Tag Archive: Insurance Companies

When Health Insurance Works: A Look Inside Switzerland’s Healthcare System

The enigmatic independence of Switzerland is perhaps best demonstrated in the fact that its healthcare system manages to satisfy both free marketers and the statist-socialists in the country. It is a giant social safety net woven by individual responsibility and self-made wealth. Health insurance is almost entirely consumer-based, though there are strict cantonal regulations and some governing federal laws.

Read More »

Read More »

Can Switzerland Survive Today’s Assault On Cash And Sound Money?

“Switzerland will have the last word,” wrote Victor Hugo in the late 19th century. “It possesses one of the most perfect forms of government in the world.” A contemporary of his, Frederick Kuenzli, a scholar of the Swiss Army, boasted: “No purer type of Republican ideals, no more fixed and devoted adherence to those ideals can be found in all the world than in Switzerland.”

Read More »

Read More »

Will Ireland Be First Country In World To See Bail-in Regime?

Deposit bail-in risks are slowly being realised in Ireland, after it emerged overnight that FBD, one of Ireland's largest insurance companies, have been moving cash out of Irish bank deposits and into bonds.

Read More »

Read More »

The World’s Central Banks Are Making A Big Mistake

While everyone was talking about Brexit last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national governments.

Read More »

Read More »

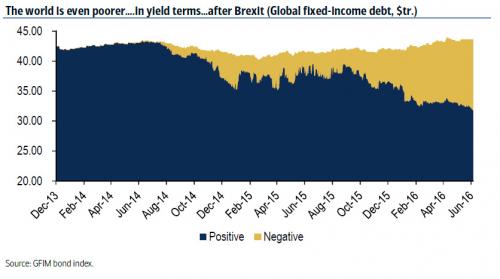

There Is Now A Staggering $11.7 Trillion In Negative Yielding Debt

It was not even a month ago when we last looked at the total amount of negative yielding debt around the globe, and were shocked to find that according to Fitch, for the first time in history (obviously), there was over $10 trillion in negative yielding debt. Fast forward 4 weeks later, and the grand total is now $1.3 trillion higher, or $11.7 trillion.

Read More »

Read More »

The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers.

Read More »

Read More »