Tag Archive: MMT

Modern Monetary Theory: Reality check

I’ve written extensively over the past years about the rise of Modern Monetary Theory (MMT) and all the terrible dangers it entailed from its very birth, not just for our economies, but for our societies too. Although it captured media interest and monopolized a lot of “expert” debates at the time, one wouldn’t be blamed for thinking it was merely a “flash in the pan”, just another crazy idea that the establishment entertained for a while to...

Read More »

Read More »

The far-reaching impact of the US election

The 2020 election was a roller coaster experience for both sides and for all International observers who understood its massive economic and geopolitical implications for the rest of the West.

Read More »

Read More »

US election: Red flags for investors

Outlook and wider impact. As showcased during the debates and in the entire campaign rhetoric, politicians in the US but also in Europe, are solely focused on promoting solutions that only serve to paper over the problems and address the symptoms of the disease.

Read More »

Read More »

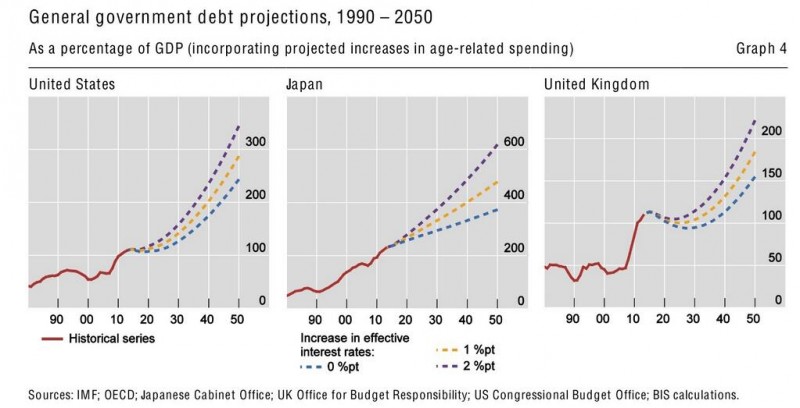

Modern Monetary Theory is an old Marxist Idea

Modern Monetary Theory, or “MMT”, has been getting a lot of attention lately, often celebrated as a revolutionary breakthrough. However, there is absolutely nothing new about it. The very basis of the theory, the idea that governments can finance their expenditures themselves and therefore deficits don’t matter, actually goes back to the Polish Marxist economist, Michael Kalecki (1899 – 1970).

Read More »

Read More »

Cool Video: Fed’s Independence Challenged and Defended

I was on the set Fox Business set this afternoon talking with Charles Payne and Quincy Krosby about Fed policy. Payne suggested that both the political left and right are trying to politicize the Federal Reserve to print money for their favorite programs.

Read More »

Read More »

Heterodox Economic Theories and GDP

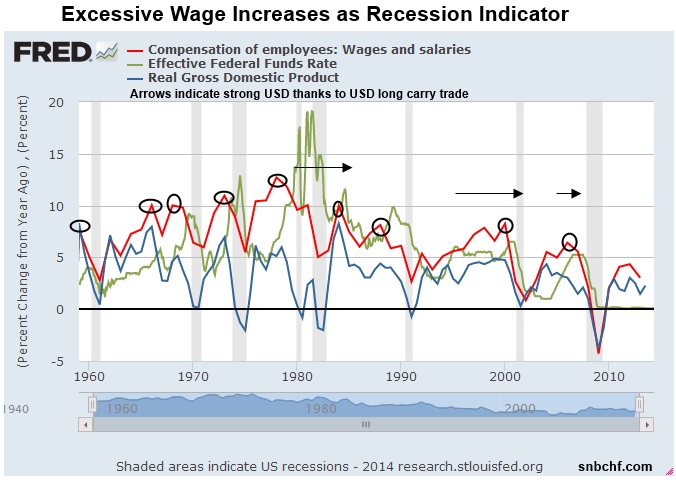

Heterodox economic theories focus on the human desires to spend, to save, to obtain credit in order to anticipate spending and future earnings, to increase or to reduce debt or even to deplete existing savings, on human behaviour. Those theories neither think that humans are rational nor that markets are efficient.

Read More »

Read More »

Why was the gold price so low in 1999/2000?

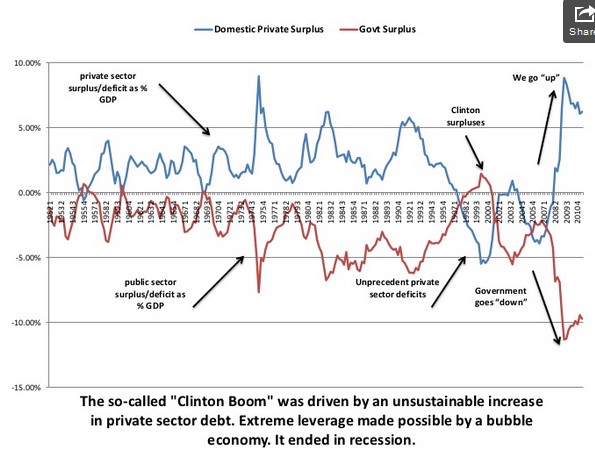

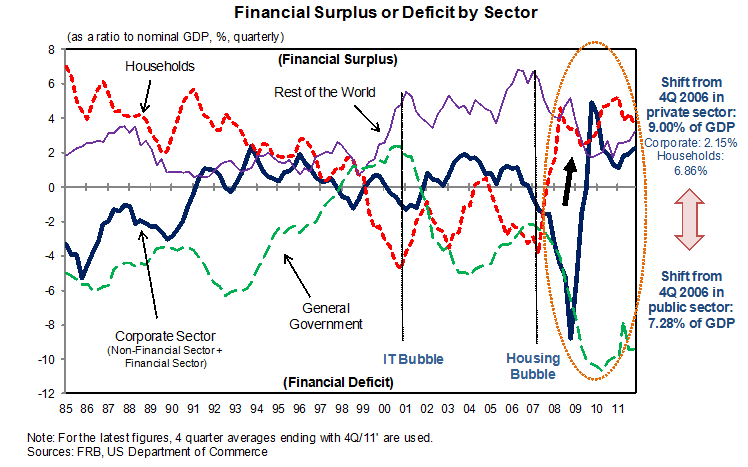

To find further explanations as to why the gold price was weak in the late 1990s we analyze sector balances. Effectively private spending and private debt went in two different directions: a heavy increase in private spending and debt in the US against less growth in private spending and less debt in the rest of world. This combination fostered GDP growth in the US and weakened it in other countries. Real interest rates were positive. Markets...

Read More »

Read More »

Inflation Expectations = Real GDP Growth = Ten-Year Treasury Yields – 0.5%?

Inflation expectations drive the Fed's and markets behaviour. Bond yields adjust, often but not always, with an inflation premium against short-term rates.

Read More »

Read More »

What Drives Government Bond Yields, Part2: Emerging Markets and Recent Discussions

Two additional criteria important for Emerging Markets: High foreign debt, a weak net investment position and a current account deficit increases government bond yields.

Read More »

Read More »

7d) Richard Koo’s and other Sector Balances

A list of long-term sector balances and related provided by Nomura's research institute and its chief economist Richard Koo.

Read More »

Read More »