Tag Archive: federal-reserve

Macro and Prices

(Combining the weekend macro commentary and price action review in one note. Check out the July monthly.) Three economic reports highlight the week ahead: Japan's labor cash earnings at the start of the week and the US employment report and China's CPI at the end of the week.

Read More »

Read More »

Stocks Hit as Central Banks Brandish Anti-Inflation Efforts

Overview: Central banks are committed to combatting inflation even as the economies weaken. This is taking a toll on investor sentiment and is dragging down equities.

Read More »

Read More »

Consolidation in FX Featured

Overview: The strong equity market rally seen at the end of last week is carrying into today’s activity. Most of the large markets in Asia Pacific rose by at least 1%.

Read More »

Read More »

Market Pulse: Mid-Year Update

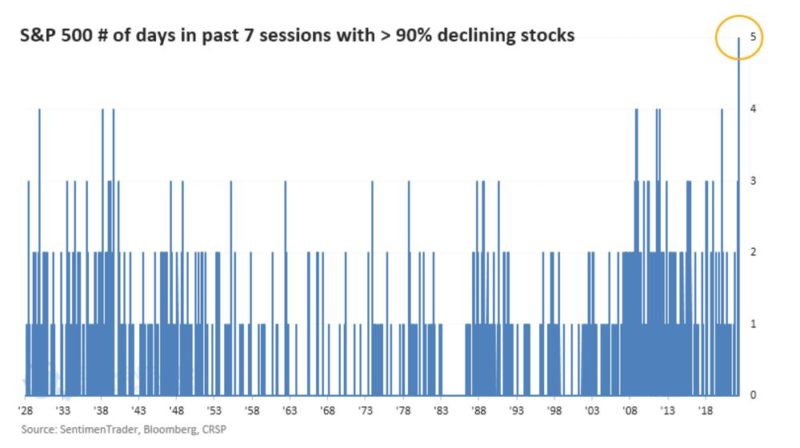

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets.

Read More »

Read More »

Risk Appetites are Fickle

Overview: Yesterday’s strong US equity gains failed to carry over into today’s session. Japanese and Australian shares fared the best among the large Asia Pacific market, with the Nikkei off less than 0.4% and the ASX off less than 0.25%.

Read More »

Read More »

Equities Jump, Dollar Slips, and European Yields Drop

Stocks are rallying. Nearly all the large bourses in the Asia Pacific region rose with China being the noted exception.

Read More »

Read More »

US Holiday Facilitates Consolidative Tone

Overview: Most equity markets in the Asia Pacific region lost ground today. China’s Shenzhen, Hong Kong, and India were notable exceptions.

Read More »

Read More »

Is a 0.3% Miss on Headline CPI Really Worth a 77 bp Rise in the December Fed Funds Yield?

Overview: Better than expected Chinese data and an unscheduled ECB meeting are the highlights ahead of the North American session that features the May US retail sales report and other high frequency data before the outcome of the FOMC meeting.

Read More »

Read More »

Prospects of Aggressive Tightening Sends Shock Waves through the Capital Markets

Overview: The markets' evolving expectations of a more aggressive monetary policy is not limited to the Federal Reserve, where the terminal rate is now straddling the 4% area, around 100 bp above late May levels.

Read More »

Read More »

Dollar Jumps, Stocks and Bonds Slide

The prospect of a more aggressive Federal Reserve policy has spurred a sharp sell-off in global equities and bonds and sent the dollar sharply higher. The large Asia Pacific bourses were off mostly 2%-4%.

Read More »

Read More »

Fed 50, BOE 25, and the BOJ to Stand Pat: Week Ahead

Three G7 central banks meet in the coming days, and they dominate the macro stage. The Federal Reserve's meeting concludes on Wednesday, the Bank of England on Thursday, and the Bank of Japan on Friday.

Read More »

Read More »

No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time.

Read More »

Read More »

Dollar Gains Pared

Asia Pacific equities were mostly lower. China and India bucked the trend. Europe’s Stoxx 600 is steady with no follow through selling after yesterday reversal. US index futures are posting modest gains and are trying to snap a two-day drop.

Read More »

Read More »

Bank of Canada’s Turn

Overview: The recent equity rally is stalling. Asia Pacific equities were mixed, with Japan, South Korea, and Australia, among the major bourses posting gains. Europe’s Dow Jones Stoxx 500 is slipping lower for the second consecutive session, ending a four-day bounce. US equity futures are little changed.

Read More »

Read More »

‘Unconscionably Excessive’ Denial

What would “unconscionably excessive” even look, legally speaking? More to the issue, who gets to decide what constitutes “excessive?”

Read More »

Read More »

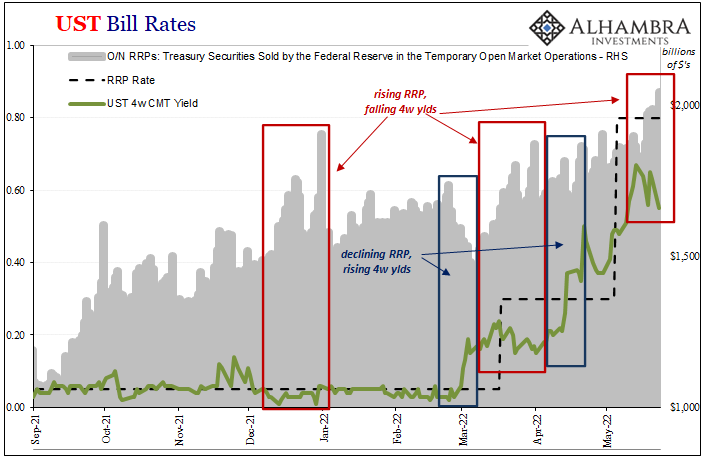

RRP (use) Hits $2T, SOFR Like T-bills Below RRP (rate), What Is (really) Going On?

You might not know it, but front-end T-bill yields are not the only market spaces which are making a mockery of the Federal Reserve’s “floor.” There are others, including the same money number the same Fed demanded the world (or whatever banks in its jurisdiction it could threaten) ditch LIBOR over.

Read More »

Read More »

Sentiment Remains Fragile, and the Euro and Sterling can barely Sustain even Modest Upticks

Equities are recovering from dramatic losses. Today, the Nikkei, Hang Seng, and Kospi surged by more than 2%.

Read More »

Read More »

Dollar and Yen Surge

Overview: Global equities are bleeding lower. Several large markets in the Asia Pacific region, including Hong Kong, Taiwan, and India are off more than 2%. Japan and Australian bourses fell by more than 1.5%.

Read More »

Read More »

No Rest for the Weary

Overview: Risk appetites are improving on the margin. Asia Pacific stocks still fell after the sharp losses on Wall Street on Monday. Still, China, Taiwan and Indian equities traded higher. Europe's Stoxx 600 is snapping a four-day 6.5%+ slide and is up around 1.2% in late European morning turnover.

Read More »

Read More »

Central Banks…Why Bother?

2022-05-21

by Stephen Flood

2022-05-21

Read More »