Tag Archive: Murray Rothbard

Cantillon effect: Who’s paying the highest price?

Every time we hear government officials announce their big spending plans, their new welfare programs and their ambitious “job creating” schemes, they always present them as being in defense of the poorest and the most marginalized members of our societies. In coordination with their central bankers, they print and spend new money at will, claiming that it is all for the benefit of the weakest among us and that all the freshly created funds will...

Read More »

Read More »

Gold Is Money – Everything Else Is Credit – J.P. Morgan – Part II

Rafi Farber, pen name Austrolib, is the publisher of The End Game Investor, a daily market commentary written from an Austrian economics perspective focusing on precious metals, the Comex, and monetary analysis. His work is followed by leaders in the precious metals industry including Eric Sprott. He also writes a weekly column on the gaming industry at CalvinAyre.

Read More »

Read More »

The Forgotten Greatness of Rothbard’s Preface to Theory and History

Anyone who advocates the ideas of the Austrian school of economics, whether broadly and publicly or even in the context of private discussions with friends and acquaintances, will almost immediately find themselves grappling with the tricky question of how to distill the core essence of what Austrian economics actually is, and how to convey those truly definitive characteristics as briefly and simply as possible.

Read More »

Read More »

Why Good Economics Matters Now More Than Ever

In a newsletter published in 1970, economist Murray Rothbard wrote, “It is no crime to be ignorant of economics, which is, after all, a specialized discipline and one that most people consider to be a ‘dismal science.’ But it is totally irresponsible to have a loud and vociferous opinion on economic subjects while remaining in this state of ignorance.”

Read More »

Read More »

Money Creation and the Boom-Bust Cycle

A Difference of Opinions, In his various writings, Murray Rothbard argued that in a free market economy that operates on a gold standard, the creation of credit that is not fully backed up by gold (fractional-reserve banking) sets in motion the menace of the boom-bust cycle.

Read More »

Read More »

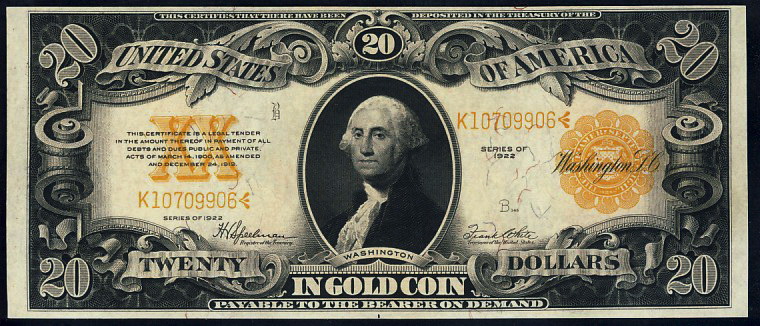

Why a “Dollar” Should Only Be a Name for a Unit of Gold

Once Upon a Time… Prior to 1933, the name “dollar” was used to refer to a unit of gold that had a weight of 23.22 grains. Since there are 480 grains in one ounce, this means that the name dollar also stood for 0.048 ounce of gold. This in turn, means that one ounce of gold referred to $20.67.

Read More »

Read More »

Why Profitability Matters and Market Forces Are Not Random

The tenets of the Efficient Market Hypothesis and Modern Portfolio Theory. It is widely held that financial asset markets always fully reflect all available and relevant information, and that adjustment to new information is virtually instantaneous.

Read More »

Read More »

Is the Economy a Machine?

A Science Goes Astray Human beings have a strong tendency to look for patterns. The natural sciences have shown that the universe is governed by laws, the effects of which are observable and measurable in an objective manner. Mostly, anyway — there...

Read More »

Read More »

What Can Gold Do for Our Money?

One of the chief virtues of a gold standard is that it serves as a restraint on the growth of money and credit. It makes runaway government deficit spending and major monetary catastrophes such as hyperinflation practically impossible.

Read More »

Read More »

Trump’s Biggest Deal

A reader asks Bill Bonner "Trump is the only candidate that might have a chance to get us out of the financial and economic mess the United States is in." Is he really?

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet!

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet! -

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”!

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”! -

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan -

Robert Fico stellt Ultimatum an Selenski: “In 12 Stunden ist dein Strom weg!”

Robert Fico stellt Ultimatum an Selenski: “In 12 Stunden ist dein Strom weg!” -

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

Wie du 100 € skalierst und wirklich unabhängig wirst

Wie du 100 € skalierst und wirklich unabhängig wirst -

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby -

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt! -

Galaktische Gewinne – die besten Ideen des Weltraum-Kapitalisten

Galaktische Gewinne – die besten Ideen des Weltraum-Kapitalisten

More from this category

- Cantillon effect: Who’s paying the highest price?

6 Apr 2022

Gold Is Money – Everything Else Is Credit – J.P. Morgan – Part II

Gold Is Money – Everything Else Is Credit – J.P. Morgan – Part II11 Nov 2020

The Forgotten Greatness of Rothbard’s Preface to Theory and History

The Forgotten Greatness of Rothbard’s Preface to Theory and History25 Jun 2020

Why Good Economics Matters Now More Than Ever

Why Good Economics Matters Now More Than Ever2 May 2017

Money Creation and the Boom-Bust Cycle

Money Creation and the Boom-Bust Cycle12 Jan 2017

Why a “Dollar” Should Only Be a Name for a Unit of Gold

Why a “Dollar” Should Only Be a Name for a Unit of Gold27 Jul 2016

Why Profitability Matters and Market Forces Are Not Random

Why Profitability Matters and Market Forces Are Not Random12 Jul 2016

Is the Economy a Machine?

Is the Economy a Machine?26 May 2016

Trump’s Biggest Deal

Trump’s Biggest Deal17 May 2016