Tag Archive: Growth

USD Looks Oversold on Intraday Basis Ahead of a Possible Risk-Off North American Session

Overview: The US dollar is trading lower against most

currencies, but the intraday momentum indicators are stretched, suggesting the

selling pressure may not be sustained through in North America today. December

US personal income and consumption data was contained in yesterday's Q4 23 GDP

data, but the market want to see the monthly print, which is expected to see

the core measure ease with the headline rate flat. Tokyo's January CPI was much...

Read More »

Read More »

China Surprises While the Dollar Begins Week Softer

Overview: The new week, which features the BRICS

meeting and the Jackson Hold symposium is off to a quiet start. The failure of

Chinese banks to pass through last week's 15 bp cut fully into the lending

prime rates was a major disappointment and it is not yet clear the logic. While

the yuan and yen are softer, as are more local Asian currencies, while most of

the G10 currencies are posting small gains against the greenback. Gold is

trading little...

Read More »

Read More »

Week Ahead: More Evidence US Consumption and Output are Expanding, and RBNZ and Norges Bank to Hike

After two-quarters of contraction, many still do not accept that the US economy is in a recession. Federal Reserve officials have pushed against it, as has Treasury Secretary Yellen. The nearly 530k rise in July nonfarm rolls, more than twice the median forecast in Bloomberg's survey, and a new cyclical low in unemployment (3.5%) lent credibility to their arguments. If Q3 data point to a growing economy, additional support will likely be...

Read More »

Read More »

Macro and Prices: Sentiment Swings Between Inflation and Recession

(On vacation for the rest of the month. Going to Portugal. Commentary will resume on June 1. Good luck to us all.) The market is a fickle mistress. The major central banks were judged to be behind the inflation curve.

Read More »

Read More »

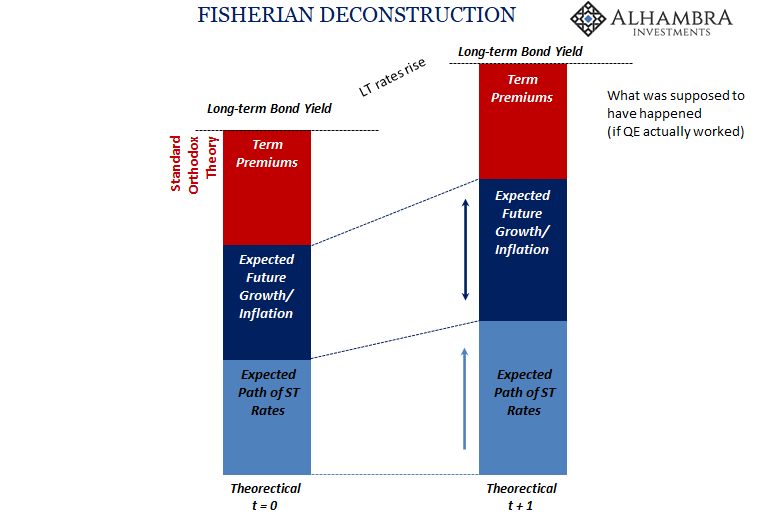

Good Time To Go Fish(er)ing Around The Yield Curve

It should be as simple as it sounds. Lower LT UST yields, less growth and inflation. Thus, higher LT UST yields, more growth and inflation. Right? If nominal levels are all there is to it, then simplicity rules the interpretation. Visiting with George Gammon last week, he confessed to committing this sin of omission.

Read More »

Read More »

The Chagrin of Beijing and the Problem of Time

The central bank meeting cycle is over. Most of the important high-frequency data has been released until early January. The US debt ceiling has been lifted, avoiding an improbable default. A year ago, there was a sense of optimism, with a couple of vaccines being announced and monetary and fiscal stimulus boosting risk-appetites. Populism, which had been in the ascendancy after the Great Financial Crisis, seemed to be retreating in Europe and the...

Read More »

Read More »

US Retail Sales and Industrial Output to Accelerate; China not so Much

At the halfway point of Q4, the markets' focus is on three things: inflation, growth, and central banks' response. With US and Chinese October inflation readings behind us, the focus shifts to the real economy's performance, the world's two largest economies reporting retail sales and industrial production figures. Helped by stronger auto sales, the first increase in six months, US retail sales likely turned in another solid showing of around...

Read More »

Read More »

Week Ahead: The First Look at US and EMU Q3 GDP and more Tapering by the Bank of Canada

The macro highlights for the week ahead fall into three categories. First are the preliminary estimates for Q3 GDP by the US and the EMU. Second, are the inflation reports by the same two. The US sees the September PCE deflator, which the Fed targets, while the eurozone releases the first estimate for October CPI. Third are the meetings of three G7 central banks, the BOJ, the ECB, and the Bank of Canada. The broad backdrop includes softening...

Read More »

Read More »

FX Daily, April 29: US GDP: The V

Overview: The market's initial reaction to the Federal Reserve statement and the press conference was that it was dovish: the 10-year yield slipped, and the dollar was sold to new lows. In fact, the two countries that appear to be ahead of the curve among high-income countries, Canada and Norway, saw their currencies rally to new three-year highs.

Read More »

Read More »

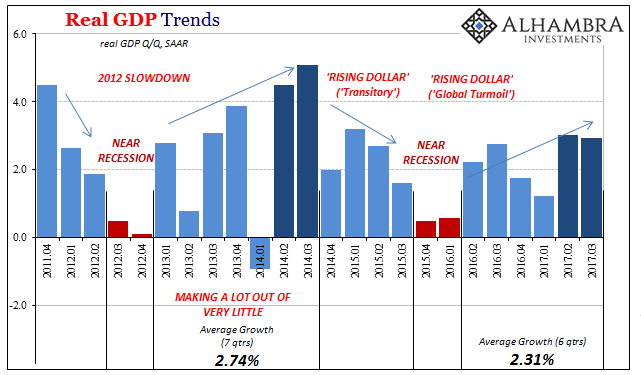

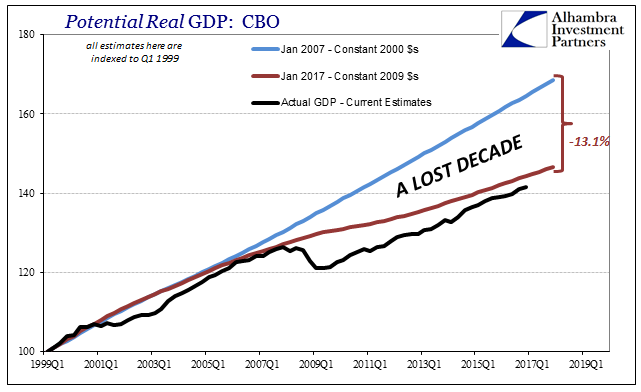

Strong Growth? Q3 GDP Only Shows How Weak 2017 Has Been

Baseball Hall of Famer Frank Robinson also had a long career as a manager after his playing days were done. He once said in that latter capacity that you have to have a short memory as a closer. Simple wisdom where it’s true, all that matters for that style of pitching is the very next out. You can forget about what just happened so as to give your full energy and concentration to the batter at the plate.

Read More »

Read More »

Great Graphic: Selected GDP Performance since 2008 and Policy

This Great Graphic was tweeted by Martin Beck, and it comes from Oxford Economics, using Haver Analytics database. It shows the relative economic growth since 2008 for the US, UK, Japan, and EMU.

Read More »

Read More »

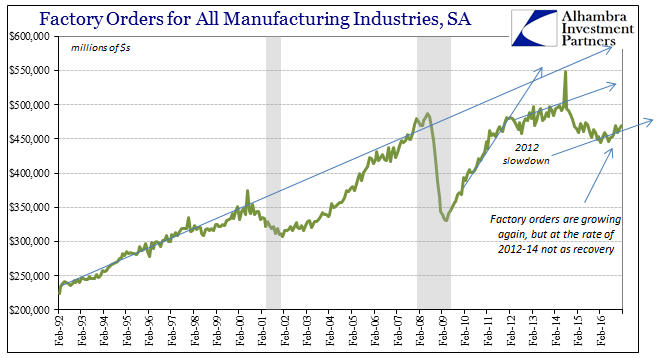

Manufacturing Back To 2014

The ISM Manufacturing PMI registered 57.7 in February 2017, the highest value since August 2014 (revised). It was just slightly less than that peak in the 2014 “reflation” cycle. Given these comparisons, economic narratives have been spun further than even the past few years where “strong” was anything but.

Read More »

Read More »

The Stinking Politics of It All

It is largely irrelevant, but still the political theater is fascinating. As is now standard operating procedure, whatever comes out of the Trump administration immediately is conferred as the standard for awful. This is not my own determination, mind you, but that of the mainstream, whatever that is these days. And so it is with the first set of budget figures that include very robust growth projections, a point of contention and an obvious one...

Read More »

Read More »

US GDP Misses, but Final Domestic Sales Accelerate

Net exports was a large drag on growth. Inventories flattered growth. Underlying signal, final domestic demand, increased 2.5% after 2.1% in Q3.

Read More »

Read More »

Some Thoughts on Q3 US GDP

US Q3 was revised higher mostly due to consumption. Business investment was a drag. Profits rose to snap a five-quarter slide.

Read More »

Read More »

Yellen and Fischer Still Singing from the Same Song Book

Many see Yellen and Fischer at odds over benefits of high pressure economy. However, this fails to put the comments in the proper context--same message different styles. They are arguing against the doves who don't want to hike this year.

Read More »

Read More »

Demographics and a New Old Paradigm

The hangover from the debt crisis and secular stagnation are the two main explanatory models for the low growth and low interest rates. Anew Fed paper brings the focus back to demographics. If true, warns of a protracted period of slow growth, low interest rates.

Read More »

Read More »