Tag Archive: federal-reserve

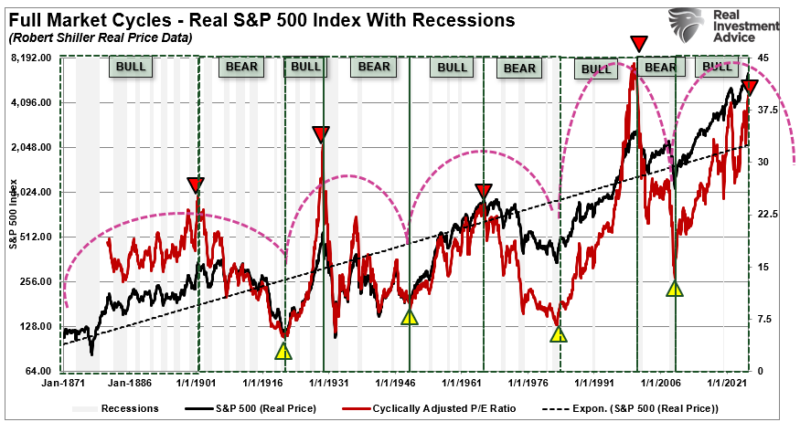

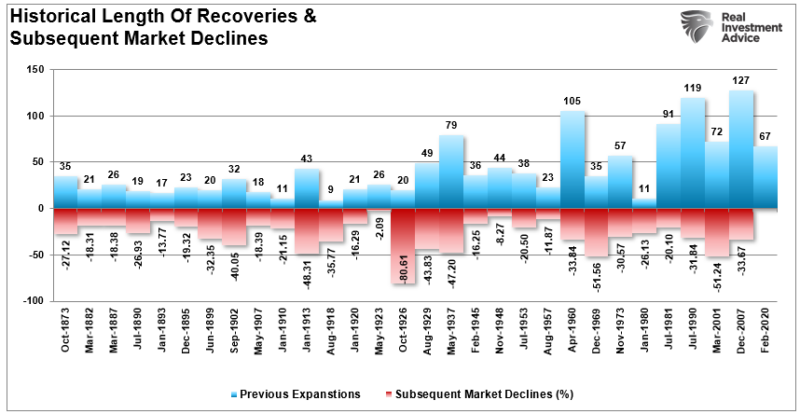

Full Market Cycles: Half Bull and Half Bear

Last week, we discussed the importance of "math" as it relates to valuations and noted the importance of understanding "full market cycles." To wit: "The math on forward return expectations, given current valuation levels, does not hold up. The assumption that valuations can fall without the price of the markets being negatively impacted is also grossly flawed. …

Read More »

Read More »

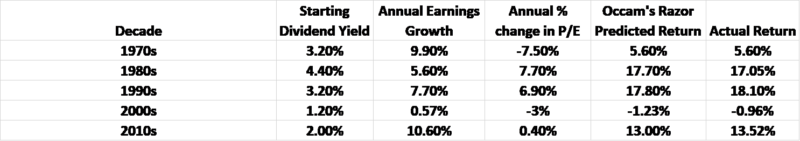

Forward Return And The Importance Of Math

During strongly trending bull markets, investors often overlook the importance of math in predicting forward returns. Such is easy to do when the market just seemingly continues to rise without regard to fundamentals. The current environment is also heavily influenced by the impact of "passive indexing," which has distorted market dynamics as well. However, none …

Read More »

Read More »

Weekly Market Pulse: Big Rate Cuts? Not Right Now

“I think we could go into a series of rate cuts here, starting with a 50 basis-point rate cut in September”. “If you look at any model” it suggests that “we should probably be 150, 175 basis points lower.”

Treasury Secretary Scott Bessent in a Bloomberg interview, 8/13/25

President Trump and others in his administration have been pushing for lower interest rates for months – one wonders what they’re worried about – and are doing and saying...

Read More »

Read More »

Busy Wednesday: French Confidence Vote, Fed’s Powell Speaks, ADP Jobs Estimate, and Beige Book

Overview: The dollar is mixed on what will start critical second half of the week. France holds its confidence vote in a few hours. Fed Chair speaks at a moderated discussion at the New York Times around 1:40 ET. The US data focus shifts to the labor market with the ADP estimate today and the nonfarm payroll report on Friday. The head of the main opposition party in Japan stepped down ostensibly until March due to a personal scandal and this has...

Read More »

Read More »

US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Overview: The US dollar has extended the losses scored late yesterday when Federal Reserve Governor Waller indicated he was still leaning toward a December rate cut. The odds of a rate cut rose to around 76% from about 66% at the end of last week. The odds are slightly lower today, around 72%. A solid jobs report on Friday and another uptick in CPI may change some minds. The only G10 currency that is weaker today is the Japanese yen, and it is off...

Read More »

Read More »

French Government on Precipice, Presses Euro Lower

Overview: The US dollar is beginning the new week and month on a firm note. It is rising against all the G10 currencies and nearly all the emerging market currencies. US-President-elect Trump's threat to BRICS if they abandon the dollar is symbolic than substantive, as we have argued, despite the occasional claim to the contrary, a BRICS currency is not realistic, and the China has little interest in fostering another competitor to the yuan. Still,...

Read More »

Read More »

Trump’s Tariff Talks Wobble Forex Market, Close Neighbors Suffer Most

Overview: As some market pundits were debating about a possible grand deal between the US and China. In exchange for a lighter tariff regime, Beijing would accept yuan appreciation. As far-fetched as such scenario may be, it was predicated on ideas that people like the Bessent, the Treasury Secretary-nominee, was pragmatic. Trump's comments hit in early Asia Pacific turnover specifically cited a 25% tariff on all product from Canada and Mexico and...

Read More »

Read More »

Sterling and Gilts Pressed Lower by Firmer CPI

US dollar and rates are firmer today. All the G10 currencies are lower, led by the Japanese yen. The UK reported firmer than expected CPI and this may have deflected some of the selling pressure away from sterling, which is off less than 0.2% to put it atop the pack ahead of the US open.

Read More »

Read More »

FX and Rates Unwind Yesterday’s Powell Effect, US Index Futures Slide

Overview: The dollar bounced, and US rates rose yesterday afternoon in response to comments by Fed Chair Powell. But he did little more that reiterate what he had said at the recent press conference. Powell expressed a lack of urgency to move after having led the central bank in delivering a 50 bp cut to start the easing in September while indicating that direction of travel will be to a less restrictive rate. The dollar has come back lower today...

Read More »

Read More »

Continued Backing Up of US Rates Extend the Greenback’s Gains

Overview: The persistent rise in US rates continues to help fuel dollar gains. The euro has been sold through $1.08 and the greenback has jumped over 1% against the yen to JPY152.75. It finished last week closer to JPY149.55. So far, Japanese officials have been fairly quiet, but this seems likely to change. The US two-year premium over Germany has widened by around 65 bp since late September to return to levels that prevailed in June. The...

Read More »

Read More »

Soft US Headline CPI is Unlikely to Be Sufficient to Reanimate Expectations of another Large Fed Cut

Overview: The US dollar is mostly softer ahead of the September CPI. The euro and Canadian dollar have recorded new lows for the move. The greenback extended its gains against the yen to JPY149.55 but has fallen to new session lows in the European morning near JPY148.85. Given the pushback against Fed Chair Powell's 50 bp cut last month revealed in the FOMC minutes, it will take more than a soft headline CPI today to renew speculation of another...

Read More »

Read More »

US Rates Extend Gains to Fray 4 percent

The stronger than expected US jobs report triggered a 20 bp jump in the US two-year yield and sent the greenback broadly higher. The market slashed the probability that the Fed would cut by 75 bp in Q4.

Read More »

Read More »

Weekly Market Pulse: Did The Fed Just Make A Mistake?

Well, they did it. The Fed cut the Fed Funds rate by 50 basis points last week and indicated that there is likely more to come. Stock investors liked it, bidding up small cap stocks (S&P 600) by 2.25%, large caps (S&P 500) by 1.4% and the NASDAQ by 1.5%.

Read More »

Read More »

Atlanta Fed GDP Tracker Says US Economy is Expanding at 3% Clip for 3rd Quarter in Past 4, and the Fed is Going to Do What?

The dollar remains offered ahead of the FOMC meeting outcome. That no official has pushed back against the press story that some suspect was planted by the Fed Chair (will a reporter specifically ask him about it today?) during a quiet period should not be taken as evidence one way or the other. And many understand that it is not unprecedented.

Read More »

Read More »

What Can Powell Say that the Markets Do Not Already Know?

Overview: The US is consolidating with a softer profile against most G10 and emerging market currencies today, ahead of Fed Chair Powell's speech at Jackson Hole (10 AM ET). He is unlikely to go much beyond confirming what the market already thinks it knows: namely, that the first rate cut will be delivered next month. By acknowledging that the economy has evolved broadly along the lines the central bank expected, it would be a gently push against...

Read More »

Read More »

Dollar Storms Back (but not Against the Yen) After Fed Signals Low Bar to September Cut

Overview: Neither the FOMC statement nor Fed Chair Powell's press conference dented the markets confidence that the Federal Reserve will begin an easing cycle at its next meeting in September. Yet, the dollar is bid against most of the G10 currencies, but the yen and Swiss franc. The Norwegian krone, apparently helped by a stronger PMI and the recovery in oil prices, is the strongest with a 0.25% gain. Most Asian emerging market currencies, but the...

Read More »

Read More »

Market Takes JPY Lower Despite Intervention Speculation, While Sterling Shines

Overview: The dollar is mostly consolidating yesterday's CPI-inspired decline. The main features include the market bidding the US dollar back above JPY159 despite more speculation that the BOJ did in fact intervene yesterday and checked on the euro-yen cross in the local session today, and unexpectedly soft Swedish inflation, which the swaps market says could spur three rate cuts here in second half. A record trade surplus and strong aggregate...

Read More »

Read More »

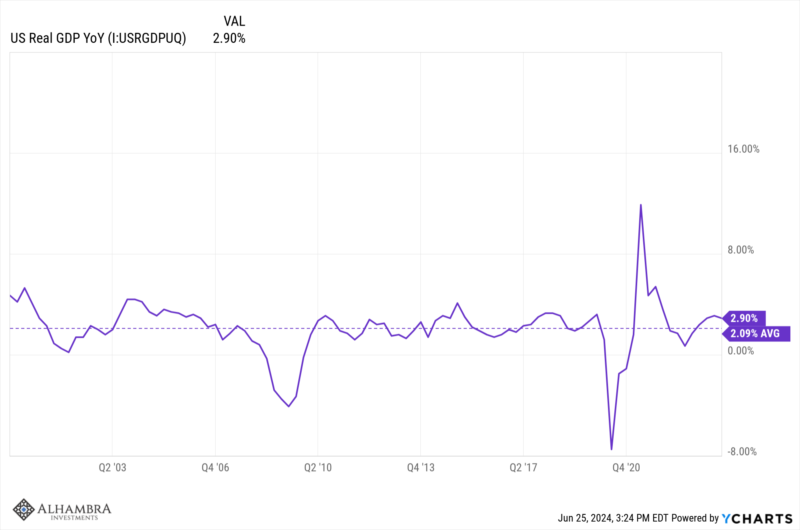

Q3 Cyclical Outlook

Growth peaked on a quarter over quarter seasonally adjusted annual rate in Q3 last year at 4.9%. The preferred reading is on an annual basis where growth peaked in Q4 of last year at 3.13%. Growth in Q1 was 2.88% and growth in Q2 has risen some and is trending at right about 3%.

Read More »

Read More »

Double Whammy: US CPI and Federal Reserve

Overview: Position adjustments ahead of today's US CPI and FOMC

meeting are giving the dollar a modestly heavier tone today. Each of these

events are typically a source of volatility in their own right and together

they promise an eventful North American session. The yen is the only exception

among the G10 currencies, but even there, the dollar is holding below

yesterday's highs. Even sterling's relative resilience this week was unmarred

by the...

Read More »

Read More »

Stocks and Bonds Retreat; Greenback Extends Recovery but Little Changed Ahead of North American Session

Overview: Stocks and bonds are lower today, and the

dollar is slightly firmer having extended yesterday's recovery. Most of the G10

currencies are lower, though the Japanese yen has recovered from after falling

to its lowest level since May 1. Slightly softer than expected German states'

CPI did the euro no favors. It was sold to a three-day low near $1.0830 before

stabilizing. Sterling steadied after dipping briefly below $1.2750. Most

emerging...

Read More »

Read More »