Tag Archive: Featured

The worry rise of Europe’s hard right

Europe’s far right is on the rise, and with Elon Musk voicing his support, concerns are growing. How worried should we be? Berlin bureau chief, Tom Nuttall, explains

Sign up to our weekly newsletter: https://econ.st/4eAhtZp

Sign up to our daily newsletter: https://econ.st/4gyhHCm

Austria could soon have a first far-right leader since 1945: https://econ.trib.al/4D9wE9T

How the AfD got its swagger back: https://econ.trib.al/ygoar59

The hard-right...

Read More »

Read More »

LA BUROCRACIA EUROPEA CONTRA TRUMP

A burocracia de la UE, en vez de fortalecer lazos con Trump y reducir trabas comerciales, lo trata como enemigo y apuesta por más intervención.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon -...

Read More »

Read More »

Nestlé Waters on trial in France over illegal waste dumps

Nestlé Waters on trial in France over illegal waste dumps

Keystone-SDA

Listen to the article

Listening the article

Toggle language selector...

Read More »

Read More »

To tariff or not to tariff, that is the question in the USDCAD

It seems that Pres.Trump will impose a 25% (?) tariff on Canada but will it include oil (which he wants the price to go down).

Read More »

Read More »

Trafigura and ex-COO convicted of bribery by Swiss court

Trafigura trial: company fined, defendants jailed

Keystone-SDA

Listen to the article

Listening the article

Toggle language selector...

Read More »

Read More »

Predictions vs. Convictions

Share this article

Separating the signal from the noise

Most regular readers and friends will undoubtedly already know what my position is in regards to projections and forecasts. For many years, I have consistently maintained that any and all attempts to “time the market” are as useless as they are unrealistic and I have always urged all responsible and rational investors to be extremely wary and suspicious of anyone that claims they can...

Read More »

Read More »

Predictions vs. Convictions

Separating the signal from the noise

Most regular readers and friends will undoubtedly already know what my position is in regards to projections and forecasts. For many years, I have consistently maintained that any and all attempts to “time the market” are as useless as they are unrealistic and I have always urged all responsible and rational investors to be extremely wary and suspicious of anyone that claims they can accurately predict market...

Read More »

Read More »

1-31-25 Tips and Traps You Need to Know for Tax Season

Apple's outlook will set the tone for today's market action; the January effect will be set by the end of the day. Rich & Matt discuss tariffs & volatility; Mexico and Canada are targets. Inflation data due today with the PCE report. The FEd's target is still 2%, and there's no reason to lower rates for now. This is forcing markets to shift focus; why a little inflation is a good thing. The US Tax Code can make you cry like Selena Gomez:...

Read More »

Read More »

How Global Economies Influence U.S. Inflation and Deflation

Interest rates fluctuate due to global economic conditions. Importing deflation from Europe impacts our economy. #EconomicInsights

Watch the entire show here: https://cstu.io/1df13f

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

China’s Underground Banking Empire: How Drugs & Money Corrupt America | Sam Cooper

Sign up for my free weekly e-letter here: https://www.mauldineconomics.com/go/JM563S/YTB

China has weaponized fentanyl against the United States. You might think of Mexican kingpins as the top of the drug food chain, but everybody works for somebody. And that somebody is often a gangster in China, made “respectable” by his other legitimate business operations and a position within the Chinese Communist Party.

But it gets worse. Today we’re...

Read More »

Read More »

Turkish delight: influencing the new Syria

The fall of Bashar al-Assad in Syria will reshape the wider region. Our correspondent says few countries have as much to gain from a stable Syria as Turkey...

Read More »

Read More »

Swiss cheese exports recorded second-best year in 2024

Swiss cheese reaches second-best export year in 2024

Keystone-SDA

Listen to the article

Listening the article

Toggle language selector...

Read More »

Read More »

Unfassbarer Eklat: FDP macht RÜCKZIEHER in letzter Minute!

Wahnsinn! Die FDP macht einen Rückzieher! Meine Depot-Empfehlung:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

Bildrechte:

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT *

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR *

Haftungsausschluss:...

Read More »

Read More »

Renewed US Tariff Threat Doesn’t Stop Equities from Marching Higher

Overview: The renewed threat of a 25% tariff on Canada and Mexico as soon as tomorrow has lifted the US dollar broadly and has not derailed the firmer tone in global equities. There are still many unknowns and questions, and this will keep investors and businesses on tenterhooks. The greenback is mixed against the G10 currencies in Europe and is mostly +/- 0.25%. The Canadian dollar and Mexican peso are little changed now after selling off late in...

Read More »

Read More »

Why does Trump want the Panama Canal?

Donald Trump wants the Panama Canal back. He’s accused Panama of ripping off America and claimed Chinese soldiers run the canal. Why is Trump so fixated on it now? #geopolitics #panama #panamacanal #uspolitics #trump

Read More »

Read More »

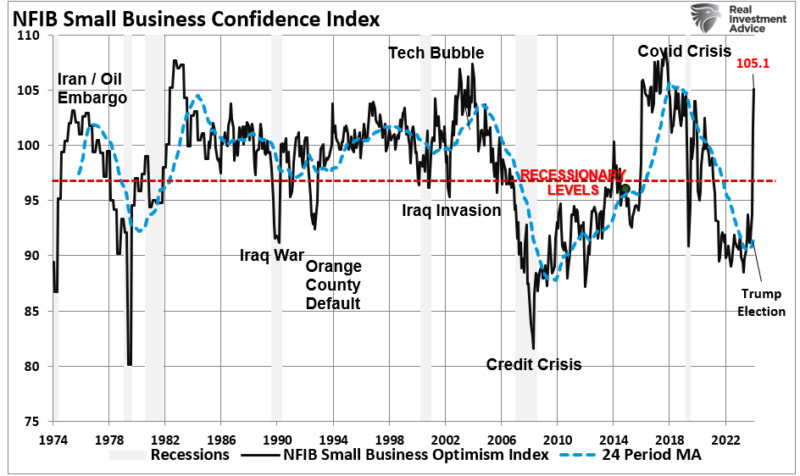

Bullish Exuberance Returns As Trump Takes Office

Bullish exuberance is returning to the markets and the economy in a big way following the Presidential election. Such is particularly the case with recent executive orders signed by Trump, which fulfill Trump's promises to "Make America Great Again." Given that short-term market dynamics are driven primarily by sentiment, as investors, we can not dismiss …

Read More »

Read More »

MSFT And TSLA: Earnings Create Quite The Conundrum

An investor reading Microsoft's (MSFT) and Tesla's (TSLA) earnings summaries on Wednesday night would likely anticipate that MSFT shares would trade higher and Tesla shares lower. At the opening of the market the following day, the opposite held. MSFT opened up 4% lower, while TSLA was 4% higher. Let's summarize their respective earnings to see …

Read More »

Read More »