Tag Archive: newsletter

Capitalism Has Improved Life in India, but the Spirit of Collectivism Still Dominates

In 1991, India's political leaders moved away from socialism, embracing markets and improving the economy. But Indian elites continue to push socialism to the detriment of the people.

Original Article: "Capitalism Has Improved Life in India, but the Spirit of Collectivism Still Dominates"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Roald Dahl and James Bond Books Are Getting Woke Rewrites. Copyright Law Ensures You Can’t Stop Them.

The estate of Roald Dahl this month announced that it would be rewriting many of the long-dead author’s books to better suit a “modern” audience. Translation: The books will be rewritten so the text is more in line with the editors’ notions of politically correct language.

As a parent of four children, I’ve read my share of Roald Dahl books over the years, although I wouldn’t consider myself an especially big fan. Yet it’s hard to imagine what is...

Read More »

Read More »

DIE UKRAINER WERDEN ALS KANONENFUTTER MISSBRAUCHT…

NEUER GRATIS TRADING WORKSHOP (3. - 5. März 2023):

? https://us02web.zoom.us/webinar/register/9216758012881/WN_XKE_2oV-QjWsy2PgXG8xDQ

Jetzt anmelden!! Plätze begrenzt...

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

Inhaltsverzeichnis:

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf...

Read More »

Read More »

Wenn ich JETZT nur einen ETF kaufen dürfte!

► Sichere Dir meinen Report, mit Tipps zu Gold, Aktien, ETFs - 100% gratis: http://lars-erichsen.de/

► NEU: Gewinne von bis zu +170%… Mein exklusives Lars-Erichsen-Depot: https://www.rendite-spezialisten.de/video/depot/

Dann stellen wir mir doch einfach mal genau diese Aufgabe: Du darfst nur einen einzigen ETF kaufen. Glücklicherweise müsste ich nicht lange überlegen, ich wüsste ganz genau, welcher es wäre. Warum, weshalb und welcher, das verrate...

Read More »

Read More »

Loss of Religious Belief Is a Greater Loss for a Civilized Society

There has been a noticeable decline in the percentage of Americans identifying as religious. Some perceive this seismic shift as evidence of a secularizing culture. In some quarters, the secularization of America is viewed favorably as an agent of modernization. But researchers are theorizing that the erosion of religious beliefs portends negative consequences for society because religion cultivates meaningful social relationships by nurturing a...

Read More »

Read More »

Angriff auf Sahra Wagenknecht! ARD verliert die Nerven!

Sahra Wagenknecht wird für ihre "Manifest des Friedens" Kampagne zusammen mit Alice Schwarzer aktuell hart angegriffen. Auch wenn ich inhaltlich anderer Meinung bin als Sahra Wagenknecht, möchte ich mich hiermit deutlich von der Diffamierung gegenüber ihrer Person und auch gegenüber Personen, die an solchen Demos teilnehmen distanzieren.

? Kostenloses ► http://link.aktienmitkopf.de/Depot *

??5 Euro Startbonus bei Bondora ►►...

Read More »

Read More »

CO2 Sensor mit ESP32, ULP, SCD40 und E-Ink-Display

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Ist #CO2 gut oder schlecht? Die Frage will ich nicht beantworten. Es ist manches Mal gut und manches Mal schlecht. Die meisten Menschen wissen gar nicht, wie viel CO2 wir in der #Atmosphäre haben. Ich weiß es bei der Außenluft. Aber in der Raumluft?

Heute stelle ich ein besonderes CO2-Messgerät vor.

Dokumentation ► https://github.com/davidkreidler/OpenCO2_Sensor

Kauf ►...

Read More »

Read More »

Amerikanische Börse im TAUCHGANG! | Blick auf die Woche | KW 09

Droht die laufende Korrektur nun sogar zur Trendwende zu mutieren? Die amerikanischen Indizes setzten in der vergangenen Handelswoche zum Tauchgang an und sanken unter die 200-Tage-Linie ab.

Aber wie sieht es am deutschen Aktienmarkt aus? Besteht hier auch die Gefahr des Abtauchens?

► Sichere dir Marios Watchliste der trendstärksten Aktien zum Traden für nur 1 € im Test: https://mariolueddemann.com/screeningdienst/

► Lerne vom Börsenexperten wie...

Read More »

Read More »

Covid-19: Will the Political and Health Scandals Erupt into the Public Light?

Three years after the covid virus hit the world, we are just starting to take a hard look at the damage caused by the covid restrictions. The "experts" not only were wrong; they were scandalously wrong.

Original Article: "Covid-19: Will the Political and Health Scandals Erupt into the Public Light?"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

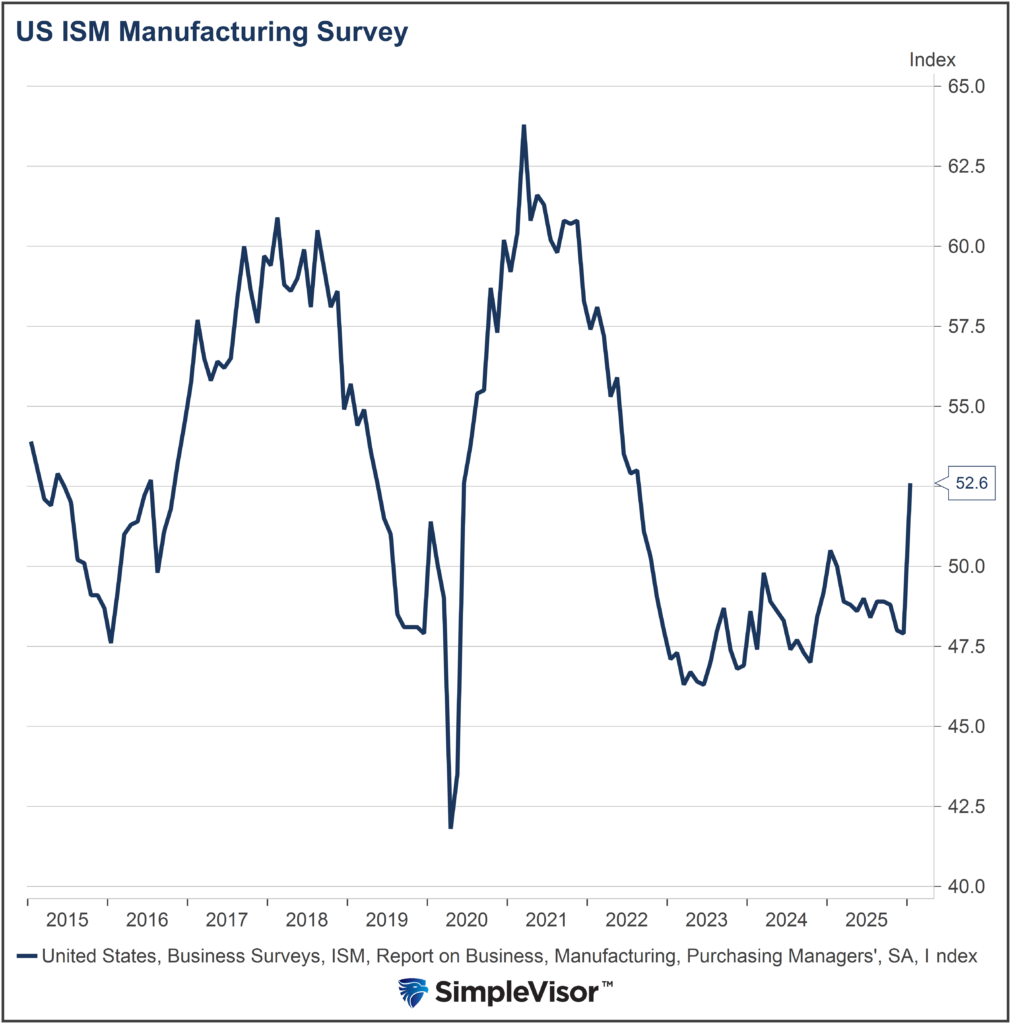

Sellable Rally? (2/27/23): Market Analysis & Commentary from RIA Advisors Chief Investment Strate…

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Upcoming personal finance free online events:

https://riaadvisors.com/events/

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/

➢ RIA SimpleVisor: Analysis, Research, Portfolio Models, and More....

Read More »

Read More »

Is Democracy under Attack in Canada? No, but It Should Be

When the legacy media tells you that democracy is under attack in Canada, don’t believe it. Democracy is alive and well, working exactly as it was designed to work, which is to benefit the political class and their friends at the expense of average citizens who still believe that their vote actually means something. This is consistent with how democracy works in most democratic countries. Professors Martin Gilens and Benjamin Page tell us:

The...

Read More »

Read More »

Markets Catch Collective Breath

Overview: After last week's flurry of activity that saw the US

dollar extend its recovery, it has begun off the new week largely consolidating

in relatively narrow ranges. The Australian and New Zealand dollar's remains

softer, and the Swiss franc is virtually flat, but the other G10 currencies,

led by sterling are posting small gains. A break-through on the Northern

Ireland protocol, which has been rumored for a more than a week may be

announced...

Read More »

Read More »

CORONA aus dem Labor? (USA Ergebnis geändert!)

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

Switzerland: Still a bright beacon of freedom

Switzerland’s long-standing and well-deserved reputation as one of the last bastions of individual and financial liberty has been recently vindicated and reaffirmed. It was a much-needed boost of confidence for Swiss citizens like myself who had come to worry over the last years whether the governmental trespasses of our neighboring nations and the way they rule their people might one day come to influence or even corrupt our own system of...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #64

NEUER GRATIS TRADING WORKSHOP (3. - 5. März 2023):

? https://us02web.zoom.us/webinar/register/9216758012881/WN_XKE_2oV-QjWsy2PgXG8xDQ

Jetzt anmelden!! Plätze begrenzt...

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram:...

Read More »

Read More »

Steigende Vola sollte anhalten im DAX – “DAX Long oder Short?” mit Marcus Klebe – 27.02.23

HIER geht´s direkt Zur Webinar-Serie: Traden mit kleinem Konto

https://register.gotowebinar.com/register/3876278094922468952?source=mk

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international...

Read More »

Read More »