Tag Archive: Featured

Wikipedia: Gründer mit Schockbotschaft für Nutzer!

Der Mitgründer von Wikipedia schlägt Alarm!

Meine Depot-Empfehlung:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

Bildrechte:

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT *

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR *...

Read More »

Read More »

90% Verlust durch Krisen?

? Würdest du dein ganzes Portfolio hebeln oder bleibst du lieber sicher? Teile deine Meinung in den Kommentaren!

Read More »

Read More »

What Rich People Do, That YOU Don’t

In this video we dive deep into the concepts of respecting property, learning from mistakes, and the invaluable lessons that come with responsibility. My friend Josh shares a powerful story about how he learned the hard way what it means to truly value what you have. It’s not just about material things—it’s about mindset.

We discuss:

Why respecting property is a sign of wealth in your mind, not just your wallet.

How mistakes, no matter how big or...

Read More »

Read More »

5 ungewöhnliche Prognosen für 2025

Im heutigen Video werfe ich einen Blick in die Glaskugel und teile mit dir meine fünf Prognosen für das Jahr 2025.

JETZT zum Webinar anmelden:

https://www.jensrabe.de/WebinarJan25

Vereinbare jetzt dein kostenfreies Beratungsgespräch:

https://jensrabe.de/Q4Termin24

Aktien kann Jeder - jetzt testen:

https://jensrabe.de/YTAKJ

Schau auf meinem Instagram-Account vorbei:

@jensrabe_official

https://www.instagram.com/jensrabe_official

ALLE Bücher von...

Read More »

Read More »

Eil: Habeck poltert gegen Elon Musk in Neujahrsrede!

Habeck eskaliert gegen Elon Musk!

Meine Depot-Empfehlung:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

Bildrechte:

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT *

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR *

Haftungsausschluss: Anlagen...

Read More »

Read More »

Mastering Stop Loss Strategies to Avoid Mistakes and Protect Investments

Stop losses can be frustrating for investors! Giving a little room below the moving average may help avoid getting tripped out too soon. ?? #InvestingTips

Watch the entire show here: https://cstu.io/27058f

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

“Real Estate Changed My Life” – @BrentDanielsTTP, Tracy Garrett-Numa

Check this out! ? www.richdadandbrent.com

? Ready to break free from the 9-5 and retire early with real estate? In this episode, Brent Daniels sits down with Tracy Garrett-Numa, a Navy veteran and former NSA employee, who shares how she transitioned from cybersecurity to full-time real estate investing – and she's on a mission to retire her mom! ??

Tracy’s story is packed with inspiration, practical steps, and the mindset shifts that helped her...

Read More »

Read More »

Billions of voices heard: a year of elections

In some places, votes resulted in political chaos; in others they showed a promising shift away from identity politics. Our deputy editor looks back on 2024’s pile of polls. Looking ahead, we examine the Chinese cities...

Read More »

Read More »

Scenarios For 2025

Over the past couple of weeks and into the next few weeks, you will likely be inundated with economic forecasts and stock market scenarios for 2025.

Read More »

Read More »

Politbombe: Elon Musk eskaliert gegen Steinmeier!

Der Krach zwischen Elon und der SPD eskaliert immer mehr!

Meine Depot-Empfehlung:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

Bildrechte:

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT *

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR *...

Read More »

Read More »

Year in review: A tectonic shift has only just begun

Share this article

As we’re approaching the final hours of 2024, it is a good time to take a step back and remember what this year taught us. History might not repeat itself, but it does rhyme, as the saying goes, and the past is always the best teacher to prepare us for the future.

For many of our fellow humans, 2024 was yet another turbulent year, filled with terrible strife, war, death, pain and indescribable suffering. The two ongoing war...

Read More »

Read More »

Year in review: A tectonic shift has only just begun

As we’re approaching the final hours of 2024, it is a good time to take a step back and remember what this year taught us. History might not repeat itself, but it does rhyme, as the saying goes, and the past is always the best teacher to prepare us for the future.

For many of our fellow humans, 2024 was yet another turbulent year, filled with terrible strife, war, death, pain and indescribable suffering. The two ongoing war fronts and the images...

Read More »

Read More »

2025: Finanzielle Selbstverteidigung!

5 wichtige Elemente der eigenen Finanzen.

Meine Depot-Empfehlung:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

Bildrechte:

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT *

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR *

Haftungsausschluss:...

Read More »

Read More »

Ray Dalio – My Biggest Failure Became My Strength

One principle that I’ve really learned is “Pain + Reflect = Progress.”

#principles #raydalio #mentor #investing

Read More »

Read More »

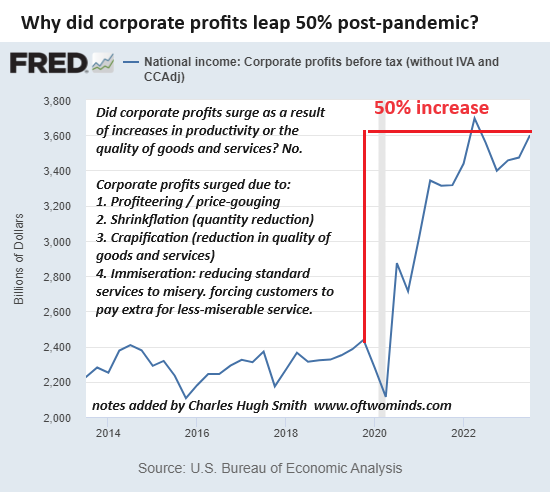

"Too Big to Care" and the Illusion of Choice

In a functional economy with real competition and transparency, every one of these cartel-corporations would be driven out of business by their 'too big to care' incompetence.

Read More »

Read More »

Zeit Journalist rastet völlig aus!

Die ersten Wahlleiter warnen vor der Briefwahl!

Meine Depot-Empfehlung:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

Bildrechte:

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT *

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR *...

Read More »

Read More »

CK*Persönlich: Dirk Müller trifft Dr. phil. Christoph Quarch – „Das Leben ist ein Gespräch“

? ????????.???: ????? ? ????? ?ü? ?€ ?????? ►► https://bit.ly/Cashkurs_1

?In einem inspirierenden Dialog voller Humor und Tiefgang diskutieren Dr. phil. Christoph Quarch und Dirk Müller, was Philosophie im Kern ausmacht. Seit der Antike stellt sich den Menschen eine grundlegende Frage – es geht es um nicht weniger als die Suche nach einem guten Leben. Das Gespräch dreht sich darum, wie wir als Gesellschaft wieder mehr Gemeinschaft und Sinn finden...

Read More »

Read More »