Tag Archive: federal-reserve

FX Daily, February 17: Follow-Through Dollar Buying after Yesterday’s Reversal Tests the Bears

Overview: After reversing higher yesterday, the US dollar sees follow-through gains today, leaving the euro around a cent lower from yesterday's highs. Sterling's surge is also being tempered. Most emerging market currencies are lower as well.

Read More »

Read More »

FX Daily, January 12: Markets Catch Collective Breath

Overview: The capital markets were stabilizing today after dramatic moves yesterday. Equity markets are recovering, and the dollar is paring yesterday's gains. Most equity markets in the Asia Pacific region rose, though Taiwan, South Korea, and Australia were notable exceptions.

Read More »

Read More »

Consumers, Too; (Un)Confident To Re-engage

There is a lot of evidence which shows some basis for expectations-based monetary policy. Much of what becomes a recession or worse is due to the psychological impacts upon businesses (who invest and hire) as well as workers being consumers (who earn and then spend).

Read More »

Read More »

FX Daily, December 16: Greenback Slides Ahead of FOMC as Optimism Underpins Risk Appetites

Overview: The S&P 500 snapped a four-day downdraft helped by optimism over the progress toward fiscal stimulus and some hope that a new trade deal can still be negotiated between the UK and EU. Europe reported better than expected PMIs. Equities are broadly higher, as are interest rates, while the dollar slumps.

Read More »

Read More »

Polar Opposite Sides of Consumer Credit End Up in the Same Place: Jobs

If anything is going to be charged off, it might be student loans. All the rage nowadays, the government, approximately half of it, is busily working out how it “should” be done and by just how much. A matter of economic stimulus, loan cancellation proponents are correct that students have burdened themselves with unprofitable college “education” investments.

Read More »

Read More »

FX Daily, November 20: US Treasury-Fed Dispute Spurs Handwringing but Immediate Market Impact was Exaggerated

Overview: News that the stimulus talks between the House Democrats and Senate Republicans was the excuse traders were looking for to extend the US equity gains yesterday, but shortly after the close, confirmation that Treasury was not going to agree to extend several Fed facilities sent stocks reeling.

Read More »

Read More »

FX Daily, November 17: Greenback Remains Under Pressure

Overview: Moderna's announcement did not spur nearly the magnitude of the disruption caused by Pfizer's similar announcement a week ago. Still, in the US, the NASDAQ underperformed the other indices, and the US Dow Industrials saw record highs.

Read More »

Read More »

FX Daily, October 08: Markets Catch Collective Breath

The S&P 500 and NASDAQ closed at their highest levels in around a month yesterday, recouping Tuesday's presidential tweet-driven drop. We thought the market overreacted to the end of the fiscal talks as many had already recognized that a stimulus agreement was unlikely before the election, but the near round-trip seen in stocks and bonds was surprising.

Read More »

Read More »

Monthly Macro Monitor – September 2020

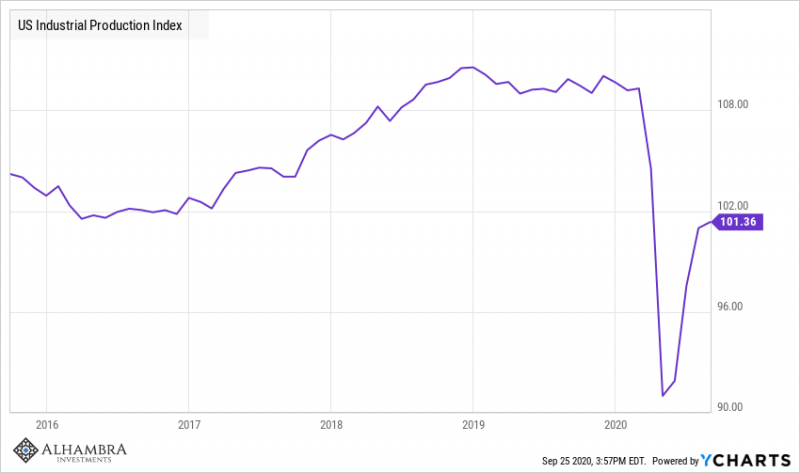

The economic data over the last month continued to improve but the breadth of improvement has narrowed. Additionally, while most of the economic data series are still improving, the rate of change, as Jeff pointed out recently, has slowed. I guess that isn’t that surprising as the initial phase of the recovery comes to an end.

Read More »

Read More »

FX Daily, September 18: When Every Thing is Said and Done, More is Said than Done

Asia Pacific equities have taken the march on the US. Led by a 2% rally in Shanghai, most regional markets but Australia closed the week with gains. A two-week fall in the MSCI Asia Pacific Index has been snapped. European stocks are little changed, and the Dow Jones Stoxx 600 is holding on to its second week of gains.

Read More »

Read More »

FX Daily, September 17: Powell Lets Steam Out of Equities and Spurs Dollar Short-Covering

Profit-taking after the FOMC meeting saw US equities and gold sell-off. The high degree of uncertainty without fresh stimulus did not win investors' confidence. The Fed signaled rates would likely not be hiked for the next three years, and without additional measures, that appears to be the essence of the switch to an average inflation target.

Read More »

Read More »

FX Daily, September 16: Dollar Eases Ahead of the FOMC

Overview: The dollar has been sold against nearly all the world's currencies ahead of what is expected to be a dovish Federal Reserve, even if no fresh action is taken. The Scandis and Antipodean currencies are leading the majors.

Read More »

Read More »

FX Daily, August 28: Powell and Abe Drive Markets

After a confused and volatile reaction to the Federal Reserve's formal adoption of an average inflation target, it took Asian and European traders to embrace the signal and take the dollar lower. It is falling against nearly all the currencies and has slumped to new lows for the year against sterling and the Australian dollar.

Read More »

Read More »

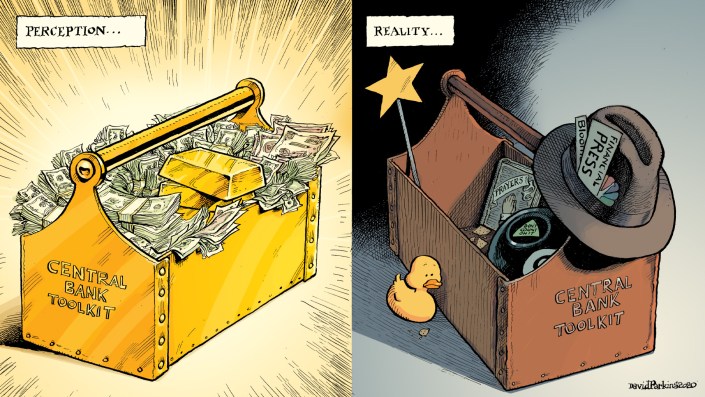

This Has To Be A Joke, Because If It’s Not…

After thinking about it all day, I’m still not quite sure this isn’t a joke; a high-brow commitment of utterly brilliant performance art, the kind of Four-D masterpiece of hilarious deception that Andy Kaufman would’ve gone nuts over. I mean, it has to be, right?I’m talking, of course, about Jackson Hole and Jay Powell’s reportedly genius masterstroke.

Read More »

Read More »

FX Daily, August 27: After much Build-Up, Could Powell be Anti-Climactic?

The strong rally in US equities yesterday, with the fifth consecutive gain in the S&P 500 and a big outside up day in gold, failed to spur follow-through buying today. Asia Pacific equities were mixed. China, Australia, and India rose while most of the rest of the regional markets fell.

Read More »

Read More »

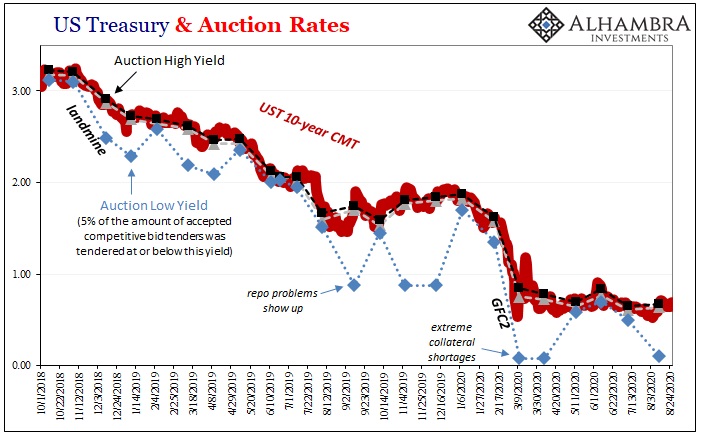

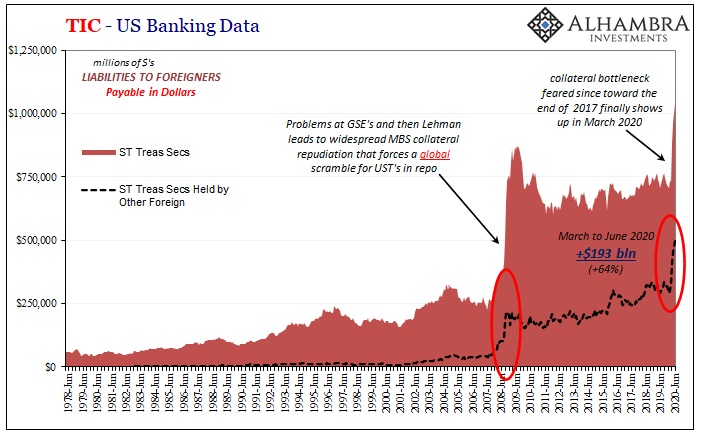

Not This Again: Too Many Treasuries?

Tomorrow, the Treasury Department is going to announce the results of its latest bond auction. A truly massive one, $47 billion are being offered of CAH4’s notes dated August 31, 2020, maturing out in August 31, 2027. In other words, the belly of the belly, the 7s.We’ve already seen them drop for two note auctions this week, both equally sizable.

Read More »

Read More »

FX Daily, August 20: FOMC Minutes Spur Profit-Taking

Overview: The FOMC minutes depicted a Federal Reserve that appeared to be not quite ready to take fresh initiatives, whether it is yield curve control or changing the composition or quantities of its bond purchases. This unleashed profit-taking on some of the large moves in equities, the dollar, and gold.

Read More »

Read More »

August Survey Data and Beyond

Economists are often lampooned because of their inability to forecast changes in the business cycle. But the pandemic helped them overcome the challenge this time. A record contraction in Q2 was anticipated before in March. Similarly, economists generally expected the recovery after the March-April body blow.

Read More »

Read More »

Eugene Fama’s Efficient View of Stimulus Porn

The key word in the whole thing is “bias.” For a very long time, people working in and around the finance industry have sought to gain tremendous advantages. No explanation for the motive is required. Charts, waves, technical (sounding) analysis and so on.

Read More »

Read More »

A Second JOLTS

What happens when we are stunned and dazed? We filter out the noise to focus on the bare basics by getting back to our instincts, acting reflexively based upon our deeply held beliefs and especially training. When faced with a crisis and there’s no time to really think, shorthand will have to suffice.

Read More »

Read More »