One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday.

Read More »

Tag Archive: Fed Funds Rate

Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish.

Read More »

Read More »

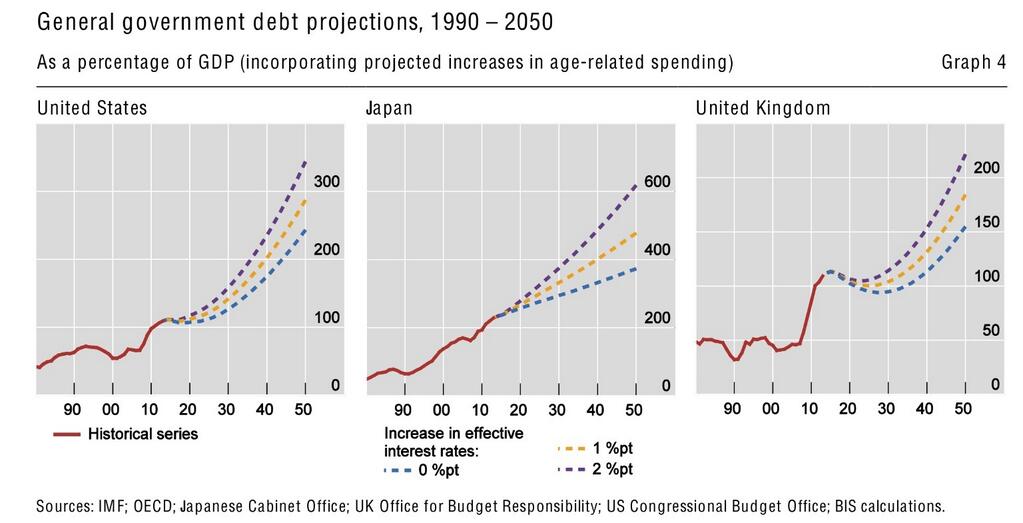

How Does It All End? Part II

Low Rates Forever, Nothing much is happening in the money world. The press reports that traders are hanging loose, wondering what dumb thing the Fed will do next. Rumor has it that it may decide to raise rates in September, or maybe November… or maybe not at all.

Read More »

Read More »

Bernanke’s Advice: More Emphasis on Data, Less on Fed Guidance

Bernanke reviews the changes in the long-term dot plots. There as been a clear trend toward lower long-term growth, unemployment and Fed funds equilibrium. The full adjustment may not be over.

Read More »

Read More »

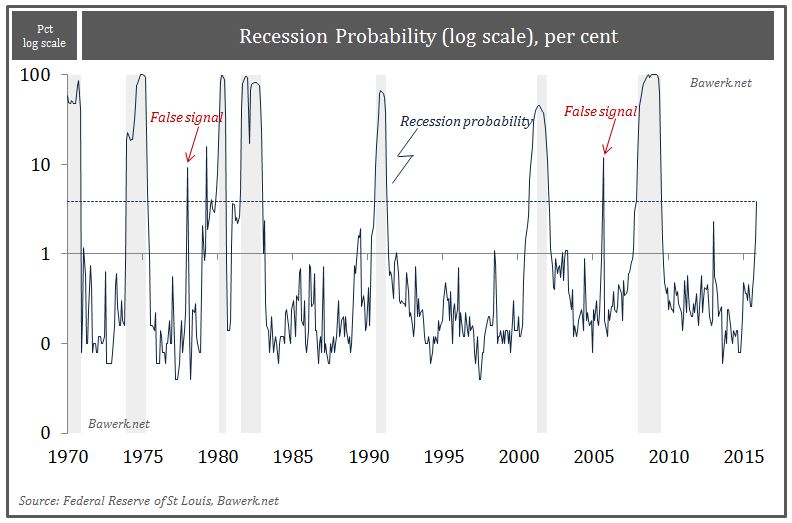

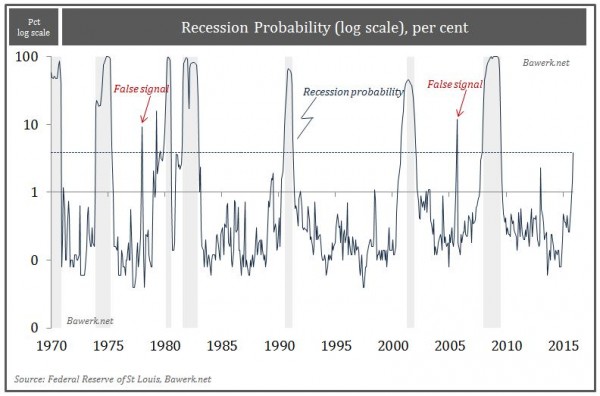

Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beg...

Read More »

Read More »

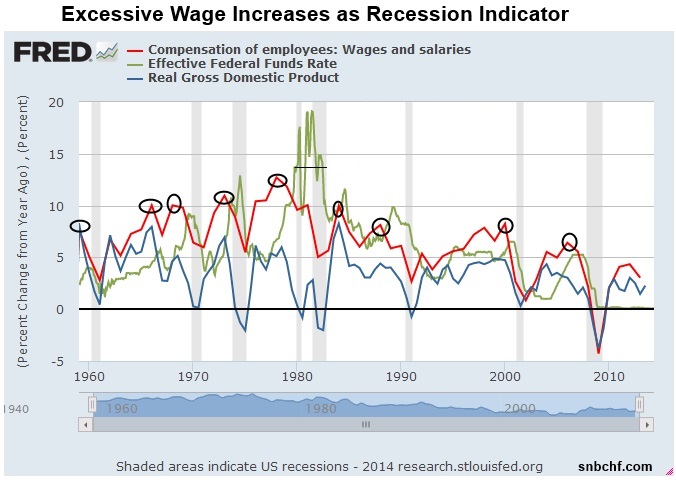

A Little History of Wages, Inflation, Treasuries and the Fed – And What We Learn from it

On this page we show that

Inflation expectations and wages drive the behaviour of the Fed and Treasury bond yields.

Excessive wage increases lead to recessions, more or less voluntarily caused by central bank tightening

Central banks pin down the short end of the yield curve, while financial-market participants price longer-dated yields

Some Emerging Markets seem to copy strong wage increases and inflation that we lived in the 1970s

Quickly...

Read More »

Read More »

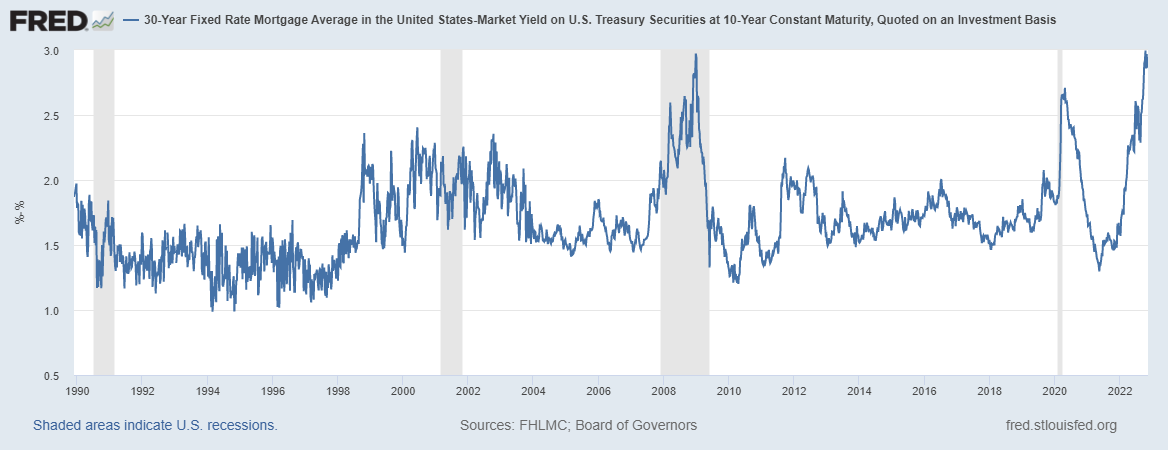

Inflation Expectations = Real GDP Growth = Ten-Year Treasury Yields – 0.5%?

Inflation expectations drive the Fed's and markets behaviour. Bond yields adjust, often but not always, with an inflation premium against short-term rates.

Read More »

Read More »

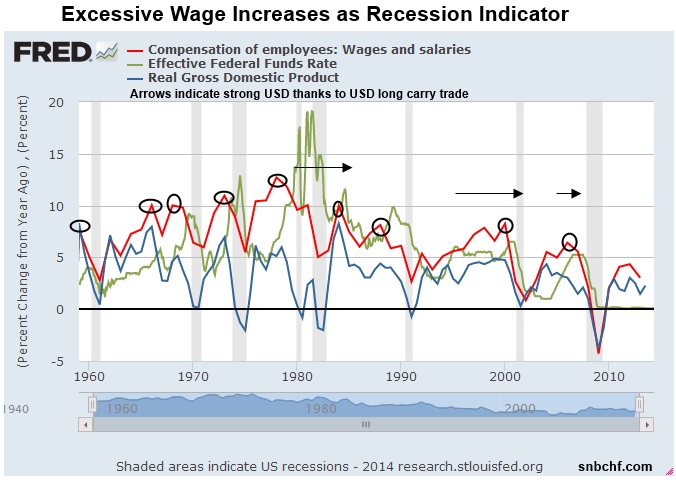

Why There Won’t Be A Strong Dollar, Even If The Financial Establishment Thinks So

In this second part of our series we provide arguments why the widely expected strong dollar period might not come. We look at the most important economic indicators that might justify a stronger dollar: the ISM manufacturing index and the interest rate differences between the U.S. and Europe.

Read More »

Read More »