Tag Archive: inflation

Good Time To Go Fish(er)ing Around The Yield Curve

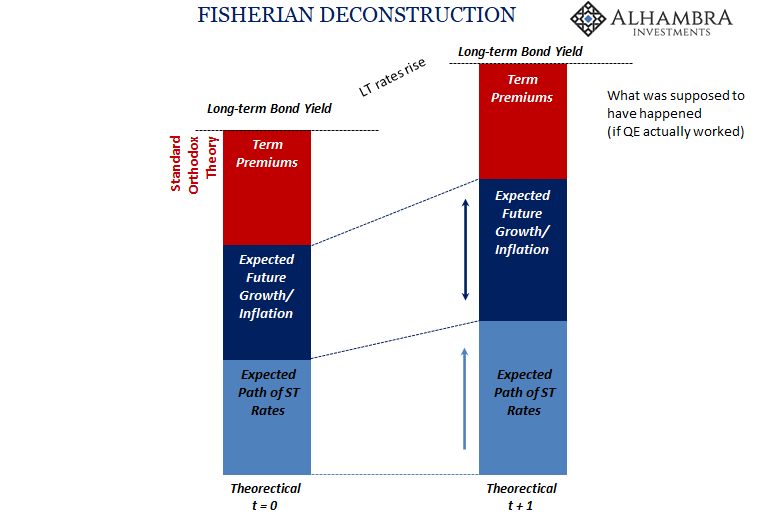

It should be as simple as it sounds. Lower LT UST yields, less growth and inflation. Thus, higher LT UST yields, more growth and inflation. Right? If nominal levels are all there is to it, then simplicity rules the interpretation. Visiting with George Gammon last week, he confessed to committing this sin of omission.

Read More »

Read More »

Weekly Market Pulse: A Very Contrarian View

What is the consensus about the economy today? Will 2022 growth be better or worse than 2021? Actually, that probably isn’t the right question because the economy slowed significantly in the second half of 2021. The real question is whether growth will improve from that reduced pace.

Read More »

Read More »

US CPI Reaches Seven On US Goods Prices, With Disinflation Setting In Everywhere Else (incl. US Services)

How is that US Treasury rates out in the independent longer end of the yield curve have now “suffered” a seven percent CPI to go along with double taper and triple maybe quadruple (if the whispers are to be believed) rate hikes this year, yet have weathered all of that allegedly bond-busting brutality with barely a market fluctuation?

Read More »

Read More »

How the Market Responds to US CPI may set the Near-Term Course

Overview: US stocks built on the recovery started on Monday and Powell's suggestion of letting the balance sheet shrink later this year eased some speculation of a fourth hike this year, which seemed to allow the Treasury market to stabilize.

Read More »

Read More »

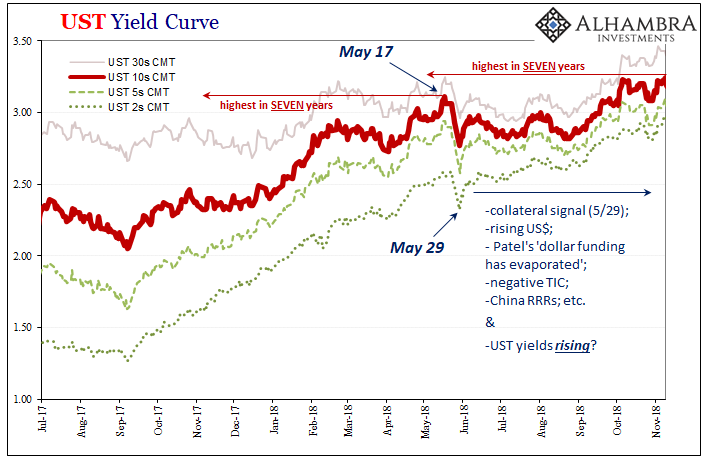

Conflict Of Interest (rates): 10-year Treasury Yield Highest in Almost Two Years

The dollar was high and going higher. Emerging markets had been seriously complaining. In one, the top central banker for India outright warned, “dollar funding has evaporated.” The TIC data supported his view, with full-blown negative months, net selling from afar that’s historically akin to what was coming out of India and the rest of the world.

Read More »

Read More »

Inflation and Geopolitics in the Week Ahead

The Omicron variant may be less fatal than the earlier versions, but it is disrupting economies. The surge in the Delta variant well into Q4 in the US and Europe was already slowing the recoveries. Investors will likely take the high-frequency real sector data with the proverbial pinch of salt until January data available beginning later this month.

Read More »

Read More »

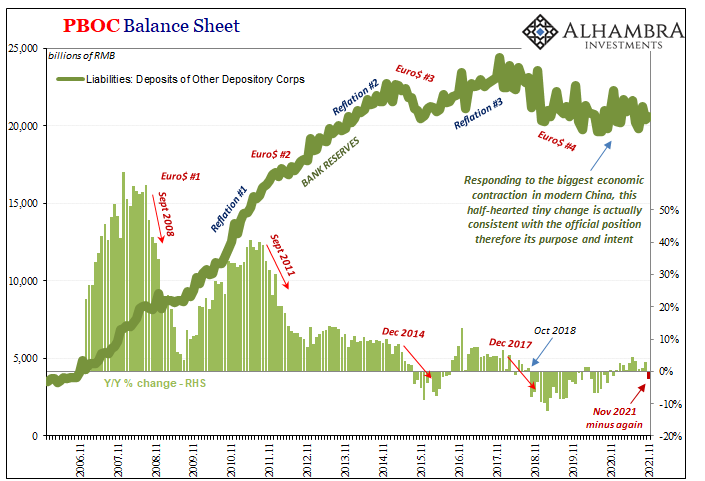

The Historical Monetary Chinese Checklist You Didn’t Know You Needed For Christmas (or the Chinese New Year)

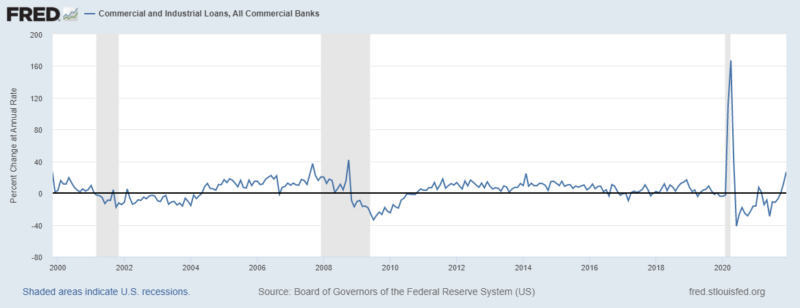

If there is a better, more fitting way to head into the Christmas holiday in the United States than by digging into the finances and monetary flows of the People’s Bank of China, then I just don’t want to know what it is. Contrary to maybe anyone’s rational first impression that this is somehow insane, there’s much we can tell about the state of the world, the whole world and its “dollars”, right from this one key data source.

Read More »

Read More »

Start Long With The (long ago) End of Inflation

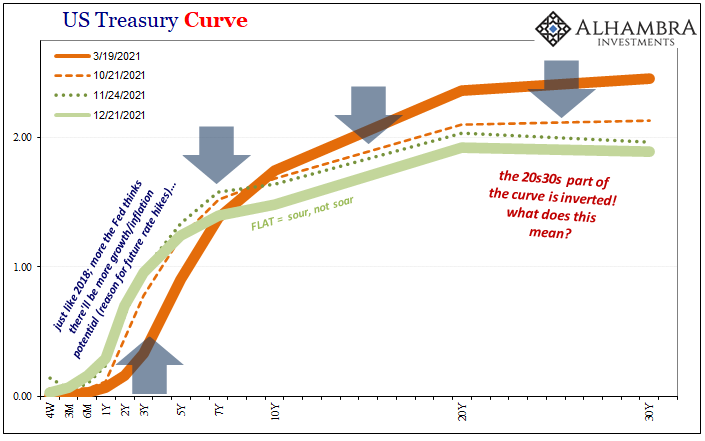

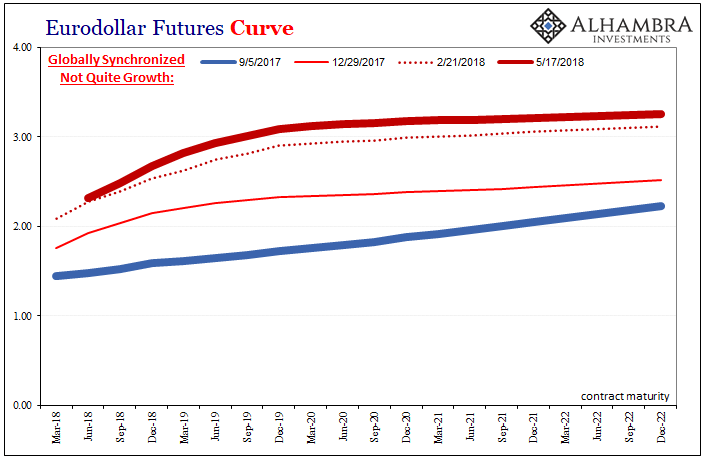

With the eurodollar futures curve slightly inverted, the implications of it are somewhat specific to the features of that particular market. And there’s more than enough reason to reasonably suspect this development is more specifically deflationary money than more general economic concerns.

Read More »

Read More »

One Shock Case For ‘Irrational Exuberance’ Reaching A Quarter-Century

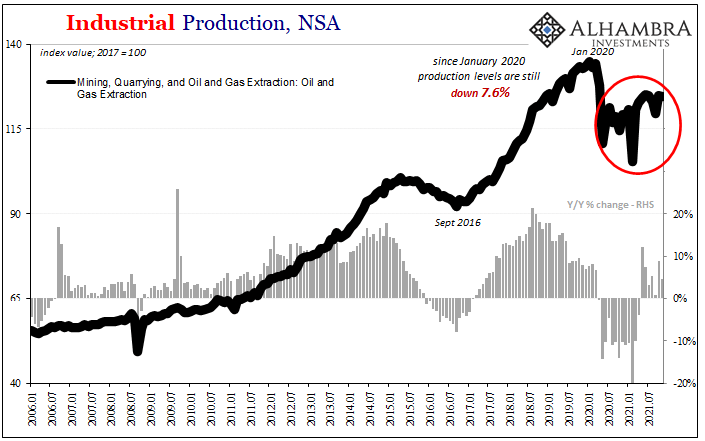

Have oil producers shot themselves in the foot, while at the same time stabbing the global economy in the back? It’d be quite a feat if it turns out to be the case, one of those historical oddities that when anyone might honestly look back on it from the future still hung in disbelief. Let’s start by reviewing just the facts.

Read More »

Read More »

The Chagrin of Beijing and the Problem of Time

The central bank meeting cycle is over. Most of the important high-frequency data has been released until early January. The US debt ceiling has been lifted, avoiding an improbable default. A year ago, there was a sense of optimism, with a couple of vaccines being announced and monetary and fiscal stimulus boosting risk-appetites. Populism, which had been in the ascendancy after the Great Financial Crisis, seemed to be retreating in Europe and the...

Read More »

Read More »

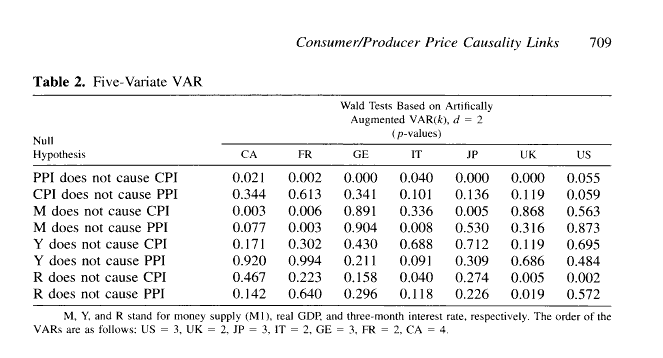

Testing The Supply Chain Inflation Hypothesis The Real Money Way

Basic intuition says this is a no-brainer. Producer prices rise, businesses then pass along these higher input costs to their customers in the form of consumer price “inflation” so as to preserve profits. This is the supply chain hypothesis. Statistically, we’d therefore expect the PPI to lead the CPI.And this was expected for much of Economics’ history, taken for granted as one of those self-evident truths (kind of like the Inflation Fairy). After...

Read More »

Read More »

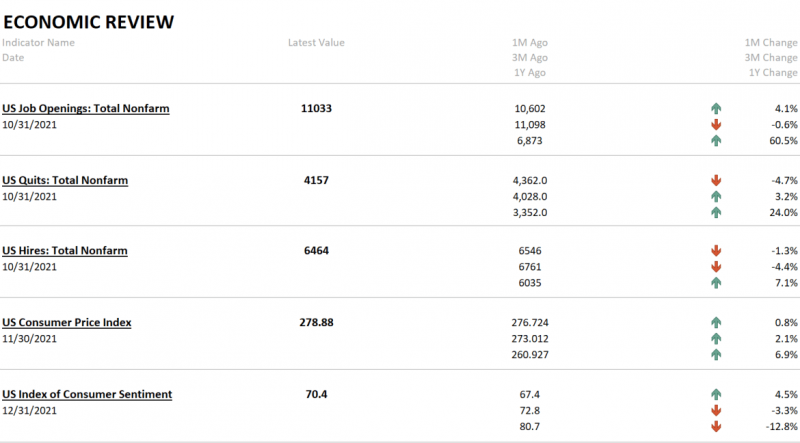

Weekly Market Pulse: Has Inflation Peaked?

The headlines last Friday were ominous: Inflation Hits Highest Level in Nearly 40 Years. Inflation is Painfully High… Groceries and Christmas Presents Are Going To Cost More. Inflation is Soaring..

Read More »

Read More »

Yuan Rises Despite China’s Move and the Fed’s Course is Set Regardless of Today’s CPI

Overview: After US equity indices posted their first loss of the week, Asia Pacific and European equities fell. While the MSCI Asia Pacific Index fell for the first time since Monday, Europe's Stoxx 600 is posting its third consecutive decline. US futures are trading slightly firmer. The US 10-year Treasury yield is up about 1.5 bp to 1.51%, which is about eight basis points higher than it settled last week when the sharp drop in equities saw...

Read More »

Read More »

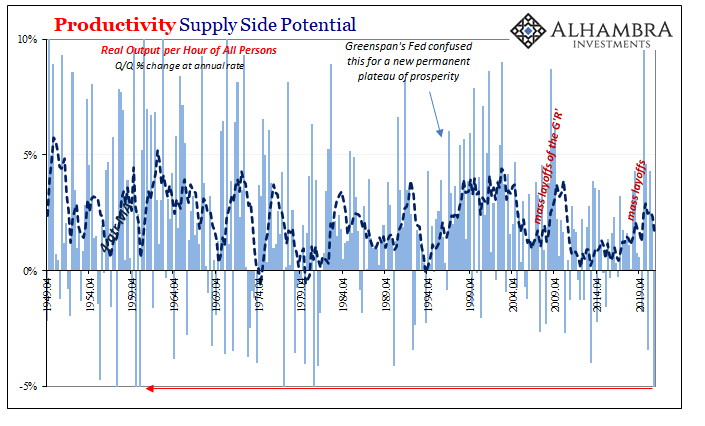

The Productive Use Of Awful Q3 Productivity Estimates Highlights Even More ‘Growth Scare’ Potential

What was it that old Iowa cornfield movie said? If you build it, he will come. Well, this isn’t quite that, rather something more along the lines of: if you reopen it, some will come back to work. Not nearly as snappy, far less likely to sell anyone movie tickets, yet this other tagline might contribute much to our understanding of “growth scare” and its affect on the US labor market.

Read More »

Read More »

US CPI to Accelerate, while Omicron adds Color to Covid Wave that was Already Evident

At the risk of over-simplifying, there seem to be three sources of dynamism in the investment climate: Covid, the Federal Reserve, and market positioning. The last of these is often not given its due in narratives in the press and market commentary, so let's begin there. The anthropologist Clifford Gertz once posed the question about distinguishing between someone winking and someone with a twitch in their eye, and a person mimicking the wink or...

Read More »

Read More »

The Greenback Finds Traction ahead of the Jobs Report

Overview: The Omicron variant has been detected in more countries, but the capital markets are taking it in stride. Risk appetites appear to be stabilizing. The MSCI Asia Pacific Index rose for the third consecutive session, though Hong Kong and Taiwan markets did not participate in the advance today. Europe's Stoxx 600 is struggling to hold on to early gains, while US futures are narrowly mixed. The US 10-year yield is a little near 1.43%,...

Read More »

Read More »

This Is A Big One (no, it’s not clickbait)

Stop me if you’ve heard this before: dollar up for reasons no one can explain; yield curve flattening dramatically resisting the BOND ROUT!!! everyone has said is inevitable; a very hawkish Fed increasingly certain about inflation risks; then, the eurodollar curve inverts which blasts Jay Powell’s dreamland in favor of the proper interpretation, deflation, of those first two.

Read More »

Read More »

Pessimistic Omicron Assessment Squashes Risk Appetites

Overview: A pessimistic assessment offered by the CEO of Moderna shattered the fragile calm seen yesterday after the pre-weekend turmoil. Risk appetites shriveled, sending equity markets lower and the bond markets higher. Funding currencies rallied, with the euro and yen moving above last week's highs. The uncertainty weighs on sentiment and makes investors question what they previously were certain of. The MSCI Asia Pacific Index fell over 1%...

Read More »

Read More »

Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes

2022-01-09

by Stephen Flood

2022-01-09

Read More »