Tag Archive: gold is money

Korruption & Machtmissbrauch – Die dunkle Seite der Politik!

In dieser Folge im Modelhof begrüßen wir Claudio Grass – Unternehmer, Edelmetall-Experte und überzeugter Verfechter individueller Freiheit und Selbstverantwortung. Seit Jahrzehnten beschäftigt er sich mit dem Geldsystem, der Geschichte des Goldes und den globalen Machtverhältnissen hinter der Finanzwelt.

Im Gespräch analysieren wir, wie korrumpiertes Geld ganze Gesellschaften verändert, warum Zentralbanken mehr Einfluss haben als viele...

Read More »

Read More »

Gold’s flashing warning: The end is nigh for fiat

Gold’s spectacular performance has drawn a lot of attention and invited endless analyses and commentaries. There are many theories out there as to why the yellow metal is surging like never before in modern memory, however most of them are shortsighted, or tend to miss the forest for the trees. The metal’s meteoric rise is not merely sending message about inflation expectations or rate policy. It’s flashing a clear warning sign about the...

Read More »

Read More »

A conversation with Catherine Austin Fitts

I recently had the great pleasure of (virtually) sitting down with Catherine Austin Fitts, investment banker, President of Solari, and former US Assistant Secretary of Housing and Urban Development for Housing, and having an extremely interesting conversation about the outlook for gold and silver. It was a fascinating discussion, especially given our current economic, monetary and geopolitical context: there so many risks and challenges ahead, that...

Read More »

Read More »

Geopolitical theater and implications for investors (or lack thereof)

The last month has been truly remarkable for modern human history – at least if one was paying attention to mainstream news headlines and TV anchors. Apparently, we came extremely close to World War III and we very likely had a very tight escape from an all-out nuclear holocaust that could have forever changed the our species’ trajectory and annihilated millions.

It all started with Israel’s surprise bombardment of Iran (which wasn’t really a...

Read More »

Read More »

A Politically Incorrect “Where Are We Now?”

A few days ago, I had the great pleasure to sit down again with my good friend James Patrick in person, in Monte Brè. It was a truly spontaneous and unfiltered conversation about the current state of the world, the bizarre geopolitical situation and the tragicomical moment in history that we find ourselves in. We talked about the extreme, and likely unprecedented, risks we face in the global economic and financial system and I’m very glad we...

Read More »

Read More »

Predictions vs. Convictions

Share this article

Separating the signal from the noise

Most regular readers and friends will undoubtedly already know what my position is in regards to projections and forecasts. For many years, I have consistently maintained that any and all attempts to “time the market” are as useless as they are unrealistic and I have always urged all responsible and rational investors to be extremely wary and suspicious of anyone that claims they can...

Read More »

Read More »

Predictions vs. Convictions

Separating the signal from the noise

Most regular readers and friends will undoubtedly already know what my position is in regards to projections and forecasts. For many years, I have consistently maintained that any and all attempts to “time the market” are as useless as they are unrealistic and I have always urged all responsible and rational investors to be extremely wary and suspicious of anyone that claims they can accurately predict market...

Read More »

Read More »

Gold climbing from record high to record high: why buy now?

Share this article

Part I of II

There is no question that gold owners have been finally and spectacularly vindicated over the last months: the “barbarous relic”, the “worthless shiny rock”, as many have called the yellow metal, once again proved its value as a true safe haven. In the face of inflation, intense geopolitical turmoil and widespread uncertainty, investors fled to safety “en masse”, as they consistently, repeatedly and predictably...

Read More »

Read More »

Economic freedom: Politics, of course, by its nature is always the pursuit of the Left

Share this article

Article II of II, by Claudio Grass

Collectivism is extremely versatile and very easy for political animals to “sell” to the public and to weaponize. Politics, of course, by its nature is always the pursuit of the Left, if we are to follow strict definitions. It seeks to influence and coerce others and it abhors individual liberties and self-determination. What we know as far-right is national socialism and the rest is...

Read More »

Read More »

Interview with Executive Global: “The Return of Marxism in the West”

Our special interview on Swiss Wealth Advisor with CLAUDIO GRASS, CEO and Independent Precious Metals Consultant, explores the manner in which astute investors may preserve wealth against the backdrop of debilitating central economic planning and monetary inflation.

Read More »

Read More »

Is gold too expensive to buy right now?

Share this article

This question has been at the center of a great many conversations I’ve been recently having with clients and friends. The way I like to answer it is with another question: Expensive compared to what?

Despite its recent surge to record highs, there are compelling reasons why purchasing gold right now is a prudent decision, with strong indications that its value is poised to climb even higher. Making investment decisions...

Read More »

Read More »

Private property rights under siege

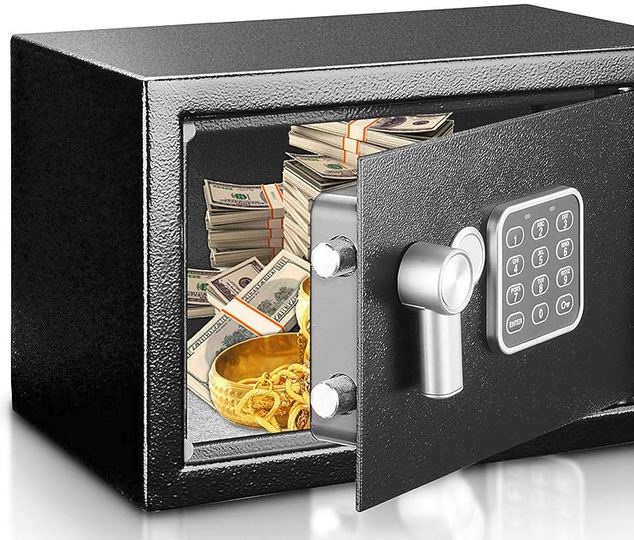

People invest in gold for many different reasons. Many do so out of concern over economic, monetary or political uncertainty. Others seek a hedge against inflation, a way to protect and preserve the real purchasing power of their savings.

Read More »

Read More »

2024 outlook: Gold Shines Bright in the Gathering Storm

The year 2024 is poised to be a critical period for the global economy and it already appears to be fraught with economic and geopolitical challenges, casting a dark shadow over the global landscape. Signs of a looming economic downturn are becoming increasingly evident and the many challenges we faced over the past year will certainly remain with us for many months to come.

Economic and monetary landscape

Central bankers in most advanced...

Read More »

Read More »

War is the health of the State

Part I of II by Claudio Grass

For any reasonably well read adult, any amateur student of history or any responsible citizen for that matter, the idea that ”war is the health of the State” should be adjacent to a truism. After all, literally nobody benefits from violence and bloodshed apart from those at the heart of any State that is directly or indirectly involved and their cronies. In fact, the more horrific the violence and the more...

Read More »

Read More »

Rethinking “safe” investments

Part II of II by Claudio Grass, Hünenberg See, Switzerland. For those of us who have studied history, these Ingenuous beliefs and expectations likely bring a smirk to our face. However, these are entirely reasonable assumptions for most citizens, as the majority of the population is blissfully unaware of the numerous real-life examples that clearly demonstrate just how capable and how eager the government is to do these things – to fail, or to lie,...

Read More »

Read More »

Rethinking “safe” investments

Part I of II by Claudio Grass, Hünenberg See, Switzerland

To most observant citizens and diligent investors it is surely quite obvious that the current monetary, fiscal and banking system is inherently flawed, hopelessly unjust, corrupt, unsustainable and simply destined to collapse sooner or later. With every (predictable) recession and every (foreseeable) crisis, this structure gets weaker; its very own architects increasingly second-guess...

Read More »

Read More »

Gold for the people

At the end of September, a very interesting story made the rounds in the media and caught my attention. Apparently, the US big box giant Costco added one rather surprising product to its range and it proved immensely popular. Next to humongous multipacks of cereal, buckets of peanut butter, mattresses and air fryers, customers were offered the opportunity to throw a gold bar in their carts as well.

Selling like hotcakes

According to a...

Read More »

Read More »

The demise of the dollar: What comes after that?

Part II of II

A good start

Whatever one might think about which currency is better suited to be used in trade or as a benchmark or as a central bank reserve, the fact remains that the USD’s days as the “only right answer” to that question are numbered. It might not happen tomorrow, but a credible challenger will eventually emerge.

As Patrick Barron also highlighted in his analysis: “Led by China and later by Russia, some nations of the...

Read More »

Read More »

“Bank walk”: The first domino to fall?

In early May, Reuters published a report that truly captured my attention. “European savers are pulling more of their money from banks, looking for a better deal as lenders resist paying up to hold on to deposits some feel they can currently live without,” the article reported. Over in the US, we see a very similar picture. As the FT also recently reported, “big US financial groups Charles Schwab, State Street and M&T suffered almost $60bn in...

Read More »

Read More »