Tag Archive: newsletter

Has the FED Destroyed the Economy? with Marc Faber

Original Full Interview -

This video is a clip from the WTFinance Podcast Interview with Marc Faber, Editor and Publisher of the ‘’Gloom, Boom & Doom Report’’.

Dr Marc Faber was born in Zurich, Switzerland. He went to school in Geneva and Zurich and finished high school with the Matura. He studied Economics at the University of Zurich and, at the age of 24, obtained a PhD in Economics magna cum laude.

Between 1970 and 1978, Dr Faber worked...

Read More »

Read More »

The morning forex technical report for January 4, 2022

A look from a technical perspective at some of the major currency pairs vs the USD. The USD is lower in trading today, reversing some of the price action seen yesterday.

Read More »

Read More »

Switzerland’s Premier Crypto Conference Returns With a Two-Day Format in Zurich & Davos

Wrapped around the Annual Meeting of the World Economic Forum (WEF), the CryptoSummit.ch will kick off on Monday, 16th January 2023 at the Hyatt Circle Conference Centre at Zurich airport. The second day of the event is set to take place on Friday, 20th January 2023 in Davos.

The theme of CryptoSummit.ch 2023

The theme of the CryptoSummit.ch 2023 is regaining trust in crypto and advancing technology.

It is set to open with the keynote from...

Read More »

Read More »

Central Bankers Are Poor Archers: The Problems and Failures of Inflation Targeting and Price Stability

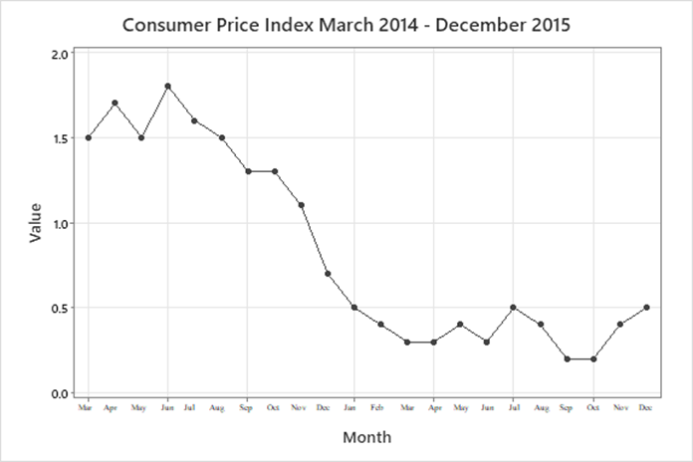

The famous quote, “Insanity is doing the same thing over and over again and expecting different results,” is usually attributed to Albert Einstein. While intended as a parable for quantum insanity, such a quote could equally be a parable for inflation policy. With the Bank of England and the Federal Reserve seeking to maintain target rates of 2 percent, the UK inflation rate has only fallen to 10.7 percent from 11.1 percent.

Read More »

Read More »

WELTÄRZTE CHEF RUTSCHT WAHRHEIT RAUS!

Wirtschaft aktuell: Was passiert jetzt? Jetzt ein Demokonto eröffnen & in Sachwerte kaufen? Negativzinsen durch ein Online Bankkonto umgehen? Macht Forex Trading, CFD Handel und Aktien oder der sichere Hafen Girokonto und Gold Sinn?

Read More »

Read More »

Yesterday’s Gains Unwound may Make the Greenback a Better Buy Ahead of FOMC Minutes

Overview: Yesterday's greenback gains have been

mostly reversed today. New efforts by China in its property market and

anticipation of more stimulus helped rekindle the animal spirits today. Asia

and Europe shrugged off yesterday's losses on Wall Street and the rally in

bonds continued. The 8-12 bp decline in European benchmark 10-year yields comes

even though the final composite PMI was better than expected fanning hopes of a

short and shallow...

Read More »

Read More »

LAST CHANCE: This Entire USA Assets Will Protect American Life Savings

#CharlieMunger #CharlieMungerinflation #CharlieMungereconomy #CharlieMungerinvesting #CharlieMungergold

Read More »

Read More »

The Roundtable Insight – Dr. Marc Faber & Yra Harris on the Economy, Geopolitics and the Investment

Support us on Patreon - https://www.patreon.com/roundtableinsight

http://financialrepressionauthority.com/2023/01/03/the-roundtable-insight-dr-marc-faber-and-yra-harris-on-the-economy-geopolitics-and-the-investment-environment/

Read More »

Read More »

Michael Mross: Mit der Abrissbirne durch Deutschland

#michaelmross #freiheit #untergang #boom #aktien

Michael Mross ist ein bekannter deutscher Börsenexperte, Buchautor, Wirtschaftsjournalist und Moderator.

Read More »

Read More »

DIESE GEBÜHREN ZERSTÖREN DEIN DEPOT ?

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

DIESE GEBÜHREN.... MUSST DU VERMEIDEN! (Trick 17) ?

Gebühren die man vermeiden sollte und die jedem Anleger helfen können. Was Anleger beachten sollten in diesem Video.

#rendite #finanzen #Finanzrudel

? Schmerz ist proportional zur Rendite ►► https://www.sparkojote.ch/der-schmerz-ist-proportional-zur-rendite/...

Read More »

Read More »

Over 50,000 new Swiss companies were founded in 2022

A total of 50,015 companies set up in Switzerland last year thanks to a late surge in the last quarter. The number of new firms entering the marketplace has remained stable. The total corresponds to a drop of 1% compared to 2021 and an increase of 7% compared to 2020, according to data from commercial registers compiled by Help.ch published on Tuesday.

Read More »

Read More »

Die guten Zeiten sind vorbei! ?#shorts

? https://betongoldwebinar.com/yts ?Jetzt Gratis Immobilien-Webinar ansehen!

Gerald Hörhan ist der österreichische Selfmade Multi-Millionär mit Lederjacke und 50+ Millionen EUR Immobilienportfolio, und erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich. Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich schnell...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #31

Gratis Trading-Workshop (Jetzt in 2023 absichern): https://us02web.zoom.us/webinar/register/2216698238673/WN_HGjVPNwDQlCJ34S41vZeyA (jetzt anmelden!)

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht...

Read More »

Read More »

Dirk Müller: Dividenden-Champion BASF – Wird langsam richtig interessant

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Update230103

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Update vom 03.01.2023 auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »

Part 2: Economic Disasters in 2023 – Robert Kiyosaki, @JamesRickardsProject

The U.S. is the world’s largest economy, the dollar is the world’s reserve currency, and today’s guest explains “what happens here, doesn’t stay here.”

James Rickards, author of “Sold Out: How Broken Supply Chains, Surging Inflation, and Political Instability will Sink The Global Economy” says, “We’re heading for a very severe recession.” Rickards explains how Jerome Powell and the Fed’s rate hikes will throw the economy into a recession and by...

Read More »

Read More »

Heute kommen die ersten Marktmover – “DAX Long oder Short?” mit Marcus Klebe – 04.01.23

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

Ferdinando Galiani, an Italian Precursor to the Austrians

The Austrian School of economics did not develop out of thin air. It built upon the work of a number of other economists and philosophers going back as far as Aristotle. Among the precursors of the Austrian School were a number of Spanish and Italian scholastic economists.

Read More »

Read More »