Tag Archive: Germany ZEW Economic Sentiment

A monthly economic survey. The ZEW Economic Sentiment is an almalgamation of the sentiments of approximately 350 economists and analysts regarding the economic future of Germany for the next six months. The survey shows the balance between those analysts who are optimistic about Germany’s economic future and those who are not.

FX Daily, July 10: May Survives to Fight Another Day, but Sterling’s Recovery Falters

The political obituary of UK's May, who many see as an "accidental" Prime Minister, has been written many times in the past year and a half only to be withdrawn. Again, it looked like the resignation of two ministers, and a couple of junior ministers was going to spur a leadership challenge. While this still may come to pass, the hard Brexit camp, which has huffed and puffed, simply does not appear to represent a majority of the Tory Party, and...

Read More »

Read More »

FX Daily, June 12: US-Korea Summit Fails to Impress Investors

The US dollar initially rallied in early Asia ahead of the US-North Korea summit but has subsequently shed the gains and more. As North American dealers return to their desks, the dollar is lower against nearly all the major currencies, but the yen and Canadian dollar.

Read More »

Read More »

FX Daily, April 17: Dollar Recovers from Further Selling as Turnaround Tuesday Unfolds

After the retreating in the North American session yesterday, despite a rebound in retail sales after three-months of declines, the greenback has been sold further in Europe and Asia. The euro edged through last week's high near $1.24, and sterling rose through the January high to reach its best level since the mid-2016 referendum. Sterling rose through $1.4375 before the easing after the employment report.

Read More »

Read More »

FX Daily, February 20: Dollar Trades Higher, but Stocks Challenged at Key Chart Point

The dollar is finding better traction today, building on the upside reversal seen before the weekend. The news stream has been light and it seems like primarily an issue of positioning rather than a change in sentiment or the consensus narrative. The focus has shifted from monetary policy and idea that the ECB and BOJ are exiting their extraordinary monetary policy to return of the twin deficit problem in the US.

Read More »

Read More »

FX Daily, January 23: Dollar Stabilizes Near Recent Lows

The US dollar has come back better bid in late Asian activity. The session highlight was the BOJ meeting. BOJ maintained forecasts and policy. There was a small tweak to the inflation assessment, noting that prices were skewed to the downside, and said there was no change in inflation expectations. Last time it has said expectations were weakening. It also reiterated that there was no policy implication to the bond operations.

Read More »

Read More »

FX Daily, December 12: UK Front and Center, but Sterling is Laggard in Today’s Move Against the Dollar

The US dollar is trading with a lower bias against most of the major and emerging market currencies. The upside surprise in Sweden's inflation is helped the krona recover from its recent slide. It is the strongest of the majors, gaining 1.1% against the dollar and nearly as much against the euro, which is in a third of a cent range below $1.18.

Read More »

Read More »

FX Daily, November 14: Euro Rides High After German GDP

Sterling is trading in the lower end of yesterday's range and has been confined to about a quarter a cent on either side of $1.31. On the other hand, the euro has pushed a bit through GBP0.8950 to reach its best level since October 26. Sweden also reported softer than expected October inflation.

Read More »

Read More »

FX Daily, September 19: Quiet Tuesday, Follow the Leader

Politics seems to dominate the talking points today. Boris Johnson's weekend op-ed has been rejected by May, and there is talk that Johnson may resign or fired. Sterling is consolidating after pulling back yesterday. Carney said that if the UK does hike it will be gradual and limited. The markets did respond dramatically to the BOE minutes and suggestions by even some of the doves that rates may need to be lifted, but there is still a good reason...

Read More »

Read More »

FX Daily, August 22: Turn Around Tuesday Sees Firmer Dollar, Rates, and Equities

The US dollar has recouped most of yesterday's declines. However, as we have seen over the past couple of sessions, he North American market appears more dollar negative than Europe or Asia. The dollar's rise through the European morning has left the intraday technical indicators a bit stretched, warning that this short-term pattern continues today.

Read More »

Read More »

FX Daily, July 18: Dollar Dumped on Doubts on US Economic Agenda

News of the defection of two more Republican Senators doomed the Senate attempt to replace and repeal America's national health care. The failure to replace the system dubbed Obamacare, despite the Republican majority in both legislative chambers and the executive branch raises questions about the broader strategy of the Administration and raises serious questions about the rest of its legislative agenda.

Read More »

Read More »

FX Daily, June 13: Dollar Softens Ahead of Start of FOMC Meeting

The US dollar is trading with a heavier bias against all the major currencies save the Japanese yen. The Scandis and Canadian dollar are leading the move. Sweden reported a 0.1% rise in the headline and underlying inflation while the median expected a decline of the same magnitude. The year-over-year pace slowed but not as much as expected.

Read More »

Read More »

FX Daily, May 16: Greenback and Dollar Bloc Lose Ground to Europe and Yen

Dollar selling pressure emerged at the end of last week, partly in response to disappointing US economic data. This selling pressure carried over into yesterday's activity. It appeared to have been trying to stabilize yesterday in the North American session.

Read More »

Read More »

FX Daily, April 11: Dollar Pushed Lower in Subdued Activity

The US dollar has a slight downside bias today through the European morning. The market does not seem particularly focused on high frequency data, though sterling traded higher after an unchanged year-over-year reading of 2.3%, and the euro traded higher after a stronger Germany ZEW survey.

Read More »

Read More »

FX Daily, March 14: Brexit Takes Fresh Toll on Sterling, While Dollar Firms more Broadly

UK Prime Minister May got the parliamentary approval the courts ruled was necessary to formally trigger Article 50. It is not clear what UK she will lead out the EU. Scotland is beginning the legal proceedings to hold another referendum on independence. There is some talk that Northern Ireland, which voted to remain, might be allowed to rejoin the Republic of Ireland.

Read More »

Read More »

FX Daily, February 14: Markets Showing Little Love on Valentines

Corrective pressures are gripping the major capital markets today.The Dollar Index's nine-day advancing streak is being threatened by the position adjustment ahead of Yellen's testimony later today. Despite record high closes in the main US equity markets yesterday, Asia could not follow suit. It tried to initially, and recorded new highs since July 2015, but sellers emerged and the MSCI Asia Pacific Index closed marginally lower on the lows of the...

Read More »

Read More »

FX Daily, January 17: Trump’s Comments Send the Dollar Reeling

The Pound has been subjected to a heavy amount of pressure as we progress further into 2017, with GBP/CHF rates being one of the heaviest losers. The pairing is now trading at a similar level to GBP/USD levels below the 1.22 mark. Their is an enjoyable symmetry between the two from an analysts point of view. Both are well regarded as safe-haven currencies, and in this time of increased uncertainty, both have almost the exact same value in the...

Read More »

Read More »

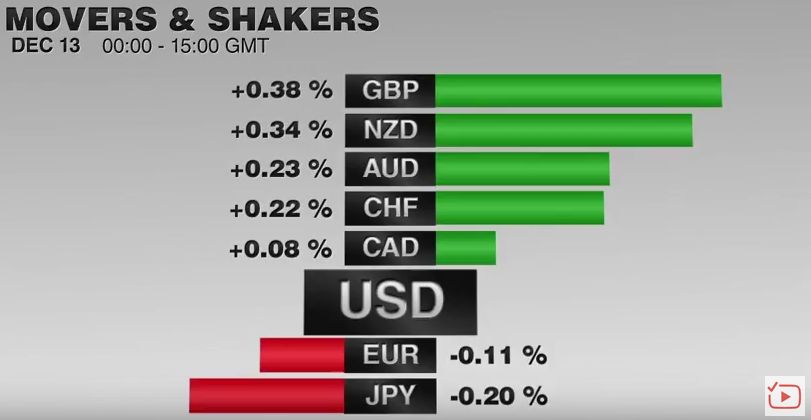

FX Daily, December 13: Narrowly Mixed Dollar Conceals Resilience

The US dollar is little changed against most of the major currencies. The dollar finished yesterday's North American session on a soft note, but follow through selling has been limited. After rallying to near 10-month high above JPY116 yesterday, the greenback finished on session lows near JPY115.00. Initial potential seemed to extend toward JPY114.30, but dollar buyers reemerged near JPY114.75, and it rose back the middle of the two-day range...

Read More »

Read More »

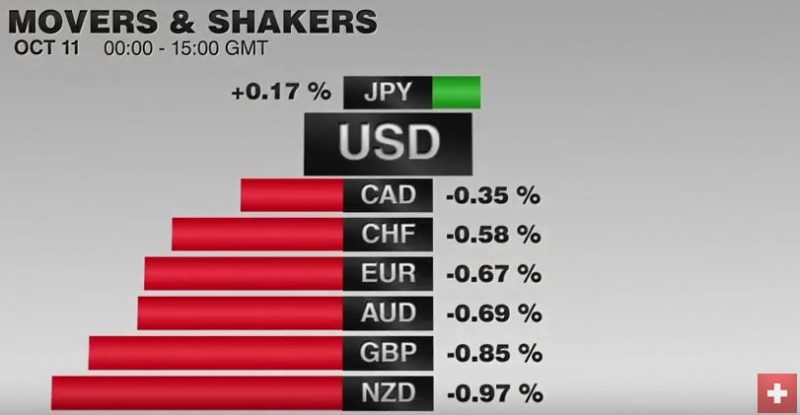

FX Daily, October 11: The Dollar Remains Bid

The US dollar is bid against all the major and most emerging market curerncies. An important driver is the backing up of US rates. The two-year yield, which is particularly sensitive to Fed policy is at it highest levbel since early June (~86 bp). The US 10-year yield is five basis points hihger today at 1.77%, which is the highest in four months.

Read More »

Read More »

FX Daily, August 16: Dollar Slumps, but Driver may Not be so Obvious

The US dollar is being sold across the board today. The US Dollar Index is off 0.65% late in the European morning, which, if sustained, would make it the largest drop in two weeks. The proximate cause being cited by participants and the media is weak US data that is prompting a Fed re-think.

Read More »

Read More »

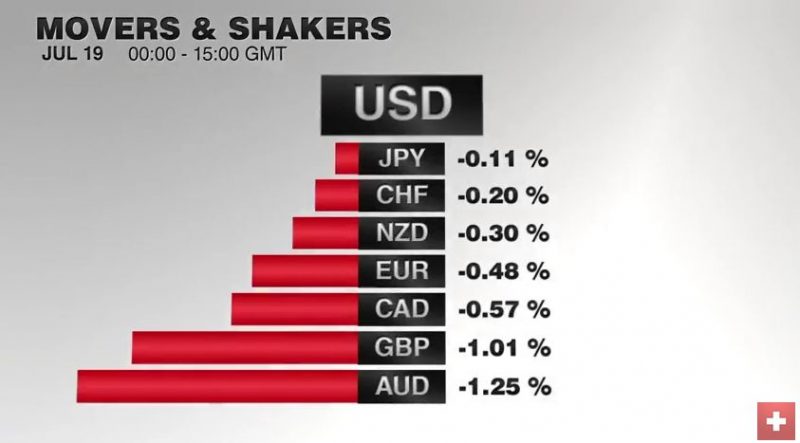

FX Daily, July 19: Dollar-Bloc Tumbles, but Euro and Yen Little Changed

The US dollar is sporting a firmer profile today, but it is not the driver. Heightened speculation that Australia and New Zealand may cut interest rates next month is pushing those respective currencies more than 1% lower today.

Read More »

Read More »