Crash is Coming

In this new episode of GoldCore TV, Dave Russell welcomes Jon Forrest Little, publisher of The Pickaxe. They explore a wide range of topics, varying from what the real inflation rate is to whether or not it is realistic for Bitcoin to serve as a form of currency.

Jon has an ability to recognize the connections between historical events and current events.

Visit this link to join our very...

Read More »

Read More »

A Collapse In Fiat Currencies Within The Next 2 Years? | Alasdair Macleod

WORRIED ABOUT THE MARKETS? SCHEDULE YOUR FREE PORTFOLIO REVIEW with Wealthion's endorsed financial advisors at https://www.wealthion.com

Is it really possible that the world's major fiat currencies could be replaced soon, perhaps by a hard-asset backed solution?

Today's guest expert, Alasdair Macleod believes so, having the made the case on this channel a few months ago.

We check in with Alasdair here to see how developments since his last...

Read More »

Read More »

VORSICHT!: Nächster Zinsschock durch Jackson Hole?

Am Donnerstag findet das Treffen der internationalen Notenbänker in Jackson Hole statt. Ich erläutere dir in diesem Video, welche Chancen und Risiken bei diesem Treffen auf uns zukommen können und wie das die Märkte beeinflusst.

0:00 Das beschäftigt den Markt aktuell

3:50 Auswirkungen der Inflation

13:45 So beeinflusst die Politik den Markt

16:40 Soll man jetzt alles verkaufen?

Vereinbare jetzt Dein kostenfreies Beratungsgespräch:...

Read More »

Read More »

Dann schlafe ich auf der Parkbank!

Wie man durch eine Krise kommt

? bis zu 2 Gratisaktien bei Depotempfehlung für ETFs & Sparpläne ► http://link.aktienmitkopf.de/Depot *

Burrys Depot auf Spatz folgen ► https://gospatz.com/finance/portfolio...

? Kostenlose Anmeldung bei Spatz Portfolio Software ►►► https://gospatz.com/signup

MyDividends24 App Downloaden ► http://myfinances24.de/mydividends24

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR

? Meine Shirts & Hoodies...

Read More »

Read More »

Märkte noch auffällig lahm – US Opening Bell mit Marcus Klebe – 23.08.22

Märkte noch auffällig lahm - US Opening Bell mit Marcus Klebe - 23.08.22

#DowJones #Trading #MarcusKlebe

Read More »

Read More »

The morning forex technical report for August 23, 2022. What is driving the forex market

The EURUSD made another new low going back to December 2002, reaching to 0.9900. The price high stayed below the swing low from July 2022 at 0.99515 keeping the sellers in firm control. The 14 day RSI is diverging and moving toward oversold, but the price still needs to get and stay above 0.99515 if the pair is going higher.

The USDJPY move to a new high going back to July, and on the downside stalled just ahead of the June high near 137.00. ...

Read More »

Read More »

Markets Slicing Through Support Levels | 3:00 on Markets & Money

(8/23/22) Friday's market sell-off is followed by mayhem on Monday, with the worst day of performance since the market found its bottom back in July. Markets sliced clean through levels of support yesterday and this morning are poised for a mild opening; we don't think it will be able to stick, however, as the 20-DMA is retested. Will Markets follow the trendline established for the past 20-weeks? The 100-DMA of 4080 is likely a more logical level...

Read More »

Read More »

How to Navigate Through Stagflation

(8/23/22) Markets slice through the 100-DMA; potential impact of the coming Jackson Hole extravaganza; We export inflation and import cheap stuff; how to navigate through stagflation; back to college, self-checking at Walmart, Full-service filling stations; the saga of Meme Stocks; don't try to always make money in the market; outperforming a down market is key to success. Watch for slower economic growth as Fed continues to tighten; how Zoome...

Read More »

Read More »

Surging Energy Prices Pushing Europe Closer to Recession

The poor eurozone PMI underscores likely recession and weighs on the single currency, which was sold to a new 20-year low. Rather than a "Turn Around Tuesday" a broadly consolidative session is unfolding. Asian and European equities are weaker, while US futures are positive but little changed. Benchmark 10-year bond yields are mostly firmer and the premium offered by Europe's periphery is edging higher. The US 10-year is little changed near...

Read More »

Read More »

Gravitas: Russia thwarts terror plot against India, detains I-S operative

Russia has thwarted a terror plot against India. The FSB has apprehended an Islamic state operative who planned to carry out a 'suicide attack' in India over the blasphemy row.

Read More »

Read More »

Marc Faber: An Kriegen ist niemals nur einer schuld

▶︎ EINLADUNG ▶︎ „Die größten Gefahren für Ihr Vermögen“ - Online-Info-Veranstaltung

✅ Hier gratis anmelden: https://bit.ly/3AaFfst

MARC FABER ONLINE

▶︎ Marc Fabers Gloom Boom Doom Webseite: https://www.gloomboomdoom.com/

▶︎ Marc Faber auf Twitter: twitter.com/gloomboomdoom

▶︎ Marc Faber auf Facebook: www.facebook.com/gloomboomdoom

#marcfaber #aktien #sachwertfonds

Marc Faber - Jahrgang 1946 - ist ein renommierter Schweizer Börsenexperte,...

Read More »

Read More »

Warning: Oil Moving Rapidly to “Contango” [Ep. 277, Eurodollar University]

The calendar spread (1- and 3-month) in the oil futures market (West Texas Intermediate) is compressing and is THIS close to being in contango. That would be the oil market saying, 'We don't see the demand. Keep your barrels—don't call us, we'll call you.'

Read More »

Read More »

Adipositas – Eine Volkskrankheit aus Investorensicht – Podcast mit Maximilian-Benedikt Köhn

In der industrialisierten Welt spielen Zivilisationskrankheiten eine zunehmend bedeutsame Rolle. Insbesondere Adipositas ist auf dem Vormarsch. Wohin zeigen die Trends? Welche Therapien gibt es? Woran arbeitet die Forschung und welche neuen Entwicklungen könnten nicht nur für die Betroffenen, sondern auch aus Sicht von Investoren spannend sein?

Darüber sprechen wir heute mit dem Healthcare-Spezialisten im DJE Research Team: Maximilian-Benedikt...

Read More »

Read More »

Developer invests CH170 million in new Swiss tourist resort

The Andermatt Swiss Alps (ASA) company, majority owned by Egyptian financier Samih Sawiris, is to build a new 1,800-bed Alpine resort in the Sedrun region in southeast Switzerland.

Read More »

Read More »

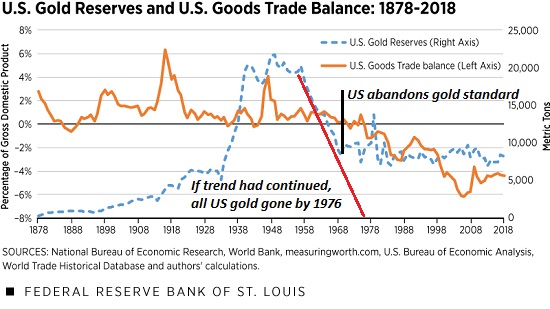

The Real Story of America Abandoning the Gold Standard

Even currencies maintaining convertibility to gold are still subject to bond yields, interest rates, trade and capital flows. It's widely held that all of our financial woes are the result of abandoning the discipline of the gold standard in 1971. The premise here is that if the U.S. had maintained the gold standard, the excesses of the fiat currencies regime could not have arisen.

Read More »

Read More »

The Sphere of Economic Calculation

Economic calculation can comprehend everything that is exchanged against money. The prices of goods and services are either historical data describing past events or anticipations of probable future events. Information about a past price conveys the knowledge that one or several acts of interpersonal exchange were effected according to this ratio. It does not convey directly any knowledge about future prices.

Read More »

Read More »