Tag Archive: Finland

Central Banks Buying Stocks Have Rigged US Stock Market Beyond Recovery

Central banks buying stocks are effectively nationalizing US corporations just to maintain the illusion that their “recovery” plan is working because they have become the banks that are too big to fail. At first, their novel entry into the stock market was only intended to rescue imperiled corporations, such as General Motors during the first plunge into the Great Recession, but recently their efforts have shifted to propping up the entire stock...

Read More »

Read More »

Destroying The “Wind & Solar Will Save Us” Delusion

Submitted by Gail Tverberg via Our Finite World blog, The “Wind and Solar Will Save Us” story is based on a long list of misunderstandings and apples to oranges comparisons. Somehow, people seem to believe that our economy of 7.5 billion people can get along with a very short list of energy supplies. This short … Continue reading »

Read More »

Read More »

80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded "fake news" by the established financial "kommentariat."

Read More »

Read More »

Basic Income Arrives: Finland To Hand Out Guaranteed Income Of €560 To Lucky Citizens

Just over a year ago, we reported that in what was set to be a pilot experiment in "universal basic income", Finland would become the first nation to hand out "helicopter money" in the form of cash directly to a select group of citizens.

Read More »

Read More »

Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017's 'known unknowns' suggest a year of more mayhem awaits... Here's a selection of key events in the year ahead (and links to Bloomberg's quick-takes on each).

Read More »

Read More »

European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB balance sheet at market prices and amounted to €15.79 billion.

Read More »

Read More »

Finland Unleashes Helicopter Money In “Greatest Societal Transformation Of Our Time”

Finland is about to launch an experiment in which a randomly selected group of 2,000–3,000 citizens already on unemployment benefits will begin to receive a monthly basic income of 560 euros (approx. $600). That basic income will replace their existing benefits. The amount is the same as the current guaranteed minimum level of Finnish social security support.

Read More »

Read More »

Yahoo Finance Editor “We’re Suffering Of Too Much Democracy”

Following James Traub's mind-numbingly-elitist rebuttal of the democratic rights of "we, the people" in favor of allowing "they, the elite" to ensure the average joe doesn't run with scissors, "It's time for the elites to rise up against the ignorant masses."

Read More »

Read More »

“Marxist Dream” Crushed – In Landslide Vote, Swiss Reject Proposal To Hand Out Free Money To Everyone

This weekend the Swiss population was called upon to make a historic decision, when Switzerland became the first country worldwide to put the idea of free money for everyone, technically known as Unconditional Basic Income (of CHF2,500 per month for every adult). The Swiss rejected the proposal with a big majority.

Read More »

Read More »

Financial Cycles History, 1990-1996: Breakdown of Communism, German Reunification, Housing Busts in Europe and Japan

A history of financial cycles: 1990-1996 the breakdown of communism leads to a boom in Germany and - due to high interest rates and inflation - to a breakdown of the European monetary system.

Read More »

Read More »

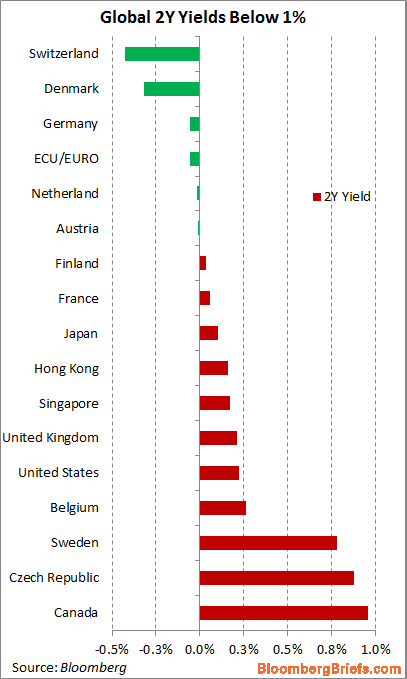

German Schatz turns negative again

After the first time End May, the German Schatz turns negative:

German June 2014 Schatz Average Yield -0.06% vs 0.10% on June 20

Swiss Eidgenossen 2yrs still at -0.4%

Read More »

Read More »

At the Euro summit there was nothing really new. What was the party about ?

At the euro summit today there was essentially nothing what was really surprising. We wonder what markets are so excited about.

Read More »

Read More »

The Northern Euro introduction: A retrospective from the year 2030

A retrospective from the year 2030 on two decades of failed european integration policy and 10 years of successful disintegration policy The following essay shows that currency regimes come and go over the time. Nothing is stable with the time, especially the use of a currency. What has never happened in history is the use …

Read More »

Read More »

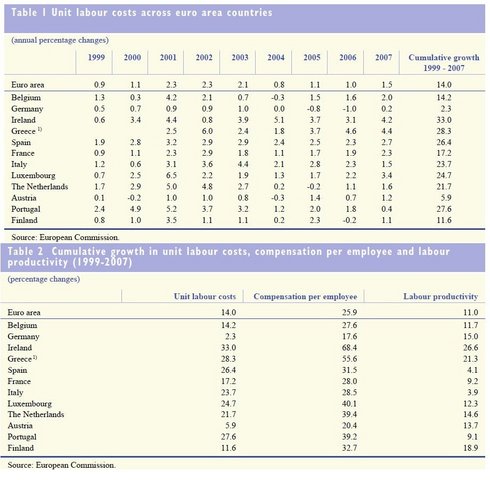

Jürgen Stark’s resignation and the ECB 2005 warning about labor cost divergence in the Euro-zone

The Wirtschaftswoche reports about the real reasons of ECB Chief economist Jürgen Stark’s resignation. The reasons are rather political, namely a protest against European governments:

Read More »

Read More »