Tag Archive: Featured

Macht Ordnung reich?

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_jJH37V-ThJc

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_jJH37V-ThJc

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_jJH37V-ThJc

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_jJH37V-ThJc

Trade...

Read More »

Read More »

Why China wants Taiwan

Reporting on China is challenging. The country’s leaders seldom give interviews to Western media and when they do they tend to stick to prepared official lines. To understand China, journalists rely on well-connected academics who know the workings and worldview of the Communist Party.

The Economist’s Geopolitics editor, David Rennie, speaks to one of China’s shrewdest experts on America, Da Wei. He is a professor and director of the Centre for...

Read More »

Read More »

Ihr wollt es, ihr kriegt es: Krypto

Bitcoin? Blockchain? Altcoins? 🤯 Keine Sorge – wir erklären’s Dir!

💰 Krypto klingt spannend, aber Du blickst nicht durch? Dann ist unser neuer Kurs in der Finanztip Academy genau richtig für Dich!

📚 Dort lernst Du:

🔹 Wie Blockchain & Bitcoin funktionieren

🔹 Was Altcoins von Bitcoin unterscheidet

🔹 Wie Du investieren kannst – aber nicht musst

💡 So kannst Du selbst entscheiden, ob Krypto was für Dich ist – ohne Hype, ohne Bullshit.

⬇️ Teil den...

Read More »

Read More »

Wofür geben Deutsche ihr Geld aus? #konsum

Wofür geben Deutsche ihr Geld aus? 💶 #konsum

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

Reclaiming the Antistate Roots of Christmas

Shortly after hearing about the birth of Jesus, Herod the king tried to have the child murdered. Indeed, Herod's oppressive rule and the predations of the Roman state play a huge role in the Christmas story.

Read More »

Read More »

Why Are Houses So Expensive? It’s Deliberate Government Policy

Historically, it has been very poor manners in Washington to admit that keeping home prices high is a deliberate policy. High prices are not the "unintended consequence" of good intentions.

Read More »

Read More »

More Largesse from Santa Claus Trump

All children eventually learn that the presents under the Christmas tree come from family and friends, who must pay for them with their own money, and not from Santa Claus.

Read More »

Read More »

Süßigkeiten: Preisexplosion im Advent

Plätzchenpreise auf Rekordhoch 🍪💥

📈 Seit 2020 sind die Preise für Süßes massiv gestiegen – besonders vor Weihnachten!

🍪 Kekse sind Spitzenreiter mit einer Preissteigerung von fast +90 %

🍫 Schokolade und andere Süßwaren liegen deutlich über dem Durchschnitt

🛒 Die allgemeinen Verbraucherpreise sind im Vergleich dazu nur moderat gestiegen

💡 Adventszeit = Hochsaison für Teuerungen. Wer Geld sparen will, sollte Süßes früh einkaufen – oder selbst...

Read More »

Read More »

EU-kritische Medien jetzt auf “Feindesliste”!

🎁 Erhalte bis zu 20 US-Aktien gratis (im Wert von bis zu 800 USD, bis 31.12.) 👉

https://link.aktienmitkopf.de/Depot *

✅ Meine Depotempfehlung

Investiere global mit dem Freedom24-Broker:

Mehr als 40.000 Aktien und 3,600 ETFs mit transparenter Preisgestaltung

Direkter Zugang zu mehr als 20 globalen Börsen

Kostenloser persönlicher Assistent und Anlageideen

👉 https://link.aktienmitkopf.de/Depot*

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Reclaiming the Antistate Roots of Christmas

Shortly after hearing about the birth of Jesus, Herod the king tried to have the child murdered. Indeed, Herod's oppressive rule and the predations of the Roman state play a huge role in the Christmas story.

Read More »

Read More »

The Libertarian Political Messages in “The Mark of Zorro”

The 1940 version of The Mask of Zorro is more than a swashbuckling film featuring Zorro and his skills with the sword. It is also a reminder that the state is oppressive and seeks to take away the natural rights and liberties of the people.

Read More »

Read More »

OBAMA DECLARÓ UNA AMENAZA A LA SEGURIDAD NACIONAL

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram -...

Read More »

Read More »

Who are the real screen addicts?

Do you think kids spend too much time on their phones? You might be worrying about the wrong age group. Tom Wainwright, our media editor, reveals which generation is the most square-eyed.

Read More »

Read More »

Dynamische Strompreise: So kann ein Tag aussehen

Strom dann nutzen, wenn er billig ist? Mit dynamischem Tarif geht das! ⚡️

📈 Fixpreis bleibt den ganzen Tag gleich – rund 28 ct/kWh

📉 Dynamische Tarife schwanken:

🔹 an günstigen Tagen z. B. nachts nur 13 ct/kWh

🔸 an teuren Tagen in der Spitze über 45 ct/kWh

💡 Wenn Du Strom clever verlagerst, kannst Du bei dynamischen Tarifen richtig sparen – z. B. beim Wäschewaschen oder E-Auto-Laden.

Aber Achtung: Nicht jeder Tag ist günstig – der Tarif lohnt...

Read More »

Read More »

Swiss-made candles thrive as imports dominate shelves

Once used mainly for lighting, prayer or birthdays, candles have become a lifestyle accessory and symbol. The Swiss public broadcaster RTS met candle-making entrepreneurs in French-speaking Switzerland who are carving out a niche for themselves. With more than 120,000 candles sold last year, the company Hello Candle is growing steadily. It was founded in 2018 …

Read More »

Read More »

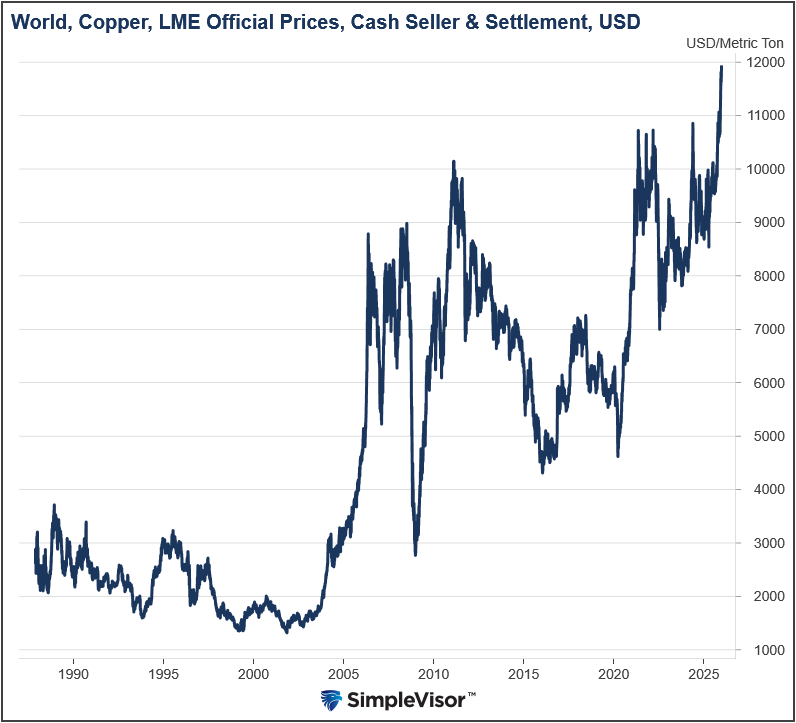

Copper Prices Surge To All Time Highs

On Monday night, copper prices, as shown below, reached an all-time high of over $12,000 per metric ton. Copper is often referred to as "Doctor Copper" because it serves as a barometer of global economic activity. However, the current surge in prices is not due to sharply rising demand; tariffs and physical dislocation are heavily …

Read More »

Read More »

Swiss bank secrecy probe dropped against news portal

The Zurich public prosecutor has dropped a probe against online portal Inside Paradeplatz, which was accused of violating banking secrecy. +Get the most important news from Switzerland in your inbox The prosecutor said that the protection of journalistic sources prevents evidence from being presented in the case in key respects. + How Swiss banking secrecy …

Read More »

Read More »

Lab-grown meat ‘not market ready for five years’: Bell CEO

A phase of strong growth in meat substitute products is over, according to the CEO of Swiss food producer Bell Food Group. +Get the most important news from Switzerland in your inbox Sales of Bell's meat substitute range are only growing by 0-1% per year, Marco Tschanz said in an interview with the Neue Zürcher … Continue reading »

Read More »

Read More »

St. John Chrysostom’s Moral Critique of Socialism

“Equality imposed by force,” Chrysostom insists, “would achieve nothing, and do much harm.”

Read More »

Read More »