Tag Archive: FOMC

Weekly Market Pulse: The Turkey Leg

Note: I wrote most of this commentary prior to the US strike on Iran and I decided to go ahead with it anyway. I don’t know any more than you do about what is going on in the Middle East and trying to predict what will happen in the coming days and weeks is a fool’s errand. We have a strategic allocation to commodities in our portfolios exactly because we can’t predict things like this.

Read More »

Read More »

Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Overview: The selection of Scott Bessent, the hedge fund manager as next US Treasury Secretary was greeted euphorically in the capital markets: one of their own and, arguably, like many of new economics team could have been picked in any Republican administration. Risk appetites have been animated. Still, we suspect market positioning may have led to an exaggerated response. The dollar has been sold. Stocks have bought. The euro is leading the G10...

Read More »

Read More »

Fragile and Consolidative Tone Starts the Week in FX

Overview: The US dollar has begun the new week consolidating in a mixed fashion against the G10 currencies. Bank of Japan Governor Ueda remains circumspect and did not provide guidance about next month's central bank meeting. Without positive guidance, the market sold the yen, but the swaps market shows about 13 bp of tightening has been discounted, up a couple of basis points from a week ago. Leave aside the New Zealand dollar, which is also under...

Read More »

Read More »

Searching for Direction

Overview: The capital markets have been choppy as pre-existing positioning meets new thoughts on the implications of a second Trump administration. The dollar has found better footing today after giving back a chunk of Wednesday's gains yesterday. The yen is an exception, but it is not exception that the dollar trades heavier against the yen as the US 10-year yield drifts lower. On the week, the most G10 currencies are holding on to gains against...

Read More »

Read More »

Serenity Now

Overview: The markets are calmer after yesterday's post-US election drama. A consolidative tone has emerged in the foreign exchange market, and the dollar is softer against all the G10 currencies, led the 1% gain in the Norwegian krone, after the central bank left rates on hold. Sweden's Riksbank delivered the expected half-point cut and the krona is up 0.5%. Japanese officials warned against excessive moves, and the PBOC set the dollar's...

Read More »

Read More »

Stocks Higher, Dollar Lower: Post-Fed

Overview: The Federal Reserve's 50 bp rate cut has made for a volatile 15 hours or so in the foreign exchange market. As North American traders return to their posts, the greenback is heavy. They will find that only the yen and Russian ruble are softer. Norway delivered a hawkish hold, and the krone leads the G10 currencies with more than a 1% gain. Australia's employment data was sufficiently strong that the Reserve Bank of Australia will likely...

Read More »

Read More »

Greenback Continues to Trade Heavily amid Heightened Speculation of a 50 bp Cut Wednesday

Overview: The markets are continuing to be impacted by the possibility that Fed officials planted a press report to put 50 bp cut back on the table after the market had moved away from it after the recent jobs data and CPI. In the Fed funds futures, there is around an 80% of a half-point move on Wednesday discounted and about an 80% chance of a second 50 bp cut this year. This has taken a toll on the greenback and cut short the technical correction...

Read More »

Read More »

Heightened Speculation that Fed may Cut 50 bp Next Week Sends the Dollar Lower

Overview: The US dollar is falling against nearly all the world's currencies today amid heightened speculation that a 50 bp cut is still on the table for next week's FOMC meeting. In the derivatives market, the odds are the highest in several weeks. The ostensible trigger was apparently a news wire story by a reporter thought to be used by some Fed officials to foster communication. A few former Fed officials also seemed to endorse a half-point...

Read More »

Read More »

Consolidative Tuesday

Overview: The US dollar is mostly consolidating so far today with a slightly heavier bias against the G10 currencies and most emerging market currencies. The larger than expected Chinese trade surplus did not lift the yuan. The greenback is trading above its 20-day moving average against the Chinese yuan for the first time since late July. Sterling is rising for the first time in three sessions after a strong jobs report. The Canadian dollar is the...

Read More »

Read More »

The Dollar and Rates Come Back Firmer

The US dollar's decline continued yesterday after the steep jobs’ revision and an unusual solid auction of the Treasury's 20-year bond. The minutes from the recent meeting confirmed that the FOMC will begin its easing cycle next month.

Read More »

Read More »

US Benchmark Payroll Revisions Over-Hyped? Dollar may Benefit from Buying on Fact after Being Sold on Rumors

Overview: The preliminary annual revision to US jobs growth is front and center today. It has gotten more play that usual, amid speculation of a historically large revision. Yet, the direct impact on policy may be minimal. Federal Reserve officials, including Chair Powell, acknowledged that the payroll growth may have been overstated. Moreover, the Fed's judgment of the labor market is not based on one element of the multidimensional labor market....

Read More »

Read More »

Is the US CPI Anti-Climactic?

Overview: Today's US CPI is the focus but the bar to a Fed cut next month is low, and it could prove anti-climactic. The more moderate inflation reading creates more space for the central bank to respond to signs of a continued slowing of the US labor market and adopt less restrictive policy. The dollar is mixed as the North American session gets under way. The rate cut by the Reserve Bank of New Zealand, not a total surprise, but has seen fall 1%....

Read More »

Read More »

Subdued Market Compared to a Week Ago: Is the Dramatic Position Unwinding Over?

Overview: The capital markets have begun the week in subdued fashion. Japanese markets were closed for the Mountain Day celebration, and this week's key events, which include US and UK CPI, and the Reserve Bank of New Zealand meeting and potentially its first rate cut. The uncertainty about the market positioning and the extent of the carry-trade may also be dampening activity. The yen and Swiss franc are the weakest of the G10 currencies today,...

Read More »

Read More »

Consolidation Featured

Overview: Yesterday's poor 10-year note US Treasury auction helped turn the equity market lower and this carried over into Asia Pacific and European activity today. Today, Treasury completes its quarterly refunding with the sale of $25 bln 30-year bonds. The general tone in the foreign exchange market is one of consolidation. Japanese investors were buyers of foreign stocks on bonds last week, according to the latest portfolio flow report, which...

Read More »

Read More »

BOJ Delivers, Sending Greenback to Almost JPY150; Now Over to the Federal Reserve

Overview: A 15 bp hike by the BOJ and plans to halve its bond purchases by the end of FY25 (in March 2026), coupled with a hawkish press conference by Governor Ueda sent the dollar to nearly JPY150, its lowest level in four months. A soft-core inflation reading in Australia send the Aussie lower and is the weakest of the G10 currencies. The others are little changed. The focus is now on the Federal Reserve, which is expected to signal that its...

Read More »

Read More »

Market Boosts Odds of a BOE Rate Cut this Week

Overview: The US dollar is mostly firmer today ahead of what promises to be an eventful week. Sterling is bearing the brunt today, off a little less than half-of-a-cent as expectations creep up of a rate cut this week and Chancellor of the Exchequer Reeves plays up the poor state of public finances left by the Conservative government. Sterling (and the euro's) five- and 20-day moving averages have crossed. The yen is mostly within the pre-weekend...

Read More »

Read More »

Q3 Cyclical Outlook

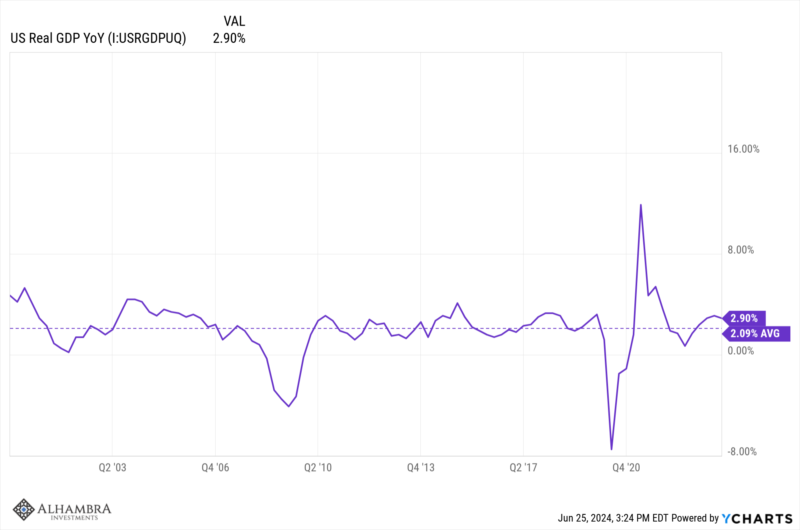

Growth peaked on a quarter over quarter seasonally adjusted annual rate in Q3 last year at 4.9%. The preferred reading is on an annual basis where growth peaked in Q4 of last year at 3.13%. Growth in Q1 was 2.88% and growth in Q2 has risen some and is trending at right about 3%.

Read More »

Read More »

Self-Inflicted Wounds in Europe and Japan Help the Greenback Shrug Off the Drag of Lower Rates

Overview: The dollar is bid. What makes its

performance standout is that it is taking place as US rates have fallen. The US

10-year yield is near 4.20%, the lowest in more than two months. The two-year

yield is near 4.67%. It has fallen every session this week for a cumulative

decline of more than 20 bp. It is not so much that constructive developments

took week, but that Europe and Japan are suffering from self-inflicted injury. Macron's

call for...

Read More »

Read More »

Dollar Comes Back Bid

Overview: The dollar fell alongside US rates

yesterday after the softer than expected CPI. The move on both rates and the

dollar were pared after the FOMC meeting which held rates steady as widely

expected, but the median dot now anticipated one cut this year rather than

three. The dollar has recovered more ground today and is trading with a

slightly firmer bias G10 currencies. However, trading is quiet and mostly

narrow ranges have dominated....

Read More »

Read More »

UK CPI Disappoints

Overview: A hawkish hold by the Reserve Bank

of New Zealand and a firmer than expected UK CPI reading have allowed the New

Zealand dollar and sterling to show resilience in the face of the US dollar's

broadly firmer tone. And even there, the Kiwi and pound have seen their early

gains pared. The Swiss franc is the weakest of the G10 currencies today and has

fallen to a new 12-month low against the euro. Emerging market currencies are

mixed. Central...

Read More »

Read More »