Tag Archive: Featured

How does The Economist avoid groupthink?

How do journalists at The Economist guard against groupthink? Our editors explain the importance of reporting in the field, in a special Insider episode where they answer your questions.

Read More »

Read More »

The Rise of the State and the Fall of Natural Law

In the wake of WWI, Pope Pius XI reminded his readers that governments instituted by men can never be perfect, and they cannot even be good if they neglect natural law.

Read More »

Read More »

Kalshi Culture: How Gambling, Speculation, and Degeneracy Went Mainstream

As government continues to engage in reckless actions from inflation to starting wars, people develop shorter time horizons, creating social vacuums. Increased gambling and other irresponsible behaviors then fill the void.

Read More »

Read More »

ARGENTINA IBA A TODA VELOCIDAD HACIA LA HIPERINFLACIÓN

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram -...

Read More »

Read More »

CDU-Fiasko: Merz Asylwende scheitert krachend!

🎁 Erhalte bis zu 20 US-Aktien gratis (im Wert von bis zu 800 USD, bis 31.12.) 👉

https://link.aktienmitkopf.de/Depot *

✅ Meine Depotempfehlung

Investiere global mit dem Freedom24-Broker:

Mehr als 40.000 Aktien und 3,600 ETFs mit transparenter Preisgestaltung

Direkter Zugang zu mehr als 20 globalen Börsen

Kostenloser persönlicher Assistent und Anlageideen

👉 https://link.aktienmitkopf.de/Depot*

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Emil rankt Finanz-Fails aus der Community

Blindranking zu den größten Finanz-Fails 😬

📉 Wir haben euch nach euren schlimmsten Geldfehlern gefragt – und ich, Emil von Finanztip, hab sie für euch gerankt! Von harmlos bis richtig bitter:

1️⃣ Glücksspiel (ganz klar)

2️⃣ Schneeballsystem + Liebesbetrug 😵💫

3️⃣ Heiraten (no offense!)

4️⃣ Geld auf dem Sparbuch (geht besser)

5️⃣ Zu spät mit dem Investieren angefangen

Und Emils persönlicher Fail?

💸 Motorradführerschein und Motorrad statt...

Read More »

Read More »

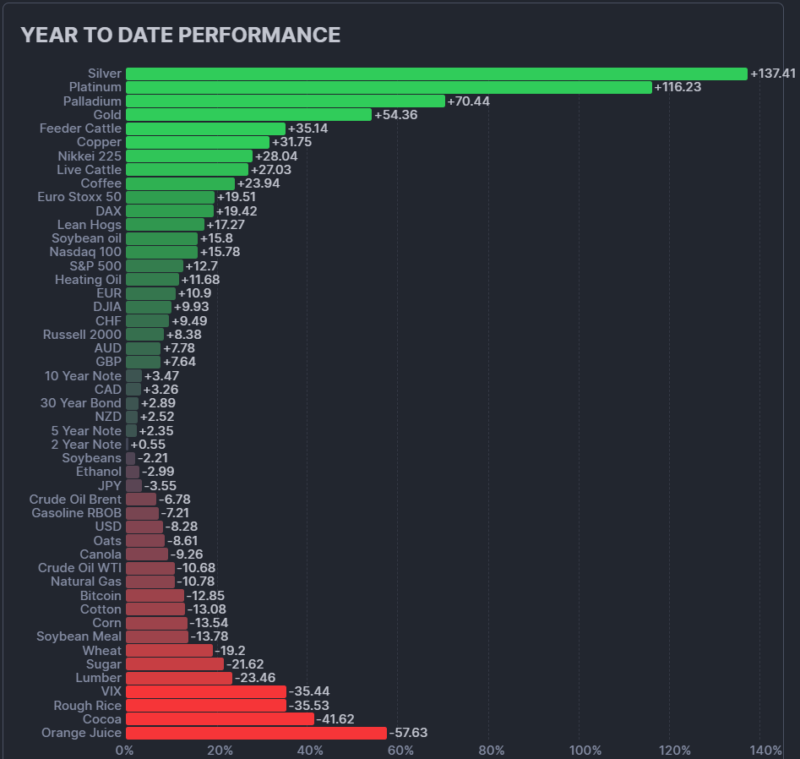

YTD Returns Highlight a Narrow Market

YTD returns across major U.S. asset classes continue to reflect a highly concentrated market. The Finviz chart below does a nice job illustrating YTD returns across a wide array of futures contracts. Large-caps dominate YTD equity returns, while small- and mid-cap stocks lag amid tighter financial conditions and slower earnings growth. Outside of equities, YTD …

Read More »

Read More »

Der Gaza-Fokus & die vergessenen Konflikte

___________📅 Marc Lädt Ein 2026 ___________

✗ Erlebe den echten Austausch zu Finanzen, Politik und Gesellschaft. Zum vierten Mal lade ich ein zum "Marc Lädt Ein 2026" und du kannst dir jetzt eines der limitierten Tickets sichern! Entweder direkt vor Ort in der Motorworld Metzingen oder digital als Streaming-Ticket. Schnell sein lohnt sich!

https://www.marc-friedrich.de/mle26

___________💰 Investments & Vermögensschutz ___________...

Read More »

Read More »

The Rise of the State and the Fall of Natural Law

In the wake of WWI, Pope Pius XI reminded his readers that governments instituted by men can never be perfect, and they cannot even be good if they neglect natural law.

Read More »

Read More »

Swiss central bank bought CHF75 million in foreign exchange in Q3

The Swiss National Bank (SNB) intervened very cautiously in the foreign exchange market in the third quarter of 2025. Between July and September, it purchased foreign currency worth just CHF75 million ($94 million) in order to slow down the further rise of the Swiss franc. +Get the most important news from Switzerland in your inbox …

Read More »

Read More »

EIL: Spektakulärster Sparkassen RAUB Aller Zeiten in Gelsenkirchen!

Werbung:

✅ Sichere dir 30 € in Bitcoin bei deiner ersten Investition in eine Kryptowährung bei Coinbase 👉 https://coinbase-consumer.sjv.io/c/6428886/3162518/9251 *

Mehr Infos zu Coinbase:

✅ In Deutschland reguliert seit 2021

💹 260+ Kryptowährungen

💰Ab 0,15% Gebühren (Advanced-Modus)

📦Limit-, Markt-& Stop-Orders

📅Flexible Sparpläne (täglich bis monatlich)

💳Visa-Karte zum Zahlen mit Krypto oder Euro

Read More »

Read More »

Kommt 2026 der große Knall? US-Arbeitsmarktsdaten im Fokus

Melde Dich jetzt für unseren kostenfreien Jahresausblick am 8. Januar an: https://investorenausbildung.de/jahresausblick-anmelden-mo/

▬ Kontakt ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Vereinbare jetzt Dein kostenloses Beratungsgespräch🤝🏽:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen👨🏽🏫:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck📈:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern📘:

►...

Read More »

Read More »

Wann willst Du in Rente gehen?

Wann willst Du in Rente gehen? 🧓🏽👵🏼

📊 Das Renteneintrittsalter ist gestiegen – aber die gesetzliche Regelaltersgrenze steigt noch schneller!

🟠 Frauen und Männer gingen jahrzehntelang im Schnitt früher in Rente als gesetzlich vorgesehen.

📈 Seit ein paar Jahren klettern die tatsächlichen Eintrittsalter aber immer näher an die Regelgrenze heran.

👥 2020 lagen beide Geschlechter bei etwa 64,6 Jahren – Tendenz steigend. Die Regelaltersgrenze? Über 65...

Read More »

Read More »

Defender la Libertad Sin Complejos

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram -...

Read More »

Read More »

Trump, Bitcoin & Wall Street: Der stille Umsturz des globalen Finanzsystems!

Werbung:

✅ Sichere dir 30 € in Bitcoin bei deiner ersten Investition in eine Kryptowährung bei Coinbase 👉 https://coinbase-consumer.sjv.io/c/6428886/3162518/9251 *

Mehr Infos zu Coinbase:

✅ In Deutschland reguliert seit 2021

💹 260+ Kryptowährungen

💰Ab 0,15% Gebühren (Advanced-Modus)

📦Limit-, Markt-& Stop-Orders

📅Flexible Sparpläne (täglich bis monatlich)

💳Visa-Karte zum Zahlen mit Krypto oder Euro

Read More »

Read More »

Silberpreis explodiert: Warum der Anstieg erst der Anfang ist

Der Silberpreis ist in wenigen Tagen massiv gestiegen und hat zeitweise historische Höchststände erreicht. In diesem Video erkläre ich, warum Silber aktuell explodiert, welche Rolle China, Angebotsengpässe und die Industrie spielen und warum extreme Volatilität jetzt dazugehört. Außerdem zeige ich, welche Kursmarken bei Silber kurzfristig entscheidend sind und wo sich neue Einstiegschancen ergeben könnten. Auch Gold analysiere ich und erläutere,...

Read More »

Read More »

Dirk Müller – Deep Dive: Was den Silberpreis wirklich treibt & Kippt das Vertrauen in Papiermärkte?

👉 𝐂𝐚𝐬𝐡𝐤𝐮𝐫𝐬.𝐜𝐨𝐦: 𝐉𝐞𝐭𝐳𝐭 𝟏 𝐌𝐨𝐧𝐚𝐭 𝐟ü𝐫 𝟏€ 𝐭𝐞𝐬𝐭𝐞𝐧 ►► https://bit.ly/Cashkurs_1M

Sie wollen investieren? Hier geht es zum 𝐃𝐢𝐫𝐤 𝐌ü𝐥𝐥𝐞𝐫 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐀𝐤𝐭𝐢𝐞𝐧 𝐅𝐨𝐧𝐝𝐬 𝐎𝐟𝐟𝐞𝐧𝐬𝐢𝐯: https://bit.ly/DMPAF-O

📧 Gratis-Newsletter ►►► https://bit.ly/CashkursNL-YT

🔴 YouTube-Kanal abonnieren ►►► https://www.youtube.com/@Cashkurscom

Bildrechte: Cashkurs.com / natatravel - Shutterstock.com

#dirkmueller #cashkurs #informationsvorsprung

https://www.cashkurs.com – Dein Kompass für...

Read More »

Read More »