Time is the soul of money, the long-view - its immortality. Hard assets are forever, even when destroyed by the cataclysms of history. It is the outlook that perpetuated the most competent and powerful aristocracies in continental Europe, well up through World War I and, in certain prominent cases, beyond; it is the mindset that has sustained the most fiscally serious democratic republic in the Western world, that of Switzerland.

Read More »

Tag Archive: Financial market

Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%.

Read More »

Read More »

Where There’s Smoke…

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we'll present the data and evidence that they've not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we're talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that are linked to them, as well...

Read More »

Read More »

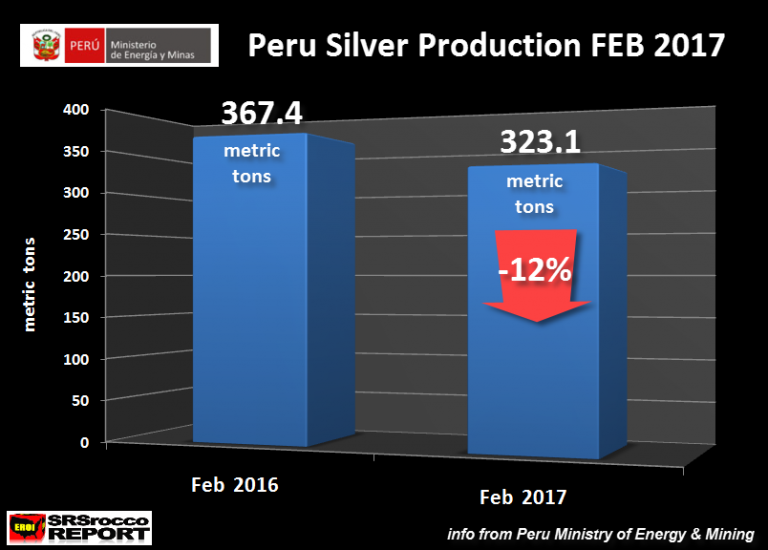

Silver Production Has “Huge Decline” In 2nd Largest Producer Peru

Silver production sees “huge decline” in Peru. Production -12% in one month in 2nd largest producer. Silver decline is due to ‘exhaustion of reserves’ in Peru. GFMS recognise that ‘Peak Silver’ was reached in 2015. Global silver market had large net supply deficit in 2016. Silver rallied 13.5% in Q1 in 2017. Base metal production accounts for 56% of silver mining.

Read More »

Read More »

Risk Reward Analysis for Financial Markets

We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble right now due to Central Banks...

Read More »

Read More »

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

2022-10-05

by Stephen Flood

2022-10-05

Read More »