Tag Archive: Germany

Adoption Of The Euro Has Been ‘Unequivocally Bad’ For Southern European Economies

Some say that the common currency prevents less productive economies from cheating by weakening their national currencies and forces them to become more efficient and competitive. Industrial production data shows that it is not the case. Italy, France, Greece and Portugal have not only stopped producing more; they are producing now less than in 1990! The decay started immediately after the introduction of the euro in 2002!

Read More »

Read More »

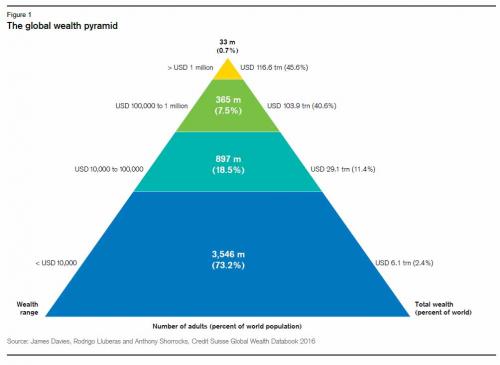

Global Wealth Update: 0.7 percent Of Adults Control $116.6 Trillion In Wealth

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what is perhaps the biggest reason for the recent "anti-establishment" revulsion: an unprecedented concentration of wealth among a handful of people, as shown in its infamous global wealth pyramid, an arrangement which as observed by the "shocking" political backlash of the past few months suggests that the lower 'levels' of the pyramid are...

Read More »

Read More »

European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB balance sheet at market prices and amounted to €15.79 billion.

Read More »

Read More »

When It Comes To Household Income, Sweden & Germany Rank With Kentucky

Last year, I posted an article titled "If Sweden and Germany Became US States, They Would be Among the Poorest States" which, produced a sizable and heated debate, including that found in the comments below this article at The Washington Post. The reason for the controversy, of course, is that it has nearly reached the point of dogma with many leftists that European countries enjoy higher standards of living thanks to more government regulation and...

Read More »

Read More »

Central Bank Austria Claims To Have Audited Gold at BOE. Refuses To Release Audit Report

After years of gradually securing its official gold reserves (unwinding leases) the central bank of Austria claims to have completed the audits of its 224 tonnes of gold stored at the BOE. However, it refuses to publish the audit reports and the gold bar list. What could possibly be so sensitive to hide from public eyes?

Read More »

Read More »

Cashless Society – Is The War On Cash Set To Benefit Gold?

Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society.

Read More »

Read More »

Seven Things I Learned while Looking for Other Things

Mainland demand for HK shares has dried up this month. EMU growth may accelerate in Q4, while the collective deficit continues to fall. German fertility rate increased last year.

Read More »

Read More »

Great Graphic: Italian Banks and a German Bank

DB and Italian bank stocks have been moving in tandem. They suffer from fundamentally different problems. The euro has been selling off as the bank shares rebound.

Read More »

Read More »

The Swiss Begin To Hoard Cash

While subtle, the general public loss of faith in central banking has been obvious to anyone who has simply kept their eyes open: it started in Japan where in February hardware stores were reported that consumers were hoarding cash, as confirmed by t...

Read More »

Read More »

NIRP Has Failed: European Savings Rate Hits 5 Year High

One year ago, when it was still widely accepted conventional wisdom that NIRP would "work" to draw out money from savers who are loathe to collect nothing (or in some cases negative interest) from keeping their deposits at the bank, and would proceed to spend their savings, either boosting the stock market or the economy, we showed research from Bank of America demonstrating that far from promoting dis-saving, those European nations which had...

Read More »

Read More »

Deutsche Bank CEO Returns Home Empty-Handed After Failing To Reach ‘Deal’ With DOJ: Bild

Following the seemingly endless procession of short-squeeze-fueling trial balloons last week - from settlement rumors to German blue-chip bailouts to Qatari investors - Germany's Bild newspaper confirms the rumors that sparked weakness on Friday: Deutsche bank CEO John Cryan has failed to reach an agreement with the US Justice Department.

Read More »

Read More »

Will The ECB Buy Stocks?

Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility. We think the ECB could legally buy ETFs that fit its requirements… but it would be controversial and we question the benefits. An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme.

Read More »

Read More »

Is The US Dollar Set To Soar?

Hating the U.S. dollar offers the same rewards as hating a dominant sports team: it feels righteous to root for the underdogs, but it's generally unwise to let that enthusiasm become the basis of one's bets. Personally, I favor the emergence of non-state reserve currencies, for example, blockchain crypto-currencies or precious-metal-backed private currencies--currencies which can't be devalued by self-serving central banks or the private elites...

Read More »

Read More »

FX Weekly Preview: Next Week’s Two Bookends

The start of next week will likely be driven by Deutsche Bank's travails and dollar funding pressures, which may or may not be related. The end of the week features the US monthly jobs report. Despite being a noisy, high frequency time series subject to significant revisions, this report like none other can drive expectations of Fed policy.

Read More »

Read More »

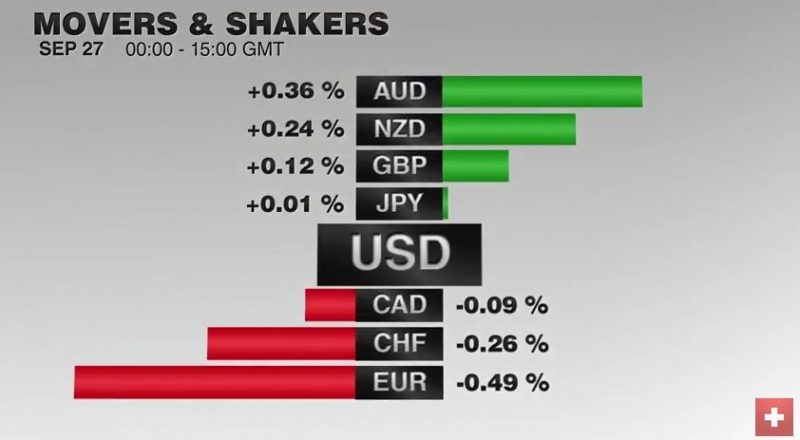

FX Daily, September 27: US Debate Lifts Peso, but Leaves the Dollar Non-Plussed

Since the monetary assessment meeting, the EUR/CHF is trending downwards. Sight deposits indicate that the SNB is intervening 0.9 bn per week. We emphasized that the preferred intervention corridor is between 1.08 and 1.0850. The first US Presidential debate may not sway many voters but has lifted the Mexican peso. The peso, which has fallen by about 1.3% over the past two sessions, has stormed by 1.5% today as the seemingly biggest winner of the...

Read More »

Read More »

FX Weekly Preview: Politics to Overshadow Economics in the Week Ahead

The major central banks have placed down their markers and have moved to stage left. There are the late-month high frequency data, which pose some headline risks in the week ahead. The main focus for most investors will be on several political developments. The first US Presidential debate is wild card, in the sense that the outcome is unknown. In recent weeks, the polls have drawn close. In early August, Nate Silver’s fivethirtyeight.com, the gold...

Read More »

Read More »

Yellow Lights are Flashing

Bonds are not rallying despite poor US data. Greater chance that Trump gets elected than the Fed hikes next week. Berlin may be more important than Bratislava.

Read More »

Read More »

Rogoff Warns “Cash Is Not Forever, It’s A Curse”

Kenneth Rogoff, Professor of Public Policy at Harvard University, postulates to get rid of cash. In his opinion, killing big bills would hamper organized crime and make negative interest more effective. Kenneth Rogoff makes a provocative proposal. One of the most influential economists on the planet, he wants to phase out cash.

Read More »

Read More »