Tag Archive: Germany

China Surprises While the Dollar Begins Week Softer

Overview: The new week, which features the BRICS

meeting and the Jackson Hold symposium is off to a quiet start. The failure of

Chinese banks to pass through last week's 15 bp cut fully into the lending

prime rates was a major disappointment and it is not yet clear the logic. While

the yuan and yen are softer, as are more local Asian currencies, while most of

the G10 currencies are posting small gains against the greenback. Gold is

trading little...

Read More »

Read More »

Surprise-Packed Tuesday: China Cut Rates, Japan’s Q2 GDP Rises Twice as Fast as Expected, and UK Wages Accelerate

Overview: Today's highlights include a surprise rate

cut from China after another series of disappointing data and much stronger

than expected Japanese Q2 GDP (6% annualized pace). The UK reported an

unexpected sharp jump in average weekly earnings, which were sufficient to get

renew speculation of a 50 bp hike by the Bank of England next month. The US

dollar is mixed. The Swedish krona and dollar-bloc currencies are struggling,

while the Swiss...

Read More »

Read More »

The Greenback is Softer Ahead of CPI but Key Chart Points Remain Intact

Overview: The deluge of Treasury supply is nearly

over for this week. On tap today are 4- and 8-week T-bills and $23 bln 30-year

bonds to finish the quarterly refunding. The sales will come after the July CPI

print that is expected to see the first year-over-year increase since last June.

The market is going into the report with about a 15% chance of a Fed hike next

month discounted. Meanwhile, September crude oil extended its recover from $80

seen...

Read More »

Read More »

After Strong Demand for US Three-Year Notes, Treasury will Sell $38 bln 10-year Notes

Overview: The first leg of the US refunding was well

received, with the three-year note being scooped up by investors, driving the

yield below it was trading in the when-issued market. Today, the Treasury sells

$38 bln 10-year notes, whose auctions have been less than stellar recently. The

US 10-year yield reached 4.20% last week and is now straddling 4%. Italian

bonds are also firm as the Italian government clarifies the

new tax on banks' windfall...

Read More »

Read More »

Dollar Comes Back Bid

Overview: The US dollar is recovering today

after it was sold following the jobs report before the weekend. It is enjoying

a firmer bias against nearly all the G10 currencies. The dollar-bloc is faring

best, while the Scandis are off close to 0.5%. Most emerging market currencies

are also softer, with only a few Asian currencies edging higher today,

including the South Korean won, Indian rupee, and Taiwanese dollar. With a

stronger dollar and...

Read More »

Read More »

Markets Remain Unsettled, Bonds and Stocks Retreat, Dollar Gains Ahead of BOE

Overview: The global

capital markets remain unsettled. The combination of the BOJ adjustment of its

monetary policy, Fitch's downgrade of the US to AA+, ahead of a flood of

supply, and new measures by China have injected volatility into the summer

markets. The US dollar has extended it gains today against the G10 currencies

and most emerging market currencies. The yen has recovered a bit after the BOJ

stepped in and bought JGBs for the second time...

Read More »

Read More »

Powerful Short Squeeze Continues to Lift the Yen

Overview: The greenback remains under pressure. The

yen's short squeeze continues, and strong wage growth has helped lift sterling

to new highs since last April. Among the G10 currencies, only the Australian

and New Zealand dollars are unable to sustain gains through the European

morning. Emerging market currencies are also advancing, with a couple of

exceptions, including the Turkish lira despite reports on foreign equity

inflows. The weaker...

Read More »

Read More »

Yen Extends Recovery on Wage Data, Yuan Ticks Up Too

Overview: A powerful short squeeze has lifted the

yen by the most in two months this week. The dollar's push today below JPY143

was encouraged by the stronger than expected wage growth. The US jobs report

will test its strength. The PBOC fixed the yuan sharply higher today and it is

the only emerging market currency that is higher on the day, ahead of the Latam

open. The dollar has not drawn much support for the surge in US yields. The

10-year...

Read More »

Read More »

Yen and Yuan Lead Move Against the Dollar

Overview: Stocks and bonds ae selling off today. The

greenback is also trading heavily. Ironically, the yen is the strongest among

the G10 currencies and the Chinese yuan is the strongest among emerging market

currencies. The dollar is firmer against the Scandis and Canadian dollar. Most

emerging market currencies, including the Mexican peso, which traded at its

best level yesterday since 2015. While nearly all the bourses

but India fell in the...

Read More »

Read More »

What Happened Today

The US dollar was mostly softer. The

New Zealand dollar was the strongest (~0.85%) helped by cross rate gains

against the Australian dollar, following the RBA’s decision to stand pat. The

Australian dollar fell to one-month lows below NZD1.08. There is scope for

another 0.5%, or so to the next target near NZD1.0750. The RBA’s decision to

leave its cash target at 4.10% was not surprising, and despite the hawkish

rhetoric, the market downgraded the...

Read More »

Read More »

Calm Start to the Week, with Little Impact from Russia’s Drama

Overview: The drama in Russia captured the

imaginations but failed to have much impact on the capital markets. Conventional

wisdom sees it as a sign of Putin's weakness, but he has been underestimated,

including by many Ukrainians who did not think Russia was going to invade

despite America's repeated warnings. It may take some time for the implications

for the two main protagonists, Wagner head Prigozhin and Defense Minister

Shoigu. The war in...

Read More »

Read More »

RBA Surprises with a Quarter-Point Hike and German Factory Orders Disappoint

Overview: The Reserve Bank of Australia surprised

many with a quarter-point hike and German factory orders unexpectedly fell.

Reports suggest that China has asked banks to cut deposit rates. The next

result is the Australian dollar is the strongest currency in the G10 and helped

lift the Canadian dollar ahead of the Bank of Canada meeting tomorrow. Australian

stocks sold off (~1.2%) while large markets outside of China rose in the region.

Europe's...

Read More »

Read More »

Fitch Puts US on Negative Credit Watch and the Dollar Extends its Gains

Overview: Concerned about the political wrangling over servicing US

debt, Fitch put the US on negative credit watch. Besides chin

wagging and finger pointing, it has had little perceptible impact. The dollar

is mostly higher, reaching new highs for the year against the Japanese yen,

Chinese yuan, and the Antipodean currencies. The euro and sterling met

retracement objective we have targeted (~$1.0735 and $1.2435, respectively).

The greenback is...

Read More »

Read More »

RBNZ Delivers a Dovish Hike and UK Inflation Surprises to the Upside

Overview: Equities in the Asia Pacific region and

Europe are being led lower by the sell-off in the US yesterday. All the large

Asia Pacific markets fell with Hong Kong and mainland shares setting the pace.

Europe's Stoxx 600 is off nearly 1.5%, which would be the largest loss in two

months. Consumer discretionary, financials and real estate sectors are off

nearly 2%. US equity futures have a softer bias. European 10-year yields are

mostly 2-3 bp...

Read More »

Read More »

Key Chart Points Hold and the Dollar’s Rally Stalls Ahead of the Weekend

Overview: Hawkish comments from Fed officials and the first

decline in continuing unemployment claims below 1.8 mln in two months boosted

US rates and the odds of a June rate hike rose to about 37%. This represents a

near tripling of the probability in the past week. It has been a trend with the

odds rising in 9 of the past 11 sessions. The two-year note yield has risen for

the past five sessions coming into today for a cumulative gain of about 35...

Read More »

Read More »

Biden to Go to G7 Summit with Debt Ceiling Unresolved

Overview: The US debt ceiling talks resume at the

White House today but a deal is unlikely to be announced. President Biden will

attend the G7 summit in Hiroshima with the debt ceiling still looming. The

dollar is mostly softer as last week's gains are pared. The Swiss franc and

Japanese are the strongest in the G10. The Thai baht and South African rand,

among the market's favorites yesterday are seeing those gains retraced. The JP

Morgan Emerging...

Read More »

Read More »

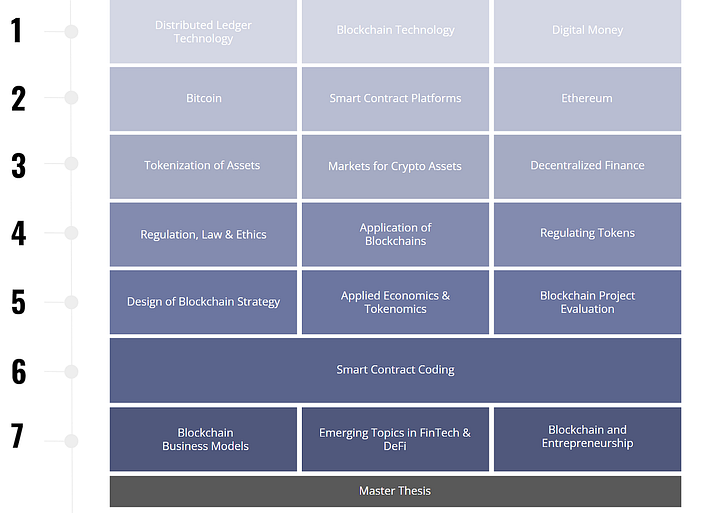

Frankfurt University Forms Master in Blockchain & Digital Assets

Frankfurt School of Finance Center and its Blockchain center designed a new four semester long post-experience master program (MSc) last year. The Frankfurt School’s goal is to provide the expert knowledge necessary to students looking to shape and lead blockchain innovation around the globe and in all industries.

Technical and economical understanding on the topics of blockchain, digital assets (including Bitcoin and Ethereum), DeFi, Web3,...

Read More »

Read More »

The Greenback Continues to Struggle

Overview: There is a nervousness that hangs over the capital markets.

Although US banks shares recovered at the end of last week, many continue to

see the sector’s challenges as the harbinger of a dramatic reversal in the Fed’s

stance. America’s debt ceiling looms large and could be a few weeks away. China

led Asia Pacific bourses higher, and, ironically, its bank shares extended their

rally. Japan, returning from last week’s holiday was notable...

Read More »

Read More »

The Greenback Remains Heavy Ahead of the Employment Report

Overview: The US dollar is weaker against all the

G10 currencies today but the Swiss franc. The backdrop seems fragile even

though a few regional bank shares have done better in after-hours trading and

Apple's earnings were received well by the markets. Due to seasonal factors and

other considerations, many are warning about a US jobs report, even though

ADP's estimate surprised to the upside earlier this week. Equities were mixed

in the Asia...

Read More »

Read More »

Dollar Pares Gains but is Poised to Recover in North America

Overview: A rise in US yields, with the

two-year Treasury closing yesterday at its best level in more than three weeks

help fuel follow-through dollar buying yesterday after an upside reversal at

the end of last week. Key levels were approached, like $1.09 in the euro,

$1.2345 in sterling, and JPY135 held, and the dollar has consolidated in Asia

and Europe. The euro and sterling recouped around half of the losses seen from

the Friday's high to...

Read More »

Read More »