Tag Archive: Featured

300€ für Dein altes Nokia? #shorts

Du hast noch das ein oder andere alte Handy zu Hause rumliegen? Dann kannst Du dafür online vielleicht sogar noch Geld bekommen. Wie das funktioniert, erklärt Dir Leo hier.

#Finanztip

Read More »

Read More »

Diese 3 Dinge vergisst Du von der Steuer abzusetzen

Weil es nie genug Tipps und Tricks für die Steuererklärung geben kann, hat Xenia nochmal 3 Dinge für Dich rausgesucht, die Du bei Deiner Steuererklärung besser nicht vergessen solltest.

#Finanztip

Read More »

Read More »

WICHTIG: Erfolgsgarantie in der JR Academy

Oft werde ich bzw. mein Team nach einer Garantie gefragt. Wie der Erfolg garantiert gelingt, erkläre ich dir im heutigen Video.

Vereinbare jetzt dein kostenfreies Beratungsgespräch:

https://jensrabe.de/Q3Termin24

Melde dich an zum Börsen-Strategie-Tag unter:

https://www.jensrabe.de/BST24

Tägliche Updates ab sofort auf:

https://aktienkannjeder.de

Schau auf meinem Instagram-Account vorbei:

@jensrabe_official...

Read More »

Read More »

Diese Werte solltest Du jetzt beobachten… I Monatsreview der Investorenausbildung

Sichere Dir hier das kostenfreie Silber-Ticket, um alle Vorträge des Kapitaltags kostenlos online zu sehen: https://investorenausbildung.de/otte

In diesem Monatsrückblick analysieren Florian und Stefan die Marktentwicklungen des ersten Halbjahres 2024. Sie diskutieren aktuelle Trends, darunter Rezessionsrisiken, Inflationsentwicklung und Potenziale verschiedener Anlageklassen. Die Experten bewerten wichtige Marktindikatoren, analysieren...

Read More »

Read More »

La DEUDA es más INFLACIÓN

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Thüringen wackelt: Verfassungsschutz in Panik!

Der Verfassungsschutz in Thüringen bricht in Panik aus!

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch! Der...

Read More »

Read More »

‘Net zero’ and Keynesian ‘stimulus’ are making us poorer

If you read the latest OECD publication, “Employment Outlook 2024: The Net Zero Transition and the Labour Market,” you would imagine that the world has not gone through the largest monetary and fiscal stimulus in decades.The results are so poor, they are embarrassing. Furthermore, the report illustrates the impoverishment of citizens and subtly suggests that achieving the net zero goal will present an even greater challenge. Translation: You will...

Read More »

Read More »

La FARSA de la Agenda 2030 y el Experimento Verde Europeo

Link al programa completo - &list=PL-j1qqL5tzpdd2AmBWsg04qNC1PMLEGl2&index=3

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!...

Read More »

Read More »

Temp Work Reduction: A Key Indicator of Economic Recession

? Keeping an eye on temp hiring! ? When companies cut down on temp work, it might be a sign of an approaching recession. #economy #finance #tips

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Achtung: Compact Ereignisse überschlagen sich!

Die Ereignisse rund um das Compact Verbot überschlagen sich!

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch!...

Read More »

Read More »

Week Ahead: US Dollar to Extend Recovery while Stocks Correct Lower

The consolidative phase for the dollar, we anticipated last week, after its recent drop, is evolving into a proper upside correction. We expect the dollar to trade broadly firmer over the next week or so. It is also part of a larger picture, where US interest rates also look to have put in a near-term bottom and are set to recover. Ideas that next US administration may favor a weaker dollar has become a talking point. Yet, of all the forces that...

Read More »

Read More »

Du zahlst heutzutage weniger Steuern als früher! ? #steuern

Du zahlst heutzutage weniger Steuern als früher! ? #steuern

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

Historischer Umbruch: USA und Israel driften auseinander…

▬ Kontakt ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Vereinbare jetzt Dein kostenloses Beratungsgespräch??:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen???:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck?:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern?:

► https://go.investorenausbildung.de/3xJn7ow

▬ Über Mich ▬▬▬▬▬▬▬▬▬▬▬▬

Florian Günther ist der Kopf hinter Investorenausbildung.de. Er ist...

Read More »

Read More »

Does the Fed Push Interest Rates Down? History Says Yes

[unable to retrieve full-text content]Jason Purcell joins Bob to discuss his historical analysis of yield curves (in both UK and US) going back to the 1870s, which shows that central banks do indeed manipulate short-term interest rates.

Read More »

Read More »

Nach Skandal-Interview: Kubicki poltert massiv gegen Merz!

Die FDP verspricht nun den Deutschen Anlegern steuerfreies Aktiensparen. Doch ich warte noch mit meiner Begeisterung!

Meine Depot-Empfehlung

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!...

Read More »

Read More »

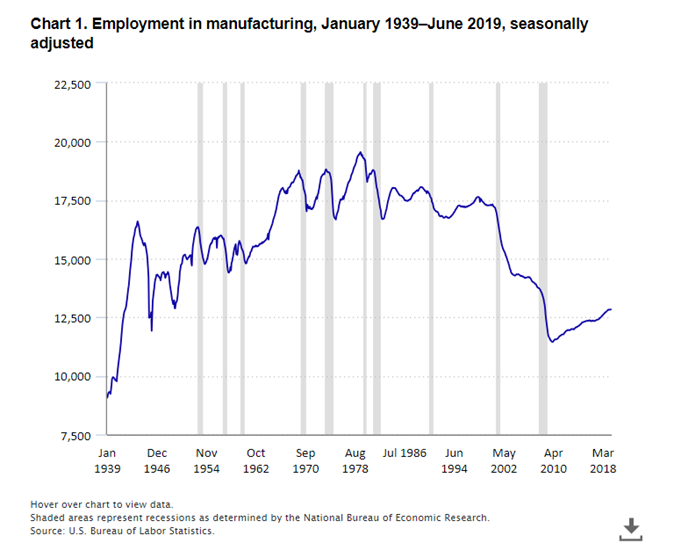

What Was Missing at NatCon 2024

National Conservatives are a growing movement on the political right. They are largely united by their belief in the failings of liberalism, in protectionist trade policy, a halt to mass migration, and a more Christianized nation. The attendees of this year’s conference, hosted by the Edmund Burke Foundation, focused on many topics: free trade, their desire to decouple from China, weaponization of government, bureaucracy in government, and even the...

Read More »

Read More »

7 Fälle für eine Mietminderung #shorts

Vom undichten Fenster bis zu Lärmbelästigungen – wir klären auf, was tatsächlich eine Mietminderung rechtfertigt. In diesem Video haben wir sieben Fälle, in denen du möglicherweise deine Miete mindern kannst.

#Finanztip

Read More »

Read More »

5 Dinge, die Du bei der Steuererklärung mal probieren kannst

Es gibt einige Möglichkeiten, mit Deiner Steuererklärung möglichst viel Geld vom Finanzamt zurückzubekommen. Neben Internet- und Handykosten nennt Dir Xenia in diesem Video 4 Dinge, die Du auch mal bei Deiner Steuererklärung einfach mal angeben kannst.

#Finanztip

Read More »

Read More »

An Austrian contribution to the praxeology of nature conservation

Without human intervention, there would be no nature conservation, only the natural struggle for species survival through evolution and adaptation. Humans actively protect and shape their surroundings, making nature conservation a practically anthropocentric concept.The conservation of natural elements involves counteracting undesirable changes to those elements and their conditioning environment. Broadly, nature protection includes activities...

Read More »

Read More »

Why Economic Inequality Is a Good Thing

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »