Tag Archive: Gold

2024 outlook: Gold Shines Bright in the Gathering Storm

The year 2024 is poised to be a critical period for the global economy and it already appears to be fraught with economic and geopolitical challenges, casting a dark shadow over the global landscape. Signs of a looming economic downturn are becoming increasingly evident and the many challenges we faced over the past year will certainly remain with us for many months to come.

Economic and monetary landscape

Central bankers in most advanced...

Read More »

Read More »

2023: A year in review

After the catastrophic covid crisis of 2020 and 2021, the extremely impactful and consequential Russian invasion of Ukraine in 2022, many hoped that 2023 would break this terrible bad spell and finally present us all with some hope, economically, geopolitically, socially, technologically. Unfortunately, it only offered further reasons for serious concerns on all these fronts.

Economically, even though the official inflation rate followed a...

Read More »

Read More »

War is the health of the State

Part I of II by Claudio Grass

For any reasonably well read adult, any amateur student of history or any responsible citizen for that matter, the idea that ”war is the health of the State” should be adjacent to a truism. After all, literally nobody benefits from violence and bloodshed apart from those at the heart of any State that is directly or indirectly involved and their cronies. In fact, the more horrific the violence and the more...

Read More »

Read More »

“Sound money must be anchored to and backed by real, tangible assets”

Dani Stüssi interview with Claudio Grass

Over the last few years, the financial woes and daily pressures that have been unleashed upon the average citizen, saver and taxpayer have put the spotlight on money itself. Countless ordinary people who have otherwise never seriously pondered these questions, began to question basic principles like: what makes their paycheck shrink from month to month, what or who actually responsible of it and what,...

Read More »

Read More »

Weekly Market Pulse: Monetary Policy Is Hard

So, is that it? Have rates peaked? Is the long bear market finally over?

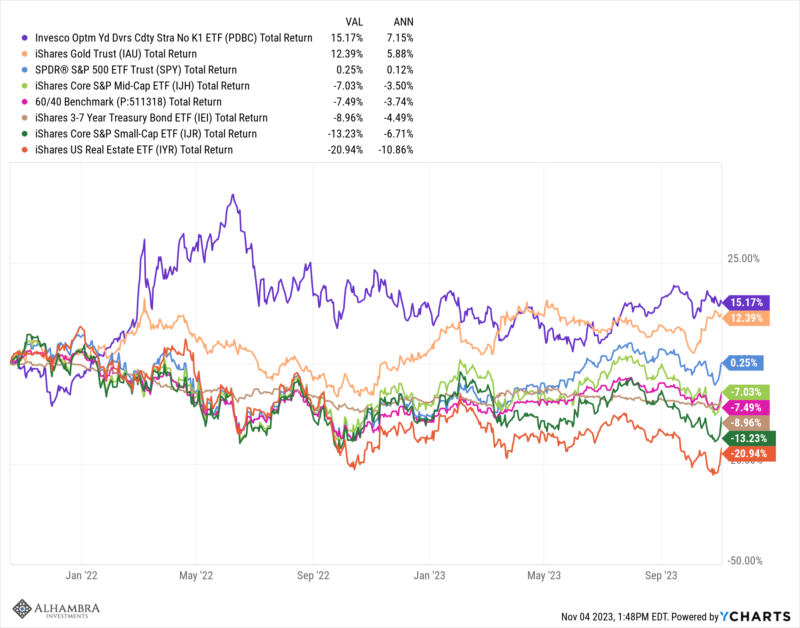

The market decided last week that interest rates have peaked for this cycle. And if rates have peaked then all the assets that have been pressured over the last two years can finally come up for air. Since October 18, 2021, over two years ago, investors have had few places to hide. Of the major asset classes we follow closely, only two – gold and commodities – were higher by...

Read More »

Read More »

Rethinking “safe” investments

Part II of II by Claudio Grass, Hünenberg See, Switzerland. For those of us who have studied history, these Ingenuous beliefs and expectations likely bring a smirk to our face. However, these are entirely reasonable assumptions for most citizens, as the majority of the population is blissfully unaware of the numerous real-life examples that clearly demonstrate just how capable and how eager the government is to do these things – to fail, or to lie,...

Read More »

Read More »

Rethinking “safe” investments

Part I of II by Claudio Grass, Hünenberg See, Switzerland

To most observant citizens and diligent investors it is surely quite obvious that the current monetary, fiscal and banking system is inherently flawed, hopelessly unjust, corrupt, unsustainable and simply destined to collapse sooner or later. With every (predictable) recession and every (foreseeable) crisis, this structure gets weaker; its very own architects increasingly second-guess...

Read More »

Read More »

Gold for the people

At the end of September, a very interesting story made the rounds in the media and caught my attention. Apparently, the US big box giant Costco added one rather surprising product to its range and it proved immensely popular. Next to humongous multipacks of cereal, buckets of peanut butter, mattresses and air fryers, customers were offered the opportunity to throw a gold bar in their carts as well.

Selling like hotcakes

According to a...

Read More »

Read More »

The Swiss franc’s “phenomenal” bull run

The strength of the Swiss franc (CHF) has been the topic of countless “expert” analyses for over a year and it has received considerable coverage in the mainstream financial press. In fact, the last time the currency garnered this much interest was probably in 2011, when its celebrated “safe haven” status backfired, as investors fled to it in droves and pushed the price to levels that forced the Swiss National Bank (SNB) to intervene and peg it to...

Read More »

Read More »

Freedom of speech and “de-banking”

Threats to freedom of speech and efforts to suppress dissenting views and voices have been on the rise over the past decades. They were exponentially intensified since the ascent of social media and as the political polarisation in the West truly took hold of our societies, the powers that be have been using any and all toolsat their disposal to “defend” the interests of the establishment against those who might try to publicly question its...

Read More »

Read More »

The demise of the dollar: What comes after that?

Part II of II

A good start

Whatever one might think about which currency is better suited to be used in trade or as a benchmark or as a central bank reserve, the fact remains that the USD’s days as the “only right answer” to that question are numbered. It might not happen tomorrow, but a credible challenger will eventually emerge.

As Patrick Barron also highlighted in his analysis: “Led by China and later by Russia, some nations of the...

Read More »

Read More »

The demise of the dollar: What comes after that?

Part I of II

Endless ink has been spilled by economists and financial analysts in their efforts to predict the impact of de-dollarization. As might be expected, most of those who embrace a US-centric view of the world and who defend the status quo paint a gloomy picture. They warn of the nightmarish consequences of a Russia- and China-dominated world order, of the threats to freedom and to human rights that this could pose and of a potential...

Read More »

Read More »

A conversation with Prince Michael of Liechtenstein

On November 15th, 2021, almost 20 months ago, I once again had the rare and delightful opportunity to have a conversation with Prince Michael. His insights, and especially his directness and unequivocal honesty, have frequently provided me with a lot of food for thought in the past. This interview was no different. His candid and unfiltered responses to a wide variety of questions and topics made this conversation as illuminating as it was...

Read More »

Read More »

“Inflation it is not an act of God”

INTERVIEW WITH GODFREY BLOOM:

Over the last couple of years, the UK has been increasingly in the news – for all the wrong reasons. The cost of living crisis, in particular, has been monopolizing headlines at home and abroad. Of course, inflation is by no means unique to the country. To the contrary, it has been hovering at similar or higher levels in virtually all advanced economies for quite some time. What is unique to the UK though, is that...

Read More »

Read More »

“Bank walk”: The first domino to fall?

In early May, Reuters published a report that truly captured my attention. “European savers are pulling more of their money from banks, looking for a better deal as lenders resist paying up to hold on to deposits some feel they can currently live without,” the article reported. Over in the US, we see a very similar picture. As the FT also recently reported, “big US financial groups Charles Schwab, State Street and M&T suffered almost $60bn in...

Read More »

Read More »

A bank is a bank is a bank – Part II

Part II of II by Claudio Grass

A real systemic crisis

If there was one thing more telling than the bank failures themselves, it was the governments’ reaction to them. The sheer panic that shook US, Swiss and Eurozone officials was almost pitiable to behold. The way they all rushed to make statements denying that this would be a repeat of 2008 was alarming instead of reassuring. And their apparent, urgent desperation to be believed was perhaps...

Read More »

Read More »

A bank is a bank is a bank

Part I of II by Claudio Grass

It might sound like an old-fashioned notion, the sort of thing that one reads about in period novels and romantically sighs “oh, the good old days”. It might sound like old timely advice, perhaps of the kind that our grandparents would have given to our parents: “It doesn’t matter if you make mistakes, even if you lose everything, as long as you still have your honor”. Sure. But in our cynical, jaded and largely...

Read More »

Read More »

Davos Man Will Fail, World Will Move Toward Decentralization

I truly enjoyed the conversation with Hrvoje Morić. I hope you will enjoy it 2.

Happy Weekend!

In liberty,

Claudio

Claudio Grass, Hünenberg See, Switzerland

This work is licensed under a Creative Commons Attribution 4.0 International License. Therefore please feel free to share and you can subscribe for my articles by clicking here

Read More »

Read More »

Gold Hits New All Time Highs

2023-11-02

by Dave Russell

2023-11-02

Read More »